Table of Contents

1. Introduction

2. AI Value

3. AI Economics

4. Global AI Market

5. AI Applications

6. Future of AI

Introduction

A few days ago, NVIDIA CEO Jensen Huang went on the BG2 pod, which is one of my favorite podcasts for investing in advanced technology. But what I thought would be a pretty cookie cutter interview ended up being over 90 minutes of Jensen dropping nonstop bombshells and revealing NVIDIA's entire AI playbook. Would I do it? Heartbeat.

I'm doing it across every single person in our company right now, right? So in this video, I want to share some of the most important takeaways for investors, because AI is about to make a lot of people very rich, including me and you. Your time is valuable, so let's get right into it. First things first, this video is a little different from my normal style.

I'm going to share some key points from Jensen's interview and then add some more context to help us find the biggest winners of the AI revolution. I'll also provide more information on the interview, which every serious AI investor should read because it's jam-packed with value, and value is the perfect place to start. In this section, Jensen explains the real value unlocked by AI and why every single company is investing in it so aggressively.

Suppose I were to hire a $100,000 employee and I augmented that $100,000 employee with a $10,000 AI. And that $10,000 AI, as a result, made the $100,000 employee twice more productive, three times more productive when I do it. Heartbeat. I'm doing it across every single person in our company right now, right? They all have co-agents. That's right. Co-workers. That's right. Every single software engineer, every single chip designer in our company already has AIs working with them. 100% coverage.

As a result, we're growing faster as a company. As a result, we're hiring more people. Our productivity is greater. Our top line is greater. Our profitability is greater. What's not to love about that? Now, apply the NVIDIA story to the world's GDP. So right away, we have a few big takeaways to talk about. First, AI isn't going to replace most jobs. It's going to augment them. We can think about AI sort of like a utility, like the internet, electricity, and gas.

We measure AI in tokens, and the goal is to use those tokens to do something productive, just like with the internet, electricity, or gas. Second, let's quickly break down Jensen's math because the economics of AI are central to the investment thesis for it. When companies hire somebody, they're hoping to get at least a 2x return on that employee's total costs, including things like benefits, training, computers, equipment, and so on.

If a company hires somebody for $100,000 a year, after all expenses, they're hoping to make at least $200,000 a year from that person's work. Usually way more, but we're being super conservative here. An employee that costs $100,000 but generates $200,000 of value has a profit margin of 50%. Jensen said that an AI agent that costs $10,000 a year can make an employee two to three times more productive. But we shouldn't just take his word for it. I mean, come on, just look at those glasses.

So let's cut his numbers in half and say that an AI agent can make an employee just 50% more productive by doing only the most obvious things we all already know that an AI can do today. Basic research, writing first drafts of documents, formatting emails and reports, taking notes in meetings, answering basic questions about articles that we already don't read. So no chip design and no serious software engineering.

Now, with that AI agent, that same employee costs $110,000 a year, but generates $300,000 worth of value instead of $200,000, which is a profit margin of 63%. Or said another way, the company made an extra $100,000 for a $10,000 investment, even when we use very conservative numbers. Oh yeah, and who says that one AI agent can't help two employees instead of one, or three, or ten. Charlie Munger famously said, show me the incentive and I'll show you the outcome.

Well, when the incentive is a 10, 20, or even 30x return per AI agent, the outcome is crystal clear. Any company not investing in AI will eventually be disrupted by one that is. But if you want to hear something really scary, 2026 is less than 100 days away. And one of the best investments you can make to get ahead is understanding AI.

Whether you work in tech or finance, sales or HR, you'll learn to use 10 of the most powerful AI tools like Gemini and Grok, best practices for prompting AI and using AI agents, and even how to automate workflows without any coding. You'll also get free access to OutSkill's exclusive community and learning dashboard to keep growing alongside other AI professionals.

No wonder over 10 million people from all over the world have already attended, and the limited slots for this one are filling up faster than ever. This is a great way to gain a competitive advantage with AI, get a serious head start for 2026, and understand the science behind the stocks. So make sure to register for your free seat with my link below today.

