Introduction to Micron Technology

Let's talk about Micron technology. Micron isn't just one of the most important companies of the entire AI era, it's also one of the most undervalued. Micron trades at a forward price to earnings ratio of around 8, while its competitors are much more expensive. So in this post, I'll break down everything you need to know about this future tech giant hiding in plain sight. Your time is valuable, so let's get right into it.

Table of Contents

1. Introduction to Micron

2. Memory and AI

3. Micron Business Units

4. Cloud Memory Unit

5. Micron Stock

One thing that always surprises me is just how little attention Micron stock gets from Wall Street analysts and the mainstream media, especially since they build one of the most critical components of the entire AI era. Micron makes memory chips, mainly DRAM, flash memory, and the high-bandwidth memory, or HBM, that goes into AI chips like NVIDIA's Blackwell GPUs. The big thing that investors need to understand about memory is that it's no longer a commodity like it was just a few years ago.

That's really for two key reasons. First, the demand for AI infrastructure is so high that memory makers are constantly running out of supply. For example, Micron said its HPM solutions are already sold out through 2026, even though they've been aggressively investing in increasing their production capacity and diverting resources away from consumer markets. And second, memory is one of the main bottlenecks for AI today.

Training and running large models is often limited by memory bandwidth, not raw GPU performance. That means very powerful and expensive GPUs can be sitting idle while they wait for data that's stored in much slower memory. And as AI models get bigger, take more data to train, and use more tokens for inference, they need that much more memory and memory bandwidth to keep up.

And if data centers don't get it, running large frontier models will come at the expense of lower GPU utilization, which means much higher costs per token than their competitors. So, there's a direct link between data centers getting enough high bandwidth memory and their bottom line. That's what makes Micron one of the most important companies of the entire AI era. Micron has four major business units, cloud memory, core data centers, mobile and client, and automotive and embedded systems.

My focus will be on cloud memory, but let me at least point out the other three so you get the full picture. Micron's core data center business unit makes server DRAM and SSDs for traditional enterprises and cloud servers, which really means all the data centers that aren't focused on AI, which is still a huge market. By the way, if you're new to AI investing, don't get scared by all these acronyms. DRAM means Dynamic Random Access Memory, just like the RAM in your computer.

DRAM is very fast because it holds the data that processors like CPUs or GPUs are actively computing on. But the trade-off is that DRAM is much more power-hungry, which makes it more expensive per gigabyte. RAM is also volatile, which means it loses data when it loses power. On the flip side, NAND memory is non-volatile. That's where data gets stored for the long term, like in solid-state drives, USB drives, and so on.

This kind of memory is much slower to read and write data than DRAM, but it's also much cheaper, making it the perfect place to store AI model checkpoints, optimizer settings, and parameter weights Don worry there no pop quiz on DRAM versus NAND but this is one of the ways that Micron breaks down their revenues so it good context for the rest of this video Anyway Micron Core Data Center Business Unit makes DRAM and NAND memory for traditional non-AI data centers.

Core data revenues came in at around $2.4 billion and 37% operating margins, which is basically flat year over year. On the other hand, revenues from Micron's mobile and client business unit came in at $4.2 billion, which is up 13% quarter over quarter and 63% year over year, with operating margins tripling over that same timeframe. This is low-power DRAM and NAND memory for smartphones, laptops, tablets, and other consumer electronics, so demand for it is pretty cyclical.

But as more AI features get rolled into phones and PCs, they're going to need more memory, So this unit should keep growing over the course of the AI era, and their automotive and embedded unit targets cars, industrial systems, networking equipment, and other systems that need highly reliable, long-lasting memory.

But just like with smartphones and laptops, cars and robots will need higher performance memory over time to support things like driver assistance, infotainment systems, and connected devices. Auto and industrial customers tend to sign big, long-term deals since cars and robots also need to work for many years to justify their costs. And these companies buy in bulk because parts shortages can destroy their production schedules, just like we saw with the chip shortage in cars a few years ago.

This business unit is still small, but it's growing fast. It's up 20% quarter over quarter and 49% year over year, with operating margins going up by 5x over that same timeframe. But when it comes to AI, the real star of the show is Micron's cloud memory unit, which which brought in $5.3 billion for the quarter. That's an increase of 16% from last quarter and 100% from last year, all while operating margins rose from 40 to 55%.

Most of that insane growth is due to the insatiable demand for high bandwidth memory in data centers focused on AI. And I expect that growth to continue because, according to MarketUS, the global artificial intelligence market is expected to almost 19x in size over the next nine years, which is a compound annual growth rate of 38.5% through 2033. But many of the companies building next-generation AI applications are not publicly traded. Think about the 90s and early 2000s.

Companies like Amazon and Google went public very early in their growth cycle. But today, they're waiting an average of 10 years or longer to go public. That means investors like us can miss out on most of the returns from the next Amazon, the next Google, the next NVIDIA. That's where Fundrise comes in, the sponsor of this video. Their venture capital product lets you invest in some of the best tech companies before they go public.

Venture capital is usually only for the ultra-wealthy, but venture capital with Fundrise gives everyday investors access to some of the top private pre-IPO companies on Earth, with an access point starting at $10.

They have an impressive track record already investing almost million in some of the largest most AI and data infrastructure companies So if you want access to some of the best late companies before they IPO check out Venture Capital with Fundrise using my link below today Alright so Micron cloud memory unit is now their biggest fastest-growing, and most profitable business unit by far, thanks to AI server demand for GPU systems with high bandwidth memory.

