Table of Contents

1. Introduction

2. Capital Concentration Risk

3. Energy Risks

4. Geopolitical Risks

5. Conclusion

Introduction

I'll leave a link to the full paper in the description below. So let me walk you through the economic apocalypse, step by step and chart by chart, without any of the emotion or industry jargon, so we can figure out what actually matters over the next few years. This is not financial advice; it's a reality check for the AI revolution, broken into a few key risks. First, capital concentration.

Most of the market's returns come from a small group of companies spending a staggering amount of money on AI infrastructure with very little payoff so far. Second, energy risks. Power demand from data centers is exploding, and the cost to train cutting-edge AI models is more than doubling year over year. Third, geopolitical risks. Taiwan is a single point of failure for making advanced chips, and China is racing to build its own AI stack outside of US control.

And of course, we'll tie it all together with what this all could actually mean for AI stocks going forward. No fear, just facts and data from JP Morgan's paper. Let's start with the concentration risk, since that's the most immediate one.

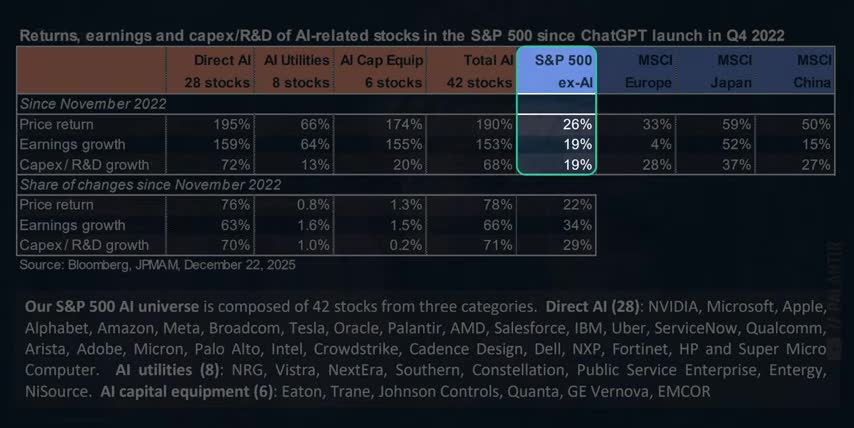

The overall S&P 500 is up by about 80% since ChatGPT came out. But if we remove those AI stocks, the other 458 companies are only up 26% over the last 3 years. That's an annual return of under 8%, which means most US stocks actually underperformed the markets in Europe, in Japan, and in China.

At the core of this story is a very specific tech stack: Nvidia and AMD designed the chips, Taiwan Semiconductor manufactures them using ASML's lithography machines, and four specific hyperscalers – Meta Platforms, Amazon, Google, and Microsoft – buy that hardware to power AI workloads for billions of users. These eight companies have grown by 6x over the last seven years, from a combined market cap of about three trillion dollars in 2018 to over 18 trillion dollars today. These eight stocks now make up around 20 percent of all equity markets. Let me say that a different way: around 20 cents of every dollar in every stock market on earth is invested in one of these eight companies. That means every retirement account, every pension fund, and every index investor is heavily exposed to this one AI stack, whether they realize it or not. But that doesn't automatically mean we're in a bubble. JP Morgan's paper points out that AI companies have much higher profit margins and returns on capital than the average S&P 500 company, and today's tech valuations are nowhere near the levels of the dot-com bubble. They even argue that today's prices are actually reasonable if earnings can keep growing the way they have been. But since so much of the market and even a good part of the economy is so concentrated in AI companies, we shouldn't be asking about their earnings at all. We should be asking what the worst thing that could happen to them over the next 5 to 10 years.

For example, what if hyperscaler earnings can't keep up with their insane spending on AI? According to JP Morgan, a metaverse moment for hyperscalers that aren't seeing returns on their AI spending is the most immediate risk to our investments. But if you've been watching this channel for a while, you know that the best investment you can make is in you. Especially if you're trying to make a big change in your life.

Whether you want to break into a new career and work from home, or level up your current job with AI, Careerist has you covered. Their AI Automation Bootcamp is no joke. It's about 7 hours a week for 4 months, but it's the fastest path I've found to go from where you are now to making anywhere from $90,000 to $140,000 a year working from home with no code required. Careers got their start at Y Combinator, just like Airbnb, Dropbox, and DoorDash.