Alright, so companies have a huge economic incentive to adopt AI, because it makes their employees much more productive, which translates directly to much higher profits, even when we use conservative numbers. But at the end of that clip, Jensen said the same math could be applied to the whole world's GDP.

And if we do that, we can see how big the global AI market can get over the next few years, which would tell us how fast it could grow from its size today and what kind of returns we could expect on AI stocks as a result. So here's the next part of that clip. Now apply the NVIDIA story to the world's GDP. And so what's likely to happen is that that $50 trillion is augmented by, let's pick a number, $10 trillion. That $10 trillion needs to run on a machine.

Now, the reason that AI is different than IT in the past, in a way, software was written a priori, and then it runs on a CPU. And it runs – a person would operate it. In the future, of course, AI is generating tokens. But a machine has to generate the tokens, and it's thinking. So that software is running all the time, whereas in the past, the software was written once. Now the software is, in fact, writing all the time. It's thinking. In order for the AI to think, it needs a factory.

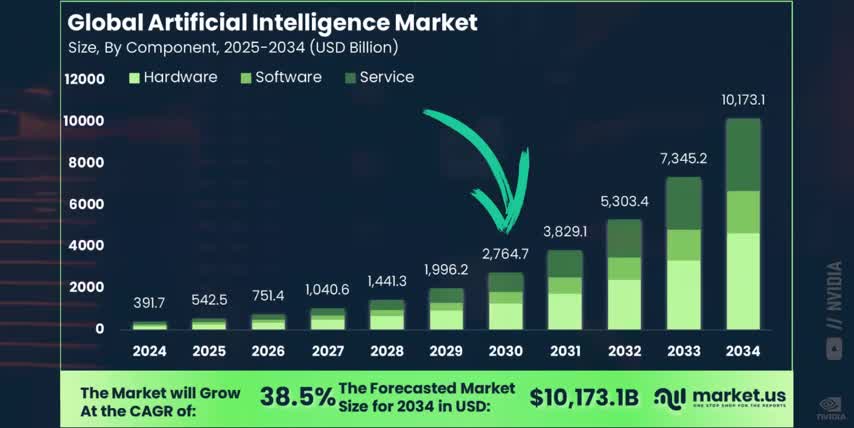

And so let's say that that $10 trillion of token generated, 50% gross margins, and $5 trillion of it needs a factory, needs an AI infrastructure. So if you told me that on an annual basis, the CapEx of the world was about $5 trillion, I would say the math seems to make sense. Yeah. So Jensen says that global AI capital expenditures could reach $5 trillion per year by the end of the decade. But again, we don't just want to trust him. So let's be ultra conservative and cut that number in half.

The global artificial intelligence market would still roughly 5x by 2030 and almost 20x by 2034, which would be a compound annual growth rate of close to 40% for the next nine years straight. That means companies building AI hardware, software, or services should grow roughly that fast, even if their market shares and margins stay the same. One nice thing about these AI markets is there are only a few major companies in each area.

For example, holding NVIDIA, AMD, Broadcom, and TSMC means holding almost 100% of the entire AI accelerator market in just four stocks. NVIDIA and AMD design the world's GPUs, While Broadcom designs many of the world's major data center ASICs, like Google's Tensor Processing Units, the MetaTraining and Inference Chips, and OpenAI's upcoming Titan XPUs. While TSMC manufactures those chips and many more. But AI data centers need much more than just processors.

They need power, cooling, memory, and storage. That's why companies like Vertiv Holdings, Micron Technology, Arista Networks, Dell, Oracle, and CoreWeave come in. Each of these companies makes critical components or provides serious services that help other AI companies scale up. And because these companies all do very different things, they don't really compete with each other. So any portfolio holding them gets a lot of exposure to AI while still being fairly diversified.

But the second point that Jensen made in that clip is even more important. Traditional software gets written once runs on CPUs and is mostly operated by people looking to achieve a specific outcome But AI doesn work the same way It has context and memory and it improves over time so it's essentially constantly getting rewritten. And instead of running on CPUs, AI runs on many distributed GPUs in parallel, which requires a very different kind of network and hardware infrastructure.

