Table of Contents

1. Introduction

2. What CoreWeave Does

2.1. CoreWeave Business Model

2.2. CoreWeave Customers

3. CoreWeave Earnings

4. CoreWeave Risks

5. CoreWeave Investment

6. Conclusion

Introduction

What if there was an AI stock so good that it was Nvidia's largest public position? And what if this AI company more than doubled their revenues year over year? Oh yeah, and what if the stock just crashed by almost 40% over the last two weeks? Buying that stock would be a great way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage. This article is all about CoreWeave, TickerSymbol: YOU.

And here's what I'm going to cover. what CoreWeave does and how they make their money, CoreWeave's latest earnings call and why the stock just crashed, why I think CoreWeave stock is cheap even though it's up by 50% since it went public six months ago, and of course what all this means for CoreWeave stock in the short term and long term. But let's start with what CoreWeave actually does and how they make their money so we can see if the stock price crashing is justified.

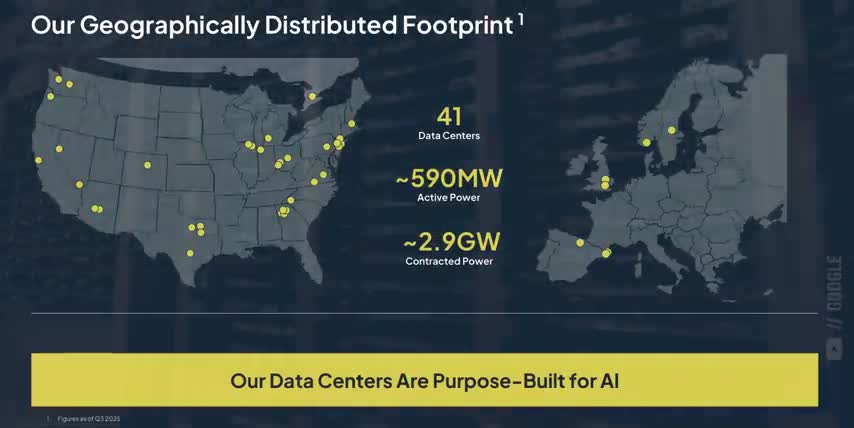

CoreWeave's business model is to be the Amazon Web Services of the ai era by providing instant access to the most advanced high performance computing infrastructure for companies that can't wait years or spend billions of dollars building it themselves coreweave currently operates 41 data centers purpose-built for ai which hold over 300 000 nvidia gpus combined across north america and europe and they have access to over half a gigawatt of active power and 2.9 gigawatts of contracted power capacity nvidia's blackwell and blackwell Ultra Racks take 120kW of power each.

So CoreWeave has enough contracted capacity to power over 24,000 racks, or over 1.7 million NVIDIA GPUs. Let's talk about who's actually buying up all this compute capacity. CoreWeave has three kinds of customers. AI labs that develop foundational models, enterprises that are adding AI into their applications and workflows, and hyperscalers that need overflow capacity when peak compute demand goes way above their own supply. AI labs need massive amounts of parallel compute for model training.

Enterprises want access to high bandwidth, low latency AI infrastructure to power inference workloads across many internal and external users at once. And hyperscalers care about availability and reliability to keep their customers happy.

CoreWeave's AI infrastructure also spans multiple NVIDIA GPU generations, like Hopper and Blackwell, and they get privileged access to Nvidia's latest chips 6-12 months before the broader market, which is a pretty big competitive advantage over other infrastructure providers. And that's why OpenAI recently expanded their agreement with CoreWeave by up to $6.5 billion this past quarter, bringing their total partnership to over $22 billion in value.

These deals provide OpenAI with dedicated compute capacity for training and deploying their latest AI models, including reasoning models like GPT-5. Reasoning models use a lot more compute during inference as they break complex problems down into steps, write snippets of code to solve harder problems, or even call more specialized models to solve problems using a mixture of experts approach.

CoreWeave also has around $10 billion of total deal value with Microsoft to support Azure's training, inference, and other AI services like Bing AI and GitHub Copilot as they continue to scale. Microsoft accounted for 62% of Corleaf's total revenue in 2024, and around 35% in 2025. As an investor, one of the risks I look for is customer concentration. If too much of a company's revenue comes from just a few clients, then losing even one of them could be catastrophic.

But one way to lower that risk is to land more massive customers Just over a month ago MetaPlatforms made a billion deal with Coreweave to provide dedicated compute clusters for training and running LLAMA as well as scaling Meta's overall AI infrastructure from now through 2031.

