Table of Contents

1. Introduction to AI Investing

2. Vanguard Information Technology ETF

3. Vanek Semiconductor ETF

4. Roundhill Generative AI Technology ETF

5. First Trust NASDAQ Cyber Security ETF

6. Key Takeaways

Introduction to AI Investing

So in this video, I'll go over the best AI funds to buy for 2026 and beyond, so that I win no matter which AI companies come out on top. That's the best way to get rich, without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage, so here are the funds I'll talk about and there are timestamps so you can jump around. But let me point out two quick things before you do.

One, this isn't a random list of funds like you'll see in other videos. I pick these AI funds specifically so that their holdings overlap to give me the most exposure to the best AI stocks, while staying safe and diversified with all the craziness going on right now in the market. So, think of these funds as a solid foundation for portfolios of all sizes, and it's fine to add other stocks on top of them. And two, I'm not a financial advisor.

My background is in electrical engineering and data science, and I have 10 years of industry experience using AI to solve real-world problems. I only buy stocks for the long term, which means at least 3-5 years, and I only buy what I understand. That's why I invest in AI and the chips that power it; I'm sharing my research for educational purposes only.

Great, with all that out of the way, let's dive into VGT, the Vanguard Information Technology ETF, which I think is the perfect fund for any AI-focused portfolio. The most important thing investors need to understand about generative AI is that it's much bigger than chatbots and funny videos. It's already making a massive impact on the most important industries on Earth. Let me show you with a quick example.

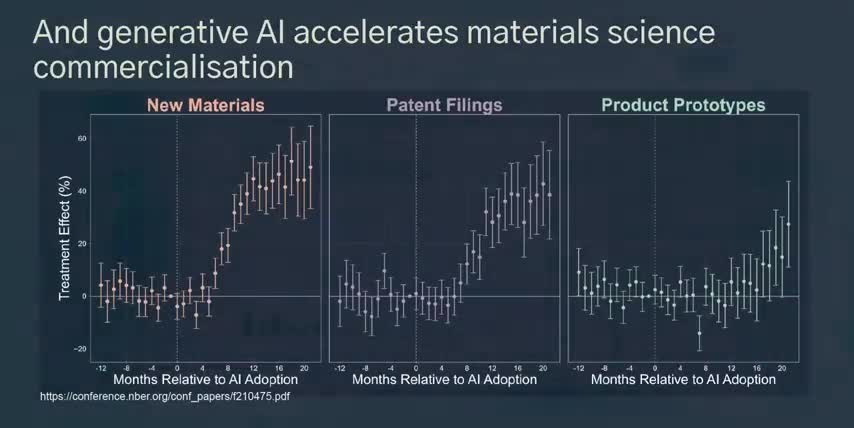

This is a slide from a conference talk that I attended by Jonathan Godwin, the CEO of Orbital Materials and the former lead for AI and Materials at Google DeepMind. Each x-axis is time in months, and the y-axis measures the impact of generative AI on the discovery of new materials in Chart 1, the number of patent filings in chart 2, and new product prototypes in chart 3.

The first 12 months of each chart show the average progress that material scientists made in each area, and the next 20 months show what happened when they started using AI. Just 6 months after adopting generative AI, they started discovering a record number of advanced materials, like the kinds that go into solar cells and solid-state batteries, AI chips and quantum computers, aerospace and robotics, the exact same industries we invest in.

Just 8 months after adopting AI, material scientists were filing a record number of new patents. And by month 17, they were testing a record number of new product prototypes. And that's just for material science. There are charts like these for gene sequencing and drug discovery, physics-based modeling and global weather simulation, robotic motion and self-driving cars, movies, music, and video games.

Almost every industry is seeing a rise in research papers, patents, and prototypes thanks to AI. That's why Vanguard's Information Technology ETF, ticker symbol VGT, is the first fund on my list. This is one of my favorite funds for a few key reasons. First, VGT holds 314 companies, which is right between the NASDAQ's 100 and the S&P's 500 in terms of diversification.

But the S&P 500 and the Nasdaq hold companies like Costco, T Pepsi and Coca while VGT is filled entirely with companies that focus on semiconductors hardware system software and applications all of the industries that are benefiting the most from generative AI while skipping the Costcos and Coca altogether But even though it holds over 300 companies, it's been outperforming the S&P 500 and the NASDAQ because it lets its winners ride.

BGT's top 10 holdings make up 60% of the fund by weight, and include companies like NVIDIA, Microsoft, Broadcom, Palantir, AMD, and Micron, all of which are involved in many different high-growth AI markets. In fact, Just NVIDIA and Microsoft make up over 30% of this fund. On top of that, VGT has lower fees than SPY and the Triple Qs. So I'm not just outperforming these indexes, I'm also saving on fees, which helps my money compound even faster over the long run.

And that's why if there was only one fund I could buy to win big over the entire AI era, VGT would be it. But that doesn't mean this is the only fund worth investing in. It just has the broadest coverage, while these next funds target specific phases of the AI revolution. Speaking of which, Black Friday is right around the corner. But while most people are buying things that lose value, one of the best investments you can make is understanding AI.

