My Top 4 Secret Stocks to Get Rich (Without Getting Lucky)

The key to finding great stocks before everyone else is understanding a company's products, not just their profits. Huge growth happens when a company has the perfect product for a hot new market. Nvidia is hitting all-time highs because their AI chips are dominating data centers. Palantir is minting millionaires as their platforms bring AI to highly regulated industries. But in this post, I'll show you the best stocks in a different market altogether.

The Rise of Cybersecurity

One that's growing so fast thanks to AI that it won't matter which company comes out on top. That's the best way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time. So here's everything I'm gonna cover. The massive rally in AI stocks and how much further they could go. How AI will produce a lot more data and the major challenges that come with it.

Why that makes cybersecurity one of the best markets to invest in right now, and of course, which stocks I'm buying as a result. There's a ton to talk about. So let me set the stage with this quick CNBC clip, and then I'll follow up with some great charts and additional context as we go. Buckle up, because we're entering the golden age for AI. What you're seeing here, that's just tip of the iceberg. You can't just play AI just by owning two or three names. You gotta play the theme.

It's not just about MAG7. It's about the second, third, fourth derivatives playing out in this fourth industrial revolution. It's a golden age for AI. And that's all the work that we've done around the globe to put together. It's a dynamic list in terms of the AI 30. Really quick, we got to go. We showed your first derivatives in that board at the start, you know, NVIDIA, Microsoft. Give us your top pick when we're talking second derivatives. People are trying to get ahead of the curve.

Yeah, I think, look, in turn, second derivatives, to me, it's really cybersecurity. security, because that's where I think you're going to see more and more of the AI spent to protect the work goods. I think right now, leading on AI will be pound, you know, is obviously pound here on the software side, but you have Palo Alto, you have CyberArk, you have Zscaler, and CrowdStrike quickly coming on the AI side. This is such a great point from Dan Ives.

Table of Contents

1. Introduction to AI Stocks

2. The Rise of Cybersecurity

3. Key Takeaways

If you've been following this channel for a while, then you know that I invest in companies with platforms that other businesses pay to build on top of. But because my background is in electrical engineering, I tend to focus on hardware platforms like AI chips, data centers, robots, and self-driving cars. That's because the global AI data center market, for example, is expected to almost 9x in size over the next 9 years, which would be a compound annual growth rate of 27% through 2034.

That means that every company that serves the data center market today would grow by that amount even if their market share stayed the same. And the overall generative AI market is expected to compound at an even faster growth rate through 2033. That's why I expect this massive rally in AI stocks to continue at least through the end of the decade.

But Dan Ives thinks that the stock market rally will actually broaden out way beyond the major AI players like Nvidia, Microsoft, Google, and even Palantir, into what he calls second derivatives, which really means companies that are benefiting from the AI boom but not powering it.

And he specifically called out four cybersecurity companies palo alto networks cyber arc software zscaler and crowdstrike so let me quickly explain why cyber security is such a smart bet for the ai era and then i'll cover what these four companies do and which ones i'm investing in according to recent studies people generate capture copy and consume roughly 0.4 zeta bytes of data every single day said in english we generate about 4 million times more data than netflix's entire library of movies and shows every single day and that data breaks down into roughly 54 video 13 social 10 gaming and around 5 each for web browsing and messaging in fact humanity sends a trillion emails every three days and a hundred billion text messages every four and that's just today the The amount of data we generated was growing by about 24% per year before generative AI, and now it's expected to grow by over 36%, a 50% increase in the growth rate of data that we generate year over year, almost all of which can be generated or at least altered by AI.

In fact, phishing attacks increased by over 1,200% year over year according to Sentinel-1, And according to CrowdStrike phishing messages generated by AI were 5 times more likely to work than ones made by humans Multiply those numbers together and phishing attacks will cause 60 times more damage thanks to AI And that just one type of cyber threat. 35% of all cyber attacks last year were ransomware, which increased 84% year over year.

Encrypted threats increased by 92% in 2024, cloud intrusions increased by 75%, percent and ddos attacks increased by 31 after chat gpt's release so according to real industry data dan ives is spot on for calling out cyber security companies as the next big beneficiaries of the ai boom by the way half of all companies are already using ai and the tech sector has shrunk by over 100 000 jobs this year alone that sounds scary but what the media isn't reporting is that these same companies are hiring anyone who understands ai the same is true if you're freelancing or if you run your own business like i do ai is not optional it's a competitive advantage that you either have or you don't all right the global cyber security market is expected to almost 4x in size over the next seven years which would be a compound annual growth rate of 22.5 but let me point out a couple things here first this chart was actually made back in 2023 so it doesn't include a lot of growth projections from generative ai and we just saw that ai will increase our overall data intake and output by about 50 percent more per year which should cause the cyber security market to grow much faster as well and second cyber security actually covers a wide range of markets including identity protection and access management data backups and loss prevention information security and response and many others not shown on this chart that's why it doesn't matter which company comes out on top.

