Table of Contents

1. Are We in an AI Bubble?

2. How Bad Can Things Get?

3. What Can We Do?

OpenAI CEO Sam Altman just warned everyone that we're in an AI bubble. A recent MIT report showed that 95% of all AI projects at companies are failing, and top AI companies like Palantir are down by 20% this week alone. So in this video, I want to answer three simple questions. Are we in an AI bubble? How bad can things really get? And what can we do to come out on top? Your time is valuable, so let's get right into it. Sam Altman recently told reporters that investors are too excited about AI.

Comparing today's market to the dot-com bubble of 2000 where the Nasdaq collapsed by around 80% after overhyped internet companies failed to generate revenues, let alone profits. And Sam Altman isn't alone.

Last week, University of Michigan business professor Eric Gordon said that investors will suffer far more from this AI boom than the dot-com crash, warning that AI startups like CoreWeave will become the poster child for the AI bubble and make even more investors suffer even more pain than companies like Pets.com did during the dot-com crash.

And earlier this year, billionaire investor Ray Dalio warned everyone that investors are confusing AI being a great technology with it being a great investment. And it's not just investors. MIT's NANDA Initiative, which is a group focused on agentic AI research at MIT, published a new report saying that 95% of companies launching AI pilot programs are seeing little to no results. But some of the biggest warnings are targeting specific companies.

For example, Citron Research recently published a short report saying that if Palantir had the same price to sales ratio as OpenAI, then it would be trading at around $40 per share, which is more than 70% lower than its current share price. And since my entire channel focuses on the stocks at the center of the AI revolution, I thought that I'd add some context to all of these warnings.

I respect your time so here's the bottom line up front: I agree that parts of the stock market are in a bubble, but I don't think it's as widespread or as dangerous as the mainstream media is making it out to be. So if you just wanted the short answer, there you have it. But I don't invest my money based on feelings; I invest based on data. So the rest of this video uses data to find out which stocks are actually in a bubble, how big that bubble could be, and for how long. Let's start with which stocks are actually in a bubble.

In my opinion, comparing today to the dot-com bubble is a big mistake. Most dot-com companies like Pets.com had little to no revenue, zero profits, and burned money like crazy on overly optimistic business plans. It was also cheap and easy to launch a dot-com company. All you really needed was a website and a dream. On top of that, the biggest problem back in 2000 was a lack of infrastructure.

Consumers weren't really shopping online yet, and broadband internet was limited, resulting in way more supply than demand for most dot-com businesses. Compare that to today, where the top AI companies are Nvidia, Google, Microsoft, Amazon, Meta Platforms, and TSMC, all of which have huge revenues and high operating margins. Also, it takes millions if not billions of dollars worth of infrastructure to compete in the AI market.

And consumers can already use AI because it's being baked into almost every app and service on the planet. As a result, there's way more demand for AI software and hardware than there is supply. That's why I think we should compare today's AI market to the rise of the mobile internet instead. Since companies and consumers were already online, as every website, every piece of software, and every service transitioned to mobile applications, just like what's happening today with AI.

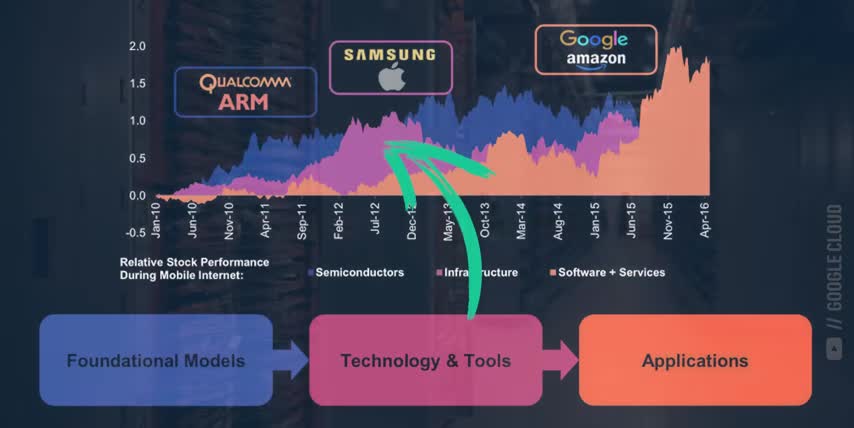

Here's a case study from Morgan Stanley research that looks at how different kinds of stocks performed during the rise of the mobile internet, and it breaks these stocks out into three groups: semiconductors, infrastructure, and software and services. The big idea here is that today's AI companies can be categorized almost the same way as foundational AI companies, AI infrastructure companies, or companies focused on AI services and applications.

