What if I told you there was another AI tech giant hiding in plain sight? A company that builds one of the most critical components for the entire AI era. And what if it was growing faster and priced cheaper than almost every other chip company today? Buying that stock would be a great way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time.

Table of Contents

1. What makes Micron important

2. Micron Technology

3. Micron Earnings

4. Risks and Valuation

This post is all about Micron technology, and here's everything I'm going to discuss. What Micron does and how they make their money, why Micron is critical to the entire AI revolution, their latest earnings call, future growth, and biggest risks, and of course, what all this means for Micron stock as a result. Let's start with what makes Micron so important when it comes to AI.

Micron Importance

Micron technology is one of the world's leading manufacturers of memory chips, mainly DRAM, flash memory, and high bandwidth memory, or HBM. The big thing investors need to understand is that memory is no longer a commodity. It's one of the biggest bottlenecks in AI training and machine learning workloads.

That's because as AI models get bigger, take more data to train, and use more tokens for inference, they need much more memory and they need to be able to access that memory much faster to work in near real time. Every AI application now needs massive amounts of memory to store, move, and process huge datasets in milliseconds. From OpenAI's latest models to physical robots and self-driving cars. That's where high bandwidth memory comes in.

HBM can move huge amounts of data at very high speeds by stacking memory chips and connecting them to a shared hub. This kind of design is much faster and much more power efficient than other types of memory because it lowers the physical distance that data needs to travel. That's why it's in such high demand in data centers. HBM is Micron's single fastest growing product category and they have much more demand than supply, with most of their HBM3E and HBM4 chips being sold out through 2026.

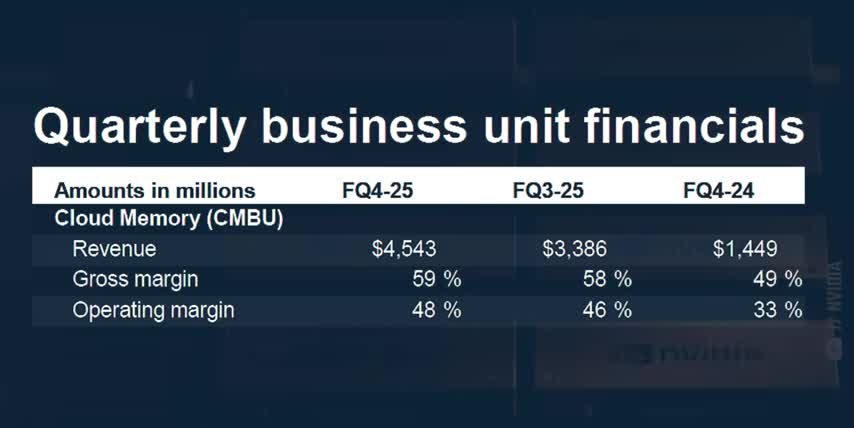

As a result, revenues from their cloud memory business unit more than tripled year over year, while their gross margins and their operating margins grew to 59% and 48% respectively, both of which are over 10 percentage points higher than they were a year ago, and much higher than the industry average for memory chips. I'll get back to this massive growth when we walk through Micron's earnings. But first, let me get specific about who's actually buying these chips.

Micron's HBM3 memory is used in Nvidia‘s Hopper H200s and their current Blackwell B200 GPUs. Additionally, it is used in AMD's Instinct MI325s, the MI350s, and the MI355 accelerators, as well as Google's 7th generation Ironwood TPUs and Microsoft's Azure AI infrastructure. Furthermore, Micron is shipping their HBM4 memory for next-generation AI accelerators, such as NVIDIA's Rubin GPUs and AMD's Altair MI400s, both of which are scheduled for release in 2026.

Micron currently has a 21% share of the global high-bandwidth memory market, making them one of just three companies dominating data center memory for AI today.

Micron is also the only US company of the three, which means they could face fewer supply chain issues and tariffs from the Trump administration than Samsung or SK Hynix both of which are based in South Korea It also worth noting that 21 is a massive share of any global market Microsoft Azure and Google Cloud are two of the most successful cloud infrastructure businesses on Earth, and their market shares are both smaller than Micron's share for high bandwidth memory.

Not to mention that the market for AI memory chips is expected to 9x in size over the next nine years, which would be a compound annual growth rate of over 27% through 2034. That means that Micron could grow roughly twice as fast as the S&P 500, even if their market share and margins stay the same. But I think Micron's market share will actually increase over time, especially as hyperscalers, supercomputers, and enterprise data centers keep diversifying their supply chains to avoid new tariffs.

