Table of Contents

1. Introduction

2. Stock Market and Interest Rates

3. CoreWeave

4. Arista Networks

5. Micron Technology

6. Conclusion

The key to finding great stocks is understanding a company's products, not just their profits. Huge growth happens when a company has the perfect product for a quickly growing market. But the Federal Reserve is about to cut interest rates, which will make some investors very rich, as long as they know which stocks to buy and which ones to avoid. So in this video, I'll highlight three smaller stocks set to win big over the course of the AI era, especially as the Fed keeps cutting rates.

Your time is valuable, So, let's get right into it. First things first, I'm not here to waste your time. So here's everything I'll cover up front. Why these three smaller AI stocks could win big as interest rates fall, CoreWeave, a quickly growing AI cloud platform built around NVIDIA's GPUs, Arista Networks, which makes high-performance Ethernet switches to connect those GPUs, and Micron Technology, which makes the high bandwidth memory for them.

That way, we're holding some of the key AI data center companies, regardless of which chip maker or hyperscaler actually ends up on top. That's a great way to get rich without getting lucky. But context is important. So here's how I picked these companies in the first place. The next Federal Reserve meeting ends on Wednesday, December 10th, and they're very likely to lower interest rates, which has a huge impact on the stock market.

Long story short, lower interest rates mean consumers and businesses can afford to borrow more money, which means they'll spend more, which means more revenues and earnings for the companies that we invest in. But when the Federal reserve cuts rates, they're actually giving the stock market two different tailwinds, not just one. Because lower interest rates also lower yields on bonds and bank accounts, which make stocks more attractive investments.

That means they get higher multiples, like price-to-earnings or price-to-sales ratios. So, as interest rates go down, a company's earnings and their P.E. ratio should both go up. A rising tide lifts all boats, but not all stocks will go up equally. So let me show you something that will put you ahead of every Wall Street analyst that's trying to find the biggest winners as the Fed cuts rates. Don't worry, I'll keep it short and sweet so we can get to the stocks.

This is a case study showing the S&P 500's average returns before and after the Fed starts cutting rates. The x-axis is time in months, and the y-axis is returns. As of quarter two, U.S. GDP is growing at 3.8% per year, and forecasts predict the same growth for quarter three, which means the economy is currently expanding. So the S&P 500's average rate of return, one year after the first rate cut, in an expanding economy is 20%. But I just said that not all stocks go up equally.

So let's look at this data a different way. What I did was take the same stock market data, but instead of the whole S&P 500, I broke it down for the S&P 500's growth and value indexes, which are SPYG and SPYV respectively. Just to check my math, I get the same average returns in an expanding economy as the original case study. But look at the huge difference when we break it down by growth versus value.

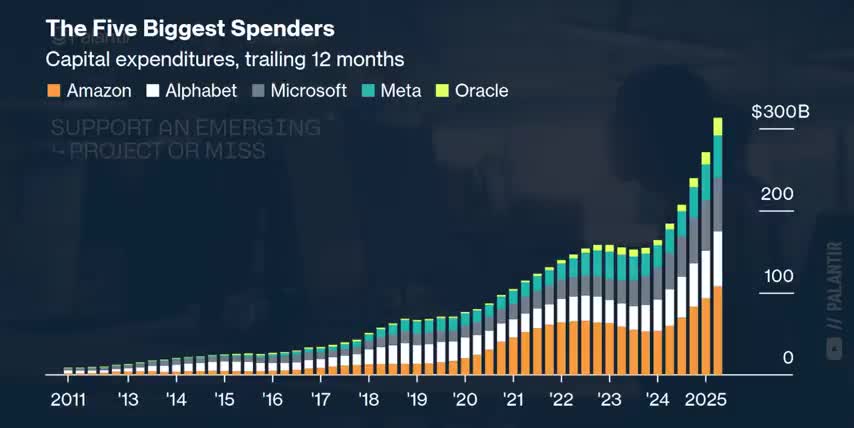

The growth index returns around twice as much as the value index at almost every point in a rate cut cycle. And I expect that difference to get even bigger over the course of the AI era since hyperscalers like Microsoft Amazon Google and Meta platforms are all spending hundreds of billions of dollars a year on data centers and I think these three smaller AI stocks will benefit big time as a result.

