Palantir just had their most important earnings call ever. Whether you're a longtime Palantir shareholder, or you're wondering if it's too late to buy the stock, you should know that this isn't only about revenues or profit margins. Palantir just showed us their place in the entire AI revolution. So in this post, I'll break down Palantir's latest earnings call, some big insights that change how I value the stock, and my future outlook for Palantir in general.

Table of Contents

1. Introduction

2. Palantir's Earnings

3. Palantir's Place in the AI Revolution

4. Key Takeaways

Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage. So here's everything I'll cover in this video.

Palantir's insane earnings results and how I track their growth, Palantir's unique position in the AI revolution, Michael Burry's big short against AI in general, and Palantir specifically, and of course where Palantir goes on my list of stocks to get rich without getting lucky in 2025, which has been crushing the market since I made this list back in December. I'm not trying to show off here.

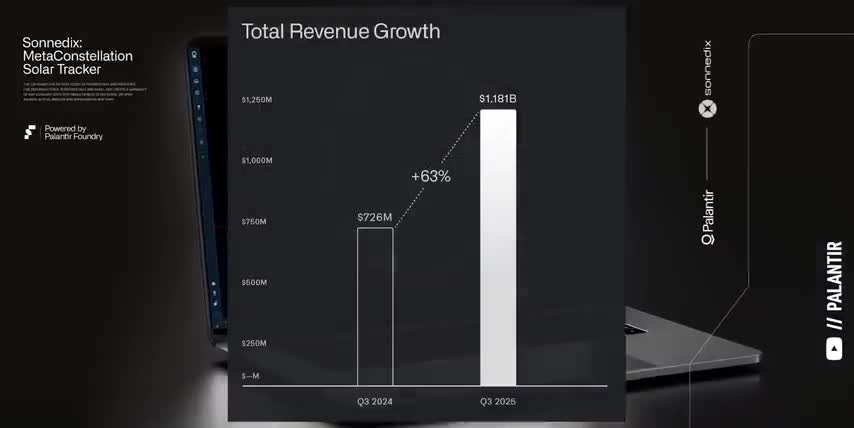

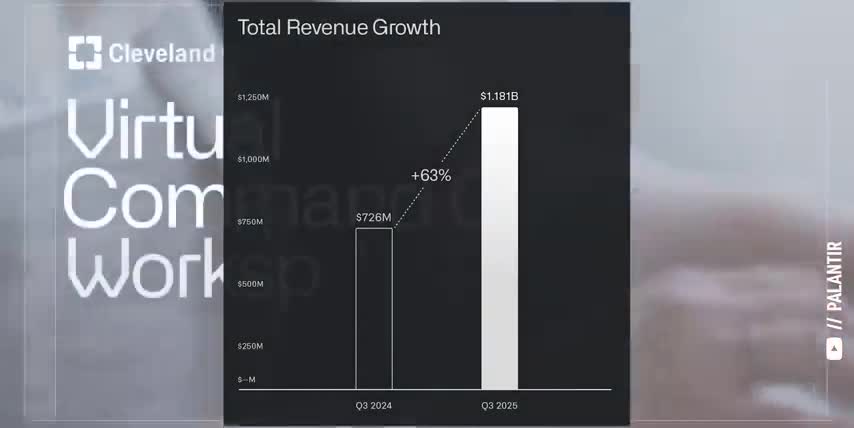

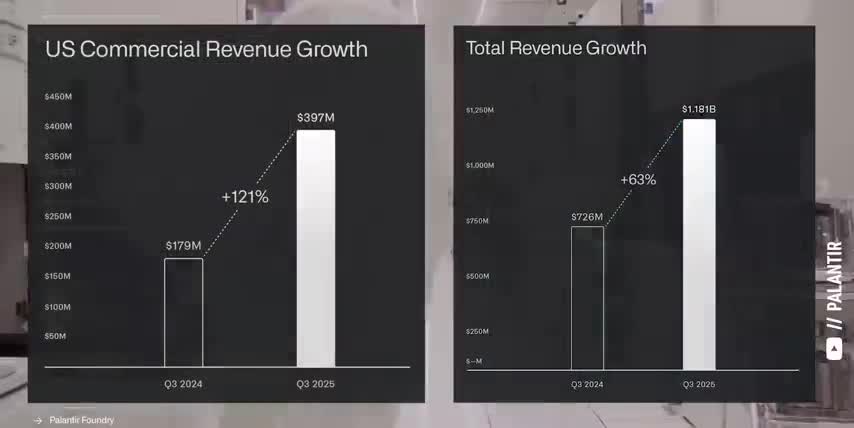

I'm trying to show you that it's worth understanding the science behind these stocks, which is just my way of saying how the businesses behind the ticker symbols actually make their money. So let's do just that by diving into Palantir's latest earnings. Palantir reported record revenues of $1.2 billion for the quarter, which is up 18% quarter over quarter and a whopping 63% year over year.

But their growth gets even crazier when we break things down by business unit palantir has four major business units u.s commercial u.s government non-us commercial and non-us government in my opinion investors want to watch palantir's u.s commercial growth specifically since that's their largest total addressable market palantir's u.s commercial revenue came in at 397 million dollars for the quarter, which is up 29% quarter over quarter and an insane 121% year over year.

As an investor, whenever I see growth that fast, I want to make sure that it's sustainable, meaning it's not coming from one huge customer, one huge deal, or another one-time windfall. So two of the key metrics I use to track the quality of Palantir's growth are customer count and net dollar retention rate. Palantir's U.S. commercial customer count grew to 530, which is up 65% from this time last year.

Said another way, for every three commercial companies that Palantir was working with a year ago, they're working with an extra two today. So this is serious year-over-year growth. 65% more customers gives Palantir much more than just more revenue.