In fact, Micron's 21% share of the HBM market is up from just 4% this time last year. That's a 5x increase in market share in just four quarters. Besides advanced memory, targeting AI applications, Micron also designs and manufactures memory and data storage products for a wide variety of other industries.

For example, they're a major supplier of DRAM and flash memory for edge devices ranging from laptops and desktops to smartphones and tablets, factory robots and self-driving cars, smart cameras and sensors, and even medical equipment. So while most investors focus on the chips that are making headlines, like NVIDIA's GPUs, Micron has a huge portfolio of products that most Wall Street analysts are completely missing. But the headlines you don't see can move the markets too.

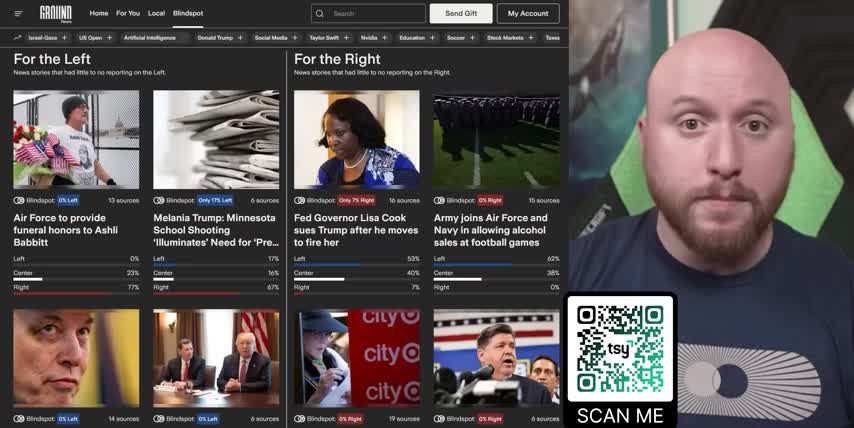

And that's where Ground News comes in. Ground News analyzes over 60,000 articles a day and rates each news source for political bias and factuality.

For example, check out this story about the US government acquiring a 10% stake in intel with about equal coverage from the left versus the right most of these sources have a high factuality rating but there's also some serious bias headlines from the left say that trump is taking control of corporate america and they're calling this investment in intel socialism while headlines on the right focus on the revenues it'll generate and what it means for industrial policy going forward and their blind spot feed shows me which stories are being ignored by one side or the other because knowing what isn't being talked about is just as important as what is these features help me keep my facts straight and save me a ton of time and right now ground news is giving my audience 40 off their vantage plan that's their biggest discount yet so go to ground.news slash ts y or click my link in the description to get unlimited access to every ground news feature for just five dollars a month that's a no-brainer for any serious investor alright so micron's memory can be found in nvidia's and amd's state-of-the-art ai accelerators Google's and Microsoft's data centers, and high-end laptops and desktops, flagship phones, and self-driving cars.

That means Micron will keep winning regardless of which GPU maker, hyperscaler, or consumer electronics companies come out on top, making it a great stock to get rich without getting lucky. And now that we understand the markets that Micron operates in and the products that they actually make, we have all the context we need to dive into their earnings.

Micron reported record revenues of billion for the quarter which is up by 22 quarter and 46 year Micron fiscal year starts in September and ends in late August So their FY25 revenue came in at billion which is up by 49 year On top of that their earnings per share came in at $2.83 for the quarter, versus just $0.79 this time last year. That's a whopping 258% increase in earnings per share. That's some serious growth. Micron breaks down their revenues by technology and by business unit.

Let's look at technology first. DRAM is Micron's best-selling technology by far, with revenues coming in at $9 billion for the quarter and $28.6 billion for the fiscal year. That means that DRAM represents over 75% of Micron's total revenues. Micron doesn't separately break out the numbers for high bandwidth memory yet, but that's what's fueling all the growth for this side of their business.

Beyond HBM, their DRAM business also includes the DDR4 and DDR5 memory chips for laptops, desktops, and data centers, as well as the mobile memory chips for smartphones and tablets that we just discussed. Micron also sells solid-state drives, as well as memory chips for robots, self-driving cars, and smart devices, all of which fall under NAND flash storage and memory.

Revenues from NAND memory came in at $2.3 billion for the quarter and $8.5 billion for their fiscal year, which is up by a respectable 5% sequentially and 18% year over year. Micron has four major business units, cloud memory, core data, mobile and client, and auto and embedded. We've already gone over all the major products that fall under each business unit, so instead, let me tell you something that will put you ahead of almost every Wall Street analyst covering this stock.

Most investors think of Micron as a commodity memory supplier stuck in a boom or bust cycle. They have high profits when demand exceeds supply, but otherwise, they have almost no pricing power and no real moat. But high bandwidth memory is not interchangeable like normal RAM is. It's customized and tightly integrated into the final chip.

