Table of Contents

1. Introduction

2. What are NeoClouds

3. CoreWeave

4. Nebius

5. Iren

6. Comparison and Conclusion

If you invested $10,000 into Nvidia stock just three years ago, you'd have over $120,000 today. And if you invested that money into Palantir, you'd have almost a quarter million dollars right now. That's because these companies have the perfect products for the fastest growing markets. But Nvidia and Palantir are two of the most well-known companies on Earth. So in this post, I'll highlight three smaller AI stocks set to win big, but that almost no one else is talking about.

Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage, so here's what I'll be covering up front. Coreweave, a NeoCloud company with a quarter million GPUs being used by OpenAI, Microsoft, and Meta. Nebius, a full-stack AI cloud for sovereign AI and sensitive data across Europe and the US. And Iren, another NeoCloud with almost 3 gigawatts of power to use for AI data centers.

And of course, which of these three stocks I think is the best buy right now? I want to make the best use of your time. So let's start with what all these companies have in common, like their markets, their revenues, and their risks. CoreWeave, Nebius, and IREN are all NeoClouds, which means they all sell access to high-end GPUs and infrastructure optimized for high-performance computing and AI workloads like training, fine-tuning, and inference. NeoClouds have three main kinds of customers.

AI labs building foundational models, enterprises adding AI to their applications and workflows, and hyperscalers that need extra capacity when compute demand exceeds their own supply. All three kinds of customers care about different things.

