Table of Contents

1. Introduction

2. Broadcom and Nvidia

3. Broadcom's Business

4. Broadcom's Partnership with OpenAI

5. Nvidia and Broadcom

6. Broadcom Stock

Introduction

And it is a tremendous amount of revenue. They said billion next year, which is a very fast ramp. And on the flip side, you've got Nvidia down. I'm just curious whether you think Nvidia has some real competition and whether its share is seriously threatened. Something big is happening at Broadcom that could mean big trouble for Nvidia stock.

Broadcom just announced that they're designing $10 billion worth of custom chips for OpenAI, which could lead other companies to do the same? Could Broadcom be the new king of artificial intelligence? And what does all this mean for the future of Nvidia stock? Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time.

So here's what I'll be covering in this video, what Broadcom does and how they compete with Nvidia, their biggest competitive advantages versus other chip companies, their latest earnings call and huge new partnership with OpenAI, and of course whether I'd still buy Broadcom stock now that it's worth over one and a half trillion dollars and where it belongs on my list of stocks to get rich without getting lucky in 2025 which has been absolutely crushing the market since i made this list back in december i'm not trying to toot my own horn here but i do think it's super important to understand the science behind these ai stocks which is just my way of saying how the business behind the ticker symbol actually makes its money and that's about to change for broadcom after the big announcements that they made on their latest earnings call but first let's get on the same page about the science behind this stock the big thing that investors need to know is that 99 of all internet traffic touches at least one broadcom chip that's because broadcom has around a 90 market share in ethernet switching chips for data centers which is just as massive as nvidia's market share for data center gpus most companies that sell data center switches like arista networks juniper and even some Cisco switches actually use Broadcom's Tomahawk chips instead of building their own custom ASICs.

That means no matter which switch supplier a data center chooses, they're actually buying chips from Broadcom. And that probably won't change anytime soon, since Broadcom designed their Tomahawk roadmap specifically around AI and machine learning, like supporting tightly coupled GPU clusters with ultra-low latency, handling distributed training workloads across thousands of accelerators, and reducing signal noise and power consumption through co-packaged optics.

It's not a stretch to say that the only reason that NVIDIA's InfiniBand doesn't have a 100% market share in AI data centers today is because Broadcom is so good at supporting distributed AI workloads over Ethernet.

Today, around 20-30% of AI workloads run on Ethernet, and that number is steadily growing, since well over 90% of the world's overall data center infrastructure runs on ethernet today and the companies running them want the most bang for their buck don't forget the overwhelming majority of today's workloads still have nothing to do with ai and since broadcom already has a huge install base and economies of scale it's going to be hard for a new competitor to come in with better performance or at a lower cost just like with nvidia's gpus but these tomahawk switch chips are only one part of broadcom's enormous business Let me show you the rest as we go through their latest earnings.

