The Federal Reserve is about to cut interest rates for the first time this year, which will make a lot of investors very rich, as long as they know which stocks to buy and which ones to avoid. So in this video, I'll show you everything you need to know about interest rates, how they affect the stock market, and which stocks will win big as rates begin to fall. Because being prepared for what's about to happen is a great way to get rich without getting lucky.

Table of Contents

1. Introduction to Interest Rates and the Stock Market

2. How Interest Rates Affect the Stock Market

3. Historical Data on Stock Performance After Rate Cuts

4. Which Stocks to Buy as Interest Rates Fall

Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage. So here's everything I'm going to cover. What the federal funds rate is and why it matters to investors. Historical data that shows just how much stocks could rise once rates start to fall. What kind of stocks will benefit the most from these rate cuts. And of course, which stocks I'm buying as a result. There's a lot to talk about.

So let's jump right into why the Federal Reserve has such a big impact on the stock market. The Federal Reserve is the central bank of the United States, and its main job is to keep our financial system stable and healthy. The Fed does this in a few ways. For example, it sets monetary policy, which means the Fed can raise and lower interest rates to help keep inflation low and employment high.

It can also add money to the economy, which is called quantitative easing, or it can take money out, which is called quantitative tightening. Whether the Fed lowers interest rates or adds money to the economy by buying bonds, what What they're really doing is encouraging banks to lend more money at lower interest rates. And that encourages people to borrow more money for major purchases and businesses to borrow more money to hire employees and make new products.

People spending more and businesses building more eventually leads to more revenue growth for the companies that we all invest in. And faster revenue growth usually means higher stock prices. But the thing is, this is a real double whammy. lower interest rates also means lower bond yields and lower rates on savings accounts, which makes the stock market look more attractive by comparison. So, investors move more money into the market.

That means not only are companies actually growing their sales and their earnings faster, but investors are paying higher prices in the form of higher price-to-earnings or price-to-sales ratios on top of that. The opposite happens when the Fed raises interest rates or takes money out the system. It becomes more expensive for businesses to borrow money, which means slower growth, which means stock prices should go down.

On top of that, bond yields and savings rates go up, which makes the stock market look less attractive by comparison. And more investors move their money into bonds, which makes most stocks trade at lower multiples of their earnings or their sales. That's the big connection between interest rates, the overall economy, and the stock market. Alright, so the Federal Reserve is about to cut interest rates for the first time this year.

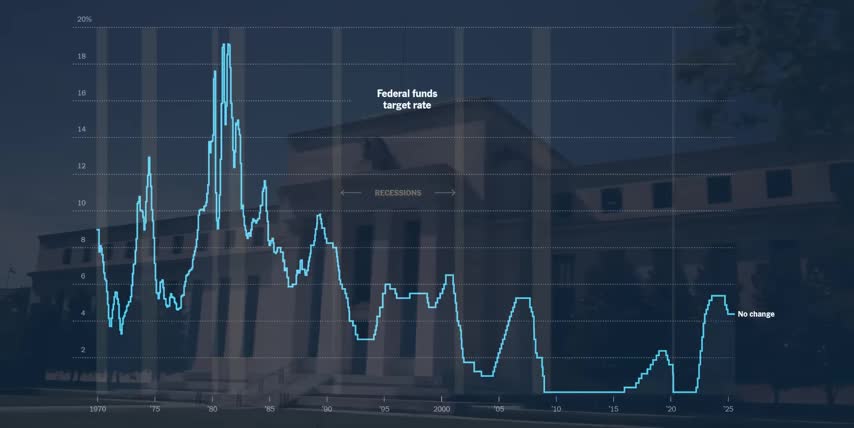

And now that we understand what that actually means for investors, let me show you something that will put you ahead of almost every Wall Street analyst trying to predict which stocks will outperform the rest of the market during this next rate cut cycle. This is a plot showing the S&P 500's average rate of returns in the months before and after the first Fed rate cut in each cycle. The x-axis is time, going from a year before the first rate cut to a year after.

