Introduction

I've been calling iREN one of the best new AI infrastructure companies because they have the power, the chips, and the capital to grow faster than almost anyone else. But iREN stock has been crashing hard, going down by almost 30% this month alone. And with such a sharp decline, there's really only one question left to ask. Is this the end for iREN stock, or are its best days still to come? Your time is valuable, so let's get right into it. First things first, this article is a little different.

I share more of my personal opinions, and they may not be for everyone. And of course, I'm not here to hold you hostage. So here's what I'll be covering up front. What IREN actually does and how they make their money, what really happened with their latest earnings, and why the stock crashed, another stock that I'm buying to help offset some of IREN's risks, and of course, whether I think IREN stock is still worth buying as a result.

Table of Contents

1. Introduction

2. What is IREN

3. Latest Earnings

4. AI Business

5. Microsoft Contract

6. Future Outlook

7. Key Takeaways

What IREN Does

Alright, let's dive right into what IREN actually does, and how they make their money. IREN started out as a Bitcoin mining company, which actually gives it a huge head start in AI. Bitcoin miners already run large-scale data centers, so they need huge amounts of power, dense racks of hardware, advanced cooling, and fast networking to keep their machines running 24-7. Neoclouds, these new infrastructure providers focused on AI, need almost the same thing.

They need megawatts of power for each site, racks packed with high-end chips, industrial-grade cooling, and low-latency networks connecting it all together. The big difference is what's inside these racks. In the old model, it was mostly custom chips for mining Bitcoin. But in the new model, it's Nvidia's GPUs for AI workloads. But the grid, the connections, the substations, the buildings, and the people running it all can carry over.

That's why you're seeing miners like Iren pivot into AI hosting. And it's not just Iren. CoreWeave has a similar story. They started out as an Ethereum mining company, spent years buying and running thousands of GPUs, and then repurposed that same infrastructure into a specialized AI cloud. Either way, the story stays the same.

Once you already have big power contracts, racks full of high-end chips, advanced networking, and the people that keep it all running, going from crypto mining to AI infrastructure as a service is a shorter jump than it first seems. But IREN's Bitcoin mining business still exists today, and it's responsible for most of their revenues while they continue their pivot to AI. On the plus side, that means they can always use their power and infrastructure to generate revenue by mining Bitcoin.

But the flip side is their revenue swings with Bitcoin's price, which can make their quarterly earnings seem very volatile, as I'll show you in a few minutes. But over the last two years, IREN has been quietly pointing more of their power and data centers at something very different. Instead of only running chips for mining Bitcoin, they're building high-density liquid-cooled data centers to host massive clusters of NVIDIA GPUs for AI training and inference.

And that brings us to the deal that basically rewrote their entire business model, a $9.7 billion multi-year AI cloud contract with Microsoft. Under this agreement, IREN will build and operate data centers filled with Nvidia GPUs, and Microsoft will use that capacity to power Azure's AI services. IRON plans to deploy about 140,000 GPUs and lock in over 4.5GW of power over the next few years.

That kind of power can support on the order of a million or more high-end GPUs over time, depending on the chip generation like Hopper, Blackwell, or Rubin, as well as the overhead for things like networking and cooling. Either way, Microsoft has already committed roughly $1.9 billion in prepayments, with another $3.6 billion of GPU financing now lined up to support this massive build-out. So today, iREN has two main revenue drivers.

The first is still Bitcoin mining, which is a flexible way to monetize their power, but it comes with all the volatility baked into Bitcoin's price. The second is renting out their power and compute capacity for AI and that revenue ramps as they bring more megawatts and GPUs online under long contracts But there a third piece that ties it all together their power and data center pipeline itself.

IREN is clearly an industry leader at securing grid-connected power across North America, which they can point at Bitcoin miners, GPUs for Microsoft, or future AI customers, depending on which option has the best economics. Speaking of economics, a new study shows that US workers who use AI every day earn 40% more than those who don't. That means AI is not optional. It's an advantage that you either have or others have over you.

Outskill is the world's first AI-focused education platform, and they're hosting a live two-day training to take you from beginner to advanced AI professional this coming Saturday and Sunday. And they're giving the first 1000 people who sign up with my link a free seat. Whether you work in tech or sales, marketing or HR, you'll learn how to use AI agents, create automated workflows, and connect them using the software and spreadsheets you already use every day.