That's where OutSkill comes in, the sponsor of this video. OutSkill is hosting a two-day live AI workshop to take you from beginner to AI power user this coming Saturday and Sunday. Over 10 million people around the world have already attended, and the slots for this one are filling up faster than ever. But for Black Friday, they're giving the first 1,000 people who sign up with my link a free seat.

Whether you work in tech or finance, sales or consulting, you'll learn 10 of the most powerful AI tools like Gemini and Grok, best practices for prompting and using AI agents, and even how to automate workflows without any coding. You'll also get free access to OutSkill's exclusive community and learning dashboard to keep growing alongside other AI professionals. This is a great way to gain a competitive advantage, get a serious head start for 2026, and understand the science behind the stocks.

So make sure to register for your free seat before they run out with my link below today. Alright, while the Vanguard IT ETF is a great foundation for any AI-focused portfolio, these next funds are much more targeted. but they don't target different industries like robotics, healthcare, or entertainment. They target specific phases of the AI era. Here, let me explain.

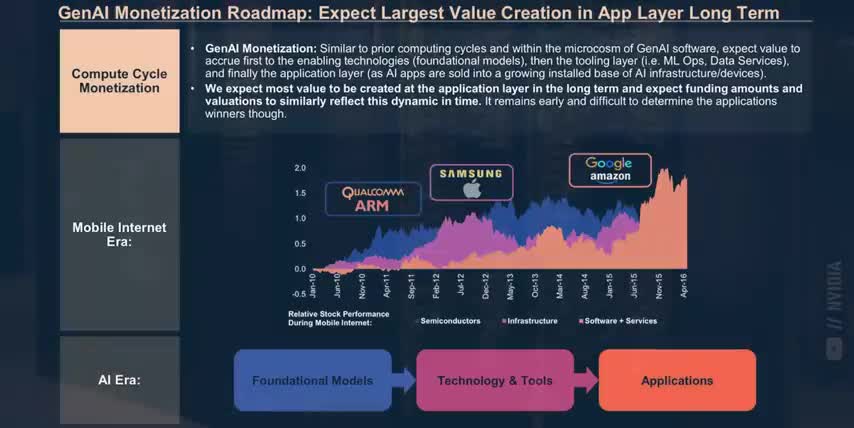

This is a case study by Morgan Stanley Research, showing how different kinds of stocks performed during the rise of the mobile internet. I've shown this case study in previous videos, because I think it can help us find companies that will win big during the rise of generative AI. So, let's walk through it together.

The x-axis is time, the y-axis is stock performance, and tech stocks were broken out into three categories, semiconductors, infrastructure, and software and services, just like with AI. The first big takeaway for me as an investor is that high-margin software and service companies have the best long-term performance, but they're also the last type of stocks to rise.

That's because these companies need data centers to host their applications, and people with edge devices like smartphones, laptops, and desktops to be able to access them. That infrastructure already exists for the mobile era, but companies companies are currently spending hundreds of billions of dollars building new AI data centers and new edge devices like humanoid robots and self-driving cars for the AI era.

And before any AI infrastructure companies can make big moves of their own, semiconductor companies need to build the AI chips that power them. Another big insight for investors is that general-purpose technologies like the mobile internet and AI evolve over a very long time.

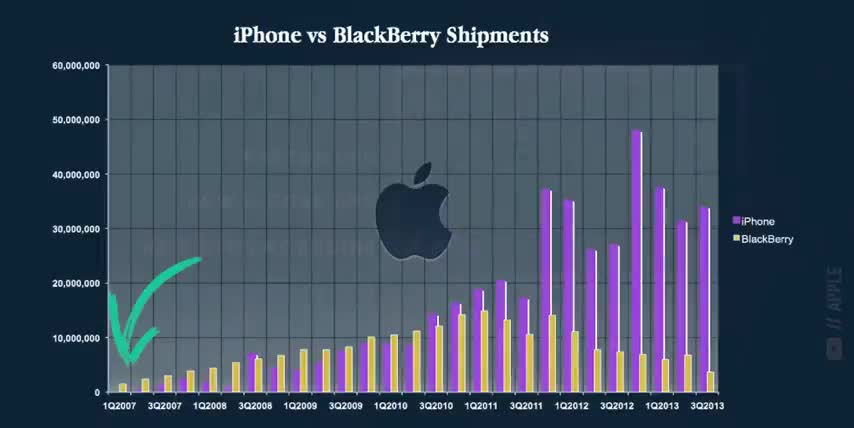

This case study starts in 2010, but the first iPhone came out in 2007, and it took three years for iPhones to hit mass market adoption disrupt Blackberry and usher in the rise of the mobile internet This chart also ends in 2016 but 5G didn even start rolling out till 2018 and many major mobile-first applications and services launched after that, like TikTok here in the US. That means the mobile internet actually evolved over more than a decade.

