Table of Contents

1. Introduction

2. Market Downturn

3. AI Bubble

4. Investment Opportunities

5. Key Takeaways

Millionaires are made when the stock market crashes, and the bigger the crash, the bigger the opportunity, especially if we can be greedy when others are fearful. So in this video, I'll show you everything you need to know about the latest market downturn, and why I think this is the investment opportunity of a lifetime. Your time is valuable, so let's get right into it. I say this every time the market drops, but I can't say it enough.

The most important thing that every investor needs to do is make decisions based on facts, not feelings. That's not always easy, and finding the right data to drive your decisions can be even harder. So I've put it all together for you in this video. I'm also not here to waste your time. So here's everything we're going to talk about.

What just caused this latest market downturn, why I think this is the opportunity of a lifetime for long-term investors, exactly how to be greedy when others are fearful, and of course, which stocks I'm buying as prices continue to drop. There's a ton to talk about, But let's start with this latest market downturn. Stock markets around the world dropped after September's jobs report showed mixed results.

Jobs data for September just came out after being delayed by almost two months because of the government shutdown. And it showed the U.S. labor market grew by 119,000 jobs, which is far above the 50,000 jobs that forecasters expected. However, the job market gains for July and August were revised down by a combined 33,000 jobs, and unemployment rose to 4.4%, which is the highest it's been since 2021.

This combination is the worst of both worlds for the stock market, because on one hand, higher unemployment and lower jobs revisions for previous months mean that the overall economy could be weaker than expected, and that means it could be time for the Federal Reserve to cut rates. But this latest jobs report coming in much stronger than expected means the labor market isn't slowing down, which gives the Fed less reason to cut rates at their upcoming December meeting.

When the Federal Reserve lowers interest rates, so do banks. That encourages people to borrow more money for major purchases, and businesses to borrow more money to hire employees and make more goods and services, eventually leading to higher revenue growth for the companies that we invest in. And higher revenue growth usually means higher stock prices.

When the Fed keeps interest rates high the opposite happens it's more expensive for consumers and businesses to borrow money which leads to lower revenues slower growth and ultimately lower stock prices the federal reserve lowers interest rates to keep the job market healthy and unemployment low so september's jobs data more than doubling expectations could make the fed less likely to reduce rates but higher interest rates are actually a double whammy for the stock market because when interest rates stay high the yields on bonds and savings accounts go up that makes the stock market less attractive by comparison so more money moves into bonds and stocks trade at lower multiples of their revenues or earnings so higher interest rates mean lower earnings for companies and lower price to earnings ratios for their stocks that's the big connection between interest rates the overall economy and the market and of course adding fuel to that fire is michael bury who's betting over a billion dollars that AI stocks are the next bubble to pop.

Burry is famous for predicting the global financial crisis and shorting the U.S. housing market before it collapsed in 2008.

