Table of Contents

1. Introduction

2. AMD Business Overview

3. NVIDIA Comparison

4. GPT-5 Impact on AMD Stock

5. Conclusion

Introduction

OpenAI just announced GPT-5, the most powerful large language model yet, but what they really showed us was where the entire AI revolution is headed next, and that direction could be big trouble for AMD stock, if you don't know what to look for. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage, so here's everything I'm going to cover.

AMD's current AI business as of their latest earnings call, OpenAI's biggest announcements for GPT-5, what those announcements mean for the future of AI, and of course, what that means for AMD stock as a result. But let me start by saying that this video is not for everyone. I did my best to keep it high level, but it gets pretty technical because AI workloads and the chips that power them are technical topics by nature.

This also isn't a video about AMD being a bad company or a bad investment, since there's so much more to AMD than just their data center business. Instead, my goal is to help you understand the real investment thesis around AMD and their place in the enterprise AI market as it evolves with new use cases, new AI models, and new hardware and software stacks to support them. So let's take a look at where AMD is today by going through their latest earnings call.

AMD has three major business units, embedded systems, client and gaming, and data centers. AMD's embedded segment was slightly down for the quarter, but it's only about 10% of their overall revenue, so we can ignore it for the sake of time. AMD's client and gaming segment grew by 69% year over year, thanks to record CPU sales and strong demand for their Radeon GPUs and console gaming products.

If you didn't know, AMD makes the semi-custom chips for the Xbox and PlayStation 5, and Microsoft partnered with them on their next generation of consoles, PCs, and handheld devices. And while I'm sure these PCs and gaming devices will have some AI capabilities in the future, that's not really the enterprise AI market that most investors want exposure to.

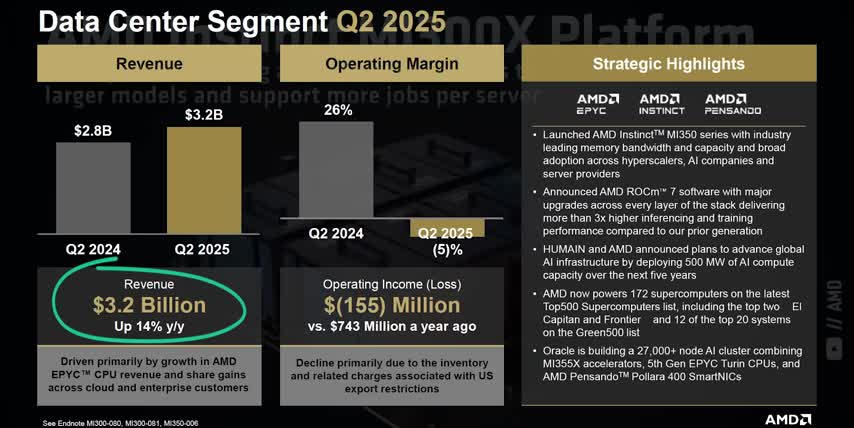

AMD's data center segment reported an operating loss of 5% for the quarter due to export restrictions on their MI308 Instinct accelerators that get shipped to China. I'm not worried about this loss though since it was a one-time $800 million write-off and their data center business would have been profitable without it. What I'm actually worried about is their data center revenues, which came in at $3.2 billion. That's up only 14% year over year.

Let me point out two important things about AMD's data center revenue. First, half of AMD's data center revenue comes from their epic line of data center CPUs, not GPUs, networking, or any other data center products. And second, if we add back in the billion or so dollars that AMD would have made from China, their data center revenue would be up by around 50%, which sounds much better until you compare it to Nvidia.

Nvidia's data center revenues were $39.1 billion last quarter, which was up by 69% year over year. So Nvidia's data center revenue is 12 times bigger and growing five times faster than AMD's, based on the actual earnings results and the actual lost chip sales to China for both companies. But let's take this comparison one step further.

Here's a table that I made comparing AMD's and NVIDIA's latest data center revenues broken down by revenue source, like CPUs, GPUs, and networking equipment, as well as by geography.

89% of NVIDIA's total revenues come from AI accelerators, infrastructure, and software specifically for AI data centers And if we add back in the billion that NVIDIA lost to export controls 22 of their data center revenues would have come from China But like I just said half of AMD data center revenues come from CPUs, not GPUs. And if we add back in the billion dollars that AMD lost to export controls, almost 40% of their data center revenues would have come from China.

So AMD's data center revenue is much less focused on AI accelerators, much more exposed to China, 12 times lower than NVIDIA's, and still growing slower, even though we're almost three years into the AI revolution. That doesn't mean AMD is a bad company or a bad investment, it just means we need to stop comparing it to NVIDIA.