And today they have over a thousand graduates at companies like Google, Amazon, Meta Platforms, Salesforce, and Uber. That's because they don't just train you and leave you hanging. You'll build real automation projects and learn to present them to real employers. They even help you with your resume, cover letter, and interview prep so that you actually get the job.

That's why they have so many great reviews from their alumni, and Course Report even named them one of the best online boot camps in 2025. Enrollment for the next boot camp closes soon, and spots are filling up fast, because big companies need tons of AI and automation professionals right now.

So if you're tired of being underpaid, and you want a recession-proof career in AI that lets you work from anywhere, invest in yourself today by using my link in the description to get up to 30% off this awesome AI automation boot camp. Alright, since the end of 2022, hyperscalers have spent roughly 1.3 trillion dollars on AI hardware, research, and development. More than the Manhattan Project, the Apollo Program, and the buildout of the entire US highway system put together.

The median company in the S&P 500 spends around 10% of their revenues on CapEx and R&D, maybe 20% for a typical tech company. But Meta alone is spending close to 70% of their revenue on AI, and Google, Amazon, and Microsoft have all been pushing their ratios higher over time.

On top of that, they've shifted from funding their projects mostly with cash flow to leaning heavily on debt, with long-term borrowing jumping a staggering 10x in a single year, from under $20 billion in 2024 to $200 billion in 2025. But the scary part isn't the spending and increased debt. It's the lack of payoff. Microsoft is basically the only hyperscaler that even shows their revenues from AI, and they're a tiny fraction of the costs to bring it online.

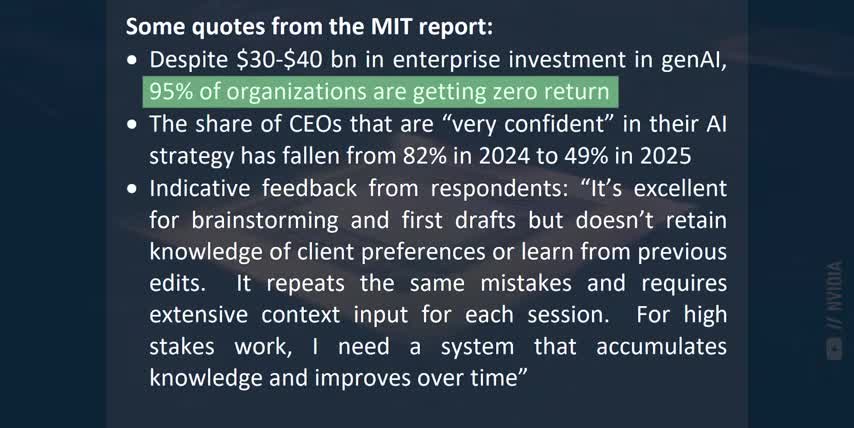

And their customers aren't doing much better. J.P. Morgan cites an MIT study that found about 95% of organizations are seeing no measurable returns from AI. CEO confidence in their AI strategy fell from 82 percent in 2024 to 49 in 2025, and most users still don't trust AI tools for high-stakes work, which makes sense because another study found that even the best AI models still hallucinate 20 to 30 percent of the time. The median model is closer to 50, and the worst offenders are straight up delusional, which helps explain why the promised productivity gains from AI haven't fully shown up in the numbers yet. This section of JP Morgan's paper is much deeper than what I'm covering here. For example, they walk through how changing the depreciation window of AI servers from three years to six boosted reported earnings by six to nine percentage points, and Oracle's earnings would fall by about 17 if they could only depreciate their AI assets over three years. Meanwhile, free cash flow margins have quietly been slipping over the course of the AI era, which is the opposite of what investors are expecting this early in a super cycle. There's even a section on Open AI specifically, where their own power and compute roadmap requires tens of gigawatts of new power generation and hundreds of billions of dollars in hardware just to even start chasing their current growth targets. So the big takeaway here isn't that AI doesn't work, but that the market could be setting up for a metaverse moment where the story gets too far ahead of profits and shareholders decide they paid too much too soon for this AI build. If earnings start to disappoint, those 42 core AI companies that are propping up global markets could easily drop by 30, 40, or even 50, like we saw in 2022, and bring down every retirement account, every index fund, and every AI-focused portfolio along with them.

