Intel and Nvidia just announced a partnership that will change the AI market forever. And the biggest loser from this deal is AMD, but not for the reasons you might think. So in this video, I'll break down everything you need to know about this unlikely alliance of CPUs and GPUs, and what it means for Intel, Nvidia, and AMD stock. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage, so here's what I'll be covering up front.

Table of Contents

1. Introduction

2. Partnership Between Intel and Nvidia

2.1. Data Centers

2.2. Consumer PCs

3. Impact on Intel, Nvidia, and AMD Stock

This huge new partnership between Intel and Nvidia, how it fits into Nvidia's broader ecosystem strategy, how this could affect AMD's PC and data center businesses, and of course what all this means for Nvidia, Intel, and AMD stock as a result. Let's jump right into the deal itself. Late last week, Nvidia announced that they're investing $5 billion into Intel, making them one of Intel's biggest shareholders after the US government, which just took a 10% stake in the company a few weeks ago.

Nvidia owning around 4% of the company gives them some influence over Intel's strategic direction and their decision making. It gives them direct access to the management team and it keeps their incentives for this partnership aligned. Nvidia's partnership with Intel has two main parts, data centers and consumer PCs. For data centers, Intel and Nvidia are collaborating on an x86 CPU that integrates NVLink directly onto the chip. Here's why that's such a big deal.

Earlier this year, I traveled to Taiwan to cover Computex, one of the biggest AI hardware and software conferences in the world. And while I was there, Jensen Wang announced a breakthrough piece of networking technology called NVLink Fusion, which allows non-NVIDIA processors like Google's TPUs, AMD's GPUs, and Intel's CPUs to work with NVIDIA's proprietary interconnects via a special NVLink chiplet.

That's huge for NVIDIA because it gets their AI infrastructure onto the upgrade path for enterprise data centers and compute clusters that are already heavily invested in non-NVIDIA chips. For example, Google, Amazon, and Microsoft can use these NVLink chiplets to use their own custom chips with NVIDIA's GPUs to create tailored AI infrastructure for a wide variety of workloads instead of having to choose between NVIDIA's GPUs and their own in-house chips for each rack.

And chip makers like Qualcomm can now use NVIDIA's interconnects instead of having to develop their own scale-up networking solutions. But this partnership with Intel takes it a step further. Instead of adding that special NVLink chiplet to an already existing Intel chip, Intel and NVIDIA are co-designing this x86 processor from the ground up, specifically for NVIDIA's data center ecosystem.

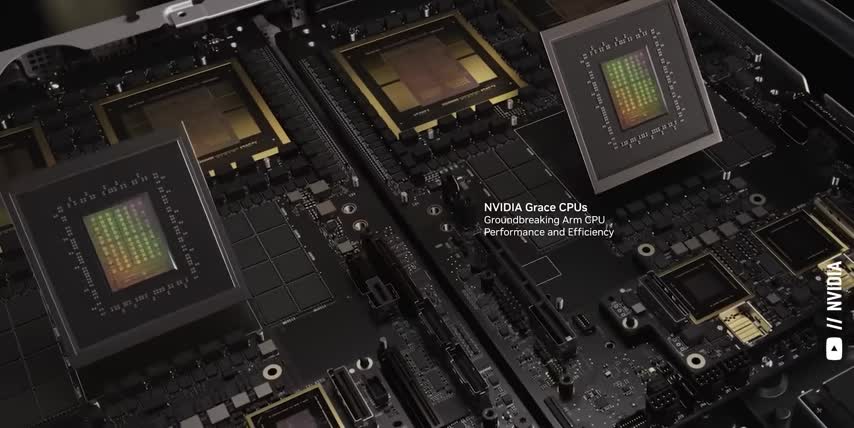

That means the CPU will be optimized for high bandwidth, low latency communication with NVIDIA's GPUs and the cache, the interfaces, the workload scheduler, and the memory controller will all be fine-tuned for Nvidia's hardware roadmap. And that's where things could get pretty dicey for AMD. Besides this partnership, the only CPU native to Nvidia's ecosystem is Grace, which isn't a traditional server CPU at all.