They also get new use cases for their platforms, which turn into more ready-to-go, out-of-the-box analysis tools and workflows, industry-specific data pipelines and visualizations, and new AI features and agents to convert even more customers in the future, which is exactly what we see if we look at Palantir's customer count over time. Not just growth, but acceleration in that growth quarter over quarter and year over year.

On the other hand, Palantir's net dollar retention rate grew to 134% for the quarter, which is an all-time high for the company. Net dollar retention measures the year-over-year change in recurring revenue from existing customers. So, Palantir's net dollar retention rate of 134% means their existing customers spent 34% more with them this year versus last. The reason I care about these two metrics specifically, customer count and net dollar retention rate, is that they multiply together.

Palantir acquiring 65% more customers and increasing their revenue per customer by 34% is how I know their insane U.S. commercial revenue growth of 121% is healthy, stable growth. And it's not just commercial revenue. Palantir's U.S. government revenue grew by 52% and their overall government revenue grew by 55%, which shows just how high the demand is for their AI platforms, even in the slowest-moving and most heavily regulated markets.

That why Palantir overall revenue is up by 63 year over year And when we look at their revenue over time we can clearly see that it been consistently accelerating for the last two years and counting This is a big reason that I been pounding the table on Palantir stock being a great way to get rich without getting lucky. Speaking of great investments, Black Friday is right around the corner.

But for Black Friday, they're giving the first 1,000 people who sign up with my link a free seat. Whether you work in tech or finance, sales or consulting, you'll earn 10 of the most powerful AI tools like Gemini and Grok, best practices for prompting and using AI agents and even how to automate workflows without any coding. You'll also get free access to OutSkill's exclusive community and their learning dashboard to keep growing alongside other AI professionals.

This is a great way to gain a competitive advantage, get a serious head start for 2026, and understand the science behind the stocks. So make sure to register for your free seat before they run out with my link below today. Alright, so far we've talked about Palantir's customer count, their net dollar retention rate, and their commercial and government revenues. But another sign of healthy, stable growth is their margins expanding. As investors, we don't just want to see more top-line revenue.