The overall cybersecurity landscape is already big enough and growing fast enough to have multiple huge winners, making it a great way to get rich without getting lucky. And now that we understand the data and we have all that context, we can dive into Dan Ives' top cybersecurity stocks. Let's start with Palo Alto Networks, which serves several big cybersecurity markets at once. Like I said earlier, I invest in companies with platforms that other businesses pay to build on top of.

Palo Alto Networks' entire strategy focuses on platformization, which is where they convince their customers to consolidate multiple different security tools and services onto their integrated platform instead of using many different vendors and solutions. And this strategy is driving serious growth for them. Their annual recurring revenue from next-generation security grew by 34% year-over-year, even exceeding their own guidance from last quarter.

Palo Alto's three main platforms work together to address the entire AI security spectrum. There's Strata for network security, Prisma for cloud and AI security, and Cortex for security operations. Their Strata platform is their foundational layer for AI infrastructure deployment. Strata includes next-generation firewalls that use AI and machine learning for packet inspection, application-based traffic routing, and threat detection and response.

On top of that, Strata's cloud manager can provide network analytics, forecast outages, and even take automated actions based on specific events and security policies. So Strata becomes a key piece of the puzzle as companies upgrade their own networks to support AI workloads and the big increase in data that I covered earlier. And then there's Prisma Cloud, which is Palo Alto's security platform specifically for cloud environments.

Prisma focuses on container security workload protection and securing infrastructure as code And Prisma AI Intelligence Response System or AIRS has solutions at every layer of the AI stack including data models apps and agents, since so many new security challenges come with enterprises adopting generative AI. For example, scanning AI models for vulnerabilities and protecting AI agents from malicious prompt injections and leaking data.

Palo Alto's third big AI platform is Cortex, an AI-driven platform for SecOps. Cortex includes security information and event management, extended detection and response, security automations, and advanced analytics to reduce manual work by 75% and the mean time between responses by 98%.

Said another way, that means that SecOps teams are doing up to four times less manual work and responding to threats up to 50 times faster thanks to Cortex, the same threats that we talked about earlier, like AI-generated phishing attacks, which is why the Cortex platform is Palo Alto's fastest product ever to reach a billion dollars in cumulative bookings.

Discounted cash flow models like Simply Wall Streets calculate PanW's fair value to be just over $250 per share, which implies over a 25% upside from today's prices. I think this integrated end-to-end three-platform approach is what puts Palo Alto networks in a great position to grow as businesses build out their new AI infrastructure, generate way more data, and deal with way more cyber attacks in general. The second stock that Dan Ives called out was CyberArk Software, ticker symbol CYBR.

CyberArk is a leader in identity security, not just for people, but for machines and AI agents. One of the biggest security challenges that comes with AI is that people can easily give AI agents access to different kinds of information.

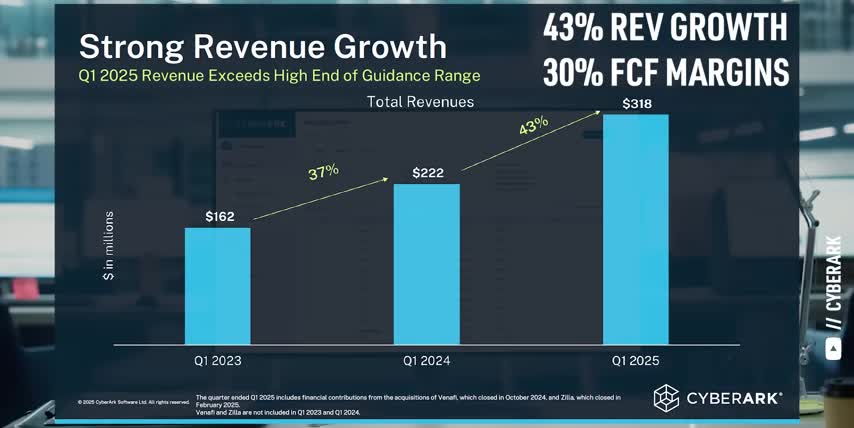

Digital and physical machines already outnumber humans and enterprises by more than 80 to 1 and ai agents are quickly becoming their own class of machine when it comes to identity access and control according to gartner 25 of enterprise breaches will be traced back to ai agent abuse by 2028 cyber arc focuses on privileged access management endpoint security and ai-powered threat detection to defend against cyber attacks their privileged access manager secures high risk access points when there are no authorized users isolates and monitors privileged sessions and keeps tabs on any ais interacting with sensitive data like financial or medical records they also have an ai engine called core ai which reduces risk by analyzing agent sessions verifying identities and scanning transcripts for secrets sensitive data and other anomalies this identity security platform runs on a subscription-based model which just hit over a billion dollars in annual recurring revenue and is growing by 50 percent year over year they also have a massive rule of 40 score of 73 thanks to their total revenue growth of 43 percent plus their free cash flow margins of 30 percent and just like palo alto networks their growth is exceeding their own guidance so even though cyber arc is smaller and much more niche than palo alto networks i think they're also in a great position to benefit as more people physical machines and digital agents need identity security solutions in the AI era.