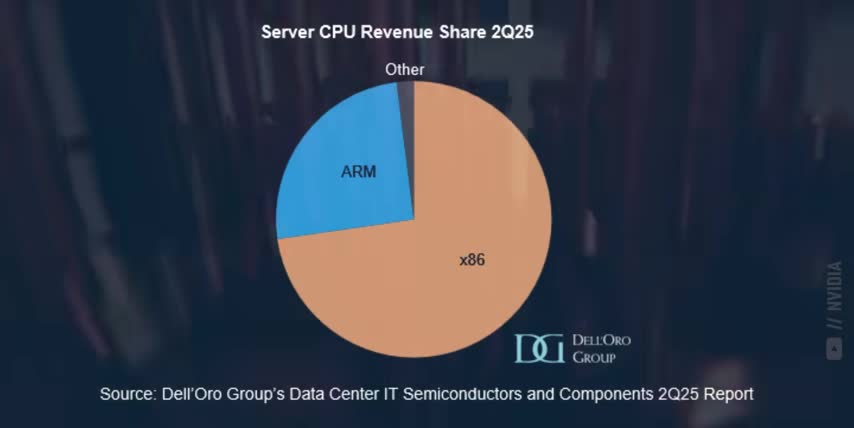

Instead, Grace is designed to efficiently manage the movement of massive amounts of data, coordinate workloads, and provide high-speed memory access to the large arrays of Nvidia's GPUs working on AI training and inference But Grace is an ARM processor in a market where 70 to 80 of existing data centers run on x86 And switching from x86 to ARM is much more expensive than just buying new chips since most enterprise applications, databases, and internal operating systems are developed, tested, and optimized for x86 and they're not always compatible with ARM out of the box.

Not to mention that the enterprise hardware, firmware, and developer ecosystems are much bigger and much more mature for x86. As a result, many established data centers don't want to deal with the upfront switching costs and risks that come with porting, recompiling and even outright rewriting software to work with ARM in the first place, which stops them from adopting NVIDIA's latest chips.

That barrier to entry is one of the big reasons that some data centers were turning to AMD, which makes industry-leading x86 CPUs and competitive data center GPUs for large language model inference. But now, Nvidia's ecosystem will support x86 as well, which means enterprises won't have to choose between upgrading for the future and keeping their existing data centers running today.

This is exactly like when Nvidia rolled out their Spectrum X Ethernet products, so that data centers could use their systems without having to migrate their networks to InfiniBand, which would be a massive infrastructure overhaul. So now, any data center can upgrade to Nvidia's latest GPUs and join the CUDA ecosystem, whether their network is on InfiniBand or Ethernet, and whether their processors are ARM-based or x86.

And since well over 80% of the world's data centers run on Ethernet and x86 today, these two options make Nvidia‘s total addressable market up to 5 times bigger. That's why this is such bad news for AMD. The entire AI revolution runs on CUDA, and now AMD will have to compete directly with that ecosystem for every single data center. But don't forget, AMD's biggest business unit isn't data centers at all. It's their client and gaming segment, which focuses on CPUs and GPUs for consumer PCs.

And now they're going to be competing with Nvidia and Intel in those markets too. So let's talk about that next. But first, let me share something personal with you real quick. We're in the middle of hurricane season here in Florida, and what most people don't realize is that storms are only the first part of the problem. Even after they pass, many parts of the greater Tampa area can be without power for days or even weeks.

That's why I got the Jackery Home Power 3600 and 500 watts worth of Jackery solar panels. The Home Power 3600 is super easy to set up. You just unfold these Jackery solar saga panels, connect them up, and plug in your most important devices. This thing can keep our phones charged and our fridge running until our power comes back on, even if it takes two weeks, all without the hassle or the fumes of a gas power generator.

Jackery even has an app so I can track its charge level, switch between AC and DC power for different devices, and set timers to preserve the battery. And since this thing is so portable, this whole setup is also great for road trips, camping, or anytime you need power on the go.

Almost all of AMD revenue growth last quarter came from their client and gaming segment which focuses on consumer CPUs and GPUs Currently, AMD offers the best high-performance integrated CPU and GPU chips in terms of power efficiency and battery life.

These accelerated processing units, or APUs, go into premium ultrabooks, ultralight laptops for professionals, and AI PCs, which are three of the fastest growing personal computing markets. But now, Intel and Nvidia are collaborating on an integrated x86 CPU and GPU that will directly compete with AMD's most advanced consumer products. Intel is bringing the x86 CPU expertise, platform integration, their reference designs, and their relationships with the whole PC ecosystem.

And they'll manufacture these chips right here in the USA, which means they'll also avoid all the tariffs and trade issues brought on by the Trump administration. On top of that, NVIDIA will bring their RTX graphics architecture for applications like hardware ray tracing, graphics upscaling, and AI acceleration.

They'll bring NVLink Fusion for super-fast data transfer between the onboard CPU and GPU, and their AI software stack which includes CUDA, TensorRT, DLSS, and a wide variety of AI-based tools for gaming, productivity, and content creation, all on one integrated chip. but the real key here is the timing. As AI features and copilots become standard in Windows 11 and beyond, the PC market will keep transitioning towards AI PCs.