But the biggest difference comes in the form of reasoning. In traditional software, the The human does the thinking, and the application is the tool. But in AI, the model does the thinking. It reasons through problems step by step. It uses tools and calls APIs. It renders graphics and compiles code. All of which take exponentially more tokens today than when ChatGPT first came out.

That means the same prompt today could take a thousand, a million, or even a billion times more tokens in the future as AI keeps evolving. The one that was probably most profound for me was you pounding the table. And you said inference isn't going to 100x, 1,000x. It's going to 1 billionx, which brings us to where we are today. I underestimated. Let me just go on record. I underestimated. And I don't just mean that AI will get better at answering text prompts.

I mean it'll get better at generating audio and analyzing HD video. It'll run physics models and robot simulations. It'll synthesize drugs and write software applications. It'll even be able to call other AI models and AI agents. But now, let me tell you something that will put you ahead of every Wall Street analyst trying to predict the future of AI. Everything we've talked about this entire video has nothing to do with the future of AI applications at all.

It's all about using AI to make existing applications more profitable and existing employees more efficient. just like we discussed earlier. That's why Microsoft, Amazon, Google, and Meta platforms are all incredible investments today, even though they're some of the biggest companies in the world. Each of these companies has hundreds of thousands of employees that will become much more productive thanks to AI, and that will skyrocket these companies' margins.

But they also run software and services that billions of people use every month, making them the perfect proving grounds for AI at massive scales. When accelerated computing and GPUs are doing the biggest jobs done by general purpose computing and CPUs like search, shopping and recommending content, but at a fraction of the cost, every single company on earth will have to make the switch. That's not in the future. It's already happening right now. Here, take a look.

Let me give you three points to think through. And these three points, it'll help you hopefully be more comfortable with NVIDIA in this future? So the first point, and this is the laws of physics point. This is the most important point, that general purpose computing is over and the future is accelerated computing and AI computing. That's the first point.

And so the way to think about that is there's how many trillions of dollars of computing infrastructures in the world that has to be refreshed. Right, right. And when it gets refreshed, it's going to be accelerated computing. That's right. Nobody disputes that. Everybody goes, yeah, we completely agree with that. General purpose computing is over. Moore's law is dead. People say these things. And so what does that mean? So general purpose computing is going to go to accelerated computing.

Our partnership with Intel is recognizing that general purpose computing needs to be fused with accelerated computing to create opportunities for them. Is that right? And so one, general purpose computing is shifting to accelerated computing and AI. Two, the first use case of AI is actually already everywhere. It's in search, recommender engines. Isn't that right? In shopping. The basic hyperscale computing infrastructure used to be CPUs doing recommenders is now going to GPUs doing AI. Right.

So you just take classical computing. It's going to accelerated computing AI. You take hyperscale computing is going from CPUs to accelerated computing and AI. And then now that's the second point.

Just feeding the Metas the Googles the ByteDances the Amazons and take their classical traditional way of doing hyperscaling and moving it to AI that hundreds of billions of dollars And because that may be four billion people on the planet today, if you take TikTok, meta into account, Google into account, who are already demanding workloads that are driven by accelerating computing. That's exactly right.

And so without even thinking about AI creating new opportunities, It's about AI shifting how you used to do something to the new way of doing something. And then now let's talk about the future. So far I've only spoken kind of largely about just mundane stuff. Just mundane stuff. The old way is now wrong. You're no longer going to use fuel light lanterns. You're going to go to electricity. That's all. And you're no longer prop planes. You're going to go to jets. That's all.

And so, you know, so far, you know, that's all I've talked about. And then now that the incredible thing is when you go to AI, when you go to accelerated computing, then what happens? And now we've come full circle. I started this video by walking you through how making an employee 50% more efficient at their existing job actually makes them twice as profitable.

The same thing can be said about the way that existing search engines like Google work today, The way that recommender systems like Netflix and Meta platforms and YouTube work today. And the way that shopping systems like Amazon work today. This whole video is about using AI to upgrade the way we do existing work today. And which companies do the most work, which means they have the most to gain from AI? Microsoft, Meta, Amazon, Google.