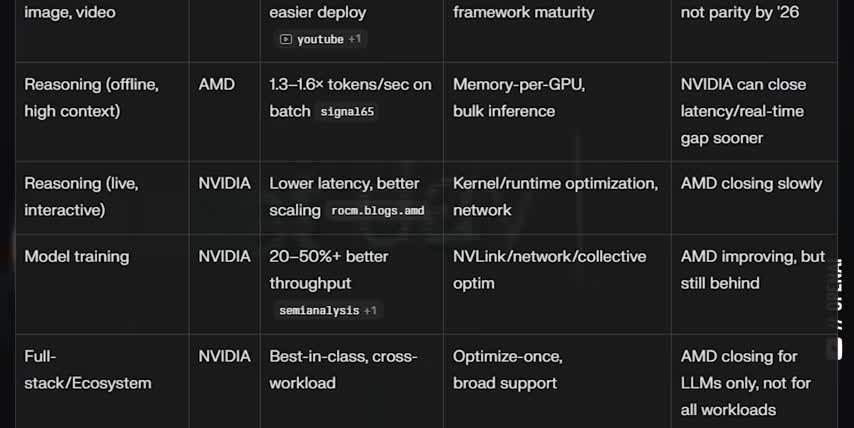

But there's a big catch here. This is only true for text and only for smaller clusters of GPUs NVIDIA has around 20 better performance for workloads involving images audio video graphics rendering or agentic tool use which are fundamentally different processes than just predicting the next word in a chain.

They're also better when it comes to workloads that need low latency, like real-time chatbots, virtual assistants, AI-enhanced multiplayer games, code generation, robotic motion and self-driving cars, or any workload where the use case demands real-time responses. It's essential to understand that AMD can't easily close these performance gaps because they come from fundamental differences in hardware and software architectures.

NVIDIA has proprietary high-speed chip-to-chip connections like NVLink, which provides much faster data transfer rates between GPUs. They also have tighter synchronization between GPUs and CPUs to route tasks to the right kind of chip and optimize processing performance. They have smart task scheduling, which lets urgent jobs cut in line and get handled almost immediately. Their chips run at higher clock speeds and come with dedicated low latency tensor cores and RT cores.

The list of features goes on and on. This is also why Nvidia's ecosystem is so much better at AI training, which requires connecting tens of thousands of GPUs together and is usually bottlenecked by latency and bandwidth, not raw compute power. On top of that, AMD's Rock'em ecosystem is nowhere near CUDA in terms of performance. It's true that Rock'em supports major frameworks like PyTorch and TensorFlow, but it typically performs 10-20% worse than on CUDA.

And by worse, I don't just mean slower. I mean the same exact model can sometimes be less accurate on AMD's framework versus Nvidia's. I just threw a ton of stuff at you, so here's a table summarizing everything I just said. AMD outperforms NVIDIA when it comes to text-only, large language model inference with large context windows. They also win when it comes to reasoning, as long as that reasoning stays text-to-text, and the use case doesn't demand immediate answers.

Key Takeaways

- AMD's data center revenue is much less focused on AI accelerators and more exposed to China compared to NVIDIA.

- NVIDIA has better performance for workloads involving images, audio, video, graphics rendering, or agentic tool use.

- AMD's Rock'em ecosystem is nowhere near CUDA in terms of performance.

- AMD's share of the data center GPU market for generative AI will probably never be more than 10 to 15% in the long run.

- The global AI accelerator market is expected to more than 9x in size over the next 9 years.

So GPT-5 just showed us that AMD's share of the data center GPU market for generative AI will probably never be more than 10 to 15% in the long run. That's bad news if you're still comparing AMD to NVIDIA. But here's the good news. 10-15% would still be a massive market share. The global AI accelerator market is expected to more than 9x in size over the next 9 years, which would be a compound annual growth rate of over 28% through 2034.

So if AMD can grow their share of this market from 4% today to just 8% over the next 10 years, they're going to see exponential growth in their data center business. I think that's very possible for them to achieve and even exceed. On top of that, AMD is eating Intel's lunch when it comes to desktop CPUs, and they're only a few years away from doing the same with data center CPUs as well.

Not to mention AMD's insane growth in the gaming market thanks to their semi-custom processors powering the next generation Xbox, PlayStation, and handhelds. Don't make the same mistake that so many Wall Street analysts are making when they compare two companies with fundamentally different products. AMD is a competitive company that's well diversified across some great computing markets, making it a great stock to get rich without getting lucky.

Not because it competes with Nvidia, but specifically because it dominates the market where it doesn't. And this is why it's so important to understand the science behind the stocks. And if you want to see the science behind the stocks I'm buying, check out this video next. Either way, thanks for watching, and until next time, this is Ticker Symbol U. My name is Alex, reminding you that the best investment you can make is in you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.