Mentioned in Video:

- Find me on Twitter: https://twitter.com/TickerSymbolYOU

- My free Discord: https://discord.gg/9UHrHex4JX

- Channel Membership – Join the family! https://www.youtube.com/channel/UC7kCeZ53sli_9XwuQeFxLqw/join

- Not into YouTube Memberships but still want to support the channel?: https://www.patreon.com/tickersymbolyou

- Support the channel and get extra member-only benefits by joining us on Patreon: https://www.patreon.com/tickersymbolyou

Cathie Wood bought into the Coinbase stock IPO (COIN) well above it's valuation because ARK Invest believes in a $500,000 Bitcoin. Coinbase IPO has many paths to grow beyond its current price, including listing Dogecoin and other cryptos, but I also think it's the best stock to buy now because it's a great tech company. This video contains my breakdown and analysis.

Video Transcript:

[00:00:00.000]

ARK Invest just made two huge purchases of Coinbase ticker symbol COIN, which is a cryptocurrency exchange that just went public via direct listing. In fact, it was by far the largest direct listing ever. So whether you're a tech stock investor deciding on Coinbase, a season's Dogecoin investor or just a cryptocurious, this video is for you. So let's talk about where I think Coinbase fits into ARK Invest's vision of the future, why they might be so bullish on it, and what kind of price action do we can expect going forward?

[00:00:31.690]

Let's take a look at ARK Invest's trading data from Coinbase's first week of trading since Cathie Wood got in right away. If we look at a bar chart that combines all of ARK Invest's Holdings, we can see that they have over 170 positions in their six actively managed ETFs. Coinbase is now number 35 in ARKK, ARK Invest's flagship innovation fund. It's number 48 in ARKW, their fund themed around the next generation of Internet applications and number 40 in ARKF, their Fintech fund. That makes Coinbase their 42nd biggest position overall with a whopping $350,000,000 in it so far.

[00:01:08.370]

And I'm sure that number will be higher in the near future. Here's why.

[00:01:12.840]

Do you have a price target for Coinbase? We do. I am reticent to give it. It is far above where it's going to open. We think now there are a lot of assumptions in there and you want to talk about volatility. Just look at a chart of Bitcoin. So there are going to be great opportunities between now and five years to buy on dips, we believe.

[00:01:43.960]

ARK Invest has a five year time horizon for the stocks that they buy. They look for a 15% year over year return, which means they expect their positions to roughly double over the next five years. So when Cathie Wood says she expects Coinbase's future price to be far above where it opened this past week, we should keep that five year time horizon in mind. And as Cathie would point it out, there will be dips. True enough as it's already down almost 15% from recent hives.

[00:02:11.170]

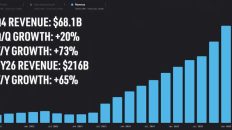

If you have a strong vision of Coinbase's future, these dips are buying opportunities. We will get to that in a minute. Another thing to point out is that Coinbase's revenue correlates very highly with Bitcoin's price, which makes sense since one big source of revenue for Coinbase as a cryptocurrency exchange is percent-based transaction fees. Shout out to Twitter user @Plantmath1 for making this plot and showing us just how highly correlated Coinbase's revenue is to Bitcoin's price. By the way, I receive and share a lot of great research on Twitter, so feel free to find me there @tickersymbolyou. Depending on your future outlook

[00:02:46.040]

on Bitcoin, that correlation is either a risk or a pretty great feature. So what does Cathie Wood think about that?

[00:02:52.440]

And you want to talk about volatility, just look at a chart of Bitcoin. So there's going to be great opportunities between now and five years to buy on dips, we believe. We do believe, however, that it has miles to go because institutional interest in Bitcoin alone, which is the largest crypto currency out there, is, we think, going to add up to $500,000 to the price of Bitcoin. And when I say that we've based this on a study focusing on what institutions are looking for, they're looking for low correlations of returns.

[00:03:37.450]

This is a new asset class. So institutions are interested, they are moving in. And if they add up to 5% in their asset allocation to Bitcoin, that alone could be up to $500,000 increase in the price. So we're at the very beginning of what we believe is going to be a long and exciting journey.

[00:04:03.760]

In ARK Invest's Big Ideas for 2021, they talk all about what it would take for Bitcoin to reach a $500,000 price. In a nutshell, it involves major institutions allocating around 6.5% of their balance sheets to Bitcoin. For reference, Tesla recently put 8% of its cash into Bitcoin. So this may not be such a distant pipedream. What would this mean for Coinbase's stock price?

[00:04:27.820]

You're reticent to maybe give us a number. But can you give me a ballpark on the percent gains that you think you could see using your five year approach?