The y-axis is percentage returns, and the bars show the average market returns before and after the Fed starts cutting rates. There have been a total of 11 rate-cut cycles since 1980, and they fall into one of two categories. The Federal Reserve can start cutting rates because they're worried about a recession. That's when economic growth is negative, businesses are cutting jobs, and consumers are spending less.

The Fed cuts rates to try and and stop this downturn, hoping that cheaper borrowing costs will help businesses survive, protect jobs, and get people and companies spending again.

Or, the Fed can cut rates even though the economy is still expanding, in order to prevent a slowdown from happening in the first place If you ever heard the term soft landing that when the Fed raises rates to fight inflation and then lowers them to avoid a recession by trying to limit job losses and encourage more spending That why the Fed is cutting rates right now after raising them aggressively to fight inflation back in 2022 and 2023. So, let's walk through this data together.

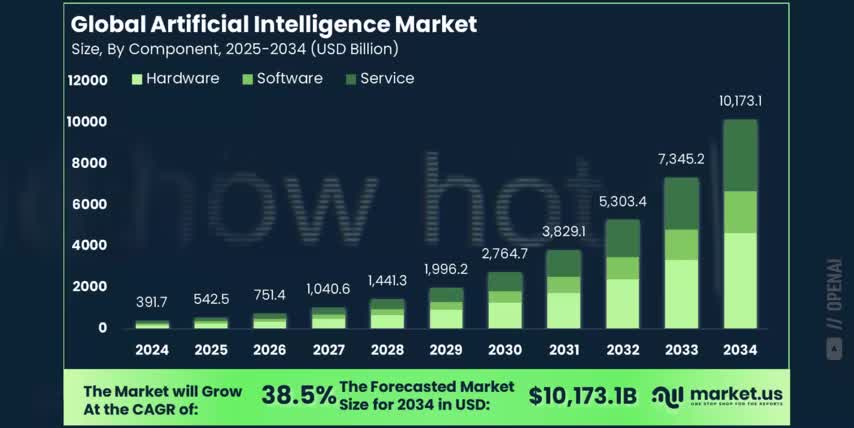

According to MarketUS, the global artificial intelligence market is expected to almost 19x in size over the next nine years which is a compound annual growth rate of over 38 through 2034 but many of the companies building next generation ai applications are not publicly traded think about the 90s and early 2000s companies like amazon and google went public very early in their growth cycle but today they're waiting an average of 10 years or longer to go public that means investors like us can miss out on most of the returns from the next amazon the next google the next nvidia that's where fundrise comes in the sponsor of this video their venture capital product lets you invest in some of the best tech companies before they go public venture capital is usually only for the ultra wealthy but venture capital with fundrise gives everyday investors access to some of the top private pre-ipo companies on earth with an access point starting at ten dollars they have an impressive track record already investing more than 200 million dollars in some of the largest most in-demand ai and data infrastructure companies so if you want access to some of the best late stage companies before they ipo check out venture capital with fundrise using my link below today alright so growth stocks return roughly twice as much as value stocks on average after the first rate cut in an expanding economy but if we want to find the best stocks to take advantage of this we need to understand why it happens in the first place value stocks are companies that already generate strong and steady cash flows today they're usually in asset heavy sectors like banking energy or industrials and their shares can trade at lower price to earnings ratios or even low price to book ratios which measure how much investors would pay for each dollar of assets that the company owns based on those metrics investors buy value stocks because they think the company is undervalued today on the other hand growth stocks are companies that reinvest most of their profits back into the business usually by hiring more people developing new products and building more infrastructure to support themselves as they expand they're called growth stocks because their earnings are expected to grow much faster than the market average and their share prices reflect those high expectations for their future value not their value today so when the federal reserve cuts interest rates Growth stocks benefit a lot more than value stocks for two key reasons.

First, you probably already understand that future dollars are worth less than dollars today, due to inflation and opportunity costs.

You'd much rather invest your money today than a year from now on average But how much less your money is worth in the future depends on interest rates When interest rates are high you could put your money in a safe investment like a bond or a bank account and earn a good return right now That makes waiting for future earnings less attractive so investors discount future profits more heavily and growth stocks go down when interest rates rise.