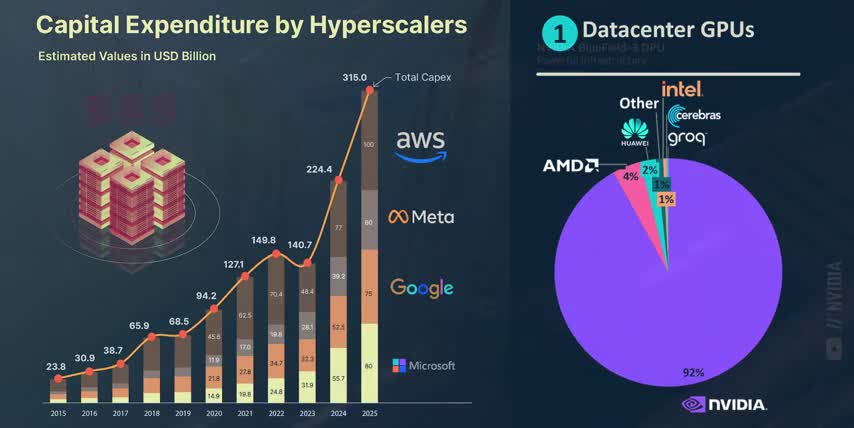

AI labs need massive amounts of parallel compute for model training, enterprises need high-bandwidth, low-latency AI infrastructure to power inference workloads across lots of users, and hyperscalers care about availability and uptime to keep their own customers happy in fact neoclouds exist because traditional hyperscalers like amazon web services microsoft azure and google cloud were originally built around cpu-centric workloads like web servers databases processing transactions email and reporting all of which are still critical for business today but those general purpose servers are too slow and too expensive to run modern ai models at scale so the market needs a new class of cloud infrastructure provider with a hardware stack built around dense racks of gpus connected by very fast networks and advanced cooling to squeeze the most performance out of every rack and every watt with software that's focused on ai training and inference over hosting websites and databases at the start of this video i pointed out that nvidia and palantir made investors rich because they have the perfect products for the fastest growing markets well the global neocloud market is expected to almost 30x in size over the next eight years and it could become a trillion dollar market by 2034 that would be over a 50 compound annual growth rate for the next eight years which is three times faster than the growth of the s p 500 that sounds crazy until you realize that traditional cloud computing is already more than a trillion dollar market today and will be three to seven times bigger by 2034 so the world just needs a massive amount of compute and about 20 to 30 percent of that will belong to ai that's the market that core weave nebius and iron are all operating in which means their businesses run roughly the same way for example all three companies spend massive amounts of money up front on land power gpus and data center infrastructure so they all need access to low-cost capital like debt financing convertible notes or equity to fund their build-outs until their cash flows can fully catch up that makes them sensitive to interest rates and market sentiment and all three companies make recurring revenue when customers rent out that infrastructure either by the hour or through multi-year commitments that means their margins depend on how full they can keep their gpus utilized how well they control their hardware and power costs how fast they can turn their capex into rentable capacity and their pricing power versus amazon microsoft and google speaking of which they also have the same strategic risks like directly competing with aws azure and google cloud which are spending hundreds of billions of dollars a year each deploying and renting out their own ai infrastructure and on the hardware side they all overwhelmingly rely on nvidia for around 90 of their gpus with only a small slice coming from amd so if nvidia prioritizes the hyperscalers or has supply chain issues all three companies will see delays in their own ai buildouts and the revenues and profits that are tied to them they also share serious customer concentration risks core weave nebius and iron all have multi-billion dollar agreements with microsoft and those first two also have huge multi-year deals with meta and of course they have the same physical bottlenecks like finding megawatts of cheap reliable power near high capacity fiber so each company lives and dies by their ability to lock down land and power at scale before their competition including the hyperscalers that they depend on for huge chunks of their future revenues i wanted to cover the risks up front because core weave nebius and iron are all still relatively small which makes their stocks very volatile and you need to know that going in but that's also why they have huge upside potential especially since they're all chasing one of the fastest growing parts of the entire ai stack and now that you understand what these companies have in common let's dive into how each one is actually innovating as they compete for the ai infrastructure throne but the biggest innovation i'm investing in is generated assets by public. Public is a platform for people who take investing seriously and their generated assets can turn any idea into a custom portfolio with a single prompt i think this is the future of personal finance here check this out say i want the top 10 ai and semiconductor companies worth over 300 billion dollars ranked by their free cash flows so ai companies that are big profitable and efficient then public's ai scans thousands of stocks builds a custom index around my idea and explains why each stock was included it even picks the weights from there you can modify your prompt manually add and remove specific companies and even backtest your idea versus the s p 500 to see how it performs then when you're ready you can invest in the whole portfolio with the push of a button on top of that public lets you invest in stocks options crypto bonds and has a high yield cash account all in one app and right now public is offering an uncapped one percent match when you transfer from another platform so if you want to turn your ideas into investments you have to try generated assets by public using my link below today i'm super impressed all right let's start with core weave ticker symbol crwv because they're currently the leader of the pack core weave operates 41 data centers purpose-built for ai which hold over 250 000 nvidia gpus combined across north america and europe they have access to well over half a gigawatt of active power and almost three gigawatts of contracted power capacity nvidia's blackwell racks take around 120 kilowatts each so coreweave has enough contracted capacity to power over 24 000 racks or more than 1.7 million gpus then they sell access to those gpus either as bare metal chips or full stack instances managed through the cloud coreweave can spin up clusters of gpus add in high throughput networking and storage and schedule large training or inference jobs all without touching the physical servers as of their latest earnings call coreweave's quarterly revenue came in at 1.4 billion dollars which was up a whopping 134 percent year over year but the special thing about coreweave isn't their revenue growth it's their revenue backlog which just reached 55 billion dollars after growing 271 percent in a single year that growth is driven mostly by multi-billion dollar multi-year contracts with companies like openai microsoft meta platforms and nvidia in fact coreweave has one of the most privileged relationships with nvidia in the entire market and that comes with three big benefits first coreweave is effectively the launchpad for nvidia's latest chips they get early access not just to gpus like blackwell ultra and rubin but also to the bluefield 4 dpus and next generation networking which tackles some of the big bottlenecks that usually leave expensive gpus underutilized second they have a formal 6.3 billion dollar partnership where nvidia will purchase any unsold cloud capacity from core weave through april of 2032 in fact right as i'm recording this nvidia and core weave announced that they're working together to build out more than 5 gigawatts of ai factories by 2030 that enough power for millions of nvidia gpus as part of this partnership nvidia invested another 2 billion dollars into core weave stock at 87 dollars per share which isn't much lower than core weave's current price and third core weave was already nvidia's biggest public investment by far representing over 85 percent of their public portfolio before this deal, and something like 95% after.