And a month before that, Coreweave and NVIDIA formalized their $6.3 billion partnership where NVIDIA will purchase any unsold cloud computing capacity from Coreweave through April of 2032, so that they can use it for their own AI labs, experiments, developers, and customers who need quick access to large GPU clusters with NVIDIA's CUDA and software ecosystems. But now, let me tell you something that will put you ahead of almost every Wall Street analyst covering this stock.

Coreweave's real value isn't just in their capacity, since hyperscalers have that too. It's in their reliability. Just like we have regular power plants to handle the grid's baseline electricity demand, and peaker plants for high demand, like on hot summer days when everyone's air conditioning turns on all at once, the same is true for data centers.

CoreWeave provides that extra capacity, so AI workloads running on Amazon Web Services, Microsoft Azure, or Google Cloud don't experience rolling compute blackouts. In my opinion, there are a few big differences between peak power demand and peak compute demand that makes CoreWeave's business model way more valuable. First, Peaks in compute demand are much less predictable.

Utility companies can forecast demand based on things like weather patterns and historical behavior, like tourism, sports games, and so on. But GPU demand is affected by unpredictable events, like new AI product launches or AI breakthroughs like DeepSeek earlier this year. Power peaks also rise and fall in relatively smooth curves, while different AI workloads can have huge fluctuations in power demand, ranging from 30% peak power for inference workloads to 90% or more for AI training.

And training workloads themselves are particularly spiky, in terms of how much compute and power they need at any given time. That's why even the biggest hyperscalers still rely on companies like CoreWeave to protect their AI workloads from getting disrupted. And now that we understand what CoreWeave does, and why it's so valuable, let's look at their latest earnings data next.

And speaking of data, I found out that over 100 online data brokers were selling my personal data, and they might be selling yours too. That's why I joined DeleteMe, the sponsor of this video. DeleteMe is a hands-free subscription service that will remove your personal information from hundreds of online data brokers. You just sign up, enter your information, and let their experts get to work. They've reviewed over 53,000 listings for me so far, Saving me countless hours and headaches.

After 7 days you get a privacy report showing everything they've done. I've been with DeleteMe for years now so I just got my 13th report. And these data brokers had way more than just my personal information. They had my wife's and my entire family's too. But here's the best part. They'll keep scanning these websites even after they remove my data. And I get my own privacy advisor if I want to talk to a real person and make a custom removal request.

So, if you care about your data and your family's privacy, you can get 20% off any consumer plan with my code SYMBOL20 by going to joindeliteme.com slash SYMBOL20 or with my link in the description. And a big thank you to DeleteMe for supporting the channel and keeping my family's data safe. Alright, let's look at CoreWeave's latest earnings data next. CoreWeave reported record revenues of $1.36 billion for the quarter, which is up 134% year over year.

But the special thing about CoreWeave isn't just their revenue growth, it's their revenue backlog which just reached billion which is almost four times bigger than it was this time last year That growth is largely driven by their massive multi contracts with OpenAI Microsoft Meta Platforms, and Nvidia that I just covered. 40% of CoreWeave's backlog is for 2-year contracts, another 40% are between 2 and 4 years, and the final 20% are 4 years or longer.

Let me point out two important things about this massive backlog. First, I think this creates a win-win-win situation where CoreWeave's customers get guaranteed and reliable compute capacity. CoreWeave gets predictable recurring revenue and CoreWeave's shareholders get clear visibility into their future growth for years in advance. And second, this is why I think CoreWeave is so undervalued today.

CoreWeave has $55 billion worth of committed revenue, but their current market cap is only $43 billion.

name one other publicly traded company growing revenues by triple digits year over year with a backlog of guaranteed business worth 25 more than the entire company itself this is what i mean when i say get in early but part of being an early investor in any company is understanding the risks so let's talk about that next core we've spent 1.9 billion dollars in capital expenditures this past quarter, which is almost 50% more than they made.

That led to a $110 million net loss for the quarter, which is one reason the stock is down after earnings. Their operating margins also collapsed from 20% last year to 4% this year, after issuing $144 million in stock-based compensation. Corweave's total stock-based compensation went up by 19x year over year. But in my opinion, the two biggest reasons for the stock crashing are both out of CoreWeave's control. First, CoreWeave decreased their overall 2025 revenue guidance by 3%.

Since the year is almost over, that actually implies around 9% lower expectations for quarter 4. But that revision was caused by construction delays at a single data center out of the 41 data centers CoreWeave controls, and they expect the issue to be fully resolved by quarter 1. In my opinion, this sounds like a one-off delay and not something systemic that investors should be worried about over the long term. The second reason is a little more nuanced.

