Top 7 AI Stocks I'm Buying to Get Rich (Without Getting Lucky)

The world is changing. Thanks to artificial intelligence, new innovations are coming out faster than ever before. From gene editing and self-driving cars, to supercomputers and the chips that power them. And AI is already changing our lives in a big way. Just like the smartphone did, and the internet before that, and the personal computer before that. So in this video, I'll highlight the companies set to dominate this multi-trillion dollar market over the rest of the decade.

And become the next Magnificent Seven in the process. These are my top 7 stocks to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage. So here's the full list of stocks I think will be the Magnificent 7 by 2030. And there are timestamps so you can jump around. But let me quickly point out a few things before you do. First, I'm not a financial advisor. My background is in electrical engineering and data science.

And I have 10 years of industry experience using AI to solve real world problems. Today, I'm a full-time investor and I only invest inside my circle of competence, which is why every stock I cover focuses on AI and the chips that power it. I always buy stocks for the long term and I share my research for educational purposes only. And second, I had to kick Tesla, Apple and Google out of the existing Magnificent Seven to make this list.

That doesn't mean I think they're bad companies or bad investments.

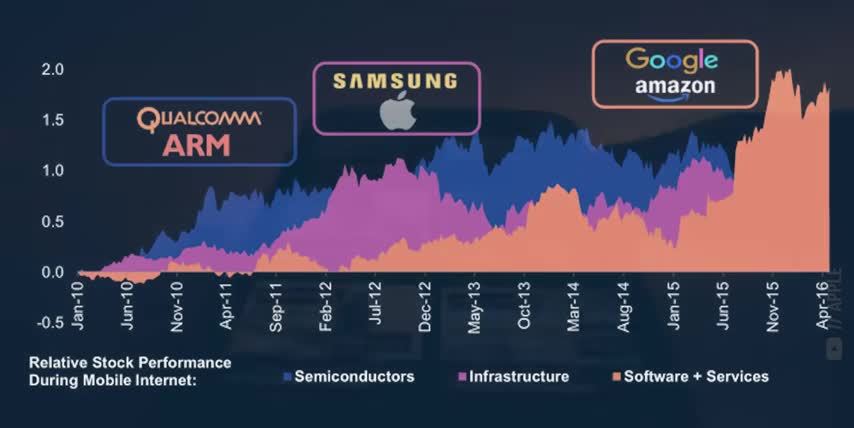

I just don't think they'll be in the top seven companies as generative AI reshapes the stock market and i'll explain why later in the video all right with all that out of the way let's talk about the new magnificent 7 for the ai era in my last video i compared the generative ai revolution to the mobile internet revolution that came before i used this case study by morgan stanley research to highlight a few key points first general purpose technologies like computers wireless internet and generative ai can take a decade or more to reach mass market adoption so we're still very early in the ai cycle second tech cycles tend to be broken up into three parts for the mobile era there were semiconductors the infrastructure built on top of them which includes both data centers and personal devices and then the high margin software and services that run on top of that and i expect the ai era to follow the same trend where ai foundation companies are the ones building ai chips foundation models and even the data centers running them ai infrastructure companies will make AI-enabled hardware and software platforms.

Table of Contents

1. Introduction to AI Stocks

2. The New Magnificent 7

2.1. Microsoft

2.2. NVIDIA

2.3. Amazon and Meta Platforms

2.4. Broadcom, TSMC, and Palantir

3. Conclusion

For example, NVIDIA's Drive AGX Hyperion platform, which is a fully integrated sensor suite, an AI compute chip, and an entire software stack for autonomous vehicles. Another example would be Palantir's software platforms, which let other companies build things like data pipelines, ontologies, and custom automations using AI, forming the infrastructure for the rest of their business.

and the third category is ai agents both digital and physical on the digital side we have companies like openai and anthropic which have their own foundation models and ai infrastructure but their actual revenue comes more and more from the ai agents built on top of them and on the physical side we have companies like tesla and waymo with products and services for end users like self-driving cars and the autonomous ride-hailing networks built on top of them speaking of electric vehicles One of the best non-profits fighting for clean energy just launched their biggest electric vehicle raffle ever, with proceeds going to the Seacan Action Fund, the sponsor of this video.

There are three reasons that you should grab a ticket right now. First, your odds of winning have never been better. Each ticket gives you three chances to win, and only 10,000 tickets will be sold. Second, the prizes are awesome.

The top winner can choose from a rivian suv or truck a new lucid gravity or lucid air or a porsche mccan or taycan second place gets the hyundai ioniq5 or the volkswagen id buzz and the third place winner gets a chevy equinox ev and the third reason to grab a ticket is to support the secan action fund's fight for clean energy nationwide so that means great odds great prizes and a great cause tickets are just $200 and to enter just go to www.evraffle.org, scan the QR code on your screen or click my link in the description.

Introduction to AI Stocks

Alright, so the current Magnificent 7 are companies that span multiple categories in the mobile era They build their own chips they have their own infrastructure and edge devices and huge software ecosystems built on top of them And I think the next Magnificent 7 will do the same They'll have their own specialized chips and foundation models, their own hardware and software infrastructure that runs on top of them, and AI-powered products and services for end users on top of that.

The New Magnificent 7

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.

Microsoft

That's why the first company on my list is Microsoft. Microsoft's Azure AI infrastructure is probably the most comprehensive AI platform on Earth. They're investing $80 billion into their data centers this year alone. On top of the $50 billion they invested last year to support more advanced AI workloads and upgrade their Azure Maya AI accelerators.

