Introduction to Google's AI Era

I was wrong about Google. Google isn't just one of the most important companies of the AI era, it's also one of the most undervalued. Discounted cash flow models like Simply Wall Street's peg the fair value of Google stock at $270 per share, which means it should be priced 40% higher than it is today.

Table of Contents

1. Google's Business Model

2. Google's AI Strategy

2.1. Google Cloud and AI

2.2. Google Gemini and AI

3. Investing in Google

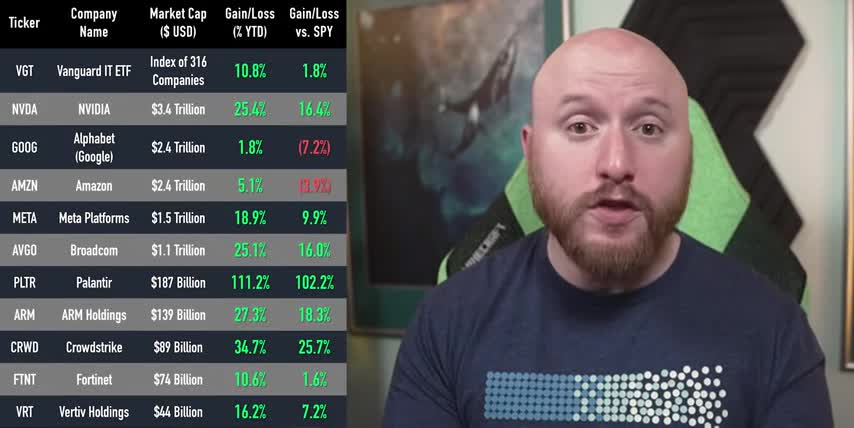

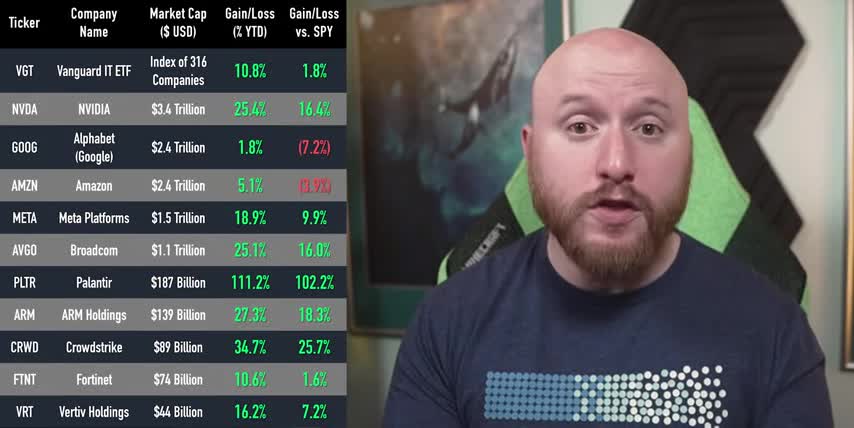

And in this post, I'll break down their aggressive plans to dominate multiple AI industries, how it's going so far, and why Google may not be as easy to disrupt as Wall Street thinks. Your time is valuable, so let's get right into it. First things first, I owe you an apology. Actually, I owe you two. At the start of each year, I put out a list of my top stocks to get rich without getting lucky, and I adjust the order of the list as news and earnings come out, but even though I've covered most of these stocks multiple times, I haven't been keeping up with the list itself because of all my travel to different AI conferences, as well as getting married. Yeah, it's been a big year, but accountability is important, and I'm sorry for not following up. So here's the list in the exact same order as it was in January, as well as each stock's performance year to date and its performance versus the S&P 500 since the whole idea is to get rich without getting lucky, as you can see, we're absolutely crushing the index, even though we haven't touched this list since the beginning of the year.

The best way to find winners and avoid losers is to understand the science behind the stocks, which is where my second apology comes in. About a month ago, I made a post about my new Magnificent Seven for the AI era and kicked out three companies to make room for TSMC, Broadcom, and Palantir. This way, I would end up with exactly seven stocks on the list. The three companies I kicked out were Apple, Tesla, and Google, which caused a lot of confusion in the comments, and I am sorry for that too.

I should have just kept the list at eight companies instead of trying to be so clever.

So let me make up for everything by explaining how Google actually makes their money, why Google is so undervalued, even though it's one of the world's biggest companies, how Google could win the AI race when most analysts think it's AI's biggest loser, and of course, where it belongs on my list of stocks to get rich without getting lucky. There's a lot to talk about, so let's dive right into how Google actually makes their money. Google operates in three huge markets, all of which are benefiting big time from AI. First, there's digital advertising. Digital ad spend is expected to more than double over the next eight years, which would be a compound annual growth rate of 10% through 2033.

That's a relatively low growth rate, which is why some analysts are expecting low growth from Google. But spend on AI in advertising is expected to more than 7x over that same timeframe, which implies a compound annual growth rate of almost 30% over the next 8 years.