The same software and services already being used by billions of people every month. But let me point out one more important thing that Jensen said about the future of AI at the end of that clip. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this. Thanks and with that out of the way, let's talk about the future of AI.

The future of AI is about much more than just moving today's work from CPUs to GPUs and from traditional software to AI models. just the first step, just like transitioning from gas lamps to electricity, from propeller-powered planes to jet engines, from horse-drawn carriages to cars, and from renting VHS tapes to streaming. The real value comes from the new things that these transitions enable that couldn't be done before.

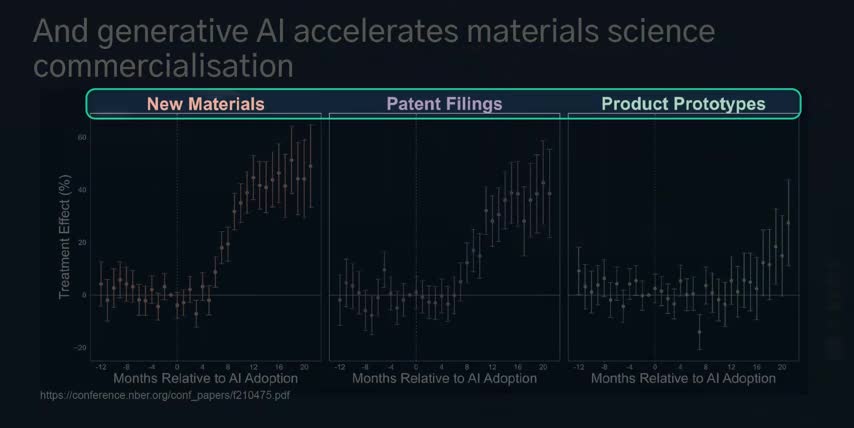

Here's a slide from a GTC panel that I attended earlier this year from Jonathan Godwin, the CEO of Orbital Materials and the former lead for AI and Materials at Google DeepMind. Each x-axis is time in months, and the y-axis is basically the impact of generative AI on the discovery of new materials in Chart 1, the resulting increase in patent filings in Chart 2, and the rise in new product prototypes in Chart 3.

The first 12 months give us a baseline for the average amount of progress in each area, and the next 20 months show us the impacts of generative AI. And the impact has been massive.

Six months after adopting AI, the scientific community We started discovering a record number of new advanced materials for transistor-based chips as well as quantum computers, for solar cells and solid-state batteries, and even lightweight composites and high-temperature ceramics for huge industries like aerospace and robotics, the same exact industries we invest in.

Just eight months after adopting Generative AI, material scientists were filing a record number of new patents, and by month 17, they were testing a record number of new product prototypes. And that's just for material science. There's a chart like this for gene sequencing and drug discovery, signal processing and communications, computer-aided drafting and product design, physics-based modeling and simulation, movies and music and video games.

Almost every industry is seeing a rise in research papers, patents, and prototypes thanks to AI. This is what I mean when I say get in early. This is why the world is spending hundreds of billions of dollars on Nvidia's GPUs. This is why it's so important to understand the science behind the stocks. And if you want to see more science behind the stocks, check out this video next. Either way, thanks for watching and until next time, this is Ticker Symbol You.

My name is Alex, reminding you that the best investment you can make is in you..

Key Takeaways

- AI is going to augment jobs, not replace them, and will make employees more productive, leading to higher profits for companies.

- The economics of AI are central to the investment thesis, with companies hoping to get at least a 2x return on an employee's total costs.

- AI agents can make employees 50% more productive, leading to a profit margin of 63%, and can help multiple employees, making the investment even more valuable.

- The global AI market is expected to grow rapidly, with potential returns of 10, 20, or even 30x, making it an attractive investment opportunity.

- Companies like Microsoft, Amazon, Google, and Meta Platforms are well-positioned to benefit from AI, with hundreds of thousands of employees who will become more productive and software and services used by billions of people.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.