Table of Contents

1. Introduction

2. Google Search

3. Google Cloud

4. Gemini

5. Stock Prediction

Introduction

What if I told you the best AI stock to buy in 2026 might not be Nvidia, or Tesla, or even Palantir? And what if this company was growing faster than every other tech giant, with a business that's already too big to be disrupted? Buying that stock would be a great way to get rich, without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time. This post is all about Google.

Really their parent company Alphabet, but I'll call it Google for short. And here's everything I'm going to talk about. How Google actually makes their money and it's not just Google search. Why I think Google is so undervalued even as one of the world's largest companies today. How Google went from being AI's biggest loser to winning the AI race in 2025.

And of course where Google will end the year on my list of stocks to get rich without getting lucky, which has been outperforming the market since I made this list last December. Here's the full list along with each stock's year-to-date performance and how it's doing versus the S&P 500. As you can see, Google is one of my biggest winners, and it'll definitely be on my list again in 2026. But to understand why, we need to understand exactly how Google makes their money.

Google actually operates in three key markets that are benefiting big time from the AI boom. The most obvious one is digital advertising, which is expected to have a 10% compound annual growth rate through 2033. That's actually slower than the S&P 500, which is one reason that Wall Street analysts expect low growth from Google.

But that's because the entire advertising industry is undergoing a few big transitions thanks to AI, like making ads much more personalized, tracking and retargeting people across different devices, apps, and browsers, recommending products and services across multiple online stores, and even predicting future spending patterns.

All of these efforts have the same goal, increase conversion rates on ads so that companies like Google can charge more for placing them in front of billions of users every month. As a result, the global AI in advertising market is expected to more than 7x in size over that same timeframe, which would be a compound annual growth rate of 28% for the next 8 years.

But Wall Street's big worry for Google is that generative AI will destroy online advertising altogether, since services like ChatGPT and Perplexity just deliver the final answer, letting users skip all the websites and the ads that are displayed on them in the process and that part is actually true google's network revenue has been in decline ever since the start of 2022 shrinking by about two percent per year for the last three years network revenue comes from displaying ads on websites and apps through the google adsense program but network revenue only accounts for around seven percent of google's total revenue for the quarter which was actually up by 14 year over year thanks to Google search and YouTube ads both going up by 15% and revenues from subscriptions, platforms, and devices going up by 21%.

Just to put that in perspective, Google's search revenue is about as big as NVIDIA‘s total revenues today. So 15% growth is much faster than it sounds. But the real question is why Google search is growing at all, especially if generative AI is supposed to disrupt it. Well, Google's CEO actually answered that question on their latest earnings call. It turns out that AI overviews are driving serious query growth, which means more people are Googling things specifically to get answers from AI.

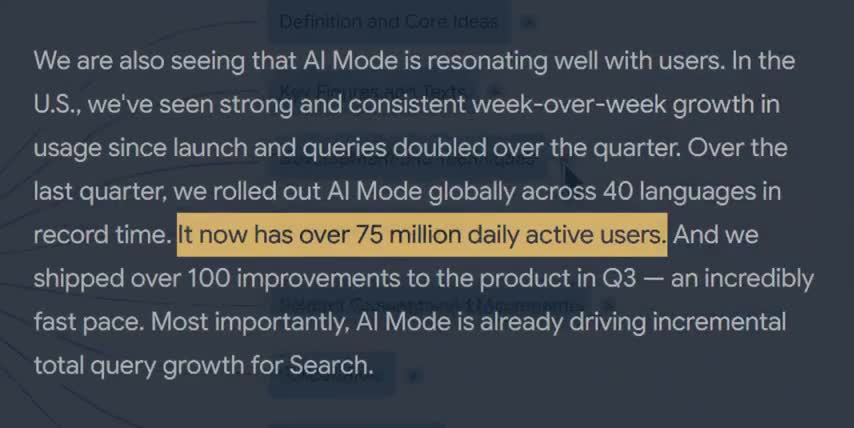

But those answers can include sponsored links, traditional ad slots, and product carousels, all of which are customized based on the user's question and the generated answer, which leads to higher conversion rates And Google AI mode is also driving more engagement specifically in the us with the number of total conversations doubling quarter over quarter over 75 million people actively use ai mode every single day so more searches times more ads per search times more conversions per ad is exactly why google's revenue is going up with ai instead of down and that's just search we're also seeing the same pattern on youtube youtube has over 2.7 billion users around the world, making it the second largest search engine only after Google itself.