So for investors, the takeaway is simple. Nvidia isn't just CoreWeave‘s core infrastructure supplier. They use them as a launch platform, they're the financial backer, and they're the buyer of last resort, which massively strengthens CoreWeave's position in the market. Alright, let's cover Nebius next, ticker symbol NBIS. Nebius is a neocloud with a very different angle.

They're a full-stack AI cloud, leaning into sovereign ai and regulated workloads for example healthcare where training and running models on medical images clinical notes and patient records has to comply with health data regulations or financial services where fraud detection risk models and trading systems need to touch bank transactions and customer data so they have to comply with regulations for banking and securities as of their latest earnings nebius generated about 146 million dollars in revenue which is about 10 percent of core weave's revenue but nebius is growing revenues almost three times faster three hundred and fifty five percent year over year with their core ai infrastructure business growing closer to four hundred percent their management is targeting a seven to nine billion dollar revenue run rate by the end of 2026 which would be a 13x in revenues by the end of this year about half of that is already under contract while core weave has the lead on gpu count nebius has the lead when it comes to their ai cloud platform which is called aether and it has a full software stack for training and inference including instance management high throughput storage governance and security controls for companies that care about compliance and nebius is still one of the most technically advanced nvidia shops out there they're the first cloud in europe to run blackwell ultra systems at scale and they're the first one around the world to deploy them with the latest generation of quantum infiniband that's a pretty big deal on the infrastructure side nebius currently has around 220 megawatts of connected power which they expect to 4 or 5x by the end of the year and now they expect to have over 2.5 gigawatts of contracted power which is over a 10x capacity gain that would let them power millions of gpus as fast as nvidia can ship them and similar to coreweave nebius has a huge guaranteed backlog of business including a five-year 17.4 $4 billion AI infrastructure deal with Microsoft and a separate $3 billion deal with Meta platforms.

So they're selling every bit of capacity they have and the only thing holding their revenue back is how fast they can bring new data centers online. As an investor, I really like that Nebius is specifically targeting governments, banks, healthcare, and regulated industries that want the best AI hardware while still complying with strict data rules and regulations.

That's exactly how Palantir got their start on the software side, by tackling the hardest industries first and then expanding to the broader commercial market once they've earned the trust of some of the biggest enterprises on the planet. And that leaves us with Iren, formerly Iris Energy, ticker symbol I-R-E-N. Iren is a former Bitcoin miner that's rapidly reinventing itself as an AI infrastructure company.

Iren is building massive renewable power data centers in north america and then pivoting that power to gpu clusters for high performance computing and ai workloads on the ai side they've already deployed over 23 000 nvidia hopper blackwell and blackwell ultra class gpus and from a power and capacity perspective iron already has over 800 megawatts up and running and 2.9 gigawatts of total contracted grid connected power across the US and Canada.

The thing that separates IREN from Corweave or Nebius is that only a fraction of that power is being used for AI today. Financially, their Bitcoin mining business makes up the bulk of the roughly $500 million of revenue they made in 2025, which was up more than 160% year over year. But that's starting to change.

They just won a 5-year, $9.7 billion billion AI cloud contract with Microsoft to deploy 200 megawatts of new Blackwell class data centers in Texas which is expected to generate about billion of ARR once it all fully online Being able to pivot power between Bitcoin mining and AI data centers gives IREN options in two very different markets.