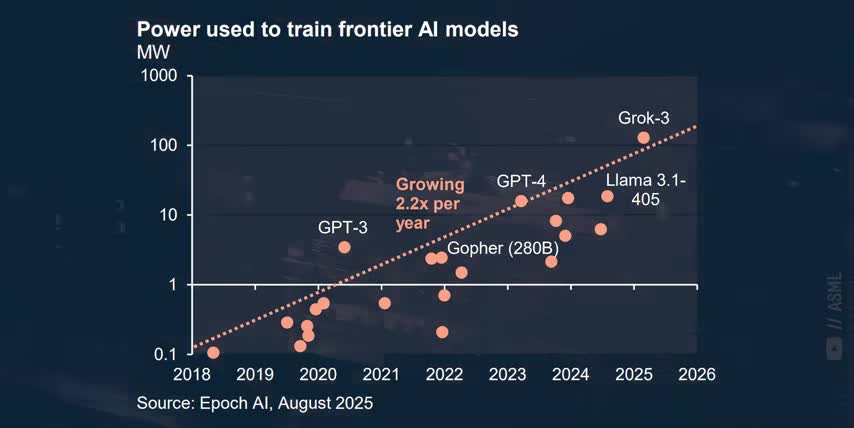

The second big risk isn't about profits; it's about physics. Even if AI profits catch up to spending, this whole AI boom can still get capped by something much more basic: not having enough cheap, reliable electricity to power it. Like I just mentioned, OpenAI isn't a software story; it's a power story, and the numbers are insane. JPMorgan cites forecasts showing that OpenAI alone could need roughly 30 gigawatts of new power generation by 2030, just to support its current AI roadmap.

For context, that's more reliable power capacity than the entire US grid added in 2024. And it's not just OpenAI. The power needed to train Frontier AI models has been more than doubling each year, and data centers are expected to drive around two-thirds of all new electricity demand, while the US is only adding around 25 gigawatts of grid capacity every year.

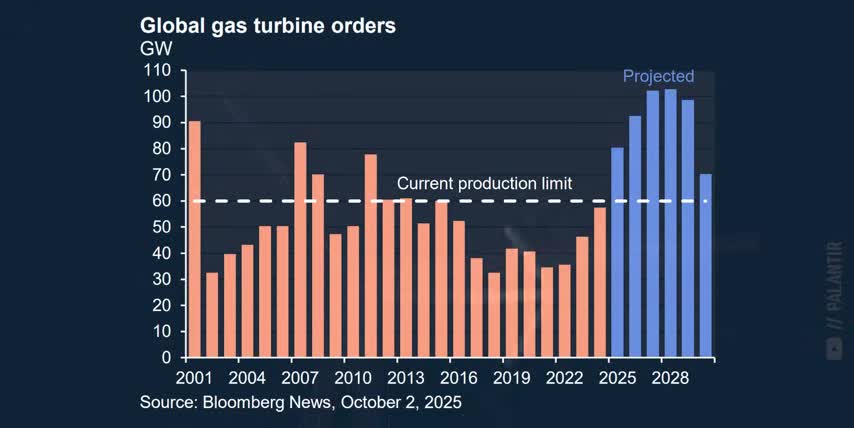

So, when companies like Microsoft and Meta Platforms announce massive 6-10 gigawatt data center buildouts, the obvious question is how they're actually going to power them. Right now, the answer is basically natural gas and very slow paperwork. But this paper points out that gas turbines and critical grid equipment, like transformers and switches, are so backlogged that new plants can take anywhere from 3-7 years to come online.

And slapping solar panels and batteries on everything won't work either. Even with a 40% tax credit, solar plus storage is still more expensive per megawatt hour than modern gas plants for 24-7 loads. That means their real bottleneck isn't GPUs or memory or network speeds. It's access to reliable power. So the big takeaway of this section is pretty simple. If the cost of intelligence becomes the cost of energy, then the winners won't be the companies with the best chips. They'll be the ones with the most efficient chips and the best deals on power.

So far, we've talked about money and power. The last big risk is politics. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps the channel out, and it lets me know to make more content like this. Thanks, and with that out of the way, let's talk geopolitics.