AI in advertising focuses on optimizing the costs behind buying and selling online ad space, as well as personalizing ads to individuals, targeting and retargeting them across different platforms, recommending products and service across multiple stores, and even predicting future customer behaviors.

The biggest bear thesis against Google is that generative AI tools like ChatGPT and Perplexity are going to destroy the online ad industry by skipping websites altogether, which means users won't see or click on all the ads displayed on all these web pages that they browse on on their way to their final answer, and I actually think that part is true. Google's network revenue refers to the money that they earn from displaying ads on websites and in apps in the Google Adsense program, and it's down one percent year over year, but Google search itself brought in 54.2 billion dollars last quarter, which is actually up 12% year over year.

Said another way, just Google search revenue is still roughly 25 more than all of Nvidia quarterly revenue. And the reason that it's growing instead of shrinking like most analysts expect is because of AI overviews. Google pulled off three back-to-back miracles when it comes to AI overviews.

First, Gemini's engineers were able to lower the cost of inference by about 90% over the last 18 months, while AI overviews still cost Google around 4 to 10 times more than a traditional search, that cost will continue to drop with new generations of Google's custom TPU chips and by serving more searches with smaller and more efficient Gemini models. Second, they were able to keep the monetization rate the same, meaning AI overviews generate the same amount of revenue per thousand searches by displaying sponsored results and integrated ads, even though the user experience is fundamentally different from traditional search, and the third miracle is that Google actually increased user satisfaction and engagement since complex queries are getting answered faster and with more detail than traditional search results could offer. Over 2 billion monthly active users in over 200 countries use AI overviews today, that's more than the populations of China and the United States put together, and that's just search. YouTube advertising revenue reached 9.8 billion dollars, growing 13 year over year, thanks to AI-powered content recommendation and ad placement algorithms that increase overall watch time and conversion rates.

Google's Business Model

That's huge, considering that YouTube has almost twice as much watch time as Netflix on TV's, which is Netflix's most dominant platform by far. On that note, Google's revenue from subscriptions, platforms, and devices grew by 20 year over year, thanks to YouTube TV, YouTube Music, and Google One cloud storage, as more and more people use Google as their one-stop shop for videos, music, their workspace, and all their data.

Google's AI Strategy

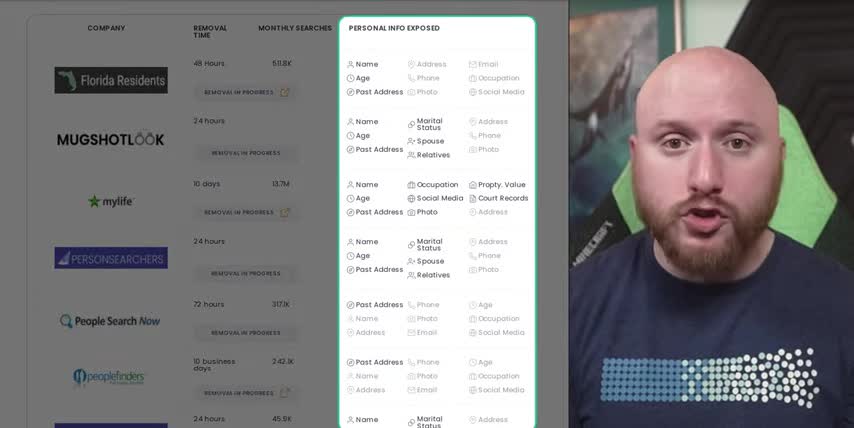

And speaking of data, I found out that over a hundred online data brokers were selling my personal data, and they might be selling yours too. That's why I joined DeleteMe, the sponsor of this video. DeleteMe is a hands-free subscription service that will remove your personal information from hundreds of online data brokers.

Google Cloud and AI

You just sign up, enter your information, and let their experts get to work. They've reviewed almost 50,000 listings for me so far, saving me countless hours in the process. After 7 days, you get a privacy report showing everything they've done. I've been with DeleteMe for years now, so I just got my 11th report, and these data brokers had way more than just my personal information. They had my wife's and my mom's too.

But here's the best part, they'll keep scanning these websites even after they remove my data. And I get my own privacy advisor if I want to talk to a real person and make a custom removal request. So if you care about your data and your family's privacy, you can get 20% off any consumer plan with my code SYMBOL20 by going to joindeleteme.com slash SYMBOL20 or with my link in the description. And a big thank you to DeleteMe for supporting the channel and keeping my family's data safe.

Google Gemini and AI

Alright, so not only is Google's advertising business not getting disrupted by generative AI, it's actually growing because of it. But Google doesn't just have a handle on search and services. They control every layer of the stack, from their custom chips inside their own data centers, to powerful foundation models and all the software and service platforms that they can integrate them into.