Bitcoin mining provides a backup use for their power if AI demand ever weakens or they're still deploying their GPUs, so their resources will stay fully utilized. But AI workloads have much higher revenues per megawatt, and IREN can capture that upside by shifting that power to AI when demand is strong, like with that Microsoft contract I just mentioned.

As a result, IREN is guiding for an annual run rate of about $3.4 billion in AI cloud revenue by the end of 2026, which applies almost a 7x increase in total revenues year over year. That's tied to scaling their GPU fleet from 23,000 today to around 140,000 GPUs, which would still only use about 16% of their 3GW power portfolio. That means they can keep signing multi-billion dollar deals well beyond 2026, as more of that capacity comes online.

As an investor, I really like this combination of Iran's flexibility in shifting power between Bitcoin and AI, plus the sheer amount of capacity they already have secured. Alright, before we can decide which of these three stocks is the best buy right now, here's a table summarizing everything I covered. But keep a few things in mind as you read through it.

I built this table myself by pulling numbers from each company's latest earnings, and I tried to make every row as apples to apples as I could. But CoreWeave, Nebius, and Iren all have different fiscal calendars, different contract lengths with hyperscalers like Microsoft and Meta, and they ramped their revenues and backlogs from very different starting points over the last year.

On top of that, metrics like the number of GPUs, active power, and even the number of data centers are approximations. They depend on things like which GPUs, how much cooling, and whether you count individual facilities or larger campuses. So, take this table as a good way to compare their size and scale, but not as official audited numbers. And now that we have all that context, we can answer the big question.

Which NeoCloud company is the best investment right now? And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this. Thanks, and with that out of the way, let's talk about CoreWeave, Nebius, and IronStock. CoreWeave is the clear leader of the NeoCloud pack.

They have the biggest revenues, the deepest backlog, the most GPUs, the broadest data center footprint, and direct backing from NVIDIA. So if you're the kind of growth investor who waits for a company to prove its product market fit at scale, and have huge partners de-risking their capital spending, CoreWeave is for you. Nebius is the NeoCloud for sovereign and regulated AI. AI.

Smaller on revenue today, but aiming for a multi-billion dollar run rate from massive deals with Microsoft and Meta platforms, and they have a laser focus on governments, banks, and highly regulated industries. If you can stomach some execution risk and volatility in exchange for a shot at owning the palantir of AI infrastructure, Nebius might be the stock for you. IREN is for investors who like optionality and diversification.

They have almost as much contracted power as CoreWeave, a multi-billion dollar AI deal with Microsoft, and they can always pivot to Bitcoin mining to keep their GPUs fully utilized. So if your portfolio is already packed with AI companies that depend on NVIDIA, iREN is a great way to invest in AI infrastructure while also adding Bitcoin exposure into the mix.

Personally, I'm happy owning all three, because I believe that NeoClouds will play a huge role in the AI revolution, just like I'm happy owning Amazon, Microsoft, and Google.

But if I had to pick only one winner, based purely on market cap versus their scale, their backlog, their growth potential, and the rest of my personal portfolio, I'd go with iREN because I really like their flexibility, and I think they're underpriced based on their power capacity and the size of their deal with Microsoft.

But if I was a new investor building a portfolio from scratch, I'd go with CoreWeave because they already have the scale and they have Nvidia as their biggest backer, giving them the best risk to reward ratio of the three let me know which stock you're buying below or if you want me to make a deep dive video on any one of them and if you want to see more science behind the stocks check out this video next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- CoreWeave is the clear leader in the NeoCloud pack, with the biggest revenues, deepest backlog, and most GPUs.

- Nebius is targeting governments, banks, and highly regulated industries with its full-stack AI cloud platform.

- IREN is a former Bitcoin miner pivoting to AI infrastructure, with a unique ability to shift power between Bitcoin mining and AI data centers.

- The NeoCloud market is expected to grow 30x in size over the next eight years, with a potential market size of over $1 trillion by 2034.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.