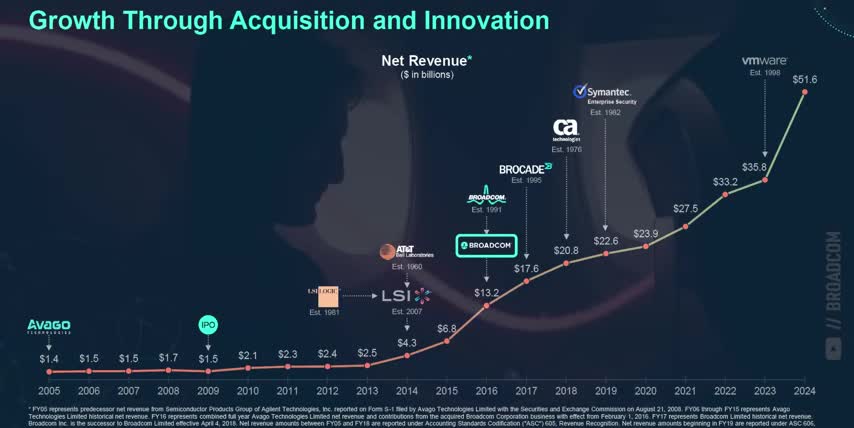

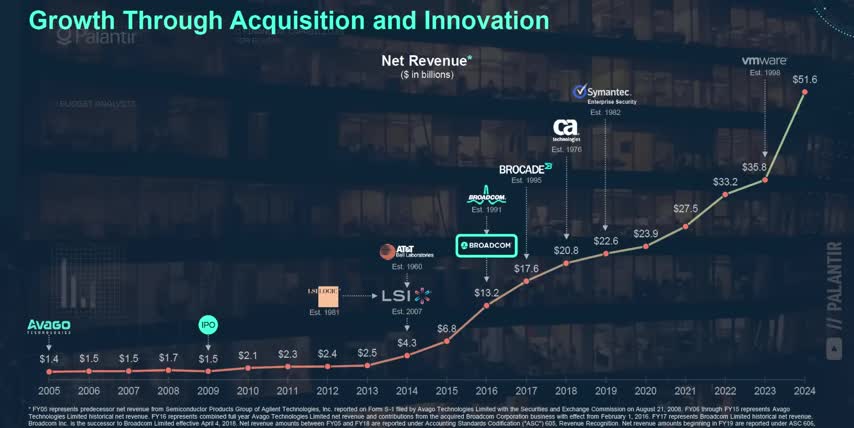

Broadcom has two big business units, Semiconductor Solutions, which account for about 57% of their revenues, and Infrastructure Software which makes up the other 43 Broadcom has a long history of acquiring companies and integrating their offerings into an end hardware and software portfolio for data centers In fact the vast majority of Broadcom infrastructure software revenue comes from companies that they've acquired, mainly VMware and before that Symantec.

VMware kind of acts like the underlying operating system for cloud and corporate data centers. It lets companies stand up virtual machines so that multiple operating systems and different kinds of applications can run on the same physical hardware in data centers and on the cloud.

VMware's flagship products like vSphere and VMware Cloud Foundation allow companies to split up servers, storage, and networking so that they can manage more workloads and move applications between local machines and the cloud.

Since Broadcom acquired VMware back in 2023, it's become a huge piece of Broadcom's $7 billion per quarter software business by giving them access to thousands of enterprise customers, stable recurring subscription revenue with high margins, and control over critical IT infrastructure as workloads keep shifting to the cloud. On the flip side, Symantec provides software to protect businesses from hackers, malware, ransomware, and data breaches.

They have products to protect laptops, desktops, servers, and smartphones from cyber threats, stop confidential information from being leaked online, and zero trust gateways that protect users when they access the internet and applications that are hosted online and speaking of security you probably know that vpns protect you and your data by encrypting it and making it look like you're somewhere else but did you know that vpns can also save you a ton of money that's where surfshark comes in the sponsor of this video surfshark is a super fast and easy to use vpn you can install on unlimited devices with just one account to protect you and your entire family.

But some online stores raise their prices based on your location. So you can also use Surfshark to always get the best price on expensive purchases, like plane tickets, hotel rooms, and rental cars. And since VPNs change your digital location, Surfshark lets you access content, websites, and services that can be blocked in your region altogether. I do this all the time when I travel.

So if you care about your family's privacy and you like saving money, you can go to Surfshark.com slash ticker to get up to 4 extra months for free. And since Surfshark offers a 30-day money-back guarantee, there's no risk in trying it with my link in the description below.

Alright, so acquiring companies like VMware and Symantec is how Broadcom can offer end-to-end software services like virtualization, management, and cybersecurity to huge customers with global data center infrastructures, as well as get recurring revenues with high margins.

But the bigger piece of Broadcom's revenue comes from Semiconductor Solutions, which focuses on designing custom AI accelerators like Google's Tensor Processing Units and Meta Platform's MTIA chips, custom networking chips like the Tomahawk switches I mentioned earlier, and many other networking devices that give them their massive market share with cloud service providers, telecom equipment managers, and OEMs are building and deploying ai infrastructure today this is where broadcom's new partnership with openai comes in it's important for investors to understand a few things about this partnership before i talk about what it means for nvidia broadcom is working with openai to design what industry sources are calling the titan xpu which is a custom processing unit that's optimized to power inference workloads for chat gpt as well as future ai models and mass production is beginning in 2026 these chips are designed exclusively for openai internal use not for sale to other companies just like Google TPUs Amazon Inferentia chips and Meta custom silicon OpenAI plans to deploy these chips across the data centers that they use to support massive compute demand for their next generation of AI models, like GPT-5.

Also custom ASICs like this Titan chip are fundamentally different from GPUs. ASICs, which stand for Application Specific Integrated Circuits, have much better performance per dollar, but they're optimized to handle only a few specific applications, just like their name implies.

For example, Broadcom's custom Titan XPUs for OpenAI could have anywhere from 2 to 5 times better performance per dollar and performance per watt over Nvidia's GPUs, but it will probably be purpose-built to handle text, speech-to-text, text-to-speech, and code generation that doesn't involve rendering graphics, since that would cover the majority of OpenAI's inference workloads, and all of those use cases are fundamentally about processing text in one way or another.

That's exactly the same pattern that we've already seen with Google's TPUs and Meta's MTIA chips, and both companies are still some of NVIDIA's biggest customers.