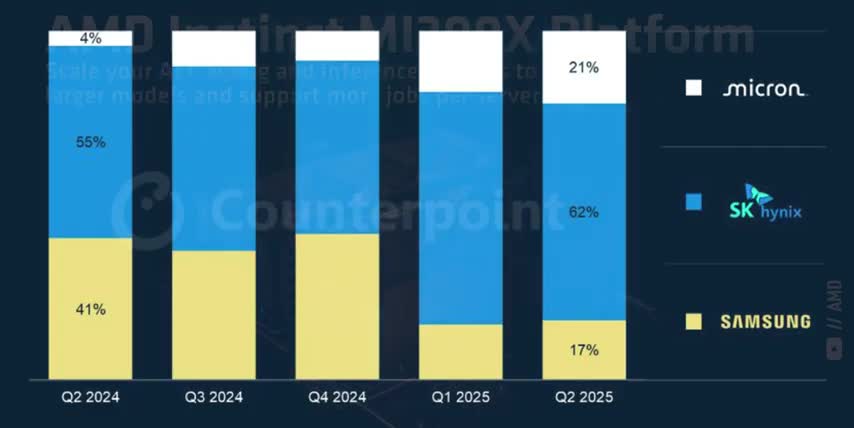

And as an investor, one nice thing about Micron stock is it wins no matter which gpu maker comes out on top microns hbm chips go into nvidia's hopper h200s and their blackwell b200 gpus but they also go into amd's instinct mi325 350 and 355 accelerators micron currently has a 21 share of the global d-ram market making them one of just three companies dominating data center memory today and even though micron has some serious competition with SK Hynix having a dominant 60% share and Samsung being one of the most well-known and valuable brands on the planet, Micron's market share has actually been increasing over time.

They had just a 4% share of this market last summer. So that's a 5x increase in just a few quarters, thanks to their production capacity investments for high bandwidth memory that I mentioned earlier. Another nice thing about Micron is they're the only US company of the three, which means they They should face fewer supply chain issues and tariffs from the Trump administration than Samsung or SK Hynix, both of which are based in South Korea.

For example, Micron can optimize the chip's architecture, manufacturing technology, and advanced packaging techniques all together, which actually matters a lot for high bandwidth memory, because of how it's designed. Instead of separate chips spread around a circuit board, HBM is built as a stack of DRAM chips that sit very close to a processor, like a GPU, and are connected through many vertical links that add up to a very high total bandwidth.

Then, the bottom of the stack usually has a logic die that acts like a hub and handles all the decoding and data routing for the memory layers above it. So, Micron controlling the end-to-end process of how these chips are made lets them improve the performance, the power, and the yields for all of the parts of that stack. Another benefit is that Micron can prioritize their manufacturing towards the highest value segments like AI, data centers, and mobile chips.

That's exactly why Micron is winding down the crucial brand of RAM and SSDs for consumer PCs and every silicon wafer is instead going towards higher margin enterprise markets. And because they make chips in the US, they qualify for government incentives.

For example, Micron's received over $6 billion in direct federal chips act grants and billions more in state incentives and tax credits to support their fabs in new york and idaho but micron making their own chips also exposes them to some risks just like it did for intel owning fabs means micron must spend tens of billions of dollars on tools clean rooms and upgrading machines regardless of how much demand they have so if demand falls or competition starts squeezing memory prices micron's margins can fall pretty fast while fabless companies can just cut their orders without worrying about their factories sitting idle Making everything in-house also means that if they make any mistakes, have any delays, or they have yield problems in the process, they have to fix it themselves, while their competitors will eat up their market share.

That's exactly what happened with Intel, which makes their own chips, versus AMD, which doesn't. Just to be clear though, Micron is currently firing on all cylinders.

They're hitting all of their internal milestones on their advanced DRAM nodes, they're quickly ramping up production capacity for their high-value products, and they're selling every enterprise chip they make high bandwidth memory goes into nvidia's and amd's gpus and high density ddr5 ram modules go to companies like amazon microsoft google and meta platforms in fact if we look at their performance by technology we can see that dram now represents 79 of micron's total revenue dram revenues increased 20 quarter over quarter and 69 year over year this is why we look for companies with perfect products for quickly growing markets.

This is why I think Micron is one of the most important companies of the entire AI era and one of the most undervalued. This is why it's so important to understand the science behind the stocks. And now that we understand Micron's markets, their memory products, their finances, and their risks, let's talk about the stock and their $300 billion valuation. And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps me out and it And it lets me know to make more content like this. Thanks and with that out of the way, let's talk about Micron stock. In my opinion, the numbers honestly speak for themselves. Micron's total revenues came in at $13.6 billion, which is up 57% year over year, and their margins increased across the board. As a result, their earnings per share came in at $4.60, which is up by 170% year over year. And their guidance for next quarter is even higher.

$18.7 billion in revenue and over $8 in earnings per share. That would be a revenue increase of about 37% and a 76% increase in earnings, quarter over quarter. And like I said at the start of this video, Micron trades at a forward P-E ratio of just 8, which is much lower than other chip companies like ARM, AMD, and Qualcomm, even though I just showed you they're growing much faster.

So my plan is to dollar cost average into to Micron stock even more aggressively after this insane earnings call.

Key Takeaways

- Micron is a leading manufacturer of memory chips, including DRAM, flash memory, and high-bandwidth memory.

- The company's cloud memory unit is its biggest, fastest-growing, and most profitable business unit, driven by demand for AI infrastructure.

- Micron has a 21% share of the global DRAM market and is increasing its market share over time.

- The company is an integrated device manufacturer, which provides benefits and risks for investors.

- Micron's stock trades at a forward P-E ratio of 8, which is lower than its competitors, despite its faster growth rate.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.