Table of Contents

1. Introduction

2. Palantir Financials

3. Palantir Products

4. Palantir Risks

5. Conclusion

Introduction

Palantir is one of the most powerful AI companies on the planet, because they make some of the most powerful AI platforms on the planet. But the stock is already down by almost 30% from its peak, and as AI stocks keep crashing, there's really only one question left to ask. Is now a good time to buy Palantir stock, or are their best days already behind them? Your time is valuable, so let's get right into it.

AI stocks are in a big decline, with huge names like Nvidia, AMD, and Palantir going down by 10, 20, even 30% over the last few weeks. But this could be a great opportunity to get rich without getting lucky, because Palantir just posted massive earnings on the back of huge demand for AI from some of the biggest enterprises on earth. So in this video, I want to walk you through four things.

How Palantir makes their money, where their insane earnings are actually coming from, the biggest risks to their growth over the long term, and of course, whether it's worth buying Palantir stock at these prices. But let me be clear about one thing up front. This wasn't just another good quarter for Palantir. It was a step change in how the entire business is scaling.

Palantir reported record revenues of $1.4 billion for the quarter, which is up 19% quarter over quarter and a whopping 70% year over year. That's not small cap growth off of a tiny base. It's hyper growth from a company already making multiple billions of dollars a year. Here's what I mean when I say hypergrowth. Over the last four quarters, Palantir's year-over-year revenue growth was 39%, then 48%, 63%, and now 70%. So revenues aren't just growing, they're accelerating at a very fast pace.

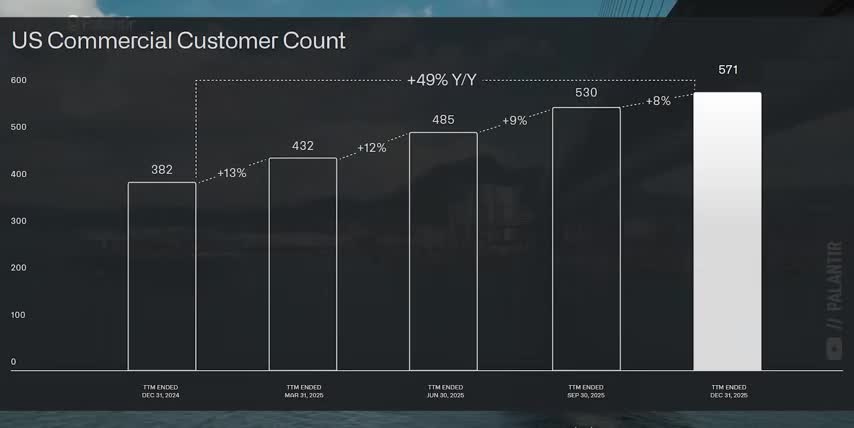

Most of that acceleration comes from Palantir‘s US commercial revenues more than doubling year-over-year. And to really understand why this is happening, let's look at two key numbers that I think every Palantir shareholder should pay very close attention to. First, their U.S. commercial customer count grew to 571, which is up 49% year-over-year.

Said another way, Palatir increased the number of commercial companies they're working with by almost 50% in a single year, giving them much broader market coverage. And second, their net dollar retention rate was 139% for the quarter, which is the highest they've ever reported. Net dollar retention rate measures how much revenue a company makes from their existing customers year over year.

So, Palantir's net dollar retention rate of 139% means their existing customers are spending an average of 39% more with them this year versus last year. That means they have much deeper market penetration. I watch these two metrics because they form the foundation for a software company's growth. 49% more customers means much more than just revenue. It means more markets and use cases for Palantir's platforms.

Every time they deploy Foundry, Gotham, or AIP in a new vertical, like supply chain management and logistics, healthcare and life sciences, energy and automotive, they learn new business patterns and turn them into pre-built workflows and solutions, which then make it faster and cheaper for them to acquire and onboard new customers in those same markets. Net dollar retention is the other side of that coin.

139% net dollar retention rate means Palantir isn't just signing new deals, they're expanding inside the accounts they already have. Existing customers are rolling Palantir software out to more facilities, more business units, and using more AI-driven workflows over time. That's how you get accelerating revenues without also accelerating sales and marketing spend.

