Table of Contents

1. Introduction to CoreWeave

2. CoreWeave's Business Model

3. Earnings and Risks

4. Investing in CoreWeave

Introduction to CoreWeave

What if there was an AI stock so good that Nvidia holds 4 billion dollars of it? And what if this AI company just tripled their revenues year over year? Oh yeah, and what if the stock just crashed and it's now 45% off its highs? Buying that stock would be a great way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to waste your time. This post is all about CoreWeave, ticker symbol CRWV.

And here's everything I'm going to cover. How CoreWeave actually makes their money, CoreWeave's recent earnings and their biggest risks, why CoreWeave is still cheap, even though it's up by over 100% since its IPO, and of course, what all this means for CoreWeave stock as a result. But let's start with why NVIDIA owns almost $4 billion worth of CoreWeave stock, making it over 90% of NVIDIA's public holdings.

CoreWeave's business model focuses on being the Amazon web services of AI, by providing instant access to the most advanced GPU infrastructure for companies that can't wait years or spend billions of dollars building out their own infrastructure.

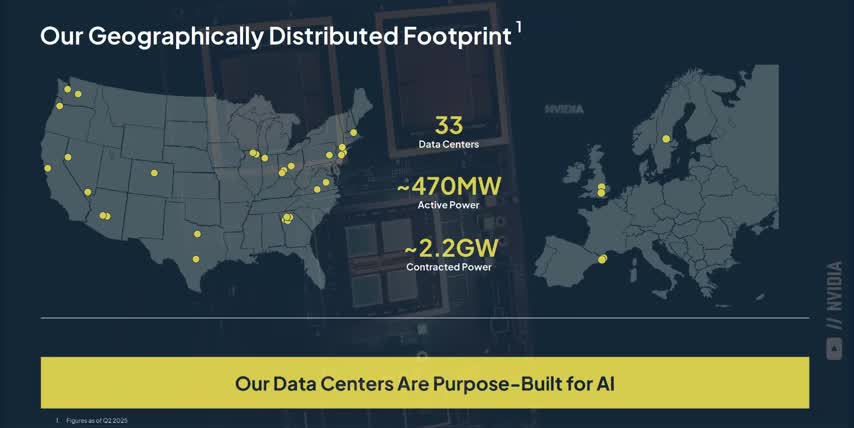

CoreWeave currently operates 33 data centers purpose-built for AI, which altogether hold over a quarter million NVIDIA GPUs across North America and Europe, and they have access to almost half a gigawatt of active power with 2.2 gigawatts of contracted power capacity. Let's get specific about what they actually do and for who. Coreweave has three kinds of customers.

AI labs that develop foundational models, hyperscalers that need overflow compute capacity, and enterprises implementing AI applications. Each kind of customer has different requirements. For example, AI labs need massive compute for model training. Hyperscalers need reliable access to overflow compute capacity, and enterprises want an easy way to implement inference solutions.

CoreWeave's AI infrastructure also spans multiple NVIDIA GPU generations, like Hopper and Blackwell, and they usually have privileged access to new architectures 6 to 12 months before broader market availability. That's a huge competitive advantage over other hyperscalers and other specialized infrastructure providers. And that's why OpenAI signed a $12 billion five-year agreement with CoreWeave back in March, and then expanded that deal by another $4 billion this past quarter.

These deals provide OpenAI with dedicated compute capacity for training and deploying their latest models, including reasoning models like GPT-5. Reasoning models use a lot more compute at inference as they break problems down step by step, write snippets of code to solve harder problems, or even use a mixture of experts approach where they consult with more specialized models before outputting an answer.

Microsoft is currently CoreWeave's biggest customer, accounting for well over half of their revenue in 2024 after increasing their spend with CoreWeave by 8x from 2023's already substantial $230 million deal. Microsoft uses CoreWeave's infrastructure when demand exceeds Azure's internal capacity for things like GitHub Copilot, Bing AI, and Azure's main enterprise AI applications.

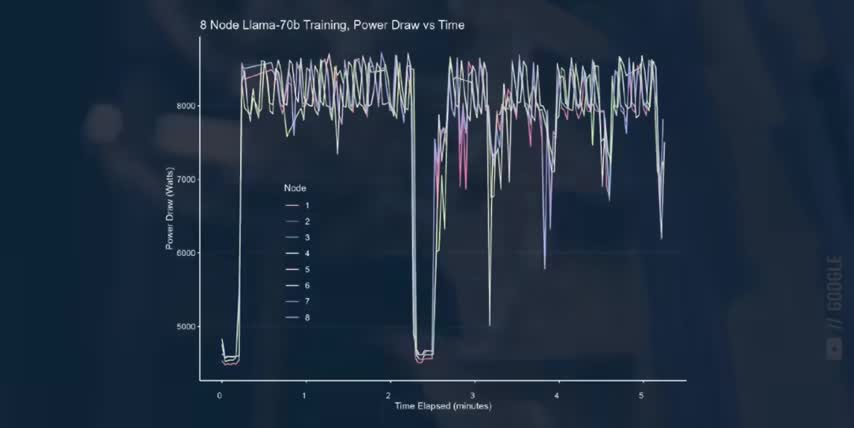

But let me tell you something that will put you ahead of almost every Wall Street analyst trying to cover this stock. AI data centers can have huge fluctuations in power demand, ranging from 30% of peak power when they're running inference workloads to 90% peak power or more during AI training.