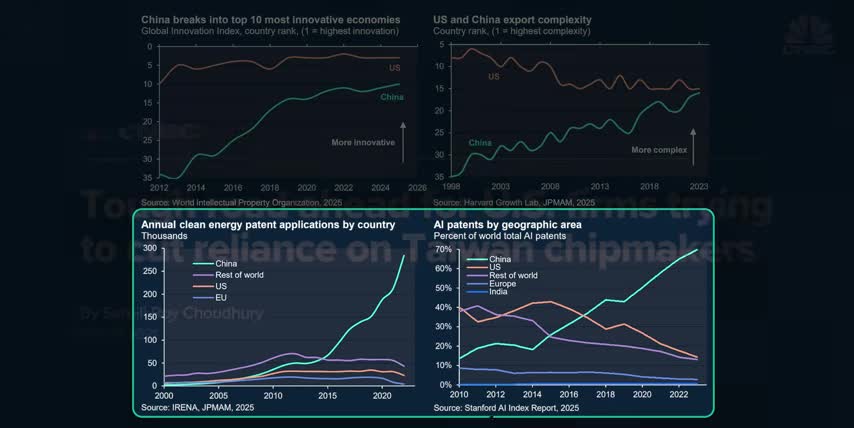

Even if profits surpass spending, and we somehow build enough power, the entire AI era still has two key risks. China is building their own independent AI stack, and Taiwan acts as a single point of failure for the world's most advanced chips and the market's top tech stocks. China isn't trying to jump the US AI moat; they're slowly tunneling underneath it. JP Morgan shows that China is climbing into the top 10 on global innovation rankings.

They're narrowing the gap with the US on exports and leading the world in clean energy patents, AI patents, and nuclear engineering research.

On top of that, China built 11 times more power generation than the US since 2019, giving them a huge amount of energy to throw at AI. That innovation and power build-out is backed by the full weight of the state, with a $48 billion chip fund and subsidies that can make up 20 to 30 percent of total corporate profits in some parts of their AI and semiconductor markets. Their goal is clear here: remove choke points from the exact technologies I cover on this channel, like lithography, high-bandwidth memory, and advanced packaging, so that China can make its own Nvidia, its own TSMC, and its own ASML-style tech stack over time. And their plan is working. Huawei doubled the yields of their Ascend 910C AI chip in 2025 and now accounts for over 75% of China's AI chip production. They're also getting closer to full vertical integration, from wafer fabrication and memory to chip packaging and huge AI clusters, and a team of former ASML engineers in Shenzhen have already built an EUV prototype with production targeted before 2030.

Now, just to be clear, Nvidia is still way ahead in terms of chip performance. JP Morgan's paper shows that Nvidia's Blackwell Ultra delivers around 2.9 times the compute, 2.5 times the memory bandwidth, and two times better power efficiency than Huawei's chips at the rack level. But let me point out two important things here. First, that performance gap is probably much smaller than most people realize. Huawei's latest racks are around three times more efficient than Nvidia's Hopper generation, which was the state of the art not too long ago.

And second, while Chinese AI clusters need two to three times the power for the same amount of compute, their grid has that amount of power, and their government has the money to do it. The real takeaway for investors isn't that China is about to leapfrog the US. It's that China is only one or two generations behind, and they're willing to trade the power efficiency and profitability for independence in what will likely be the world's largest AI market.

China's push for an independent AI stack also has a nasty side effect. It quietly weakens Taiwan's silicon shield. The more confident Beijing becomes that it can live without TSMC, the more strategic risk there is around Taiwan for the rest of the world.