So, when you combine 49% more customers and 39% more revenue per customer, you get the kind of multiplying effect that explains why Palantir's revenues have been accelerating as the company gets bigger, instead of slowing down. And it's not just commercial revenues. Government revenue grew by 60% overall and 66% in the US, which shows just how high the demand is for Palantir's AI platforms even in the slowest and most heavily regulated industries.

This kind of hypergrowth usually only happens when a company is chasing customer count and revenue growth at any cost He burn huge amounts of cash on sales marketing and headcount just to show big top line numbers but that not what's happening here palancy reported gap operating margins of 41 compared to just one percent in quarter four of 2024 about 20 percent in quarter one of 25 27 percent in quarter two and 33% in Q3.

So their margins moved from basically break even a year ago to 41% today, right alongside their revenues. For investors, the key points are clear. There's huge demand for Palantir's platforms across many industries and markets. Existing customers are spending 39% more with them, even as most companies are cutting their budgets, and Palantir's becoming much more profitable in the process.

All strong signals that this level of growth is actually sustainable, which makes Palantir one of the strongest AI stocks on the market.

DeleteMe is a hands-free subscription service that will remove your personal information from those online data brokers. They give you a quarterly privacy report showing everything they've done. And they've reviewed almost 55,000 listings for me so far. But what really surprised me is that these data brokers had way more than just my private data. They had my wife's and my entire family's too. That's another reason I really like DeleteMe.

They have a family plan so we can all have more control over our personal data.

So if you care about your data and your family's privacy, you can get 20% off any consumer plan with my code symbol 20 by going to join delete me dot com slash symbol 20 or with my link in the description and a big thank you to delete me and to you for supporting the channel all right so far we've talked about palantir's commercial and government revenues their customer account net dollar retention rate and expanding margins there are two more financial metrics that we should look at and they're really two sides of the same coin in my opinion free cash flow is the ultimate measure of a company's success and that's exactly where palantir really separates itself from other high growth software companies this past quarter palantir generated 791 million dollars in adjusted free cash flow which works out to a free cash flow margin of 56 percent most software companies growing revenues by 70 year over year are still burning cash or sitting at single digit free cash flow margins which investors will usually tolerate because of that massive growth.

But to show you just how rare a company like Palantir is, let's take a look at our second metric, the Rule of 40. The Rule of 40 is simple. You add a company's revenue growth rate to its profit margins, usually their operating margins or free cash flow margins. If they add up to 40 or more, you're probably looking at a healthy software business.