And the average amount of time each user spends on YouTube is slowly going up as well, from just under 40 minutes a day in 2019 to 49 minutes per day last year. That also makes YouTube the number one streaming service in the US by total time watched, and almost twice as big as its next two biggest competitors combined, Netflix and Disney+.

Add in AI-powered content recommendation systems to increase watch times even further, and more personalized product and ad placements to improve conversion rates, and that's why YouTube advertising reached $10.2 billion last quarter instead of getting disrupted by video generators or smaller and leaner AI startups. On top of that, revenues from subscriptions, platforms, and devices came in at $13 billion for the quarter and grew by 21% year over year.

This segment includes things like Google One, YouTube Premium TV and Music, as well as Android devices, the operating system, and the App Store. So, when you're investing in Google, really Alphabet, you're actually investing in several different huge hardware and software businesses that all work together. But good investing isn't just about making money, it's about saving money too.

Ever since I got married, I've been paying much more attention to my family's finances, and man, have things gotten expensive. That's where today's sponsor, Rocket Money can really help. Rocket Money is the personal finance app that actually helps you manage your money by canceling subscriptions, setting budgets, and even lowering your monthly bills. Rocket Money helped me find subscriptions that I wasn't using and cancel them before they renewed, all right inside the app.

So if you're ready to take control of your finances and save some serious money, go to rocketmoney.com slash ticker, scan the QR code, or use my link in the description to get started for free and unlock even more features when you sign up for premium. Alright, so Generative AI isn't disrupting Google Search or YouTube. In fact, it's helping them grow. But Alphabet is much bigger than search and subscription services.

Google Cloud

They actually control every layer of their tech stack, from the custom TPU chips in the Google Cloud data centers to Gemini 3 Flash, the state-of-the-art fast reasoning model that they just announced earlier this week. Let's talk about Google Cloud first. The global cloud computing market is expected to almost 7x in size over the next nine years, which would be a 23% compound annual growth rate through 2034.

And within that, the infrastructure as a service market is currently growing at 28% year over year, and it's now over $100 billion in size. Google Cloud is the third largest cloud infrastructure service provider on the planet, only behind Amazon Web Services and Microsoft Azure. But there are a few important things that set Google Cloud apart. Google Cloud is the only one of the three built specifically for AI, since AI has been a core part of Google search long before ChatGPT came out.

For example their AI stack runs mostly on Google TPU accelerators and their Axion CPUs instead of being built around NVIDIA GPUs and x86 CPUs And just like NVIDIA Blackwell or Rubin Google also co-designs their compute, storage, and high-bandwidth networking chips and manages them as one giant platform, which Google uses to power its Gemini models, as well as external AI workloads for Google Cloud's customers.

In fact, out of the three hyperscalers, Google Cloud has the highest percentage of large AI workloads as a fraction of their overall output. That's why Meta Platforms is in talks with Google to buy billions of dollars worth of TPUs and potentially deploy them inside Meta's own data centers in 2027. That's also why Anthropic chose Google as their primary hardware infrastructure partner to train and deploy their cloud models using Google's large-scale AI clusters.

In fact, Anthropic just expanded their partnership to reserve up to a million Google TPUs, which will bring well over a gigawatt of new AI compute online in 2026. I think MetaPlatforms and Anthropic partnering with Google Cloud is a massive validation of their entire tech stack, since Llama and Claude are both direct competitors to Google Gemini, and honestly, also Google Search. These aren't just symbolic partnerships.

These models need to be optimized to work on Google's TPUs, so that workloads like speech-to-text and text-to-speech, multimodal prompts that combine text, images, audio and video, and deep reasoning run as fast and as cheap as possible across millions of users on millions of chips. These companies wouldn't make such big hardware commitments with a direct competitor unless it was the best solution.