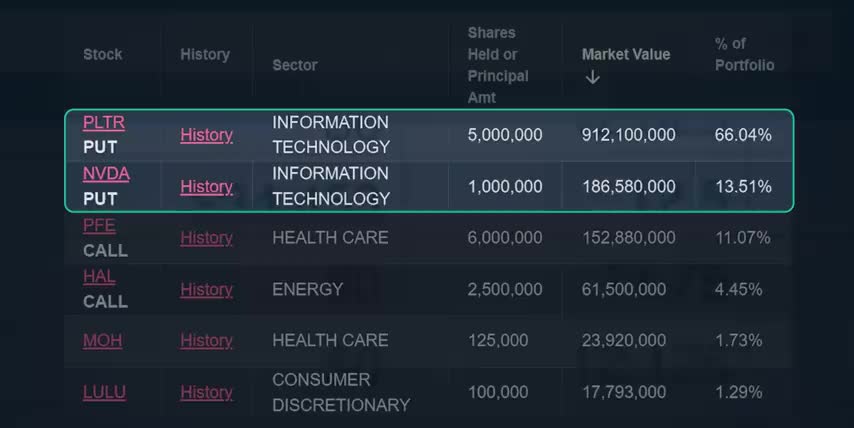

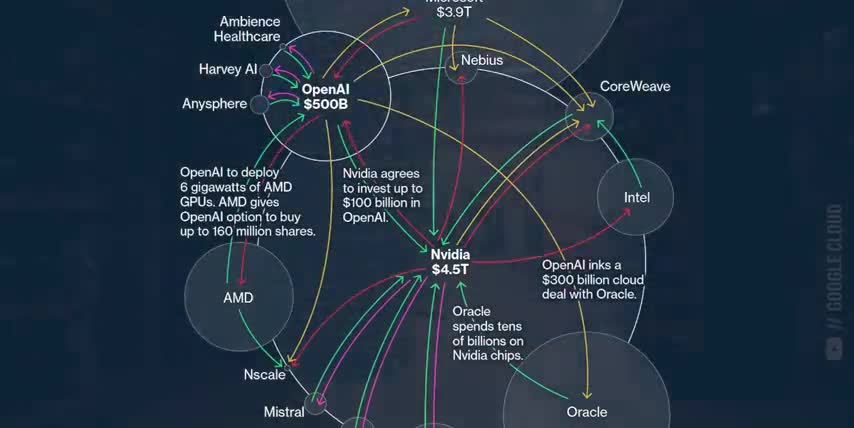

And earlier this month, his fund Scion Asset Management disclosed a $900 million short position against Palantir and another million short position against Nvidia These two short positions are almost 80 percent of michael burry overall portfolio making this a massive bet against ai stocks burry has two big arguments for the ai bubble first major cloud and ai infrastructure companies are under reporting the depreciation of their ai chips by claiming they have a longer useful lifespan that lets them spread out their depreciation costs over longer periods of time and artificially boost their earnings and since companies like amazon oracle google microsoft and meta platforms are all spending hundreds of billions of dollars a year on hardware burry says this accounting tactic could lead to companies like meta platforms and oracle overstating their profits by over 20 percent which is tens of billions of dollars burry's second argument for the ai bubble is that true demand for ai is ridiculously small and most of the growth is actually coming from circular deals where AI model makers, cloud infrastructure providers, and semiconductor companies are all buying hardware and software from each other, while simultaneously getting funding, equity, cloud credits, or other forms of payment from the very same companies they're buying from.

The thing is, Burry is famous enough to move the market, so his short positions become something of a self-fulfilling prophecy, since all the media attention and headlines that cover them become the exact same reason those stocks fall in the first place but the headlines you don't see can still move the markets and that's where ground news comes in ground news analyzes over 60 000 articles a day and rates each news source for political bias and factuality for example check out this story about flight cancellations during the recent government shutdown with about twice as much coverage from the left versus the right while most of these news sources have a high factuality rating there's also some serious bias headlines from the left say that President Trump was threatening to ground even more planes if no deal was reached, while headlines on the right said that reducing air travel was actually a data-driven decision.

And their blind spot feed shows me which stories are being ignored by one side or the other, because knowing what isn't being talked about is just as important as what is. These features help me keep my facts straight and save me a ton of time.

That's a no-brainer for any serious investor. Alright, so this downturn was caused by the latest jobs numbers coming in much higher than expected and reducing the odds for the Fed lowering interest rates.

On top of that, Michael Burry is adding fuel to the fire by claiming the AI bubble is about to pop and spending over a billion dollars shorting nvidia and palantir but as a long-term investor it doesn't matter exactly when the fed lowers interest rates they meet eight times a year and the longer interest rates stay high the longer we can buy great stocks at great prices and neither of michael burry's arguments make much sense based on readily available data for example nvidia releases lots of updates that improve their gpu performance over time one example i showed in previous videos was an open source software package called tensor rtllm which literally doubled the inference performance of nvidia's gpus not just the ones in data centers but the previous generations as well which means they should actually last longer in data centers and be depreciated over a longer period of time and we know that demand for ai is actually through the roof by looking at very obvious metrics like ChatGPT weekly active users over time OpenAI released ChatGPT exactly 3 years ago, and it currently serves around 800 million people a week.

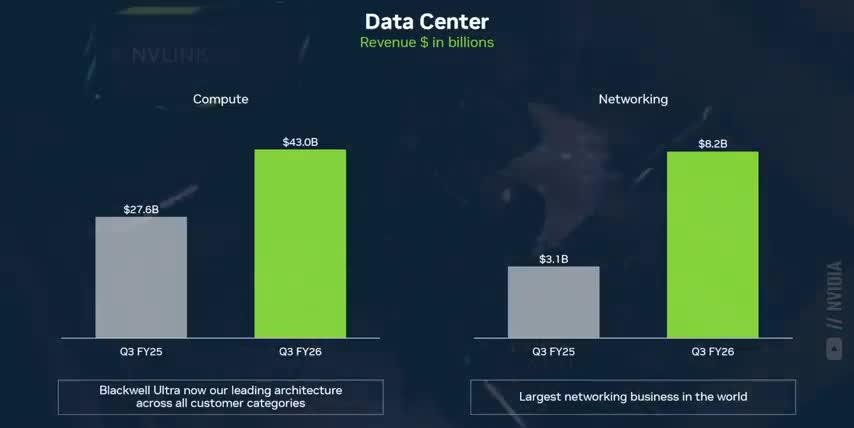

That's 1 out of every 10 people on Earth. Another obvious place to look would be Nvidia's latest earnings results, which they just reported earlier this week. Nvidia's revenue grew to $57 billion for the quarter. That's up 22% from quarter 2 and 62% year over year. Said another way, they added over $10 billion of revenue in just the last 90 days.

But their earnings per share also grew by 20% quarter over quarter and 67% year over year, which isn't something we would see if Nvidia was spending all that money with other companies like Michael Burry claims. Not to mention that more and more of Nvidia's data center revenue is actually coming from networking technologies like Spectrum X Ethernet, Quantum InfiniBand, and NVLink.