On the flip side, when interest rates fall, bonds and bank accounts don't offer as good returns, so future profits start looking more attractive by comparison. Investors don't discount future cash flow as much, so they're worth more in today's dollars. That's why I show discounted cash flow models when I talk about a stock's value in my videos.

So, the first reason growth stocks benefit a lot more from rate cuts is because their future earnings are worth more in today's dollars, since bonds and bank accounts are going to start offering lower returns. The second reason is one we've already covered. Growth companies need to make big investments into new equipment, data centers, manufacturing sites, supply chains, and research and development. These are called capital expenditures.

And when interest rates fall, capex-intensive businesses can borrow more money to expand faster, upgrade more, and innovate at a lower overall cost. Now let's put everything together to find the best stocks to buy as interest rates start to fall. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out, and it lets me know to make more content like this. Thanks, and with that out of the way, let's talk about stocks.

The best stocks to buy when interest rates start to go down in an expanding economy all have the following things in common. First, they're in markets where spending is growing fast, like AI, cloud computing, data center infrastructure, and semiconductors. Second, they need to have a moat, so they can't easily be replaced or out-competed for this money.

Companies with patents, proprietary chips, software, or networking technology can protect their margins and win more business as AI spending expands. And third, they need to have direct exposure to hyperscalers like Amazon, Microsoft, Google, and Meta platforms. We're not looking for the companies spending the most money. We're looking for the companies that they're spending it with. Specifically, companies who are sensitive to small changes in that spending.

When there's a ramp up in orders, these companies' revenues and profit margins grow much faster than the hyperscalers themselves, who have a lot of other business units like advertising, e-commerce, and so on. I recently covered all the companies I'm about to show you, so I'm just going to quickly run through how they each meet the three criteria I just laid out. Fast-growing markets, deep moat, and direct exposure to hyperscalers, so that rate cuts turn into direct revenue growth.

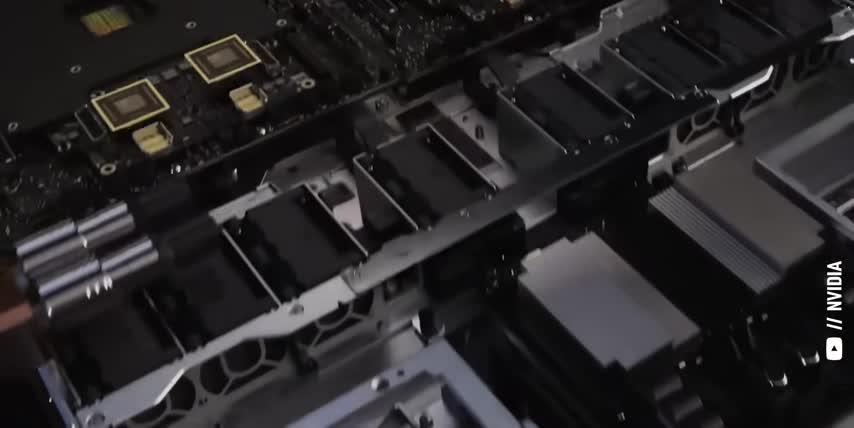

NVIDIA is the global leader in AI accelerators, with a 90% market share and an unrivaled portfolio of AI chips and supporting data center infrastructure, both in terms of hardware and software. Every major hyperscaler is one of their top customers. They rely on NVIDIA for generative AI and advanced training clusters. NVIDIA's earnings and their revenue skyrocket when AI and data center spending ramps up, which is exactly what we saw happen over the last two years.

No other chipmaker is as important to both hyperscaler deployment and the broader AI boom. I really think that NVIDIA will be the world's first $6 trillion company, which implies a price of $247 per share, or roughly a 38% upside from today's prices. CoreWeave operates one of the largest independent NVIDIA-powered AI cloud platforms, securing direct multi-billion-dollar contracts from multiple hyperscalers and AI model companies.