And training workloads are particularly spiky in terms of compute and power demand As a result even the biggest hyperscalers still rely on other companies during peak workload demand kind of like peaker power plants but for compute capacity instead of electricity. Coreweave can provide that extra capacity so that AI workloads running in these huge data centers don't experience rolling compute blackouts, just like electricity blackouts.

And just like peaker plants need transmission lines to supply power core weave needs the latest gpus and the power capacity to run them that's why i think core weave stopped crashing after they announced their acquisition of core scientific is a big mistake by the market core scientific is a digital infrastructure company that was one of the largest bitcoin miners on the planet before going bankrupt in 2022 thanks to a combination of crashing crypto prices and rising energy costs but by 2024 they successfully restructured as an AI infrastructure company, using their high-density data centers to power training and inference workloads instead of mining Bitcoin.

Today, Core Scientific has over 1.3 gigawatts of contracted power capacity across nine data centers in the U.S. and over $10 billion in secured contracts for AI and high-performance computing. They have industry-leading liquid cooling systems to handle ultra-high-density GPU clusters.

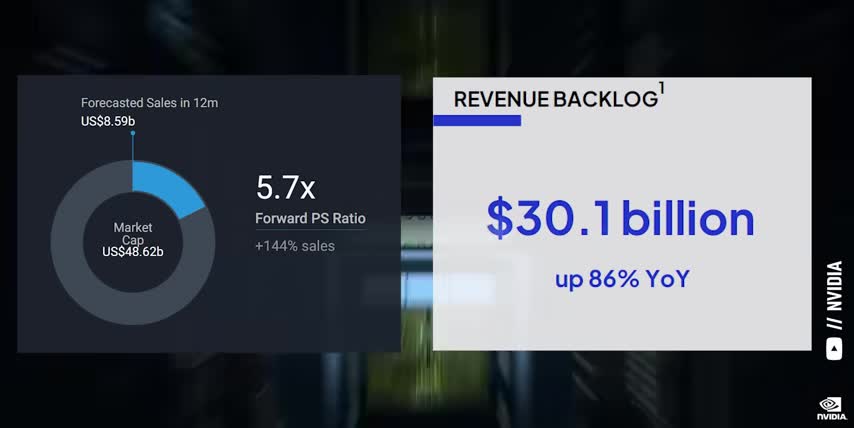

They have direct utility partnerships for low-cost power and they have custom-built infrastructure optimized for deep learning neural networks and generative ai that's why i think that core weave's acquisition of core scientific has so much synergy and will help them get through their 30 billion dollar backlog of demand let me say that again core weave is worth under 50 billion dollars today but they have a 30 billion dollar backlog of signed multi-year commitments for their ai infrastructure and data center services.

This tells me two big things as an investor. First, the demand for AI infrastructure is far outpacing supply. The global artificial intelligence market is expected to more than 8x in size over the next eight years, which would be a compound annual growth rate of 30% through 2033. But I'm starting to believe that this is a conservative estimate, and the growth rate could be closer to 40% or even 50% if it's not limited by supply.

and second core weave is incredibly undervalued name one other company with a backlog of guaranteed business worth more than half of its total market cap today but to understand just how undervalued core weave actually is we need to look at their earnings by the way one thing i always get asked is how i can cover so many stocks when news sources constantly use clickbait headlines and put a spin on the truth my secret weapon is a platform called ground news ground news analyzes over 60 000 articles a day and rates each news source for political bias and factuality for example check out this story about microsoft hitting a four trillion dollar valuation right away we can see that 33 sources are reporting on this story with 50 more coverage from the left versus the right and while most of them have a high factuality rating there's some serious bias here headlines from left-leaning sources focus on microsoft's spending on data centers and it being a temporary achievement while sources on the right focus on microsoft's earnings results and how this is a key moment for ai and their blind spot feed shows me which stories are being ignored by one side or the other because knowing what isn't being talked about is just as important as what is these features help me keep my facts straight and my research unbiased while saving me a ton of time and right now ground news is giving my audience 40 off their Vantage plan That their biggest discount yet So go to ground or click my link in the description to get unlimited access to every Ground News feature for just $5 a month.

And a big thank you to Ground News for supporting the channel and making the media more transparent. Alright, so CoreWeave earns revenue by selling companies access to their AI infrastructure and their related data center services. But instead of the less predictable usage-based model where companies can pay as they go, CoreWeave has a $30 billion backlog of pre-sold, multi-year contracts. Here's a chart explaining how CoreWeave's contracts work.

Once a contract is signed and a purchase order is submitted, CoreWeave spends the next four months buying and installing the AI infrastructure that they need to support their customer.