And when most hardware consumers hear the words AI, they immediately think of NVIDIA, which gives these chips the brand recognition that they need to seriously compete with AMD's integrated Ryzen and Radeon chips for high-end gaming laptops and desktops. Alright, now that we've covered the partnership between Intel and Nvidia and how the chips they're working on fit into Nvidia's broader ecosystem, let's talk about what all this actually means for Intel, Nvidia and AMD stock as a result.

And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this. Thanks and with that out of the way, let's talk about the future of these chip stocks. For Intel, I think this partnership with Nvidia is equal parts salvation and surrender.

Intel's biggest differentiator has always been that they can design and manufacture their own chips, which gives them a level of vertical integration and independence that no other semiconductor company could ever claim. Every other chip designer relies on foundries like TSMC and Samsung, and every other foundry needs chip designers to fund their production lines.

But with this partnership, Intel is finally admitting that they need Nvidia to stay relevant as the AI revolution unfolds, both in terms of data centers as they become AI factories and for laptops and desktops as they become AI PCs. Intel only gets to participate in the AI boom by co-designing processors for Nvidia's data center infrastructure.

Having a chip with a guaranteed place in the world's most valuable AI ecosystem is a huge win for Intel, especially given their struggles with advanced manufacturing and their competitive positioning in the past. But now, the pressure is on Intel to produce these chips on time, scale and with high power efficiency.

If they miss on the design the schedule or the cost AMD and ARM will quickly fill that demand instead Ultimately I think the US government and Nvidia stepping in to buy around 15 of the company shows that while Intel might be too big to fail they couldn really succeed on their own, especially in the AI era. So for that reason, I'm still not buying Intel stock. On the other hand, this could be a huge win for Nvidia.

Like I mentioned earlier, this partnership dramatically expands Nvidia's total addressable market by removing two of their biggest barriers of entry. Data centers either had to migrate to ARM or manage systems running both CPU architectures. Now, every existing data center running on x86 is a potential customer for NVIDIA's AI hardware and software platforms, which is exactly what NVIDIA needed after being effectively banned from the Chinese AI market.

This partnership also makes NVIDIA much more sticky, since it creates higher switching costs at the hardware level. Once a data center deploys Intel processors that are optimized for Nvidia's ecosystem, and they have native NVLink integration, it'll be much harder and much more expensive to move to another chip. All without Nvidia having to design an x86 chip themselves. But the biggest win for Nvidia is that they now have a solution for every kind of enterprise.

No matter how fast or how slow, that enterprise wants to transition to AI. Companies can start with these new Intel x86 NVLink processors, and then gradually transition to Nvidia's native ARM-based Grace chips over time. Or not, all while staying within the broader CUDA ecosystem. And on the consumer side, Nvidia's discrete GPUs are mostly an enthusiast gaming laptops and desktops with no real presence in integrated chips or in any professional markets.

But now, their partnership with Intel will give them another entry point into mainstream ultrabooks, light and thin laptops, and AI PCs. I don't really think that these consumer chips will be a huge revenue generator for Nvidia. But they do open the door to hundreds of millions of new devices, which means more developers, more AI users, and ultimately a more competitive ecosystem for Nvidia.

And that's exactly why this is bad for AMD, not because of processing power or any other performance metric. Like I said in my last AMD video, it's a great investment because they consistently win in the markets where they don't compete with Nvidia, but that list of markets just got a whole lot smaller.

Just to be clear, I still think that AMD will win big in general-purpose computing and traditional server workloads with their Ryzen and their Epic lines of CPUs, as well as in semi-custom chips for game consoles and other integrated devices. But Nvidia is definitely the gold standard when it comes to AI. So for me, Intel is now a speculative turnaround play if they can execute and deliver on schedule.

And while AMD might have some more upside in the near term, we need to wait and see what happens to their market share once these Intel and Nvidia chips come out in 2027. The real big winner here is Nvidia, because this partnership seriously expands their total addressable markets, makes them more sticky, and lowers the barrier of entry into their ecosystem, making Nvidia a great stock to get rich without getting lucky.

And if you want to see what other stocks I'm buying to get rich without getting lucky, check out this article next. Either way, Hey, thanks for reading and until next time, this is TickerSymbol: YOU. My name is Alex, reminding you that the best investment you can make is in you.

Key Takeaways

- Intel and Nvidia have announced a partnership to develop an x86 CPU with integrated NVLink for data centers and consumer PCs.

- This partnership expands Nvidia's total addressable market, removes barriers to entry, and makes them more sticky.

- Intel will co-design and manufacture the chips, while Nvidia will provide their RTX graphics architecture, NVLink Fusion, and AI software stack.

- The partnership is expected to have a significant impact on AMD's market share, particularly in the data center and consumer PC markets.

- Nvidia is seen as the gold standard for AI, and this partnership solidifies their position in the market.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.