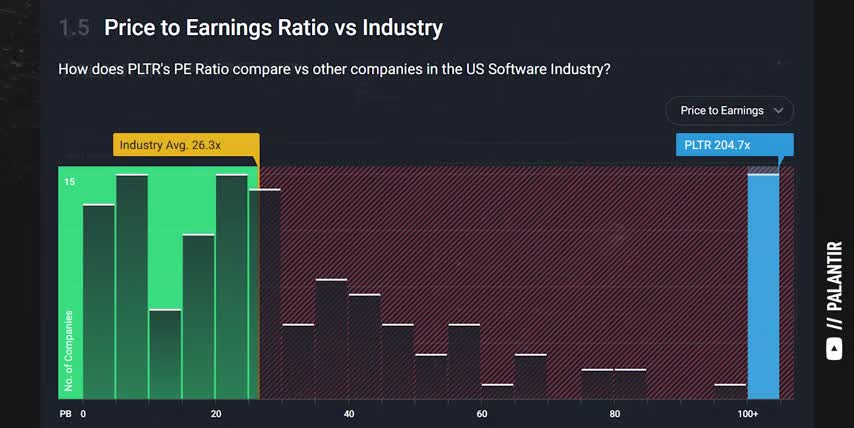

The Rule of 40 exists because the price to earnings ratio can be very misleading for high growth companies early on earnings are tiny relative to revenues so p e ratios look insanely high even if a company has great unit economics and later specific accounting choices stock-based compensation and one-time expenses can all drastically affect earnings while the company's underlying growth and profits are still strong either way focusing only on the p e ratio is a great way to miss most of the upside from the best performing stocks palantir's 70 revenue growth and 41 gap operating margins gives them a rule of 40 score of 111 or 127 if we use management's adjusted numbers no other enterprise software company even comes close to this score it's worth noting that the rule of 40 score isn't just some vanity metric you can see its effects directly on the balance sheet because palantir is generating so much cash at this level of growth, they've built up a $7.2 billion cash pile with zero debt That means they can keep funding research development sales and platform expansions using their own cash flows instead of new equity raises or taking on debt when interest rates are high And now that we gone through the numbers let's talk about what Palantir actually does, and what makes them so different from a typical software company.

At a high level, Palantir sells three core software platforms. Gotham is their platform for defense and intelligence.

It ingests and combines sensitive data, helps analysts and operators identify patterns and supports mission planning and targeting foundry is for commercial and civil customers it connects data across different enterprise systems factories supply chains and assets and turns it into a live model of the business which people can then use to analyze operations and run day-to-day workflows on top of those sits aip palantir's artificial intelligence platform aip wires large language models and other ai systems directly into live business data and workflows, so analysts can move from numbers on a dashboard to AI agents that actually propose and execute actions inside of the business or mission.

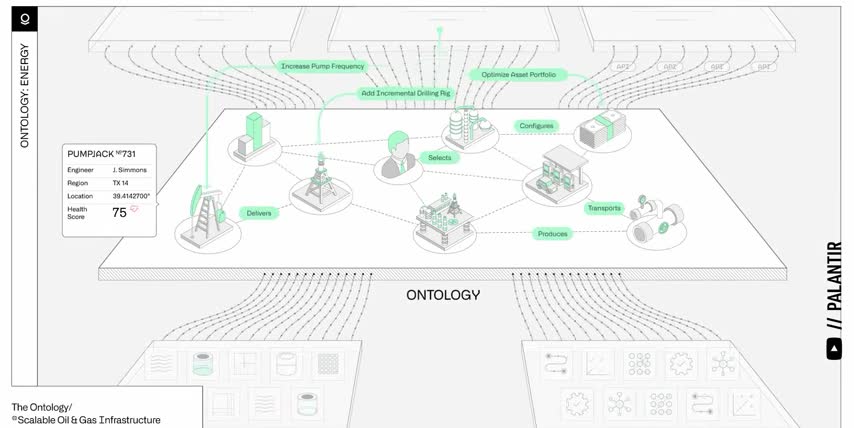

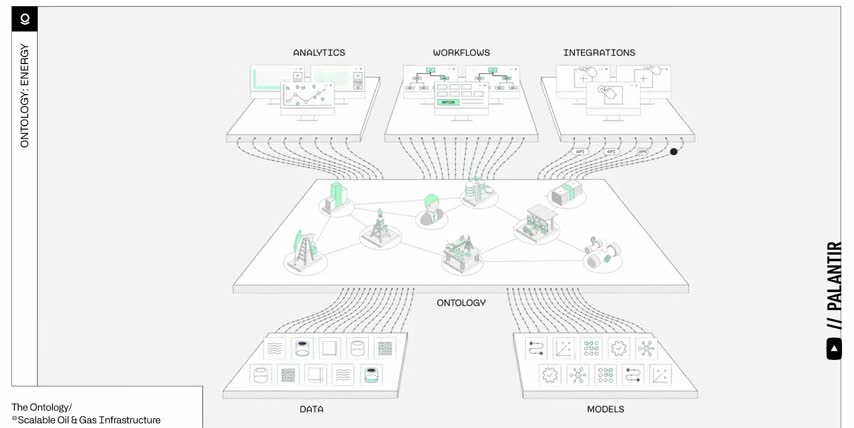

Palantir's real value proposition and their deep moat is what they call an ontology. An ontology is a structured map of an organization. Its assets, orders, customers, shipments, employees, computer systems, you name it, plus the relationships between them. Instead of dumping everything into a generic data lake and asking an AI model to guess what it all means, Palantir helps their customers build this single source of truth. This ontology is what AIP plugs into.