Nvidia's revenues from networking grew from $3.1 billion last year to $8.2 billion this past quarter, or almost two times more than all of AMD's data center revenues. In fact, this 164% year-over-year growth just made Nvidia the largest networking business on the planet. So 16% of Nvidia's data center revenues now come from networking, not compute. And I expect that percentage to grow because network bandwidth is one of AI's biggest bottlenecks.

And that's important because data centers can upgrade their networks and their AI chips completely separately to keep increasing their overall system performance, which increases the useful lifespan of their hardware even further and pokes another hole in Michael Burry's arguments about depreciation. And that's exactly why I think this is a once-in-a-lifetime opportunity.

We have the market pricing in fears of the Federal Reserve keeping interest rates high, and Michael Burry shorting two of the highest-performing AI stocks on the market, at a time where half a trillion dollars worth of AI infrastructure is being built by some of the biggest, safest, and most diversified businesses on Earth. Even Warren Buffett just bought over $4 billion worth of Google stock just this past quarter.

And of course, that brings us to Buffett's most famous quote, be fearful when others are greedy, and greedy when others are fearful. So let me show you exactly how I do that, because this has made me a lot of money over the years. This is CNN's Fear and Greed Index, which I check every time the market drops. The index goes from 0 to 100, and it's currently showing extreme fear in the market.

You can also see a one-year timeline, which is a good way to see how fast the index fell into extreme fear territory, which is very useful information for anyone looking to be greedy when others are being fearful.

Like I say in every one of these videos, this is one of my favorite indexes because it's calculated from seven very useful measures of risk in the market, including stock price momentum, strength and breadth, the ratio of puts to call options, market volatility, and overall demand for stocks versus bonds. The two indicators I watch the most are market momentum and volatility.

I put more money into the market when the S&P 500 dips below its 125-day moving average, which is 6 months worth of trading days.

As you can see, we are almost there, and the last time the S&P went below its 6-month moving average was from mid-March to mid mostly after President Trump announced his Liberation Day tariffs And that ended up being a great time to buy stocks I also buy stocks when the VIX which measures the S 500 volatility hits around 30 or more And if we look back at April, we can see that it topped out on April 8th, which is the exact bottom for the S&P 500.

These levels of extreme fear are enough for me to start dollar cost averaging in to stocks more aggressively. But I always hold enough cash in case the market drops even lower. Like if the Federal Reserve really doesn't lower rates in December, or Michael Burry makes more headlines that keep spooking the markets. And now that we've come full circle, we can talk about which stocks to buy if the market keeps dropping.

And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out, and it lets me know to make more content like this. Thanks, and with that out of the way, here are the AI stocks that I think are the most undervalued right now. Let's start with Vertiv Holdings, ticker symbol VRT. Vertiv provides mission-critical power, cooling, and physical infrastructure for data centers.

Almost every hyperscaler uses Vertiv for their large-scale expansions, and Vertiv's revenue rises with the volume and speed of data center buildouts, which are currently at all-time highs.

And once a big tech company integrates Vertiv's power and cooling solutions, they often stick with them for future upgrades and expansions, because switching can be risky and costly due to the required downtime time and retraining their staff discounted cash flow models like simply wall streets calculate the fair value of vertive stock to be around 215 dollars per share while the current price is at 160.

that makes vertive around 25 undervalued based on their expected future cash flows said another way vertive stock would have to go up by 35 to hit its fair value today and speaking of data centers meta platforms is investing over half a trillion dollars into AI data centers over the three years. As of their latest earnings call, Meta has over 3.5 billion unique daily active users across its family of platforms, including Facebook, Instagram, WhatsApp, Messenger, and Threads.

That's almost half the population of the entire planet, which gives Meta one of the biggest and richest datasets for AI training, inference, and monetization through personalized ads.

There are only a handful of companies on Earth that can compete with Meta's scale for digital distribution or their physical ai infrastructure let alone both according to dcf models meta platforms is currently 45 undervalued so it would have to go up by 84 to hit its fair value today that's an 84 upside on one of the biggest most profitable and diversified founder led ai companies on earth like i said at the start of this video millionaires are made when the stock market crashes and now you can see why in fact meta platforms is trading at a much cheaper forward price to earnings ratio than google microsoft and apple while having higher earnings growth than all of them talk about an obvious investment for the entire ai era hopefully this video helped you understand why stocks dropped over the last week how to be greedy when others are being fearful and of course a couple great stocks to buy if and when prices continue to fall because making decisions based on data instead of your gut is a great way to get rich without getting lucky and if you want to see what else i'm buying to get rich without getting lucky check out this video next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

Key Takeaways

The current market downturn presents a unique investment opportunity, especially in the AI sector. Michael Burry's short positions against Nvidia and Palantir may not be justified, and the demand for AI is actually high. Vertiv Holdings and Meta Platforms are two undervalued stocks worth considering. It's essential to make decisions based on data and not emotions, and to be greedy when others are fearful. The Fear and Greed Index is a useful tool to gauge market sentiment, and dollar-cost averaging can help investors take advantage of low stock prices.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.