Investing in AI Data Centers: A Key to Getting Rich Without Getting Lucky

Introduction to AI Data Centers

Something big is happening in AI data centers as we speak. Something that most Wall Street analysts won't see coming until it's too late. And it's happening so fast that it doesn't even matter which AI companies come out on top. That makes the one stock I'm about to show you a great way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time. So here's everything I'm going to talk about up front.

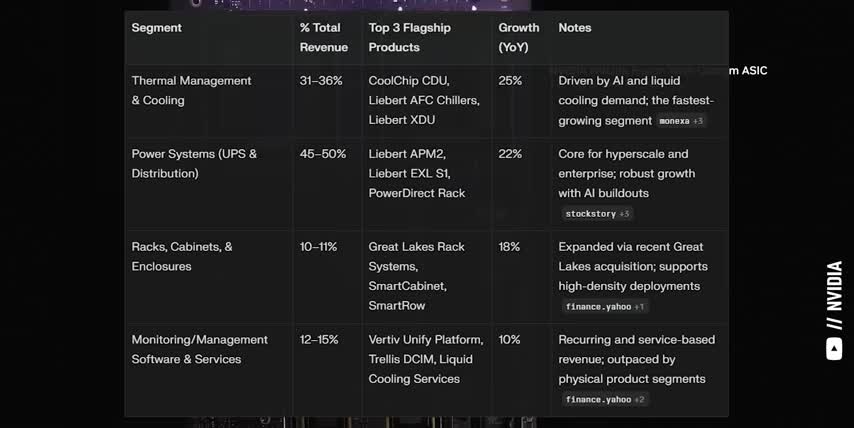

why data centers must make massive infrastructure changes to keep up with AI demand, an overview of Vertiv Holdings, ticker symbol VRT, and how they make their money, Vertiv's most recent earnings call, their catalysts and risks, and of course, where Vertiv stock belongs on my list of stocks to get rich without getting lucky in 2025, which has been outperforming the market by a large margin year to date.

Table of Contents

1. Introduction to AI Data Centers

2. Vertiv Holdings Overview

3. Earnings and Risks

This is a once-in-a-lifetime opportunity, so strap in and let's talk about the big changes brewing in the AI market, and I'll do my best to avoid any industry jargon along the way. The biggest thing investors need to understand is that the costs for using AI are going up exponentially because of reasoning. When OpenAI released ChatGPT three years ago, it was doing something called one-shot inference.

All that means is when you give the model a prompt, it immediately starts generating a response. This one-shot approach has a lot of benefits, like being fast and computationally cheap with predictable costs when serving millions of people. But it also comes with serious issues, like providing different responses to the same question, and getting stumped on complex problems, and hallucinating instead of verifying its own answers.

So, over the last couple years, AI researchers have come up with new techniques to generate even better responses. And what most Wall Street analysts are missing is that these same techniques are the main reason for this massive cycle of data center upgrades, which means that understanding them can help us understand which upgrades are actually in demand. Let me quickly walk you through three of the big ones.

Introduction to AI Data Centers

Chain of Thought Reasoning forces a model to break a problem down into steps, solve and verify its solution at each step, and then provide a final answer. This is great for a wide range of tasks that people tackle step by step today, from making shopping lists and travel plans, to troubleshooting and financial analysis. But the trade-off is that Chain of Thought Reasoning takes 5 to 10 times as many tokens to run as one-shot inference.

Best Event Sampling is where you have a model generate multiple answers to the same prompt and then choose the best answer. For example, generate 20 titles for a YouTube video and then pick the most provocative one. Or generate 20 different portfolio strategies for investing and then pick the one with the best risk vs reward. Or generate 20 variations of a resume and then pick the most impressive one. This is great for problems where quality matters way more than speed.

But the trade-off is that you're spending tokens on every generation, so all of my examples cost 20 times the tokens of one-shot inference. But this third technique is by far the most computationally expensive, because it kind of combines the other two. Tree search is where a model compares multiple approaches to solving a problem, and is used when the journey to the answer matters just as much as the answer itself.