Michael Burry is famous for predicting the global financial crisis and shorting the US housing market before it collapsed in 2008. And just last week, he bet over a billion dollars that AI will be the next bubble to pop.

One of Burry's biggest arguments for the AI bubble is that major cloud and AI infrastructure companies are under-reporting the depreciation of their assets by saying that AI chips will have longer useful lifespans, so that they can spread their depreciation costs out over longer periods of time to boost their earnings.

By his estimates, this accounting tactic would understate depreciation costs by about $176 billion across the industry, and companies like Meta Platforms and Oracle could be overstating their profits by 21 to 27% respectively.

Look, I'm not going to sit here and pretend that I'm smarter than michael burry but if you've been watching this channel for a while you might remember when i covered something called tensor rt llm don't worry i'll break it down for you back in 2023 nvidia came out with an open source software package called tensor rt llm which literally doubled the inference performance for large language models running on nvidia's gpus that meant the hundreds of thousands of hopper h100 gpus bought by these same exact companies amazon Microsoft, Google, and Meta platforms got twice as good at running large language models overnight thanks to this software update.

But Nvidia's hardware and software ecosystems are designed to be backward compatible so the same software package also works on the Ampere A100s which predate the H100s and it also works on their current generation of Blackwell GPUs In my opinion this is a clear example of older chips having their useful lifespan extended by a software update, which means they can reasonably be depreciated over longer periods of time.

For example, if we're following Moore's Law, which says that computer chips get roughly two times better every two years and tensor rtllm just made the h100s twice as good at inference then that should extend their useful lifespan by two years for depreciation purposes and of course nvidia has many more software packages that focus on improving the ai performance of their chips which should keep extending their useful lifespan i'm not a corporate accountant and i'm not a tax lawyer but i do think that if software updates can make a chip stay in a data center rack for five years instead of three that would go directly against Michael Burry's points about accounting fraud, underreporting expenses, and boosting earnings by extending useful lifespans.

And of course, that has huge implications for CoreWeave, which is a young, newly public AI hardware company whose biggest expenses are the same exact chips and the infrastructure that supports them. So I think it's these three things. Large amounts of capex and stock-based compensation causing a net loss for this quarter. Construction delays causing lower guidance for next quarter and Michael Burry's big short on AI that are creating a lot of downward pressure on Corweave stock.

But I think all three are short-term issues that are shaking short-term investors out of the stock, which means there's a huge opportunity here for long-term investors. And now that you understand what Corweave does, how they make their money, and the risks that come with investing in this kind of AI infrastructure business, let's talk about whether it's a good stock to buy now that it's crashed by 40%.

And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this. Thanks and with that out of the way, let's talk about CoreWeave stock. In my opinion, CoreWeave is Nvidia's largest public position because they can see the long-term value of guaranteed access to reliable AI infrastructure in a world where demand far exceeds supply.

And and that value is worth the upfront costs, the capital expenditures, the occasional construction delay, and all the other short-term risks. And even though Corleave is spending more money than they make today, I think the long-term risks are pretty low for three key reasons. One, their future revenues are very predictable thanks to their $55 billion backlog of multi-year contracts. Two, that backlog is growing much faster than their spending.

And three, the money they are spending is going directly towards growing their business, whether that means acquiring or building more data centers, securing more power, or paying more employees. In my opinion, Coreweave is the definition of a company selling picks and shovels in the middle of a gold rush, and the market is making a big mistake on this stock.

Coreweave's stock crashed by almost 40% since the start of November, and is currently trading at $85 per share, while discounted cash flow models like Simply Wall Street's calculate its fair value to be around $420. That means it's 80% undervalued at its current price. Said another way, Coreweave stock would have to go up by 400% just to hit its fair value today, making it a great stock to get rich without getting lucky.

And if you want to see what else I'm buying to get rich without getting lucky, check out this video next. Either way, thanks for watching and until next time, This is ticker symbol you. My name is Alex reminding you that the best investment you can make is in you.

Key Takeaways

- CoreWeave is a company that provides high-performance computing infrastructure for AI applications.

- They have a strong business model with a large backlog of multi-year contracts with major customers like OpenAI, Microsoft, and Meta Platforms.

- CoreWeave's stock has crashed by 40% due to short-term issues, but the company has a strong long-term outlook.

- The market is undervaluing CoreWeave's stock, with a current price of $85 per share and a fair value of $420 per share.

- CoreWeave is a good investment opportunity for long-term investors due to its strong growth potential and undervalued stock price.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.