Wall Street still doesn't understand Nvidia. Whether you're a long-time shareholder or you're worried about an AI bubble, Nvidia's earnings call was about much more than revenues and profit margins. Nvidia just showed Wall Street why they're dominating the entire AI era. So in this video, I'll break down everything you need to know about Nvidia's latest earnings and what it all means for Nvidia stock in 2026 and beyond. Your time is valuable, so let's get right into it.

Table of Contents

1. NVIDIA's Earnings

1.1. Data Center Revenues

2. NVIDIA Stock

2.1. Dominating the AI Era

3. Future Outlook

First things first, I'm not here to hold you hostage. So here's what I'll be talking about up front.

NVIDIA's quarter three earnings results, focusing on data centers, what Wall Street analysts still don't get about NVIDIA's ecosystem, my thoughts on NVIDIA stock, and if I'd still buy it at a $4.5 trillion valuation since it's the biggest company on earth, and of course, where NVIDIA goes on my list of stocks to get rich without getting lucky in 2025, which has been absolutely crushing the market since I made this list a year ago.

So, here's the full list, along with every stock's year-to-date performance and how it's doing versus the S&P 500. As you can see, NVIDIA is right at the top and we're outperforming the market by a large margin. I'm not trying to toot my own horn here, but I do think it's important to understand the science behind these stocks, which is just my way of saying how the companies behind the ticker symbols actually make their money.

So, let's do just that by diving into nvidia's latest earnings call nvidia reported record revenues of 57 billion dollars for the quarter which is up 22 percent quarter over quarter and a whopping 62 percent year over year it's easy to take these huge numbers for granted so let me say it another way nvidia's quarterly revenues grew by 10.3 billion dollars in the last 90 days that's over a billion dollars more than all of amd makes and nvidia posted earnings per share of a dollar and 30 cents which is up by 20 percent from last quarter and up by 67 percent from last year so the biggest company in the world is growing revenues and earnings by over 60 percent per year that's not something the stock market sees every day on paper nvidia has four major business units data center gaming and ai pc professional visualization and automotive and robotics but in reality nvidia's data center business accounts for 90 of their total revenues and is growing faster than any of their other segments so that's where i'm going to spend your valuable time nvidia's data center revenues came in at 51.2 billion dollars which is up 25 from last quarter and 66 from last year there are three big points about these numbers that are important for investors to understand First, they don't include any chip sales to China, and NVIDIA's current guidance assumes zero data center revenues from China going forward.

So, if NVIDIA can ever re-enter the Chinese AI market, that would be pure upside from here. Second, NVIDIA's B300 Blackwell Ultra chip sales are still ramping up. Like I said last quarter, these B300 chips will be huge for NVIDIA's data center revenues in the second half of 2025, and now everyone can see that in their revenue growth.