Vertiv Holdings Overview

For example, finding the best strategy in chess depends on the order of your moves, your opponent gets to respond to each one. Or generating a business strategy or a project timeline where schedules and milestones matter just as much as the end results. In each case, TreeSearch has to break complex problems into steps and think through multiple possible paths to the solution before returning the final answer, which can easily cost over 100 times more tokens than one-shot inference.

But here's the real kicker. Much better answers also means much more user adoption.

The number of people using generative AI has increased 15 times in the last 3 years, and the average number of prompts per person has increased 10 times as people find more ways to use AI. Thus, 15 times more users multiplied by 10 times more prompts per user, multiplied by around 20 times more tokens per prompt, means we need 3 times more compute power to support generative AI applications today than we needed just 3 years ago. And that's just for large language models.

The number of tokens per prompt skyrockets when we switch from text to video, or to code for games and apps, or to simulations for drug discovery or product design, the list goes on and on.

Earnings and Risks

And now that we understand the 3,000-fold increase in demand isn't just coming from more users, but from ongoing fundamental changes to how AI models spend tokens, we can talk about how Vertiv is supporting the massive infrastructure transition that data centers need to make if they want to meet all of that demand. I really think this context is important for investing.

Warren Buffett became one of the richest men in the world by staying inside his circle of competence and investing in businesses that he understands, and right now, the most important thing for investors to understand is AI.

So make sure to register for your free seat with my link below today. Alright, so 3000 times the demand for tokens means data centers need to pack way more chips in the same amount of space, power them, and keep them cool. Around 90% of all server racks are air-cooled today, but industry estimates suggest that up to 80% of that will eventually transition to direct to chip liquid cooling, which coincidentally is up to 3,000 times more efficient than air cooling.

Vertiv reported $2.64 billion in net sales for the quarter, which is up by 34% year-over-year and 10% over their prior guidance. Their adjusted operating profits came in at $490 million. dollars, which is up 28% from last year and 11% over their prior guidance. As a result, their adjusted earnings per share came in at $0.95, which is up by 42% from last year.

But that doesn't mean there are no risks to Vertiv‘s business. Vertiv faces ongoing risks from supply chain disruptions, manufacturing transitions, increased costs, and tariff headwinds as they ramp up new production facilities in North America to be closer to their biggest customers and avoid tariffs.

Global AI infrastructure is also an incredibly competitive industry right now, with many major companies racing to launch new liquid cooling and power management solutions for the next generation of data centers, which are owned and operated by some of the richest companies on the planet. If Vertiv doesn't stay on the bleeding edge and keep exceeding customer expectations, their biggest customers will find another company that will.

And finally, becoming a global company exposes Vertiv to the geopolitical risks associated with Asia and the EMEA, including foreign regulations for data protection, localization, foreign tariffs, and national security hurdles. For example, changes in the US's relationship with China could impact Vertiv's supply chain and total addressable market.

Key Takeaways

My key takeaway on Vertiv right now is that they're firing on all cylinders their quarter to earnings exceeded expectations on sales on operating profits and on earnings per share they're raising their guidance on every metric that investors care about and they're deploying capital to keep growing their capacity to serve the accelerating demand for AI infrastructure.

Tariffs, supply chain challenges, and competition are all real risks that every company needs to manage. But Vertiv's management team has shown that they can navigate those challenges and still come out on top. I've also talked to Vertiv's employees at multiple conferences now, and they all seem genuinely excited for the future of the AI industry and for their place in it.

I also ended up moving CrowdStrike up two spots for the same reasons. I've been a shareholder for years now, and I think they're another core AI infrastructure company but on the software and security side, and I think that AI infrastructure stocks will outperform the market over time. As a result, I ended up moving Amazon and ARM down two spots on my list, and I'll keep reassessing things as more news and earnings come out.

And if you want to see what else I've been investing in, check out this video next. Either way, thanks for watching to the end, even though I gave you everything up front. And until next time, this is ticker symbol you. My name is Alex, reminding you that the best investment you can make is in you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.