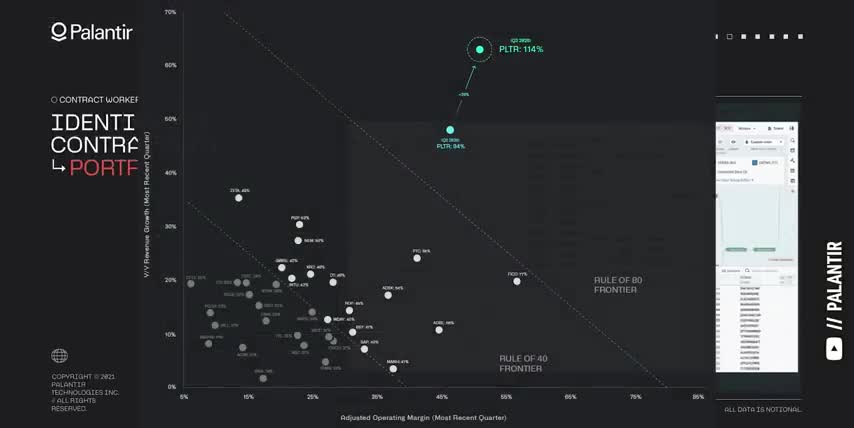

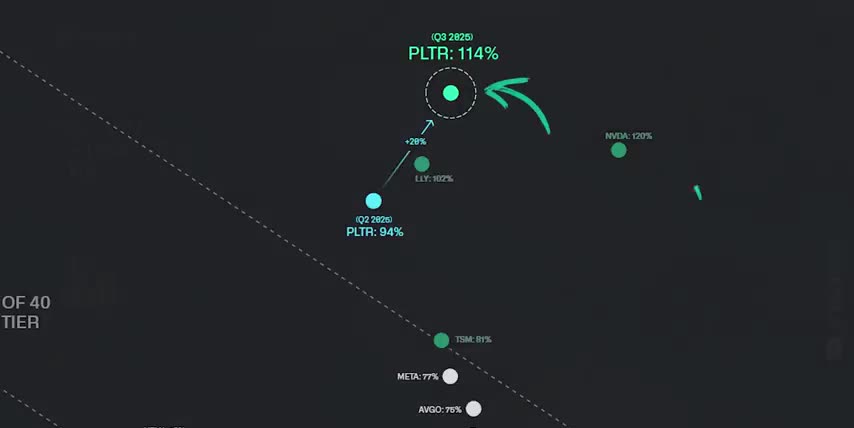

We want to see them make more profits. Palantir reported adjusted operating margins of 51% and gap operating margins of 33%, which more than doubled from the 16% they reported last year. As a result, Palantir's rule of 40 score is at a mind-bending 114%. I mean, look, when you're printing a rule of 114, again, people who aren't technical, I think roughly an incredible score, like an Olympic grade score on rule of 14 is like 50.

I mean, that's roughly like if you're between 50 and seven, you're an Olympic athlete, a unique implement athlete. This is like Michael Phelps-like score, like Michael Jordan. Like there are no scores like this. To understand why Alex Karp cares so much about this score and why Palantir dedicates three full slides of their earnings presentation to it every quarter, we need to understand why the Rule of 40 exists in the first place.

I know that I walk through this every quarter, but the higher Palantir's score gets, the more important it is to understand since it can't stay this high forever. Let me explain why. The Rule of 40 score exists because the price-to-earnings ratio is not a one-size-fits-all metric, and a lot of investors miss a lot of great stocks just because their PE ratios are too high. For example, let's take a look at Nvidia's price and their price-to-earnings ratio over the last three years.

Back in 2023, investors bought tons of Nvidia stock after they started reporting massive data center revenue growth from their H100 Hopper GPUs and Nvidia's PE ratio spiked from 50 to 250 in just a few months. But look what happened next. Their stock price quadrupled over the course of 2024 and 2025, but the P-E ratio collapsed by over 80%, which means their earnings were growing five times faster than their market cap.