So when an AI agent does something, it's acting on real objects like a specific factory line, a specific shipment, or a specific object being tracked by a radar, all with the right permissions, the right approvals, and the guardrails built right in. That's a big reason why customers end up spending 39% more with Palantir year over year. Once a business has an ontology and starts building on top of it, it's virtually impossible to rip out and replace.

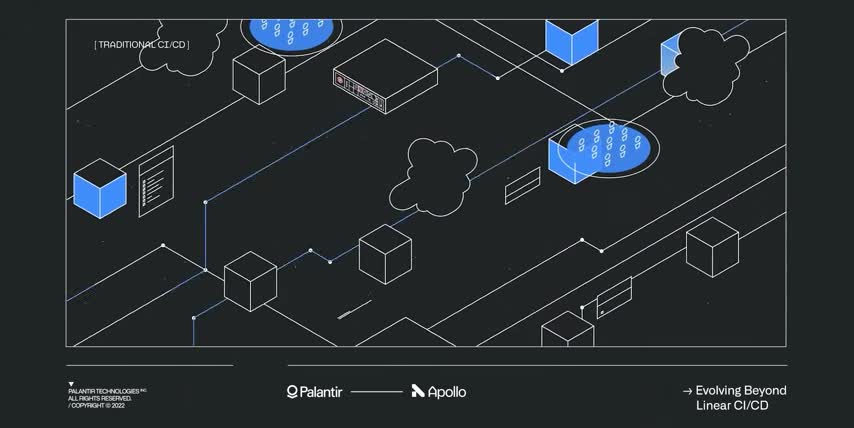

Over the last year, Palantir has been turning AIP from a toolkit into a full development environment for operational AI.

They've rolled out an ontology software development kit so that developers can build Python and Java applications on top of them, they've added workflow builders so teams can design complex, multi-step AI processes, and and they've shipped tools to let customers use any LLM in production while still getting Palantir-level security, tracking, and transparency into what those models are doing.

Altogether, these features make it much easier for large enterprises and governments to move from prototypes to full-production AI systems that can actually be managed and trusted at scale. So, the big insight for investors is that Palantir isn't trying to train the best AI model or sell the cheapest cloud compute. They're becoming the business operating system of the entire AI era by turning data and models into actual insights and actions.

That's how they're achieving 70% revenue growth, 139% net dollar retention, and a rule of 40 score of 127%. Alright, let's zoom out and talk about Palantir's biggest risks. And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps the channel out, and it lets me know to make more content like this thanks and with that out of the way let's talk about palantir's biggest risks starting with the competition like i just said palantir isn't trying to be another hyperscaler or foundation model vendor instead their platforms sit on top of clouds and ai models from other companies and they focus on turning that hardware and software infrastructure into real workflows and applications for commercial and government customers microsoft Google and Amazon all have their own AI toolboxes and analytics platforms, but their overall focus is on selling compute, storage, and generic cloud services inside their own ecosystems.

The same idea applies when you compare Palantir to data platforms like Snowflake or Databricks. Snowflake is a cloud data warehouse, and Databricks is a platform for data analysts. Both are strong when it comes to storing and analyzing data, but only Palantir builds an and ontology and supports the workflows, the apps, and the AI agents that sit on top of it.

So the biggest risk to Palantir doesn come from direct competition It that hyperscalers and data platforms could successfully copy enough of Palantir simpler and more convenient features and then bundle them with cheap compute and aggressive discounts. And that brings us directly into Palantir's second big risk, management's aggressive guidance, which leaves no room for mistakes.