And that brings us to Zscaler, which is actually the longest-running leader for Security Service Edge, beating out other great companies like Palo Alto Networks, Fortinet, Cloudflare, and Broadcom's Symantec in Gartner's Magic Quadrant. Zscaler's secret lies in its massive cloud platform called the Zero Trust Exchange. Unlike traditional firewalls and VPNs, Zscaler flips digital security on its head by by connecting users directly to applications, not networks.

Think of it like sort of an intelligent switchboard, but instead of connecting any to telephones directly, it connects more than 47 million users to applications in over 150 different data centers around the world. That ends up being over 500 billion information transactions every single day.

Zscaler Internet Access is a secure web gateway solution that protects all internet bound traffic by doing things like URL filtering, data loss prevention, security certificate inspection, and even detecting AI-enhanced cyber attacks like the phishing and malware campaigns I covered earlier.

Zscaler Private Access replaces traditional VPNs by providing secure access to internal applications without ever touching the corporate network Which means if an AI attack does steal a user credentials those credentials can be used to access anything else What I like about this solution is it scales with the number of users and the number of applications being protected in a given organization and it can work across multi-cloud environments since the network doesn't matter.

On top of that, their AI security platform is focused on securing AI deployments, inspecting prompts and interactions between AI models and users, and even browser isolation for AI sessions to prevent data leaks. They even have a tool called Zscaler Deception, which deploys AI powered decoys and honeypots to catch more sophisticated attacks that could have targeted much more valuable and vulnerable AI infrastructure and datasets.

Zscaler's revenue is growing by 24% year over year, and they have free cash flow margins of 28%, which gives them a solid rule 40 score of 52. Zscaler stock is up by over 70% this year alone, and I expect their growth to continue as their revenue and margins keep expanding over the course of the AI era. And the fourth stock on our list is CrowdStrike, which is also up 40% year-to-date.

CrowdStrike is the market leader in endpoint protection, with Gartner ranking them above great companies like Palo Alto Networks, SentinelOne, and even Microsoft for the fifth year in a row. Endpoint Protection is all about securing workstations, laptops, tablets, smartphones, and any other device that connects to a specific network. Which means it doesn't really compete with Zscaler at all, since they bypass networks altogether and connect users directly to apps.

CrowdStrike has a platform that defends against breaches and responds to attacks. It's called Falcon and it has three major parts. First, it has a library of cloud-based modules that do things like antivirus scans, firewall management, and locking down different kinds of cyber threats and malware.

They also have a proprietary threat graph that tracks the connections between users, their devices and permissions, and the networks that they have access to, which can then be compared against actual device and network traffic to deal with any discrepancies as they come up.

And to keep that threat graph up to date, the Falcon Agent is a tiny piece of software that runs on every device, and sends data back to CrowdStrike, which also lets them know when to run their different cloud modules and their generative ai security analyst called charlotte is an ai assistant that lets security teams use plain language to find hidden threats analyze security data and automate manual tasks which is a huge deal when ai starts creating much more malicious content year over year speaking of which crowdstrike recently reported earnings and their revenue grew 22 year over year with 80 subscription gross margins alright so here's why i think these cyber security stocks are great investments right now and if you feel i've earned it consider hitting the like button and subscribing to the channel that really helps me out and it lets me know to make more content like this thanks and with that out of the way let's talk about these four stocks and why they could be great investments right now first they're all market leaders in different areas of cyber security so i'm owning the entire market instead of trying to pick a single winner second their revenue is really reliable, since most of it comes from recurring subscriptions as opposed to professional services.

And they all have very high retention rates, because it's hard for a company to switch security solutions that they just spent years and millions of dollars integrating into the rest of their services. And third, their growth is inevitable, since everyone on earth is going to consume, produce, and transmit a lot more data, and new kinds of data as generative AI gets integrated deeper into our smartphones, tablets, laptops, and workstations.

So cybersecurity is going to be a serious issue for every single industry, which means it'll grow even faster than most analysts predict, as we start seeing new kinds of software applications and data that need to be secured, new rules and regulations for what counts as secure in the first place, new kinds of malware and hacking techniques, and way more cyber threats in general as AI gives more leverage to bad actors. So let me know if you want me to do deep dives on any of these companies.

This is an area I'm really excited to learn more about and I'd be happy to share anything I find with you. After all, understanding the science behind the stocks is the best way to get rich without getting lucky. And if you want to see what else I've been investing in to get rich without getting lucky, make sure to check out this video next. Either way, thanks for watching and until next time, this is Ticker Symbol U.

Key Takeaways

Here are the key takeaways from this video:

- The AI boom is creating a huge demand for cybersecurity solutions.

- Palo Alto Networks, CyberArk, Zscaler, and CrowdStrike are four cybersecurity stocks that are well-positioned to benefit from this trend.

- These companies have strong growth prospects, reliable revenue streams, and high retention rates.

- Cybersecurity is a critical issue for every industry, and the demand for cybersecurity solutions will only continue to grow as AI becomes more prevalent.

My name is Alex, reminding you that the best investment you can make is in you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.