So putting everything together, we want to find companies that are small enough to be sensitive to interest rates and serving markets where spending is growing fast, since lower rates will increase that spending even more. Keep in mind that smaller stocks tend to be more risky. So think about your overall portfolio and make sure to understand the companies you're holding. That way you don't panic sell if the market drops again in 2026.

Over 10 million people around the world have already attended and the slots for this one are filling up faster than ever.

But for the holidays, they're giving the first 1,000 people who sign up with my link a free seat. Whether you work in tech or finance, marketing or retail, you'll learn to use some of the most powerful AI tools, best practices for prompting and using AI agents, and even how to automate workflows without any coding.

You'll also get free access to OutSkill's online community and learning dashboard for people turning artificial intelligence into real revenues this is a great way to gain a competitive advantage get a serious head start for 2026 and understand the science behind the stocks so make sure to register for your free seat before they run out with my link below today alright so now that you have the context on how i pick these stocks let's talk about the stocks themselves starting with core weave ticker symbol crwv core weave's goal is to be the amazon web services for AI workloads by providing the most advanced computing infrastructure to companies that can't afford to spend years and billions of dollars building it themselves.

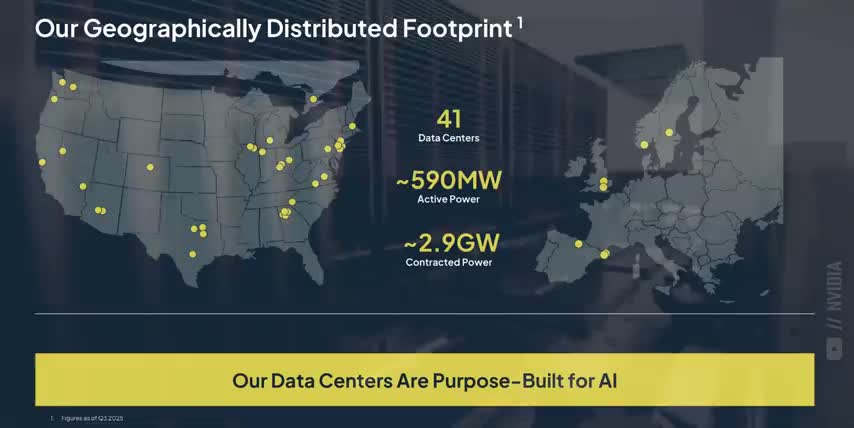

CoreWeave currently operates 41 data centers that are purpose-built for AI, which hold more than 300,000 NVIDIA GPUs combined across Europe and North America. But don't forget that most data centers are limited by power, and CoreWeave has over half a gigawatt of active power and almost 3 gigawatts of contracted power capacity. That's enough to power over 24,000 Blackwell Ultra racks, or over 1.7 million NVIDIA GPUs. There are three kinds of companies that want access to those GPUs.

AI model makers like OpenAI and Anthropic, enterprises adding AI to their apps and internal workflows, and hyperscalers that need extra capacity when there's too much demand on their own servers. One special thing about CoreWeave is they get priority access to NVIDIA's latest chips, like the new Blackwell Ultras or the Vera Rubin architecture that's coming out next year. That's a pretty big competitive advantage over other infrastructure suppliers.

And that's why OpenAI expanded their agreement with CoreWeave by another $6.5 billion last quarter, bringing their total partnership to over $22 billion in value.

These deals will provide OpenAI with dedicated compute capacity to train and deploy their latest AI models including reasoning models like gpt5 which generate a lot more tokens during inference Meta Platforms made a billion deal with CoreWeave for compute clusters dedicated to training and running LLAMA, as well as scaling Meta's AI infrastructure from now through 2031.

CoreWeave also has around $10 billion worth of deals with Microsoft to support training and inference on Azure, as well as other AI services like Bing AI and GitHub Co-Pilot, not to mention their partnership directly with NVIDIA, where NVIDIA will purchase any unsold compute capacity from CoreWeave through 2032, and use it for AI developers and customers that need quick access to GPU clusters running the CUDA ecosystem.

My point is, even though CoreWeave is still relatively small, they're working with some of the biggest companies on Earth today, and they're growing exceptionally fast. As of their latest earnings call, their revenues grew by 134% year over year, and they have a $55 billion backlog of deals, which is almost four times bigger than it was a year ago. And that's mostly driven by the multi-year contracts I just mentioned. That's why I think CoreWeave is so undervalued today.

They have $55 billion worth of committed revenue on their books, but their current market cap is only $44 billion.