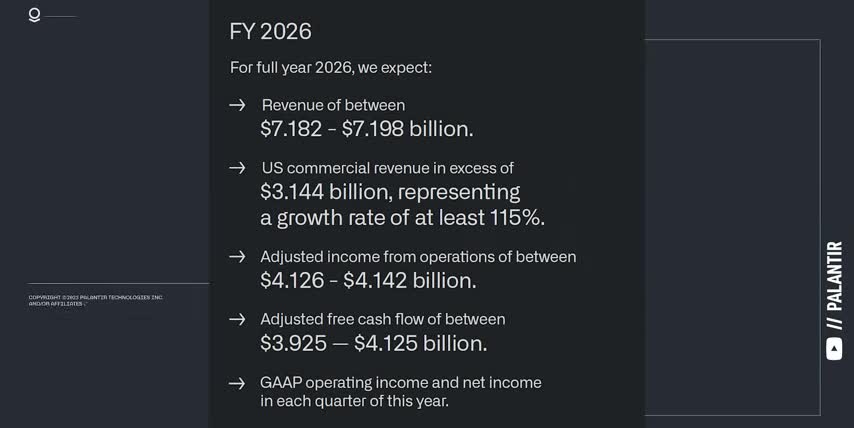

Management is currently guiding for $7.19 billion of revenue in 2026, which implies around 60% growth from their current $4.5 billion base. They've also guided for US commercial revenues of over $3.1 billion, representing a growth rate of at least 115%. For that to happen, Palantir needs commercial AI demand to stay red hot. They need government demand to remain strong despite everything going on and for margins to stay near today's levels.

Any slowdown in AIP adoption, any delays in a few big deals or any pushback on pricing from big customers can make those targets hard to hit. And that leads us straight into risk number three, Palantir's current valuation. Palantir stock already trades at very high multiples of earnings and sales compared to other software companies, even after this most recent pullback.

With guidance set so high, if Palantir only grows revenues by 50% instead of 60, it could hit the stock pretty hard, especially when investors are looking for any excuse to sell AI stocks after their massive multi-year run.

Not to mention the structural and political risks built into Palantir's business, like policy changes affecting their work in defense, intelligence, law enforcement, and critical infrastructure, not just here in the US, but in Europe and other regions with their own laws, their own regulations, and their own compliances.

Palantir isn't any more immune to these risks than NVIDIA was when the Trump administration changed its policies around exporting AI chips to China or proposing tariffs on Taiwan. Alright, so what does all this mean for Palantir stock going forward? At the end of the day, Palantir is in the absolute top tier of software companies by any metric.

70% overall revenue growth, 137% US commercial revenue growth, 41% operating margins, 56% free cash flow margins, 139% net dollar retention, and a Rule of 40 score of 127. And they got there by becoming an operating system that turns data and AI models into real-world decisions in the industries that matter most. Defense, government, industrials, logistics, energy, and healthcare, all built on top of an ontology that their customers can't replace.

The flip side is that the market already understands this, which is why this stock trades at sky-high multiples and why management's revenue guidance leaves no room for mistakes. If Palantir keeps compounding anywhere close to what it has been, you're looking at another trillion-dollar tech giant in just a few years' time. But any slip-up from slower AIP deals or a few delayed contracts to regulatory changes at home or abroad will all punish the stock.

Even if everything goes right for Palantir, the market can simply rotate out of AI stocks like it's doing right now. So as an investor, the only real question left to ask is whether you think Palantir can sustain this insane level of growth given all the risks we just covered. If you don't, or you think the price is too high, you can either wait for their price to drop or for their earnings to catch up to their valuation, both of which are kind of happening as we speak.

But I personally think they will keep growing faster, as more industries, companies, and even governments start seriously adopting AI. So my plan is to dollar cost average even more aggressively into Palantir stock as the price keeps coming down. This isn't about catching a falling knife. It's about consistently growing my position in what I think is one of the best stocks to get rich without getting lucky. Let me know what you think about Palantir down in the comments.

And if you want to see what else I'm investing in to get rich without getting lucky, check out this episode next. Either way, thanks for watching and until next time, this is Ticker Symbol U. My name is Alex, reminding you that the best investment you can make is in you..

Key Takeaways

- Palantir is a powerful AI company with strong financials, including 70% revenue growth and 41% operating margins.

- The company's software platforms, including Gotham, Foundry, and AIP, are in high demand across various industries.

- Palantir's ontology is a key differentiator, providing a structured map of an organization and its relationships.

- The company's biggest risks include competition from hyperscalers and data platforms, aggressive guidance, and high valuation multiples.

- Investors should consider whether Palantir can sustain its growth rate and navigate potential risks before making a decision.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.