Then, once that AI cloud goes live, their customer begins their monthly payments this is also where core weave recognizes that initial prepayment just to keep things simple from there companies can extend or expand their contracts as well as access extra gpus on demand as long as they're available i think that this model creates a win win win situation where core weave's customers get guaranteed compute capacity core weave gets predictable and recurring revenue and core weave's investors get a lot more visibility into their future growth and now that we understand what core weave actually does and how they make their money let's talk about their earnings and 50 billion dollar valuation next core we've reported record revenues of 1.2 billion dollars for the quarter which is up 207 percent year over year that means their revenue has been growing by anywhere from 30 to 50 percent every single quarter usually a company growing that fast is still private which is why i think this is a pretty rare opportunity to get in early on a big winner in the ai era their revenue backlog just reached 30 billion dollars which is up 86 year over year that growth is largely driven by their 16 billion dollar multi-year contracts with open ai as well as with a new contract with one of the hyperscalers which i'm assuming is microsoft azure either way 50 of their backlog is for two-year contracts.

Another 40% are for between two and four years, and the final 10% are four to six year contracts. That's a long revenue runway for a company this size. But that doesn't mean we should ignore the risks. Corwee spent $2.9 billion in capital expenditures this past quarter, which is almost two and a half times their revenue. That led to a $290 million net loss for the quarter, which I think is a big reason the stock crashed.

Their operating margins also collapsed from 20% last year to just 2% this year after they issued $145 million in stock-based compensation. Corweave's total stock-based compensation is up by 20x year over year. But the third and biggest reason for the stock crashing is simply selling pressure. Corweave went public back in March, and the IPO lockup period just ended on August 15th.

That means insiders, institutional investors, and hedge funds could finally sell their shares, which were up by 100 or even 200 percent since the ipo so all of these early investors were finally able to lock in their massive gains i think these three things the company posting a huge net loss for the quarter ramping up their stock-based compensation and early investors finally being able to sell their shares are what created the perfect storm for core weave stock throw in the nine billion dollar acquisition of core scientific and it easy to see why investors are worried about core weave spending much more money than they make But here the thing I don think any of these are actually really bad for Coreweave in the long term.

First, those $2.9 billion of capex were invested into scaling their platform to service even more customers. That's exactly where the money should be going, especially since they already have a $30 billion backlog in demand, meaning CoreWeave will obviously see returns on all of this invested capital. The same is true when it comes to their acquisition of Core Scientific, and whenever they can secure large power contracts, since most data centers are limited by power, not by budget or area.

Their adjusted EBITDA came in at $750 million, which tripled year over year, and represents an adjusted EBITDA margin of 62%. While I'm not a huge fan of this metric, it does show that CoreWeave has very strong unit economics once their AI infrastructure is actually deployed. Second, I think that huge amounts of stock-based compensation is just par for the course when it comes to fast-growing AI companies.

The simple truth is that there is way more demand for AI hardware and software engineers than there is supply. So companies offer stock-based compensation to attract and retain their talent. This was something that troubled Palantir investors for years. And look how that turned out. And third, insiders will always sell for massive gains. This happens after every IPO because long-time employees want their big payday, and institutions want to lock in their returns and hit their quarterly numbers.

These people are not playing the long game, which means there's a huge opportunity here for the investors that are. And now that you understand the science behind CoreWeave stock, let's talk about whether it's a good stock to buy now. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this. Thanks, and with that out of the way, let's talk about CoreWeave stock.

In my opinion, Nvidia has $4 billion in CoreWeave stock because they can see the forest for the trees. They understand the power of guaranteed access to AI infrastructure in a world where demand far exceeds supply. And while CoreWeave is spending much more money than they make today, I think those risks are mitigated by three key factors.

One, their business is very stable and unpredictable since it's based on multi-year contracts and not pay-as-you-go spending two their massive 30 billion dollar backlog is growing much faster than their spending and three the money they are spending is going directly towards growing their business whether that means securing more megawatts of power acquiring more data centers and compute capacity or simply retaining talent via stock-based compensation coreweave is the definition of a picks and shovel supplier in the middle of the ai gold rush and the market just made a big mistake on this stock after its crash discounted cash flow models like simply wall street's calculate the fair value of core weave stock to be around 220 dollars per share which means it's 55 undervalued at its current price said another way core weave stock would have to go up by 120 just to reach its fair value today that's 120 upside in nvidia‘s biggest public holding which makes core weave a great stock to get rich without getting lucky and if you want to see what else i'm buying to get rich without getting lucky check out this video next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- CoreWeave is a company that provides AI infrastructure and data center services, with a strong backlog of pre-sold, multi-year contracts.

- The company has a competitive advantage due to its privileged access to new NVIDIA GPU architectures and its industry-leading liquid cooling systems.

- CoreWeave's acquisition of Core Scientific is expected to help the company scale its platform and increase its revenue runway.

- The company's adjusted EBITDA margin is 62%, indicating strong unit economics once its AI infrastructure is deployed.

- Despite the stock's recent crash, CoreWeave‘s valuation is still considered undervalued, with a potential upside of 120% to reach its fair value.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.