Name one other publicly traded company, more than doubling their revenues every year with a backlog of business worth 25 more than the entire company itself like i said at the start of this video huge growth happens when a company has the perfect product for a quickly growing market for a core weave that's on-demand access to the latest ai infrastructure and we'll see just how big they'll grow now that interest rates are going down letting companies spend even more that's also why i picked arista networks ticker symbol a-n-e-t arista designs specialized ethernet switches and network control software to help deploy fast huge and reliable networks for a wide variety of applications like cloud computing video streaming and of course ai model training training and running today's ai models at scale involves breaking up massive amounts of data calculating partial products on thousands of interconnected chips and then recombining all those partial answers to form a final solution that means the whole ai system is only as fast as the slowest part of the network and any bottlenecks or lost data means wasted compute time lower reliability and ultimately higher costs arista's software and switches are engineered for extremely high speeds low latency and maximum reliability and because they use open standards their customers don't get locked into a single vendor which makes their offerings even more attractive arista also has a highly programmable operating system called eos that runs all of their networking equipment eos helps data center operators manage and automate systems balance workloads across thousands of nodes monitor network health and even identify and solve issues as they come up and they work very closely with broadcom arista's switches and software are built around broadcom's ultra-fast tomahawk switch chips so they're able to stay ahead of the growing demand for hyperscale ai networks and that demand is growing fast the global artificial intelligence market is expected to almost 19x in size over the next nine years which would be a compound annual growth rate of over 38 That 3 times faster than the S 500 and that before the Federal Reserve started lowering rates.

Which means this market could grow even faster as companies like Amazon, Google, Microsoft, and Meta platforms spend billions of dollars connecting their AI clusters together using Aristas, switches, and software.

you can't have hyperscale computing without high bandwidth memory and that's where micron comes in ticker symbol mu micron technology makes memory for the entire computing industry including solid state drives ram modules and flash memory for data centers pcs and smartphones they have over a 20 percent share of the global d-ram market putting them only behind sk hynix and samsung but sk hynix and samsung are both south korean companies so they could face tariffs that micron could avoid by being a US company.

Not to mention that the market for AI memory chips is expected to 9x in size by 2034, which would be over a 27% compound annual growth rate for the next 9 years straight. The memory market is split between volatile memory, like the high bandwidth memory modules attached to Nvidia's GPUs, and non-volatile memory, like the solid-state drives used to store AI datasets, model weights, and training results.

In my opinion, the big reason to invest in Micron is high bandwidth memory since that's what ai factories need the most high bandwidth memory is designed to move huge volumes of data at extremely high speeds by stacking memory chips and connecting them to a shared hub hbm is much faster and much more power efficient than other kinds of memory because it lowers the physical distance that data needs to travel modern frontier models can have trillions of parameters and they need to handle massive data sets as fast as possible traditional memory would be a big bottleneck in that process so high bandwidth memory is one of the big reasons that ai models can be trained so fast have such huge parameter accounts and do reasoning without taking hours to generate a single answer high bandwidth memory is a type of dram and as of micron's latest earnings their dram business is bringing in nine billion dollars a quarter representing 79 of their total revenue and just like core weave and arista networks micron is a high-growth company with DRAM revenues growing by 27% quarter over quarter and 62% year over year.

Micron's next earnings call is in a couple of weeks, so consider hitting the like button and subscribing to the channel if you want to see a full deep dive on this high-growth AI memory maker. Either way, there you have it. Three smaller AI stocks that could win big as the Federal Reserve keeps cutting rates because they provide high-performance computing infrastructure, high-speed networking, and high bandwidth memory that every data center needs if they want to be a part of the AI revolution.

That makes these three stocks a great way to get rich without getting lucky. And if you want to see what else I'm investing in to get rich without getting lucky, check out this video next. Thanks for watching and until next time, this is Ticker Symbol You. My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- The key to finding great stocks is understanding a company's products, not just their profits.

- Lower interest rates mean consumers and businesses can afford to borrow more money, leading to increased spending and higher revenues and earnings for companies.

- The three smaller AI stocks mentioned (CoreWeave, Arista Networks, and Micron Technology) could win big as the Federal Reserve keeps cutting rates due to their high-performance computing infrastructure, high-speed networking, and high bandwidth memory.

- These stocks provide a great way to get rich without getting lucky by investing in the AI revolution.

- It's essential to understand the companies you're holding and think about your overall portfolio to avoid panic selling if the market drops.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.