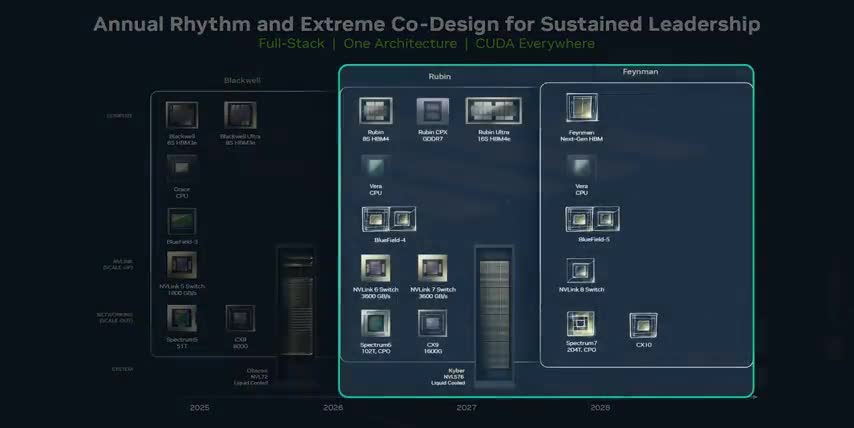

but while wall street is reacting to their massive growth after earnings my audience saw it coming months ago because every single one of you is taking the time to understand this company's products not just their profits and we knew that blackwell ultra's 50 increase in performance throughput and high bandwidth memory means much more revenue and once blackwell ultra is done ramping nvidia still has vera rubin coming in 2026 rubin ultra in 2027 and fineman in 2028 so we see this pattern year after year after year and the third important point about nvidia's data center revenues is they don't just come from the gpus themselves 8.2 billion dollars of that revenue came from rack level networking technologies like spectrum x ethernet and quantum infiniband as well as chip to chip connections like nvlink and nvlink fusion as a result nvidia's revenues from networking grew by a whopping 164 year over year and they now account for 14 of nvidia's total revenues so not only is nvidia's networking business already bigger than their gaming visualization and robotic segments it's also now the largest networking business in the world by quarterly revenue and just like we already know about nvidia's next three gpus we also know they're coming out with new data center cpus new versions of their bluefield data processing units or dpus as well as new chips for nvlink spectrum x and infiniband every single year this is why nvidia is dominating the entire ai era this is what i mean when i say get in early this is why it's so important to understand the science behind these stocks on top of that according to market us the global artificial intelligence market is expected to almost 19x in size over the next nine years which is a compound annual growth rate of 38.5 through 2033 but many of the companies building next generation ai applications are not publicly traded think about the 90s and early 2000s companies like amazon and google went public very early in their growth cycle but today they're waiting an average of 10 years or longer to go public that means investors like us can miss out on most of the returns from the next amazon the next google the next nvidia that's where fundrise comes in the sponsor of this video their venture capital product lets you invest in some of the best tech companies before they go public venture capital is usually only for the ultra wealthy but venture capital with fundrise gives everyday investors access to some of the top private pre-ipo companies on earth with an access point starting at ten dollars they have an impressive track record already investing almost 400 million dollars in some of the largest most in-demand ai and data infrastructure companies so if you want access to some of the best late stage companies before the ipo check out venture capital with fundrise using my link below today alright so nvidia's revenues and earnings per share both grew by more than 60 percent year over year on top of that they have visibility into more than half a trillion dollars in total blackwell and ruben revenue for 2025 and 2026 combined which is more than five times the lifetime revenues for hopper the gpu architecture that kicked off the entire generative ai revolution by powering chat gpt when openai released it back in 2022 but now let me show you something that will put you ahead of every investor saying it's too late to buy nvidia stock or that the market's in an ai bubble the real reason that nvidia will dominate the entire ai era isn't because they make six new ai chips every year.

It's the value they unlock by putting them all together. During his recent keynote speech in Washington DC, Jensen Huang showed three slides that every investor needs to understand. So, let me break them down for you.

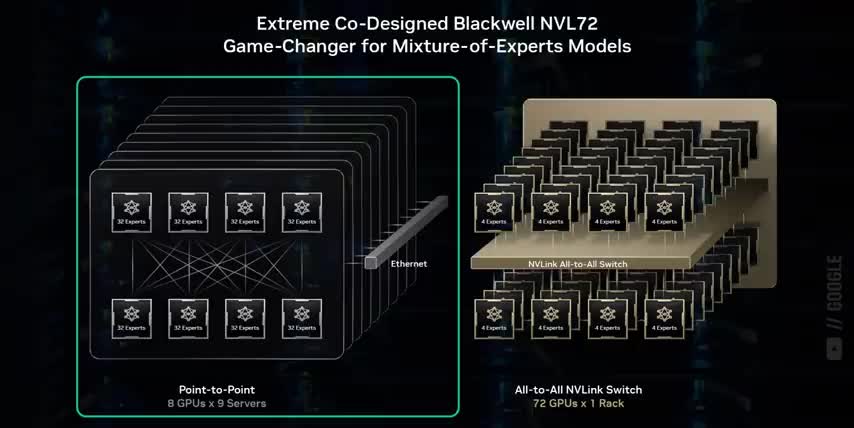

This first slide explains the difference between Hopper and Blackwell at a high level Hopper systems have nine compute trays with eight GPUs per tray But while each tray GPUs can work together the trays were connected via ethernet creating a big bottleneck on the other hand blackwell connects all 72 gpus together via 9 and vlink switch trays so they can all act like one giant gpu and that changes everything jensen's second slide compares the performance of blackwell and hopper in two ways The x-axis is tokens per second per user and the y-axis is tokens per second per megawatt.

Long story short, Blackwell systems can generate 4 to 6 times more tokens per GPU or they can support 3 to 6 times the users for the same amount of power. Depending on their needs, data centers can make trade-offs between the number of users they support and the number of tokens they want to generate per user, which is what this GB200NVL72 line represents.

So compared to the choices that Hopper provided, Blackwell systems can generate around 10 times more tokens per dollar or per watt or per second which directly translates to 10 times more revenues for the data centers running them. And this third chart shows the same thing, but in terms of costs instead of performance. So while it costs 70 cents to generate a million tokens on Hopper, it costs just 7 cents to generate those same tokens at the same speeds on Blackwell.

