An exceptionally brutal day on Wall Street. Decidedly red, especially the Nasdaq. Meta and Microsoft shares have fallen and off their eyes trading. That's where the pain really is. Investors are panic selling some of the best stocks on the market. And the bigger the decline, the bigger the opportunity. Especially if we know which stocks to buy and which ones to avoid. So in this post, I'll cover everything you need to know about this AI stock sell-off and which ones I'm buying as a result.

Table of Contents

1. Introduction

2. AI Stocks

2.1. Broadcom and Oracle

3. AMD

4. Meta Platforms

5. Microsoft

6. Key Takeaways

Your time is valuable, so let's get right into it. AI stocks around the world saw heavy losses late last week after Oracle and Broadcom reported earnings and sparked new fears of an AI bubble. Oracle stock had its worst single-day percentage decline since the dot-com bust after they reported lower-than-expected revenues and much higher AI spending. That caused their free cash flows to collapse to negative $10 billion for the quarter, which is twice as low as analysts expected.

Oracle's AI buildout is turning out to be much more expensive and much slower to make money than investors anticipated, and Wall Street is worried that the same thing is happening at other AI companies. And just one day later, Broadcom stock had one of its largest market cap losses in history, losing around $220 billion in a single day after they reported earnings. The difference is that Broadcom beat analyst expectations on revenue and earnings per share. But the stock dropped anyway.

That's because Broadcom's management warned investors that gross margins could go down as custom AI chips became a bigger part of their overall portfolio, and that Broadcom wouldn't see much revenue from their multi-billion dollar agreement with OpenAI in 2026. Both Oracle and Broadcom stocks are down over 10%, and this is where Wall Street just made a huge mistake. Let me show you why. First, custom chips are nothing new to Broadcom or to their shareholders. users.

Broadcom helped design and manufacture multiple generations of Google's Tensor Processing Units or TPUs, Meta Platform's Training and Inference MTIA chips, and the custom chips that ByteDance uses to help power TikTok's content recommendation algorithm. And just two months ago, Broadcom announced that they're partnering with OpenAI to co-develop and deploy around 10 gigawatts of custom accelerators for ChatGPT, GPT-5, and their other Frontier models.

So of course investors shouldn't expect much from that deal in 2026, which starts in just three weeks, especially since advanced AI accelerators take a lot of time to design, manufacture, test, optimize, and deploy. And by the time Broadcom delivers OpenAI's custom chips, there will be even more demand for them, which means Broadcom is very well positioned to win even more multi-billion dollar contracts from other AI companies.

In fact, on their most earnings call, Broadcom said that they had a $73 billion backlog of AI orders over the next 18 months, including $21 billion from Anthropic. And it's not just their backlog.

Broadcom's current revenue is also accelerating, growing by 28% year-over-year, with AI chip revenues up by 74 over that same time frame Now compare that to Oracle Broadcom revenue has been growing at a compound annual growth rate of 19 over the last 10 years That number is just 5 for Oracle And while Oracle looks like they're consistently beating Broadcom in terms of earnings per share, the opposite is true.