And that's why Google Cloud‘s executives think their TPUs could eventually capture up to 10% of NVIDIA's AI chip revenue, at least over the long term, which would be worth tens of billions of dollars every quarter that's huge considering revenues from google cloud just reached 15 billion dollars this past quarter and that's up 34 year over year that means that google cloud is now a 60 billion dollar a year business all by itself and i expect that growth to continue since the global cloud ai market is expected to more than 10x in size over the next eight years which would would be a compound annual growth rate of 34% through 2033.

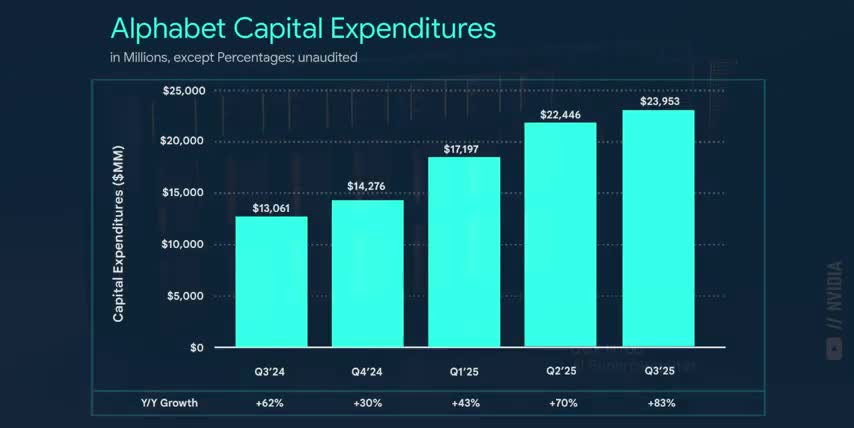

And since Google Cloud is built for AI first, it's in a great position to increase their share of this market over time. That's why they're investing so aggressively in data centers today, with capital expenditures growing by over 80% year over year and reaching almost $24 billion per quarter. That's almost $100 billion a year spent on AI infrastructure if they just keep their spending the same in 2026.

And if you're wondering if they'll ever see a return on all this invested capital, they already are. Google Cloud has a $155 billion backlog, which is up 46% quarter over quarter. Alright, so far we've talked about Google Search and Google Cloud. The third piece of the puzzle is the AI model that brings them both together.

Gemini

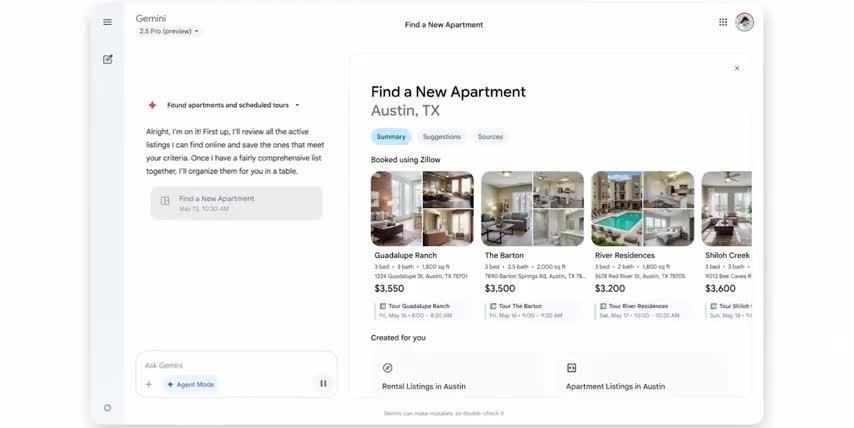

Gemini now processes 7 billion tokens per minute across all of google's customers and the gemini app now has over 650 million monthly active users with the number of queries for gemini growing by 3x quarter over quarter the special thing about gemini is that it was designed from the ground up to handle any combination of text audio image and video instead of being a large language model that got retrofitted to support those other modalities Gemini 3 also has a 1 million token context window, which is about 750,000 words.