CoreWeave's revenue is almost entirely tied to the size and speed of AI infrastructure spending. When hyperscalers deploy more GPUs, CoreWeave's business explodes. The company's expansion is pure capex and directly sensitive to interest rates.

CoreWeave customers benefit from tailored performance direct integration and priority hardware access that isn easily replaced So once organizations move large AI workloads onto CoreWeave it becomes much more difficult and costly to move those deployments somewhere else. Remember what I said earlier, when interest rates fall, future profits start looking more attractive. Investors don't discount future cash flows as much, so they're worth more in today's dollars.

Well, discounted cash flow models calculate the fair value of core weave stock to be around 218 dollars per share while today's price is around 112 dollars that makes core weave almost 50 undervalued based on their expected future cash flows which means the stock would have to double to reach that fair value today the taiwan semiconductor manufacturing company or tsmc is the world's only advanced foundry partner for nvidia amd apple and all of the custom ai chips for the major hyperscalers google amazon meta platforms and microsoft its process technology dominates the entire advanced chip market with clear advantages in their most advanced semiconductor fabrication nodes compared to companies like intel and samsung tsmc's earnings rise every time hyperscalers and chip designers step up their ai investments making it one of the biggest beneficiaries of both higher capex and cheaper costs of capital which is exactly what happens when interest rates fall discounted cash flow models calculate tsm stocks fair value to be around 260 dollars per share which is right at its current share price but remember dcf models look at today's interest rates to know how much of a discount to apply so as interest rates start to fall tsm stocks fair value will keep climbing higher another semiconductor stock that's right at its fair value is amd which is valued at around 155 dollars per share today amd is the only other major supplier of ai data center gpus besides nvidia but they're also taking share of the data center cpu market from intel companies like microsoft and meta platforms are ordering more and more of amd's chips for ai inference and to power their cloud servers i don't think amd will ever catch up to nvidia when it comes to ai hardware or software but the market is growing so fast and companies are spending so much that amd will clearly see some serious gains as interest rates begin to fall vertive holdings ticker symbol vrt provides mission critical power cooling and physical infrastructure for hyperscalers and data centers almost every hyperscaler relies on vertive for their large-scale expansions and the their revenue surges based on the volume and the speed of global data center build-outs.

The more data centers that hyperscalers build to support new AI tools and cloud services, the more business Vertiv gets. And once a major tech company uses Vertiv's power and cooling solutions in their facilities, they often have to stick with them for future upgrades, for future expansions, and for future service contracts because switching providers can be very risky and costly, since it usually comes with downtime, retraining new personnel, and compatibility problems.

Discounted cashflow models show Vertiv stock as 6% undervalued at today's prices and at today's interest rates, but I think their fair value will continue to climb as their power and water cooling solutions take more market share when data centers switch to water cooling in order to support Nvidia's Blackwell GPUs, which are already shipping as we speak.

Key Takeaways

- The Federal Reserve is cutting interest rates for the first time this year, which will likely make investors rich if they know which stocks to buy and avoid.

- Interest rates have a significant impact on the stock market, with lower rates leading to higher stock prices and faster revenue growth.

- Growth stocks tend to perform better than value stocks after rate cuts in expanding economies, with the S&P 500's growth index returning around twice as much as the S&P 500's value index.

- The best stocks to buy when interest rates start to fall have a moat, are in fast-growing markets, and have direct exposure to hyperscalers like Amazon, Microsoft, Google, and Meta platforms.

- NVIDIA, CoreWeave, TSMC, AMD, and Vertiv are some of the top stocks to consider buying as interest rates start to fall.

I know this video was a little long, but hopefully it helped you understand how interest rates affect the stock market, what kinds of stocks they affect the most, what to look for in companies as interest rates start to fall, and of course, which stocks are the best stocks to buy as a result. And if you want to see what else I'm buying to get rich without getting lucky, check out this video next. Either way, thanks for watching and until next time, this is Ticker Simple You.

My name is Alex, reminding you that the best investment you can make is in you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.