That means Micron's profits are protected by their long-term partnerships with NVIDIA for their Hopper, Blackwell, and Rubin GPUs, AMD for multiple generations of their Instinct Accelerators, and Google and Microsoft with their AI infrastructures. That means the limited supply for high bandwidth memory gives Micron a lot of upside as AI keeps expanding. But it also protects their downside if traditional memory markets start to slow down.

That's why the business unit that every investor needs to pay attention to is their cloud memory business unit, since that's Micron's revenue driver for the entire AI revolution. Their cloud memory business unit revenue grew from $1.45 billion four quarters ago to $4.5 billion this past quarter. That's a 214% increase year over year. And now, cloud memory is their biggest business unit by far. Let me say that again.

Micron's cloud memory revenue more than tripled year over year, and their margins expanded by double digits. This is why we look for companies with perfect products for quickly growing markets. This is why I think that Micron is an AI tech giant hiding in plain sight. This is why it's so important to understand the science behind the stocks.

And now that we understand Micron's markets, their memory products, and their finances, let's talk about their biggest risks and their $175 billion valuation And if you feel I earned it consider hitting the like button and subscribing to the channel That really helps me out and it lets me know to make more content like this Thanks and with that out of the way let talk about Micron biggest risks first Micron has some serious competition in the high bandwidth memory market, since SK Hynix has a dominant 62% market share today.

And I should also point out that Samsung, Micron's other major competitor, recently had delays in getting their newest HBM chips qualified to go into major AI products. Those delays are how SK Hynix and Micron ended up grabbing more market share and profits as their customers scrambled to buy all the HBM that they could get their hands on. But now, Samsung is ramping production back up, which means there could end up being more HBM supply than demand, at least in the short term.

If that happens, all three companies will have to lower prices to move their inventory, which would translate to lower profits until the oversupply ends. Unlike Nvidia or AMD, Micron actually manufactures most of their own chips. So another risk is that Micron could have trouble scaling their HBM4 production in 2026, just like Samsung did earlier this year.

There's a lot of complexity that comes with vertically stacking over a dozen ultra-thin memory dies and then connecting them together in a way that doesn't fail when they heat up at full power in actual data centers. If Micron does have any manufacturing delays or they have yield issues, SK Hynix and Samsung will have a chance to fill that demand instead. That's also exactly what happened with Intel, but with CPUs instead of memory.

And of course, we still have all the ongoing geopolitics with China, including the Trump administration's trade restrictions and export controls, which could limit Micron's access to Chinese markets or their ability to import new manufacturing equipment or slow down other parts of their supply chain. In my opinion, the competition and manufacturing risks aren't unique to Micron.

They also apply to Samsung and SK Hynix, and the geopolitical risks are actually smaller for Micron since they're a US company. Still, I wanted to make sure I called them out for you. And now that we know the risks, there's really only one question left to ask. Is Micron stock actually a good investment? And to answer that, we need to look at Micron's valuation next. In my opinion, the numbers speak for themselves.

Micron's revenue grew by 46% year over year, while their gross margins and their operating margins increased by double digits. And as we already saw, their earnings per share skyrocketed by over 250% over the same time frame. As a result of all that growth and good risk management, Micron's fair price-to-earnings ratio is around 34, while their current P.E. ratio is closer to 21.

This is just a fancy way of saying that Micron stocks should be trading at higher multiples because of how fast they're growing. That fast growth also means that Micron is trading at a forward price to earnings ratio of just 10, which is much lower than other chip companies like AMD, Texas Instruments, and Qualcomm. So my plan is to dollar cost average into Micron stock even more aggressively after this earnings call.

And if they can keep up this level of execution, Micron might even end up on my list of stocks to get rich without getting lucky in 2026. And if you want to see what other stocks I'm buying to get rich without getting lucky, check out this video next. Either way, thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- Micron Technology is a leading manufacturer of memory chips, including DRAM, flash memory, and high bandwidth memory (HBM).

- Micron's HBM is critical to the AI revolution, and their cloud memory business unit is driving growth.

- Micron has a 21% share of the global high-bandwidth memory market and is one of the few companies dominating data center memory for AI.

- Micron's revenue and earnings per share have grown significantly, with a 46% year-over-year increase in revenue and a 258% increase in earnings per share.

- Micron's cloud memory business unit revenue has more than tripled year over year, with margins expanding by double digits.

- Micron faces competition from SK Hynix and Samsung, as well as risks related to manufacturing and geopolitics.

- Despite these risks, Micron's valuation is attractive, with a fair price-to-earnings ratio of around 34 and a current P.E. ratio of 21.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.