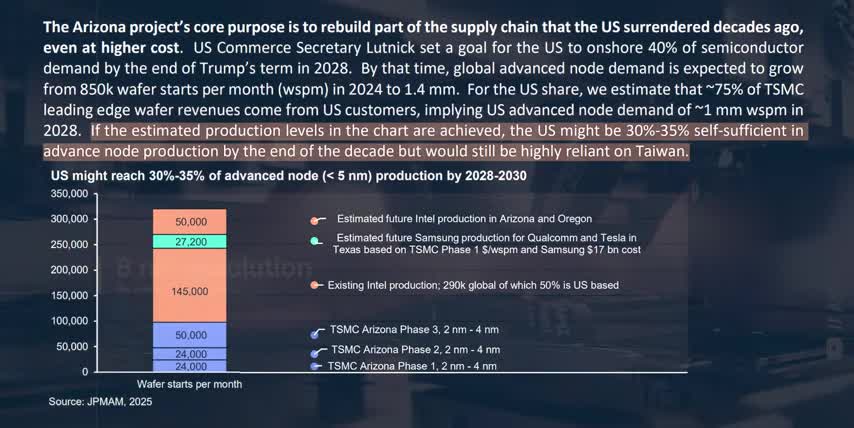

Taiwan is the single biggest point of failure in the entire AI ecosystem, and that won't change anytime soon. Taiwan makes over 90% of the world's most advanced chips, and most of those come from TSMC. And it's not so easy to move that production to the US. TSMC's five-nanometer wafers made in Taiwan have 62% gross margins, while those same chips made in Arizona are closer to eight percent, and those chips still get shipped back to Taiwan for packaging and testing. JP Morgan estimates that even by 2030, the US might only be able to make one-third of the advanced chips we consume, with the other two-thirds still having to come from Taiwan. So we're a far cry from not relying on them. On top of that, Taiwan imports around 90% of its energy and about two-thirds of their food, making it one of the most blockade-sensitive economies on earth. And since only a handful of ports handle most of those imports, Chinese military exercises focus more on surrounding the island and cutting off shipping lanes instead of practicing for a full-scale invasion.

One major study from the Institute of Economics and Peace estimates that a blockade around Taiwan could cut global economic output by close to 3% in the first year alone. That's nearly two times worse than the hit from the 2008 global financial crisis. Alright, so what does all this mean for you and me? Like I said at the beginning, this video isn't about fear-mongering. It's about understanding the real risks so that we can make smarter decisions, not just louder bets.

Risks like capital concentration. 8% of the stocks in the S&P 500 are driving more than 80% of its returns. And almost 20 cents of every invested dollar on Earth now sits in the top 8 AI names.

These companies committed over a trillion dollars to AI chips, AI data centers, and fabs with no real guaranteed payoff, so we have to watch out for a metaverse moment where hype overshadows earnings and spending outruns demand. Risks like a lack of power: training and serving frontier AI models is about energy as much as software, and the US grid is already struggling to keep up. Big tech companies are making deals for tens of gigawatts of power faster than we're able to build it, which means that power and permitting could become the bottlenecks that slow down AI growth long before AI models or chips reach their fundamental limits.

So, investors need to track data center delays and utility constraints as closely as they're tracking new GPU launches. In risks like geopolitics, China is pouring massive amounts of capital into domestic AI chips, domestic AI data centers, and power generation to build an AI stack that still works without US technology or Taiwanese fabs. At the same time, Taiwan's dominance in advanced chips is now the single biggest choke point in the world's economy.

So the big question is how fast China can achieve their AI infrastructure independence and how much risk the world is willing to carry around a single island that makes almost all of its advanced chips. I'm not saying all these risks will happen, and neither does JP Morgan's paper. The base case is that the US still leads in AI and profits keep growing alongside valuations. But now you know what the real risks are and what warning signs to watch out for.

If the market does crash and the economy does collapse, this is how it will happen. Let me know what you think about these risks in the comments, and if you are doing anything specific to protect yourself and your portfolio. That way, we can all learn together. Either way, thanks for watching, and until next time, this is Ticker Symbol You. My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- 42 AI companies are driving over 80% of the S&P 500's returns, with almost 20 cents of every invested dollar on Earth now sitting in the top 8 AI names.

- These companies have committed over a trillion dollars to AI chips, AI data centers, and fabs with no real guaranteed payoff, making them vulnerable to a metaverse moment where hype overshadows earnings and spending outruns demand.

- The US grid is already struggling to keep up with the power demands of training and serving frontier AI models, and big tech companies are making deals for tens of gigawatts of power faster than we're able to build it.

- China is pouring massive amounts of capital into domestic AI chips, domestic AI data centers, and power generation to build an AI stack that still works without US technology or Taiwanese fabs.

- Taiwan's dominance in advanced chips is now the single biggest choke point in the world's economy, and the world is heavily reliant on them for advanced chips.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.