Are We in an AI Bubble?

New technologies are always built on top of everything that came before. So while high-margin software and service stocks usually have the best long-term performance, they're also the last group of stocks to rise since they need reliable infrastructure to build on top of. AI infrastructure includes data centers as well as edge devices like smartphones, laptops, and desktops, and eventually AI-specific platforms like self-driving cars, physical robots, and digital agents.

But before that, AI infrastructure can reach mass market adoption, semiconductor companies need to build the chips that power it. That's why I don't think that semiconductor companies are in a bubble at all. In fact, they've been reporting strong revenue growth, high operating margins, and sales that are limited by supply, not demand. The same is true for hyperscalers like Microsoft, Google, and Amazon, all of which reported roughly 30 percent data center revenue growth and increasing margins, even though they've each been investing close to $100 billion into new data centers to meet so much demand.

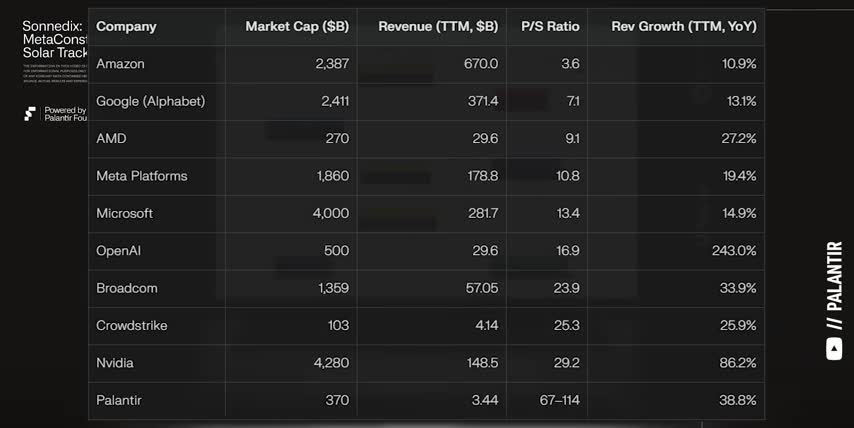

And that's this year alone. I think the real bubble is in this third group of companies, AI software and services, particularly companies like Palantir and CrowdStrike. Here's a table comparing the price and trailing 12-month sales for today's top AI companies, sorted by their price-to-sales ratio. Lower price-to-sales ratios are obviously better, but high revenue growth can justify a higher ratio today, since it implies a lower price to sales ratio in the near future.

How Bad Can Things Get?

For example, Nvidia currently has a price to sales ratio approaching 30, but their annual revenues grew by over 80% year over year. Compare that to CrowdStrike and Palantir, which have 40 to 50 times less revenue and are growing less than half as fast. This is where the real AI bubble is in my opinion. Don't get me wrong here; I'm a big believer in the next generation of AI platforms like Palantir and CrowdStrike.

And I think they'll perform great over the long term, just like the Morgan Stanley case study is suggesting. But there's no doubt that these kinds of companies are currently overvalued. On top of that, many of the companies building next-generation AI applications are not publicly traded. Think about the 90s and early 2000s. Companies like Amazon and Google went public very early in their growth cycle. But today, they're waiting an average of 10 years or longer to go public.

That means investors like us can miss out on most of the returns from the next Amazon, the next Google, the next Nvidia. That's where Fundrise comes in, the sponsor of this video. Their venture capital product lets you invest in some of the best tech companies before they go public. Venture capital is usually only for the ultra-wealthy, but Venture Capital with Fundrise gives everyday investors access to some of the top private pre-companies on earth, with an access point starting at ten dollars.

What Can We Do?

They have an impressive track record already, investing more than 200 million dollars in some of the largest, most in-demand AI and data infrastructure companies. So if you want access to some of the best late-stage companies before the IPO, check out Venture Capital with Fundrise using my link below today. All right, so while the dot-com bubble included any company with a website and a dream, the current AI bubble is concentrated around specific AI software companies like CrowdStrike and Palantir.

But that doesn't mean they're bad investments today. Everyone talks about the stock market dropping by 80 percent after the dot-com crash, but almost no one talks about what happened after. If you bought ten thousand dollars worth of Microsoft stock at the absolute peak of the dot-com bubble in 2000, you'd have over 85,000 today. That's a nine percent compound annual growth rate for 25 years straight, which more than doubled the performance of the S&P 500 over the same time frame.