This is a great way to level up your AI knowledge, get a serious competitive advantage, and understand the science behind the stocks. Over 10 million people all over the world have already participated, and the slots for this one are filling up faster than ever.

Latest Earnings

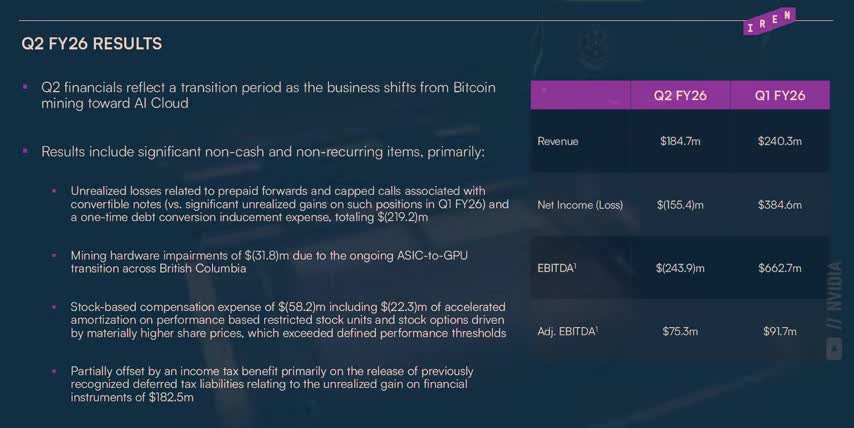

make sure to register for your free seat with my link below today alright as an investor iron's optionality is a big deal because it lowers the risks for all of their capex instead of pouring billions of dollars into single-purpose infrastructure that might not earn its keep which the market is actively punishing companies like meta and microsoft for right now iron has guaranteed revenue baked in even if it comes with bitcoin's volatility now that we understand what iren actually does let's talk about their latest earnings why the stock crashed and what this all means for the future of the company on paper iren's earnings look pretty ugly they reported 185 million dollars in revenue which missed wall street's estimates by about 20 percent and was down around 23 percent quarter over quarter but there are two important points that investors should know about these numbers first bitcoin's price fell by about 28 percent over the last quarter and second iron was running fewer mining machines because they shifted more of their power towards ai that means their mining revenue got hit twice lower bitcoin mining volume and a much worse price as a result iron's earnings came in at a loss of 52 cents per share or a net loss of 155 million dollars in my opinion that's why the stock crashed so hard the headlines only focused on shrinking revenues and huge losses without explaining why.

AI Business

But this article is all about digging into what's actually going on under the surface-level headlines. And if you dig into Iren's income statement, most of their losses come from big, one-time financing cleanup costs, so let's walk through those next. First, the debt conversion. Iren had some convertible debt, basically IOUs that could turn into shares in the future.

This past quarter, Iren gave some of their lenders an incentive to convert their debt to shares now instead of later that incentive shows up as 111.8 million dollar expense on the income statement but this is a one-time hit for cleaning up their balance sheet not money they lost by running data centers second the hedge contracts around that same convertible debt to manage dilution and risk iron set up pre-funded buyback contracts and custom call option packages that move up and down with the stock's price last quarter when the stock ripped higher those contracts showed a big non-cash gain this quarter when the stock fell they flipped into a 107 million non-cash loss but the business didn't actually lose any cash it's just the accounting updating the market value of those contracts and third are impairments iron owns a lot of bitcoin mining machines and data center equipment but as they shift more power and space to ai data centers some of that mining hardware is either being shut down early repurposed or is just worth less over time accounting rules make companies mark those assets down to their new lower value and that markdown is called an impairment.

IRON recorded a $31.8 million impairment on older Bitcoin mining equipment, as that power and space got reallocated to AI instead. Those three losses, the debt conversion incentive, the hedge contracts, and the equipment impairments, add up to over $250 million.