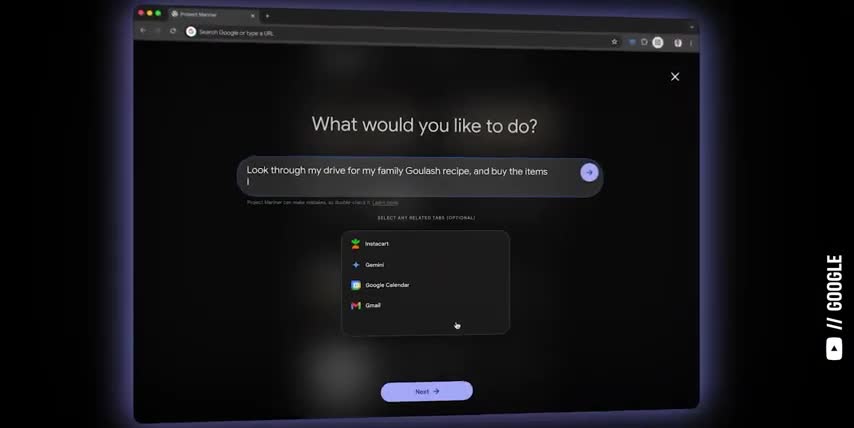

A context window is just how much information an AI model can remember at any given time and use as context for a conversation So Gemini context window is big enough to fit the entire Twilight Saga and all of the companion novels with space left over Uh, not that I would know that from experience or anything. Anyway, Gemini being multimodal from the ground up and having such a large context window puts it in the perfect position to do what Apple should have done with Siri.

Provide a powerful agentic AI assistant that understands your email calendar and contacts your photos files and texts your movie music and food preferences all so that it can do things for you the way you want them done that's why we're seeing more android phones with multimodal features like circle to search real-time translation converting text to speech and speech to text and even multi-app functions like taking notes across multiple web pages or summarizing youtube videos in a different app altogether which are real-world ai applications that regular people would actually use today all right so google went from being ai's biggest loser when chat gpt came out to winning the ai race by investing in three key ai markets online search with ai overviews ai infrastructure with google cloud and ai models with gemini and now that we have all that context let's talk about what it all means for the stock and if you feel i've earned it consider hitting the like button and subscribing to the channel that really helps me out and it lets me know to make more content like this thanks and with that out of the way let's talk about google stock in 2026 and beyond google processes more than 10 trillion tokens per day between google search youtube gemini and google cloud and yes they're on track to spend around a hundred billion dollars expanding their ai infrastructure in 2026 but they already have a backlog of demand worth over a hundred and fifty billion dollars and that backlog is growing by over 40% quarter over quarter.

Stock Prediction

And we haven't even talked about all the bleeding-edge AI research that's coming out of Google DeepMind, or how Waymo successfully scaled to almost half a million autonomous rides per week, and they're looking to double that by the end of 2026. But to me, the single biggest validation of Google's stock is that Warren Buffett bought .3 billion worth of it this past quarter.

A lot of investors don't realize this, but Warren Buffett first bought apple stock in 2016 when it was already one of the biggest companies on earth and it went on to become his most profitable investment ever so for him to invest in another tech giant in the middle of the ai boom is a pretty big deal google currently trades at a price to earnings ratio of around 30 making it the second cheapest member of the magnificent seven but based on everything i covered in this video i think it should be the second most expensive and trade at a p e ratio closer to 35 or even 40.

So my plan is to dollar cost average into Google stock even more aggressively in 2026 and I'm switching it with Broadcom stock on my list. Broadcom is a core part of the AI revolution. In fact, they help design every generation of Google's TPUs. But there's a lot more to Broadcom than AI infrastructure and I want the most AI focused companies to be at the top of my list. And Google has proven to be an AI powerhouse that I want to hold for years and years.

and it could seriously be my top stock for 2026. This is the last update I'm making to my list of stocks to get rich without getting lucky in 2025. Let me know in the comments which stocks you think should go on my list for 2026 and I'll make a video on it in a couple weeks. And if you want to see what else I'm buying to get rich without getting lucky, check out this video next. Either way, thanks for watching and until next time, this is Ticker Simple U.

My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- Google's parent company Alphabet is growing faster than other tech giants, with a business that's too big to be disrupted.

- Google operates in three key markets: digital advertising, cloud computing, and AI models.

- Google Cloud is the third largest cloud infrastructure service provider, with a high percentage of large AI workloads.

- Gemini is a multimodal AI model that can handle text, audio, image, and video, with a large context window.

- Google's stock is undervalued, with a price to earnings ratio of around 30, and could trade at a higher ratio.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.