Even though you bought Microsoft stock at the absolute top of the biggest bubble in stock market history, and you would have done much better if you dollar-cost averaged into the stock instead of buying at the top, like I point out in every single video, valuation matters, but the quality of the underlying business matters more over time. Said another way, I'd rather buy a great company at a bad price than a bad company at a great price.

And the best way to find great companies is understanding the science behind the stocks, which is just my way of saying how the high-tech company behind the ticker symbol actually makes its money. But let's say you think I'm full of it; obviously, no one in the world thinks that. But let's say you disagree with everything I've said so far. Let's look at one more important piece of data to see what could happen if we were actually in a big bubble.

This is a chart of every bull and bear market since 1956. The y-axis is percentage returns, the x-axis is time, and every recession is highlighted. A bear market happens when stocks crash by 20 or more from a peak, and a bull market begins once the market bottoms. Here are some interesting facts that long-term investors need to understand: first, bull markets last much longer than bear markets.

The average bear market lasts about one year from peak to bottom and declines by about 36 on average. The average recovery takes about two years to make a new all-time high from that bottom, and that sounds like a long time, but remember it's only two and a half years if you bought at the exact top right before the market crashed. That's also why it's so important to be patient and dollar-cost average over time, even if you missed the exact bottom. There's a huge two and a half year window on the other side.

And speaking of the other side, the average bull market lasts over six years and returns well over 200 percent over that time frame. Even if you compare the extremes, the worst bear markets were the global financial crisis and the dot-com crash, which lasted about two years each and had drawdowns of 50 to 60 percent for the S&P 500. But the biggest bull market lasted over 12 years and went up almost 600% over that time frame. So there's a massive difference between bull and bear markets.

Let's look at market corrections next, which is where the market drops between 10 and 20. So these are separate from bear markets altogether. On average, the market falls by 14 during a correction, reaches the bottom in 5 months, and takes just 4 months to recover. The S&P 500 has had around 22 corrections since 1956, which works out to about once every 3 years on average.

And just to be thorough, here's the number of 10% pullbacks the S&P 500 saw each year from 1980 through 2023. Some years, the market can go straight up without so much as a hiccup, while others, we can see anywhere from 4, 5, or even 8 separate 10% drops. Overall, the stock market sees about 1.2 pullbacks each year, which is about once every 10 months on average.

But no matter how many pullbacks or corrections or how bad of a bear market we've seen, the stock market has always recovered and gone on to make new all-time highs. And now that we have all that context, we can answer the big questions from the start of this video. Are AI stocks in a bubble? And what can we do about it? And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this.

Thanks, and with that out of the way, let's answer those questions. First, I don't think we're in an overall AI bubble. Semiconductor companies like Nvidia and TSMC have been reporting serious revenue growth and high operating margins, which is fundamentally different from what we saw during the dot-com bubble.

The same is true for AI infrastructure companies like Amazon, Microsoft, and Google, even though they've poured hundreds of billions of dollars into data centers this year alone, and I expect that growth to continue for many quarters to come, which is why I cover chip design and data center companies more than any other kind of stock. That said, I do think that AI software stocks like Palantir and CrowdStrike are currently overvalued, especially for how early we are in the AI revolution.

These companies are trading at very high price-to-sales ratios, and they're growing slower than our first two groups of stocks. That doesn't make these companies bad long-term investments. It just means that we shouldn't be investing in them as much at these prices over AI chip and data center companies. Second, we assumed that I was wrong about everything. So we looked at historic data to see how bad things could get if we are actually in a bubble.

It turns out that bull markets last around 6 times longer than bear markets and return around 6 times more than bear markets lose. We also saw that stock market corrections are way less scary than they sound. They only happen once every 3 years outside of bear markets, they only drop around 14% on average, and they usually recover in under 6 months. And if you put these two answers together, you can make a plan that's right for you.

I'm not making any big changes to my overall portfolio. My current plan is to just dollar-cost average in a little slower, keep a little more cash on the side, and move a little more money into those first two groups of companies. Big safe semiconductor companies like Nvidia, Broadcom, and TSMC. As well as the hyperscalers, which means Google, Microsoft, Amazon. Don't overcomplicate it. And if you want to see what other stocks I'm buying in this market, check out this video next.

Key Takeaways:

The current AI market is not in an overall bubble, but some AI software stocks are overvalued. Semiconductor companies and AI infrastructure companies are reporting strong revenue growth and high operating margins. The best way to find great companies is to understand the science behind the stocks and how they make their money. Bull markets last longer than bear markets, and stock market corrections are less scary than they sound.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.