So even though we've all heard of ChatGPT by now, and Nvidia is already up by 1200% over the last three years, I think we're still somewhere between the first and second phase of the AI era. That's why most of the companies I cover focus on AI chips and infrastructure. And instead of trying to predict the biggest winners between now and 2034, some of which probably don't even exist yet, I think we should focus on these three phases of AI.

Semiconductors, AI data centers and edge devices that are built on top of them, and the software and services running on top of that.

Which is exactly what these next three funds are targeting and how all the funds on my list fit together my favorite fund for semiconductors is the vanek semiconductor etf ticker symbol smh i picked this fund for a few key reasons first it only holds 25 companies making this a very concentrated fund the top five companies are nvidia taiwan semiconductor broadcom amd and micron all of which i cover on my channel very often and they make up almost 50 of the fund that's why we started with bgt as our foundation and i'm using smh to get even more exposure to semiconductors on top of that and just like bgt smh has pretty low fees the total expense ratio is just 0.35 per year but the fund has returned over 40 year to date and a whopping 250 since 2020.

in fact this fund has a long history of high performance if you invested $10,000 in SMH when it was created in 2011, you'd have $270,000 today. And the next few years look even better for semiconductors, since the global AI chip market is expected to almost 9x in size over the next 8 years, which is a compound annual growth rate of 31% through 2033.

One thing I really like about this fund is that it's not too focused on smaller software companies, and the few pure play software companies that chat does include are great businesses that I'd want to hold even if they weren't working on generative AI, like Palantir, Cloudflare, Snowflake, and ServiceNow.

Chat has an expense ratio of 0.75%, making it the most expensive fund on my list But unlike VGT and SMH this fund is actively managed So it also diversifies how our stocks get picked and rebalanced in the first place Roundhill Investments launched this fund two and a half years ago making it the youngest fund on my list But chat has returned almost 50 year to date and over 130 since its inception Like I said at the start, the global artificial intelligence market is expected to almost 19x in size between now and 2034, which is a 38% compound annual growth rate for the next 9 years straight.

And that growth is split between hardware, software, and services, which makes chat a great ETF to capture all of that combined growth. But there is one software market that's already benefiting from the AI boom, and that's where my fourth fund comes in. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out, and it lets me know to make more content like this.

Thanks, and with that out of the way, here's the fourth fund on my list. The global cloud security market is expected to almost 4x in size by 2032, which is 22% growth per year for the next seven years. But just like AI, cybersecurity is a massive industry made up of many moving parts. For example, identity and access management is about making sure only the right people can access the right devices and move around a company's network.

Data loss prevention focuses on securing data and the devices storing it, while endpoint protection is about securing laptops tablets and phones before they join a specific network in the first place the problem with all of these growth estimates is they make basic assumptions like human hackers that are manually writing malicious messages and code but today spammers are already using large language models to generate thousands of phishing emails for pennies on the dollar deepfakes and ai generated videos are tricking people into giving up their personal and financial information and ai models are helping hackers find vulnerable targets write ransomware and execute cyber attacks on larger and larger scales that's why the fourth fund on my list is cibr the first trust nasdaq cyber security etf the top 10 holdings make up over 60 of this fund and they include companies like crowdstrike broadcom which owns semantech palo alto networks zscaler and fortinet all of which i also cover on this channel cibr has a total expense ratio of 0.59 putting it right between smh and chat in terms of fees and just like smh and chat cibr only holds 33 companies making it a very targeted fund that can make big moves of its own that's why it's beating the s p 500 returning 17 year to date and 105 over the last five years and as ai keeps evolving i think every single cybersecurity market will have to grow even faster than analysts predict if companies want to keep their employees, assets, and customers secure in the AI era.

So, there you have it, four of the best AI funds to buy for 2026 and beyond, so that we win no matter which AI companies come out on top. I know this video is a little long, but I want it to be thorough since ETFs have different numbers of holdings and weights, they come with different management styles like active versus passive, which come with different fees, and it's essential to look at the top holdings themselves to see how they overlap.

For example, companies like Nvidia, Microsoft, Broadcom, AMD, and Taiwan Semiconductor sit at the top of multiple funds on this list, even though they target very different markets. That way, I'm getting more of the biggest and best AI companies as I invest in this overall portfolio, making these four funds a great way to get rich without getting lucky by trying to pick individual stocks. But if you do want to see which individual stocks I'm buying now, check out this video next.

Either way, thanks for reading and until next time, this is TickerSymbol: YOU. My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- The global artificial intelligence market is expected to almost 19x in size between now and 2034.

- The Vanguard Information Technology ETF (VGT) is a great foundation for any AI-focused portfolio.

- The Vanek Semiconductor ETF (SMH) is a great fund for semiconductors.

- Roundhill's Generative AI Technology ETF (CHAT) is a great fund for AI technology.

- The First Trust NASDAQ Cyber Security ETF (CIBR) is a great fund for cybersecurity.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.