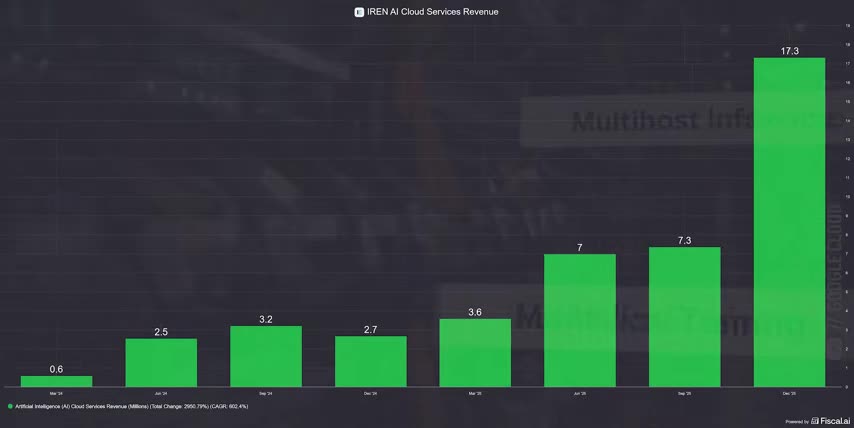

dollars so when you strip those out along with the interest taxes and appreciation they recorded iron's adjusted ebitda for the quarter was actually around 75.3 million dollars with a 41 adjusted ebitda margin that's only slightly lower than last quarter and actually with higher margins even though bitcoin fell by 28 percent and they ran fewer mining machines that doesn't make this earnings miss go away but it does tell any investor paying attention that irent's core operations aren't actually burning 155 million dollars every quarter we're just seeing a combination of bitcoin's volatility and upfront accounting noise from restructuring their debt and pivoting their hardware and power to ai let's talk about their ai business next since that's what this long-term investment is really all about even with this messy quarter irent's ai cloud business moved in the right direction their ai cloud revenue came in at 17.3 million dollars up from 2.7 million dollars this time last year that means their ai cloud revenue grew by 540 year over year and it more than doubled quarter over quarter keep in mind this growth is from a very small baseline and it's a very small portion of their overall income but it shows that the gpu capacity they're already deploying is starting to turn into real recurring revenues but the obvious elephant in the room is this Microsoft contract.

Microsoft Contract

This past quarter, IREN confirmed that they locked in .6 billion of GPU financing tied directly to that contract, and Microsoft already fronted roughly .9 billion in prepayments. Put together, that covers about 95% of the GPU-related CapEx that IREN needs for the planned 140,000 GPU expansion. That's what gives IREN's management the confidence to keep talking about hitting a .4 billion annual run rate by the end of 2026.

So the same quarter that made IREN look super risky, thanks to a big net loss, is also the quarter where they quietly de-risked most of the funding for their main AI growth engine. I think it's worth remembering why this relationship exists at all. Microsoft is in a full-on arms race with other hyperscalers to add AI compute as fast as possible. That means either They're building or leasing huge amounts of GPU capacity in regions where there's enough power, cooling, and networking.

Microsoft knows demand for AI is growing faster than they can build their own data centers. So they're leaning on specialized AI infrastructure providers, these NeoClouds, to add even more capacity even faster. That's where IREN comes in. By partnering with them, Microsoft can expand Azure's AI footprint without having to secure every megawatt of power and build every data center on its own balance sheet.

iREN brings the land, the grid connections, and the liquid-cooled data center designs, as well as the people to operate it all at scale. Microsoft brings the GPUs, the capital, and the workloads from Azure's customers, which makes iREN a strategic piece of Microsoft's AI infrastructure puzzle. But for iREN, this relationship has real upsides and real risks.

The upside is obviously a 9.7 billion dollar contract with one of the biggest AI companies on earth, which gives IREN years of revenue runway and helps them finance a massive buildout they'd never be able to afford on Bitcoin revenues alone. It's also a huge validation of their power strategy and their data center designs. But the downside is IREN is now dependent on a single customer and a single project all going according to plan.

and the Microsoft contract does have performance and delivery requirements baked into it So if I run slips on construction timelines power availability or GPU deployments Microsoft can slow their rollout renegotiate or walk away from future phases altogether So let's talk about what this all means for IREN's future and if the stock is still worth buying as a result. And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps me out and it lets me know to make more deep dives like this.

Thanks and with that out of the way, let's talk about IREN's future first to me there are three big things that stand out first even if their earnings are noisy the underlying trend is still up ai cloud revenue is growing 540 off a small base and total revenue is up roughly 60 year over year adjusted ebitda margins are in the 40s that's not what a dying business looks like it's what a business making a big pivot looks like bitcoin mining is slowly shrinking as AI revenues ramp up and their balance sheet is absorbing all these one-off, non-cash hits that come with it.