And they're already seeing returns on those investments, with Microsoft Cloud generating over $42 billion a quarter ago, which was up 22% year over year. But remember, that's just the foundation. On top of that, Microsoft has their Azure AI Foundry, which is an end-to-end platform for building, fine-tuning, and deploying AI applications that already supports almost 2,000 AI models.

NVIDIA

And now that you understand my three AI company categories, foundations, infrastructure, and agents, we can fly through the rest of My Magnificent Seven. Up next is the world's largest company, with a market cap of $3.8 trillion, and for good reason. NVIDIA's hardware stack is the literal foundation for the generative AI revolution, with over a 90% share of the data center GPU market for AI workloads.

Amazon and Meta Platforms

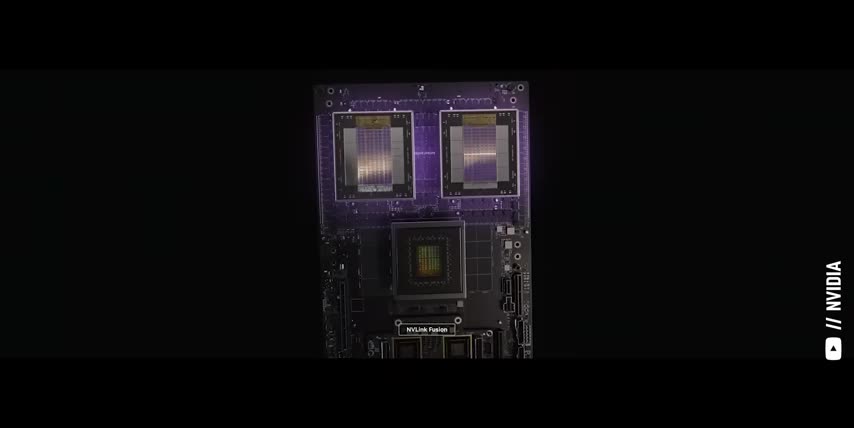

NVIDIA has built an unbeatable ecosystem around their Hopper and Blackwell GPUs, including their NVLink switches for chip-to-chip connections, Quantum InfiniBand and Spectrum X Ethernet for connecting multiple data center racks together, and innovations like NVLink Fusion to integrate with third-party chips, like Google's TPUs, Microsoft's Maya Accelerators, and even AMD's Instinct GPUs.

Broadcom, TSMC, and Palantir

data center segment alone generated 39 billion dollars in quarterly revenue which is up 73 year over year and i expect that kind of growth to continue thanks to their blackwell ultra architecture coming out later this year followed by their ruben gpus in 2026 ruben ultra in 2027 and the fineman architecture in 2028 i've made over 40 videos covering nvidia over the last four years and the stock has almost 20x in that time frame my current price target for nvidia is 204 per share which implies a 5 trillion dollar market cap and about another 33 upside from here all right let's cover amazon and meta platforms together since they're both already in the magnificent seven today and they're spread nicely across our three categories amazon web services powers over 30 of the entire internet today at a time where cloud infrastructure revenues are growing by over 20 percent year over year they also own around 20 percent of anthropic after investing over 8 billion dollars in them speaking of investments amazon is investing over 100 billion dollars into their cloud and ai infrastructure to meet the insane demand for generative ai that kind of scale means aws could be the only serious competitor to Nvidia data center business at least for specific kinds of AI training workloads where their custom Tranium 2 chips can be around 33% more efficient than Nvidia's GPUs.

AWS is Amazon's most profitable business unit by far, generating over $100 billion per year at close to 40% operating margins, So owning it alongside Nvidia is another great way to get rich without getting lucky. And that's just the data center side. They also have their bedrock platform for deploying AI models and AI agents like Amazon Q and Alexa+.

I think a lot of investors are really sleeping on Alexa's potential to be the world's most powerful digital assistant, given how many devices it already works with and the fact that it's already on Android and iOS. Likewise, Meta Platforms is adding AI services to Facebook, Instagram, WhatsApp, Messenger, and Threads, each of which deliver highly targeted ads to billions of users across Android and iOS, with Meta AI nearing a billion monthly active users on its own.

Conclusion and Key Takeaways

In conclusion, my magnificent seven for 2030 are Microsoft, NVIDIA, Amazon, Meta Platforms, Broadcom, TSMC, and Palantir. Here are the key takeaways:

Key Takeaways:

- Invest in AI foundation companies, such as Microsoft and NVIDIA, which are building the infrastructure for the AI era.

- Consider investing in AI infrastructure companies, such as Amazon and Meta Platforms, which are providing the hardware and software platforms for AI applications.

- Look for companies that are innovating in AI, such as Broadcom, TSMC, and Palantir, which are providing the chips, hardware, and software for AI applications.

Broadcom stock has been on an absolute tear lately, going up by over 40% since I covered it three months ago, and over 80% since I called the recent market bottom. So this is a company that I'd dollar cost average into slowly and over time. I actually think the fair value for Broadcom stock is closer to $235 today, making it around 15% overvalued in my view. And speaking of overvalued, let's talk about Palantir. Palantir is the only pure software company I'd put in our AI infrastructure group.

Their platforms run on AWS, Azure, and Google Cloud, which are our AI foundations, and Palantir's customers use them to make products and services for users of their own. Palantir's artificial intelligence platform, AIP, helps enterprises automate complex workflows, apply machine learning, and even build AI agents without being experts in AI themselves.