Or going the other way, Blackwell systems could generate enough tokens for 3 to 6 times more users at the same speeds for that same 70 cents. That's why Blackwell is such a big deal. And Blackwell Ultra, and Vera Rubin, and Rubin Ultra and so on. But there's one more piece of the puzzle that I didn't even think about until I talked to Dion Harris, Nvidia's Senior Director of High Performance Computing, Cloud, and AI Infrastructure go to market.

I asked Dion what metrics I should be watching as an investor to understand not just the performance, but the real value that AI is delivering to businesses. And his answer really surprised me. Here, take a look. But profits and margins are really something you see in the rearview mirror, right? So one of the questions I have is like, I try to look at forward looking indicators as an investor.

What benchmarks or metrics can we focus on to better understand like the real business value for inference in real time? As you drive more performance, more throughput per dollar per watt, that actually reduces the cost per token. And when you reduce the cost per token, you can actually embed that AI into even more services, even more use cases, and therefore deliver more value to your end users. When you think about AI, it's a lot more than LLM. So it includes image classification.

It includes, you know, lots of different types of recommender systems that are being used to serve ads and content. And so when you think about, you know, today where we are, we're in a fairly, you know, demand driven economy means there's a huge demand for a lot of these capabilities. But again, you have to be able to do it intelligently and smartly.

If you can drive the cost down to zero, now you can literally embed these AI APIs into every application that you're running. And therefore, that's when you really start to see this ubiquitous use of AI. And so that's really why we think about how we want to drive more performance and more efficiency. The cost per token goes going down by 10x will actually increase the overall utilization by 20x.

because now you have a lot more use cases where you can afford to embed these AI capabilities There a concept in economics called the price elasticity of demand which is just a fancy way of saying that when the price of something goes down, overall demand for that thing goes up much faster.

For example, when the price of electricity got low enough, every home switched over to it from wax candles, gas lighting, and coal furnaces, and that drove the overall demand for electricity up much more than the cost per kilowatt went down. And that trend is still going strong today, as every modern home uses electricity for almost everything, lighting, heating, but also for computers, appliances, and even cars.

And the big takeaway for investors is that demand for AI is working the exact same way. The 10x performance jump from Hopper to Blackwell isn't just about increasing revenues for data centers today. As the cost per token drops, that opens up new use cases across a wide variety of industries and areas of research. And as the power per token drops, some of the AI workloads that need to run in data centers can now run on edge devices.

Not just smartphones and laptops, but humanoid robots and self-driving cars, which unlock even more demand for AI in the process. As a result, a 10x cost reduction could lead to a 20, 50, or even 100x overall increase in demand for token generation. current AI users are getting more bang for their buck and new AI use cases keep getting unlocked.

And that leads to even more AI companies finding new ways to lower token costs even further, which just keeps this virtuous cycle going, just like it did for internet speeds, and computer performance before that, and electricity costs before that. And we haven't even gotten to the massive software ecosystems that sit on top of all this hardware infrastructure, which just drive costs down even further.

Let me know in the comments if you want me to make another video covering nvidia's massive software ecosystems and i'll post my full interview with deon harris pretty soon so stay tuned for that but for now let's bring the discussion back to the future of nvidia stock and if you feel i've earned it consider hitting the like button and subscribing to the channel that really helps me out and it lets me know to make more content like this thanks and with that out of the way let's talk about nvidia stock i think nvidia will be the world's first 10 trillion dollar company i'm not saying it'll happen tomorrow or even in the next couple years but it will happen sooner than most investors think their revenues and earnings are still growing by over 60 per year and that's without selling any chips to china nvidia currently has visibility into more than half a trillion dollars of total revenues from blackwell and ruben by the end of next year and we still have the ruben ultras and fineman architectures coming in the years that follow and even though nvidia is the world's most valuable company today it's still relatively cheap trading at half the forward price to earnings ratio of its two biggest competitors amd and broadcom that's why i'm still buying nvidia stock today and why it's staying at the top of my list of stocks to get rich without getting lucky only behind a fund that it sits at the top of anyway like i've been saying for years now just because a company is already big doesn't mean it won't keep growing just like microsoft did and amazon before that and almost every trillion dollar company on my list and if you want to see what other stocks i'm buying to get rich without getting lucky check out this video next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- NVIDIA's quarterly revenues grew by 22% quarter-over-quarter and 62% year-over-year.

- NVIDIA‘s data center business accounts for 90% of their total revenues and is growing faster than any other segment.

- NVIDIA's data center revenues came in at $51.2 billion, up 25% from last quarter and 66% from last year.

- NVIDIA has visibility into more than half a trillion dollars in total Blackwell and Ruben revenue for 2025 and 2026 combined.

- NVIDIA's revenues and earnings per share are still growing by over 60% per year, without selling any chips to China.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.