At the hardware level, Google's Tensor Processing Units, or TPUs, are specialized custom chips designed to complement traditional GPUs, not compete with them.

Google Cloud was one of the first hyperscalers to integrate NVIDIA‘s Blackwell Ultra Racks and their RTX Pro 6000 server GPUs into their overall hardware portfolio, letting them optimize their server costs and performance for all of the workloads we just talked about, like AI overviews, content recommendations, and ad personalization. Google Cloud revenue came in at 13 billion dollars, which is up by 32 year over year, that means that Google Cloud is now a 50 billion dollar per year business all on its own, but more importantly, operating income for Google Cloud more than doubled, coming in at 2.8 billion dollars, versus just 1.2 billion a year ago, that means Google Cloud's operating margins just jumped from 11.3 percent last year to 20.7 percent today.

Investing in Google

Now let me tell you something that will put you ahead of almost every Wall Street analyst that covers this stock. When it comes to cloud service providers, it's true that Google Cloud is almost three times smaller than Amazon Web Services and twice as small as Microsoft Azure, but what that doesn't take into account is that Google Cloud has the highest percentage of large AI workloads as a fraction of their overall output, and by a pretty large margin. The global cloud AI market is expected to more than 10x in size over the next eight years, which would be a compound annual growth rate of 34 through 2033, and Google Cloud is in a great position to increase their overall share of this market. In fact, Google Cloud doubled the number of 250 million dollar deals that they signed year over year, and in the first half of 2025, they signed the same number of billion dollar deals as they did in all of 2024, and just last week, OpenAI announced that it'll use Google Cloud to help power ChatGPT and its APIs, along with Microsoft Coreweave and Oracle. I think that OpenAI partnering with Google is one of the biggest validations Google Cloud could ever get, since ChatGPT is a direct competitor to Google Search and Gemini.

This isn't just some symbolic partnership. OpenAI has to optimize a version of their models for every cloud they run on, so that workloads like reinforcement learning, speech-to-text, and text-to-speech, and multimodal prompts can run as fast and cost as little as possible, regardless of the data center powering it. So OpenAI wouldn't go to their direct competitor unless it was the best solution.

And on the flip side, Google just raised their CapEx budget for 2025 to $85 billion, making it the largest single-year infrastructure investment ever in the history of tech companies. About two-thirds of that money will go towards data centers, including chips, TPUs, and GPUs, powering generative AI and cloud workloads, with the other third going to data center facility construction and global network expansion.

And if you're an investor that's wondering if they'll ever see a return on all this AI infrastructure spending, Google's CFO just said that Google Cloud has a $106 billion backlog of demand as of their latest earnings call. So yeah, I expect to see returns on that invested capital much sooner than later. But the crown jewel isn't Google Cloud, or AI overviews in Google search. It's actually the AI model that brings them both together.

Over 85,000 enterprises use Gemini to build applications, which is up by 35x year over year. Not 35%, 35 times. The Google Gemini app itself recently crossed 450 million monthly active users, with daily requests growing 50% quarter over quarter. As we get further into the AI era, every frontier model is finding a way to differentiate itself from its competition.

For example, XAI's GroK is optimized for real-time social discussions and web data, and Anthropik's Claude models are the best choice when it comes to coding and long-form reasoning.

But Gemini's big differentiator is that it was engineered from the ground up to combine text, image, audio, and video, instead of being retrofitted with those modes like all the other models. Gemini also has a 1 million token context window, a context window is the amount of information an AI model can keep in mind at once while it answers questions or follows a conversation, Gemini's context window is big enough to fit the entire text of the Lord of the Rings trilogy and the Hobbit and have space left over, not that I know that from experience or anything. One of the big mistakes that I made as an investor over the last year or two is putting too much weight on which AI models were winning in benchmarks like math and coding, and not enough on real-world applications.

Gemini being multimodal from the start and having such a huge context window means that Google is in the perfect position to do what Apple couldn't do with Siri, provide an all-encompassing, agentic AI assistant that understands your photos, your files, your calendar and email, your contacts and texts, your movie and music and food preferences, everything it needs to do the things you want the way you want.

That's why we're seeing more Android phones with multimodal AI features like circle to search, live translation with text to speech and speech to text, and smart cross-app functions like taking notes across multiple pages or providing text summaries of YouTube videos, real-world applications that people would actually use today.

Key Takeaways:

Google is one of the most undervalued companies in the AI era, with a fair value of $270 per share according to discounted cash flow models. Google's advertising business is not being disrupted by generative AI, but rather growing because of it. Google Cloud is well-positioned to increase its share of the global cloud AI market, which is expected to grow at a compound annual growth rate of 34% through 2033. Google's AI model, Gemini, is a key differentiator and has a huge context window, making it perfect for real-world applications. Google‘s price-to-earnings ratio is around 20, while its peers have PE ratios closer to 30 or 40, making it a good investment opportunity.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.