And now, Nvidia is the only company on earth to hit a $5 trillion valuation. My point is, the price-to-earnings ratio is a terrible metric for any company where earnings are growing fast, and most investors are using it as a crutch instead of taking the time to understand the science behind the stock. And this is where the Rule of 40 score comes in.

The Rule of 40 says that even if a company has low earnings today, it might still be a good investment if its revenue growth and its operating margins add up to 40 or more. And since the Rule of 40 score takes the top and bottom lines into account, it's a great way to compare different companies in an apples-to-apples way.

And that's exactly what Palantir is doing in the first two slides of their earnings presentation So let walk through that next The first slide compares enterprise software companies with over a billion dollars in trailing 12 revenue The x is adjusted operating margins The y-axis is revenue growth, which means that each dot is a company's rule of 40 score. Solid software companies like Intuit, which makes QuickBooks, TurboTax, and Credit Karma, have a score of 42.

Great software companies like Adobe and Autodesk have scores around 55. The Fair Isaac Corporation, which makes insane margins from running the FICO consumer credit score, has a 77. But none of these enterprise software companies really compare to Palantir's score of 114. Palantir also compared the top 25 companies around the world by market cap, regardless of their industry. Tesla, Amazon, and Samsung all have scores in the 20s.

Netflix, Apple, and Warren Buffett's Berkshire Hathaway are all in the 40s, which again, is already a great score given how big these companies are. Google, Tencent, Oracle, and JPMorgan Chase have scores in the 50s, while Meta, Broadcom, Microsoft, MasterCard, and Visa all have scores in the 70s. Taiwan Semiconductor, which makes most of the world's advanced microchips, has a score of 81, and Eli Lilly, which manufactures medicines like Prozac and Cialis, has a score of 102.

but the best two scores belong to Palantir with a 114 and NVIDIA, which has a 120. There are a few important things to remember about this rule of 40 score. First, these are adjusted operating margins. If we use Palantir's GAAP operating margins of 33% instead, they would still have a rule of 40 score of 96, which is far better than almost every other company on Earth.

Second, as a company's score goes up, each point is harder to achieve than the last, since that company would have to sustain very high revenue growth or very high operating margins while their competition keeps increasing over time. That makes every point up and to the right worth more and more than the last. And third, it's pretty rare to see a Rule of 40 score come from almost equal parts revenue growth and operating margins.

If we take a closer look at this plot, we can see that most companies have much higher margins than revenue growth. So, Palantir's score of 114, coming from 63% revenue growth and 51% operating margins, is pretty rare to see. In my opinion, this also shows their central role in the AI revolution right alongside Nvidia, which is why Michael Burry betting over a billion dollars against these two companies is so strange, at least at first glance.

Here's what Alex Karp had to say about Burry's big bet against AI. Being short is a very difficult place to be because you can lose everything. Right. You can drive these people into the ground. Thank God. Michael Burry put a really big bet on it. It's almost a billion dollars. It's nine hundred and twelve million dollars. What do you do? What do you go back in? Well, first of all, he's it's like he's actually putting a short on AI. So the way I read it was us and Nvidia.

And it's like the biggest position is you, though. Yeah. Great. OK. So and then, by the way, with the shorts, it's very complex. It's not even clear that. Honestly, I think what is going on here is market manipulation. We delivered the best results.

everyone anyone's ever seen it's not even clear he's not doing this to get out of his position you know currently as far as i can tell the two companies he's shorting are the ones making all the money which is super weird like the idea that chips and ontology is what you want to short is bat crazy i agree with alex carp that shorting ai and the chips that power it is pretty crazy but the thing that investors need to remember is that shorting is all about short-term price action not a long-term investment thesis.

So, Michael Burry isn't really betting against Palantir's platforms or Nvidia's AI infrastructure. He's just betting that their stock prices will go down before they go up. And because Michael Burry is a well-known investor, it's a self-fulfilling prophecy. Meaning he goes short, then discloses it, which results in headlines that cause the stocks to drop, which is exactly what makes him and his short position money.