Why? Because the goal of all these custom chips isn't to disrupt nvidia at all it's to make sure that nvidia's gpus are being used for the most compute intensive workloads and the most cost-efficient tasks not just training massive ai models but rendering graphics and generating and searching through videos running global climate models and simulations helping with the discovery of new materials and drugs and all the other inference workloads that aren't text-to-text remember nvidia's gpus have been constantly sold out for months or even a year in advance which means the entire ai industry is limited by supply not demand and broadcom's new chips are targeting all that extra demand for specific inference workloads and just as i'm recording this video nvidia announced a new chip called the ruben cpx a new kind of gpu designed specifically for massive context inference this system will have 7.5 times more AI performance over Nvidia's Blackwell Ultra systems, 3 times faster recall for prompts that use tons of memory, and will work with both InfiniBand and Spectrum X Ethernet.

So Nvidia is really doubling down on the AI markets where their GPUs don't have any competition, while Broadcom is capitalizing on the insane demand for text-based workloads. And the global artificial intelligence market is clearly big enough for both companies, with industry analysts now expecting it to almost 20x in size over the next nine years. That would be a compound annual growth rate of close to 40% per year through 2034, which is more than triple the growth rate of the S&P 500.

And just to gut check that number, Broadcom reported $16 billion in revenue for the quarter, which is up 22% year over year, but their revenue from AI specifically grew by 63% year over year to $5.2 billion. dollars. And they're expecting 6.2 billion dollars of AI revenue next quarter. That's the same kind of revenue ramp we saw with Nvidia. The real risk for Broadcom is actually their overall margins.

Even though revenues and gross profits are up, their operating income was flat thanks to a perfect storm of a few things. First, new chips usually need new supply chains and often get sold in large quantities, usually to hyperscalers at bulk discounts.

So, Broadcom's custom chips have higher unit costs and lower top pricing per chip which reduces their overall margins Second their operating expenses are up 9 year since they spending a lot more money on research and development, engineering, and sales to support their new AI products.

And third, Broadcom only completed its acquisition of VMware at the end of 2023, so they're still dealing with the costs of restructuring and integrating the company and its products into overall portfolio of solutions. But don't forget, there's much more to Broadcom's semiconductor solutions than just these custom chips.

They also make network interface cards, wireless networking solutions, and high-performance top-of-rack switches for AI data centers, which is why 99% of all internet traffic touches at least one Broadcom chip in the first place. And if they keep landing massive multi-billion dollar deals with companies like OpenAI, a huge percentage of AI tokens will touch at least one Broadcom chip as well.

Alright, now that we understand what Broadcom actually does, what their major products are, their latest earnings results, and how they compete with Nvidia, there's only one thing left to talk about. Is Broadcom stocks still one of the best AI stocks to buy now, even though it's up by almost 60% since the start of the year? And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps me out and it lets me know to make more deep dives like this. Thanks and with that out of the way, let's talk about Broadcom stock. I still think that Nvidia will be the king of the entire AI revolution. AI models are constantly getting bigger, training on more data, more often, and spending more time in tokens thinking through problems before responding. Not to mention, taking in new kinds of inputs and generating new kinds of outputs.

The lines between training and inference are starting to blur, and the number of markets that are adopting generative AI for different use cases is growing fast. I really believe that means more flexible chips, like GPUs, are the best tool for the job. Even before we talk about NVIDIA's broader AI hardware ecosystem for data centers, their massive CUDA platform and acceleration libraries that run on top of that, and all the software and services that NVIDIA runs on top of that.

That's why they're at the top of my list of stocks to get rich without getting lucky in 2025, 5, only behind a fund where Nvidia is the top position anyway. But like I've been saying for years now, Nvidia won't get disrupted by another GPU company, the same way that Google's monopoly on search will never get disrupted by another search engine.

It will take a fundamentally different technology to disrupt Google, like generative AI answer engines that skip ads altogether and return full answers instead of links to webpages that users need to sift through themselves. Likewise, if Nvidia can ever be disrupted, and that's a big if, it'll be by a fundamentally different kind of chip, like ASICs that do more and cost less for the most in-demand workloads.

Today, the AI market is growing insanely fast, which means there's more than enough room for both GPUs and ASICs, and I want to capture as much of that growth as I can. So I'm moving Broadcom stock up three spots on my list right under Nvidia. That way, if the market moves one way or the other, I've already got a big position in the winner. And if they both win, which is what I think will actually happen, I'll win even bigger. That's the best way to get rich without getting lucky.

And if you want to see what else I'm buying to get rich without getting lucky, check out this video next. Either way, thanks for watching and until next time, this is ticker symbol U. My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- Broadcom is designing $10 billion worth of custom chips for OpenAI, which could lead other companies to do the same.

- Broadcom has a huge market share in ethernet switching chips for data centers, with around 90% market share.

- Broadcom's semiconductor solutions business focuses on designing custom AI accelerators, custom networking chips, and other networking devices.

- Broadcom's partnership with OpenAI is for designing a custom processing unit optimized to power inference workloads for Chat GPT and future AI models.

- Nvidia is doubling down on AI markets where their GPUs don't have competition, while Broadcom is capitalizing on the demand for text-based workloads.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.