Second, the risks are already well understood. IREN has customer concentration risks around Microsoft. They have execution risks around actually delivering 140,000 GPUs and roughly 4.5 gigawatts of power on time and on budget.

There are real financial risks from Bitcoin's volatility, debt conversions and future impairments on their hardware as they keep shifting power away from bitcoin mining and towards ai and now we see exactly how those risks show up on the income statement and what it does to their share price but third i think iron strategic position is stronger than it was a year ago they've secured more power and have a cleaner better funded path to a massive gpu footprint and a relationship with a hyperscaler that most small cap companies could never get microsoft plans to spend over a hundred billion dollars in ai capex this year alone so they need partners to get it done and that's just microsoft so if iron can execute there's room for more azure workloads and more customers over time that's why i think iran is still a great stock for long-term ai-focused portfolios this quarter didn't break the investment thesis but it did remind us just how bumpy things can get along the away.

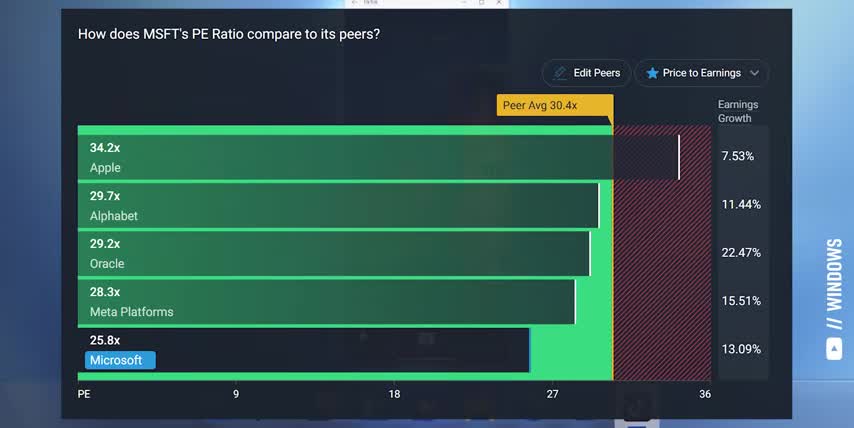

That's why I'm also buying Microsoft stock itself, especially right now. Look, I won't waste your time explaining Windows or Office. We all know that Microsoft is a $3 trillion company generating over $300 billion in revenue with operating margins in the mid-40s. But what you might not realize is that Microsoft's stock is down by over 20% from its recent peak, while their Azure and AI cloud business is growing by 39% year over year.

Microsoft currently has the lowest price to earnings ratio of the magnificent seven trading at a pe of 26 while the average is closer to 30 and that doesn't include nvidia or tesla which trade at much higher valuations and microsoft's fair p e ratio which takes into account their guidance and expected earnings growth is closer to 45 almost twice what they trade at today microsoft is even trading at a slightly lower p e ratio than IBM at the time of this recording.

Future Outlook

So, I'm buying Microsoft stock to own both sides of this .7 billion partnership, and to offset IREN's volatility with Microsoft's much bigger, broader, and more stable stream of AI and software cash flows. If you're the kind of investor who doesn't mind volatility and you're comfortable with the risks I laid out in this article, you can put more weight on IREN since that's where the biggest upside is if everything works out.

and if you're more risk averse microsoft is still one of the biggest healthiest businesses on earth and it's currently cheaper than every single one of its peers after this most recent pullback talk about a great way to get rich without getting lucky let me know what you think about iron and microsoft stock at these prices in the comments and if you want to see even more stocks that i'm buying to get rich without getting lucky check out this episode next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- IREN's AI cloud revenue is growing rapidly, with a 540% increase year over year.

- The company has a $9.7 billion multi-year AI cloud contract with Microsoft, which provides a significant revenue runway.

- IREN's strategic position is stronger than it was a year ago, with a cleaner and better-funded path to a massive GPU footprint.

- The company has customer concentration risks around Microsoft and execution risks around delivering 140,000 GPUs and 4.5 gigawatts of power on time and on budget.

- Microsoft's stock is down by over 20% from its recent peak, while their Azure and AI cloud business is growing by 39% year over year.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.