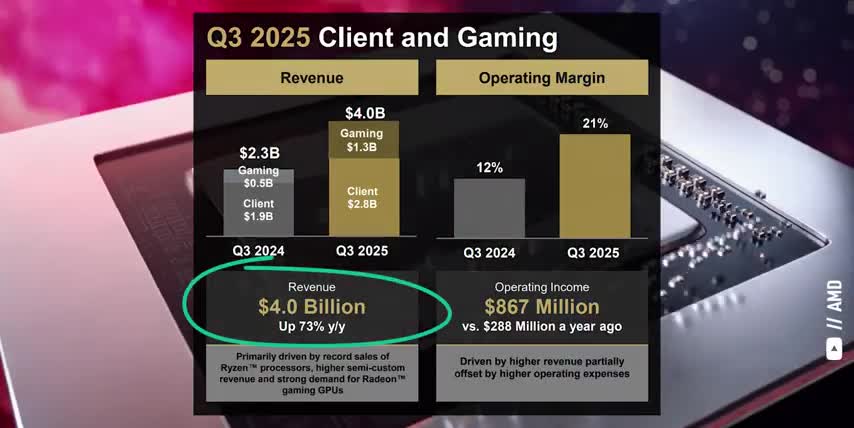

Amd stock is down by 15 over the last month because of intense competition in data centers not just from nvidia but now google is also starting to sell their custom tpus to other companies and now amd is down by almost 5 after oracle and broadcom's earnings investors are spooked because amd trades at around a hundred price to earnings ratio but if you been watching this channel for a while you know that the p ratio is a terrible valuation metric for companies with high earnings growth AMD is expected to more than double their earnings next year primarily from growing their data center business by around 80% per year for the next 3-5 years.

AMD stock is down by 15% over the last month due to intense competition in data centers, not just from Nvidia, but also from Google, which is now starting to sell its custom TPUs to other companies. Additionally, AMD is down by almost 5% after Oracle and Broadcom's earnings; investors are spooked because AMD trades at around a hundred price-to-earnings ratio. However, if you've been watching this channel for a while, you know that the P/E ratio is a terrible valuation metric for companies with high earnings growth. AMD is expected to more than double its earnings next year, primarily from growing its data center business by around 80% per year for the next 3-5 years.

A lot of that growth will come from AMD‘s massive deal with OpenAI, where they'll deploy up to 6 gigawatts of Instinct GPUs, which could be worth over $100 billion in data center revenues for AMD. And like I said when this partnership was announced, the real win for AMD here is validation for their Instinct and Rock'em ecosystems, which means they could see more huge deals for data center accelerators from other AI companies like Anthropic, just like we saw with Broadcom.

Another stock that's trading well under its fair value is Meta Platforms. According to DCF models, Meta stock is 23% undervalued, which means it has a 30% upside from its current price, even though it's one of the biggest money printers on the planet.

Meta is selling off mainly because investors are nervous about its AI and infrastructure spending, that it's gotten so big that it could hurt their near-term earnings and free cash flows, just like they did with the Metaverse in 2022. In their most recent earnings call, Meta guided their 2025 capex budget up to $70 billion.

On top of that, Meta is rolling out chatbots across Facebook, Instagram, WhatsApp, Messenger, and their hardware devices that will further personalize ads and content for more than a billion monthly active users. For example, a user can ask Meta's AI to compare different cameras for travel, and that will directly feed back into the kinds of ads that that user will be shown, not just for cameras, but for other things that can be useful on the go.

The third stock that I think Wall Street is making a big mistake on is Microsoft, which is probably the most well-diversified company on the planet between products, software, and services like LinkedIn and GitHub, Visual Studio and SQL, Microsoft 365 and Teams, and Azure and Xbox, the list goes on and on.

Microsoft is also on track to invest around $80 billion in 2025 to build out AI data centers, which was a big increase from what they spent in 2024, and they're going to increase it again in 2026. And just like Oracle, investors are worried that Microsoft won't be able to monetize their AI infrastructure quick enough for shareholders to see real returns on all of these investments.

According to Wall Street analysts, the main The challenge is that models, data centers, and power costs are already exploding, while user adoption and pricing are still ramping up. That causes a lot of concern about long-term margins and free cash flows from all these AI applications.

Key Takeaways

- The recent AI stock sell-off presents a huge opportunity for long-term investors.

- Not all AI stocks are the same, and some are crushing analyst expectations while others are struggling.

- AMD, Meta Platforms, and Microsoft are well-diversified companies with strong revenue streams in and outside of AI.

- These companies have a clear path to monetizing their AI infrastructure and are well-positioned for long-term growth.

- Investors should look beyond the current market volatility and focus on the long-term potential of these companies.

And if you want to see what else I'm buying to get rich without getting lucky, check out this post next. Either way, thanks for reading and until next time, this is TickerSymbol: YOU. My name is Alex, reminding you that the best investment you can make is in you. Thank you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.