The only place I disagree with Alex Karp is being angry about it because these same headlines also drive prices down for the rest of us including Palantir which still has almost million in approved share buybacks so the lower the stock price goes the more shares they can buy back, and the more shares we can buy as well.

The other part that I agree with is that these were the best earnings results we've ever seen from Palantir, and one of the best earnings calls I've ever seen from an AI company. But the stock is up by a massive 270% since this time last year and it's now almost $190 per share. So there's really only one question left to ask. Is it too late to buy Palantir stock or are there best days still to come? And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps me out and it lets me know to make more content like this. Thanks and with that out of the way, let's talk about Palantir stock. I honestly think that Palantir will be a critical part of the AI infrastructure for some of the biggest enterprises on earth. It's important to remember that AI models like GPT, Gemini, and Claude are the software equivalent of chips.

They're powering the AI revolution, but they need a lot of infrastructure and developer support to be useful for real businesses at large scales. That software infrastructure is exactly where Palantir shines. And I think there's a lot of growth left for Palantir stock over the long term. That said, I don't think it'll be a straight line to a trillion dollar valuation. Palantir has already crashed by 50, 60, even 70% in the past, and it's crashed by 20% multiple times this year alone.

Seriously, this is a stock where investors need to be careful and understand their own risk tolerance. For me personally, here's where Palantir goes on my list of stocks to get rich without getting lucky. I still think that Nvidia is the absolute leader of the AI revolution.

And I don't see that changing now that they're shipping their Blackwell Ultra GPUs with Rubin on the horizon, as well as the massive reach of the CUDA ecosystem in data centers and desktops, and all the other AI hardware and software platforms they've built on top of it. Palantir partnered with NVIDIA for a reason, and it's because they're in every cloud and data center powering Palantir's software platforms. NVIDIA reports earnings later this month and I'll cover them in a video like this one.

So stay tuned for that. Broadcom is a close second because their custom chips, network infrastructure, and software stack are the only real competition for NVIDIA. Broadcom helped design every generation of Google's TPUs, Meta's training and inference chips, and now they're designing custom chips for OpenAI. So I want to own the entire AI accelerator and hardware infrastructure market instead of trying to pick a winner.

But, at a $450 billion valuation and 63% year-over-year revenue growth, there's no doubt that Palantir has become a tech giant too. And they're capturing a massive part of the enterprise AI market. This was my best performing stock in 2024, and now it's up by over 150% in 2025. But that means there's plenty of room for it to drop. So my plan is to keep dollar cost averaging in slowly, which means I'm buying fewer and fewer shares as the price keeps getting higher.

The next time there's a big drop, and there will be a next time, I'll average in more aggressively. So for now, I'm moving Palantir stock up one spot on my list, right above Google.

Google is also a core part of the AI revolution, because they have a massive portfolio of products, services, and software already benefiting from AI, including Google Cloud and their custom TPU chips, the entire Android operating ecosystem, Google Gemini, Chrome, Workspace, and YouTube, the list of amazing businesses goes on and on.

But Palantir is a much more focused bet on AI specifically, so I'm confident they're going to keep outperforming over the long term, regardless of how much Michael Burry is betting against them in the short term. And if you want to see what else I'm investing in to get rich without getting lucky, check out this video next. Either way, thanks for watching, and until next time, this is ticker symbol you. My name is Alex, reminding you that the best investment you can make is in you..

Key Takeaways

- Palantir's earnings call showed significant growth and a strong position in the AI revolution.

- The company's revenue growth and operating margins are impressive, with a Rule of 40 score of 114.

- Palantir's customer count and net dollar retention rate are key metrics to track the quality of their growth.

- Michael Burry's short against Palantir and Nvidia is a self-fulfilling prophecy, but it may not affect the long-term investment thesis.

- Palantir's stock price may be volatile, but the company's growth and position in the AI market make it a promising investment opportunity.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.