[00:04:38.950]

This is well above our minimum hurdle rate of return of $15, even if it does open a 15% per year, even if it does open as high as 250 or $300, even at those prices, given our assumptions now again, we expect tremendous volatility in. This is going to be unstable in terms of investors and analysts understanding what Coinbase actually is.

[00:05:11.270]

It makes most of its money on the trading of Bitcoin and Ether. Those are the two biggest, and it's going into a lot of other cryptocurrencies and crypto assets. So it's got a lot of open ended opportunities. But right now they're making about 70 basis points on each trade on each dollar traded. And we think there will be fee compression, as there always is, as competition increases. So I think the opportunities in this stock, to the extent there are dips out there will come around the idea of, oh, my goodness, how much is competition going to drive these fees down?

[00:05:53.900]

And we do think the compression will be to $0,50 within the next five years or 50 basis points. So you'll watch the dynamic volume explosion, fee compression. And again, we'll pick our spots around volatility.

[00:06:08.970]

So, now you have an idea of ARK Invest's price expectations. Why Arc invest paid north of $350 per share for Coinbase, right, is it opened? And Cathie Wood's future plans to trade around its volatility. Keep in mind that this volatility isn't just around Bitcoin's price. An influx in trading volume on any coin on the exchange is a good thing for Coinbase, whether it's a meme or not. However, it stands to reason that if you can buy Coinbase for cheaper than Cathie Wood bought it and hold it with conviction when it dips, then you can even outperform the legendary Cathie Wood on this one specific stock.

[00:06:43.200]

So let's build that conviction now by learning a little more about Coinbase as a company. Coinbase is the largest centralized cryptocurrency exchange in America, which is kind of funny because cryptocurrency is all about decentralizing finance. The reason Coinbase can exist, despite this irony is because it's also one of the most trusted crypto exchanges, and that trust is exactly what crypto needs to hit mainstream adoption. In a world full of security breaches and stolen data, Coinbase has never been hacked, making it a trustworthy middleman in a highly untrusted space.

[00:07:16.430]

In addition, Coinbase greatly reduces the friction of buying cryptocurrency. It has a sleek design and an easy to use interface, which is absolutely critical to getting more and more people to try it out. There are well over 8000 cryptocurrencies today, and it should go without saying that that number will increase greatly in the coming decade. Coinbase lets you trade something like 50 of them, including all the staples: Bitcoin, Ethereum, Cardano, and many more. One way Coinbase can broaden its business is by allowing the trading of more and more cryptocurrencies and other crypto assets on their exchange, even as we expect the transaction fees to fall over time.

[00:07:53.120]

In that sense, I think that owning Coinbase is kind of like owning a crypto index fund. So if you're buying into Coinbase, you're buying into a trustworthy low friction expandable cryptocurrency exchange. And because ARK Invest expects institutions to diversify up to 10% of their balance sheets into Bitcoin alone, it makes sense for their vision to include Coinbase, which is one of the places institutions can go to actually make that happen. A lot of Coinbase's capabilities are geared towards businesses such as accepting cryptocurrency payments, custodying institutional cryptocurrency, and even financing for crypto-based ventures.

[00:08:29.590]

But when I buy into a stock that ARK Invest holds, I try to imagine Cathie Wood's five year vision for that company, not just the five year price target for the stock. So what's the five year vision for Coinbase, especially as more and more exchanges come online and offer lower and lower transaction fees? Well, just like Square, ticker symbol SQ, offers an entire ecosystem of financial products even in crypto, nothing is stopping Coinbase from creating its own financial products and services built on top of various blockchain technologies. Coinbase could get more into NFTs, or they could offer crypto based loans and insurance plans.

[00:09:04.900]

I personally can imagine Coinbase as the digital wallet of the crypto economy, eventually competing more directly with Square's cash app in that space. So instead of thinking of Coinbase as just a cryptocurrency index, I'm thinking of it as a category-leading technology company that can build on top of the broader crypto ecosystem. If you believe that vision, then here are some questions to ask as an investor as they release more financial information in the coming months. As a tech company, how are they innovating? What new crypto based financial products and services will they be launching?

[00:09:36.800]

And as a crypto exchange, how will Coinbase adapt the revenue streams as other exchanges drive transaction fees down over time? Part of our job as a vision first, technology investors is to identify and understand some of those answers for ourselves. Whether or not you end up buying Coinbase stock, I hope this video gave you some insight into some of the newest financial technologies entering the markets in big ways, how they might fit into ARK Invest's five year vision of the future and what they're doing about it today.

[00:10:05.740]

In my opinion, there's a bright future for cryptocurrency exchanges and technology companies building on top of blockchain in many other ways. And whether Coinbase's stock goes up or down tomorrow or the next day, that's a future I'm excited for. Yes. Including you, Dogecoin. This is Ticker Symbol: You. My name is Alex, reminding you that the best investment you can make is in you.

If you want to comment on this, please do so on the YouTube Video Here