Table of Contents

1. Introduction to TSMC

2. What TSMC Does

3. TSMC's Revenue

4. TSMC's Earnings Call

5. TSMC's Future Growth

6. Importance of TSMC in AI Revolution

7. Advanced Packaging Technologies

8. Key Takeaways

Introduction to TSMC

What if I told you that the most important company of the entire AI era is not Nvidia, it isn't Google, or Tesla, or even Palantir. And this company is growing faster than almost all of them, making its stock a great way to get rich without getting lucky. Your time is valuable, so let's get right into it. First things first, I'm not here to hold you hostage. This post is all about the Taiwan Semiconductor Manufacturing Company, ticker symbol TSM. And here's what I'm going to cover.

What they do and how they actually make their money today? TSMC's crazy quarter three earnings call and their future growth, why they're actually the most important company to the entire AI revolution, and of course what this all means for TSM stock as a result. There's a ton to talk about, so let's start with what they actually do in the AI era. There are two things that make TSMC so special.

One, they're the most advanced chip maker on the planet, and two, they don't make any chips for themselves.

Instead, they make their revenue by selling custom semiconductor wafers and fully packaged chips to the world's top tech companies and because tsmc is so far ahead of other chip makers like samsung and intel their production capacity ends up getting reserved by their customers years in advance that makes tsmc especially important for investors to follow if they want to understand where ai is headed next since the chips that tsmc built today power the software services and applications of tomorrow 87 of tsmc's revenue comes from just two markets smartphones and high performance computing so let's look at what chips they actually make and for who here's a table i made of tsmc's top customers what percent of their revenue that customer represents and the chips they make for each so for example apple accounts for around 22 percent of tsmc's trailing 12-month revenue and tsmc makes the a series chips for the latest iphones and the m series chips for macbooks and ipads but they also make chips for apple's competition like qualcomm's snapdragon 8 elite processors for flagship smartphones like the samsung galaxy s25 and the oneplus 13 as well as google's tensor g5 chips that go into the pixel 10.

What TSMC Does

that's another 15 of TSMC's overall revenue. Likewise, about 20 of their revenues come from Nvidia's Hopper, Blackwell, and upcoming Rubin GPUs, their Arm-based Grace CPU, as well as the GB200 Grace Blackwell super chips. But they also make chips for Nvidia's competition, like AMD's MI300, MI325, and MI350 series accelerators, as well as Broadcom's custom AI chips for hyperscalers and the networking chips that compete directly with Nvidia's InfiniBand.

Heck, a few percent of TSMC's revenue even comes from Intel's Lunar Lake and Arrow Lake CPUs even though Intel's Foundry business is one of TSMC's biggest direct competitors they also make the custom tranium and inferentia chips for amazon web services the custom tensor processing units for google cloud the maya 100 ai accelerators for microsoft azure the training and inference chips for meta platforms and the full self-driving chips that go into every tesla car truck cybercab and humanoid robot i'm breaking down tsmc's biggest customers for three key reasons first they account for over 70 percent of tsmc's total revenue so So now you have a solid understanding of what they actually make and for who Remember the best way to find great investments is understanding a company products not just their profits Second TSMC is so good at their job that every trillion-dollar tech giant needs to use them, even though TSMC also builds chips for their direct competitors.

TSMC's Revenue

They build power-efficient smartphone processors for Apple and for Qualcomm. They make data-centered GPUs for NVIDIA and for AMD. They build the custom AI accelerators for Amazon and Google and Microsoft. And third, as a result of these first two points, TSMC makes almost 70% of all chips made by third-party foundries on Earth, and almost 90% of all advanced processors like the smartphone and AI data center chips I just covered.

TSMC's Earnings Call

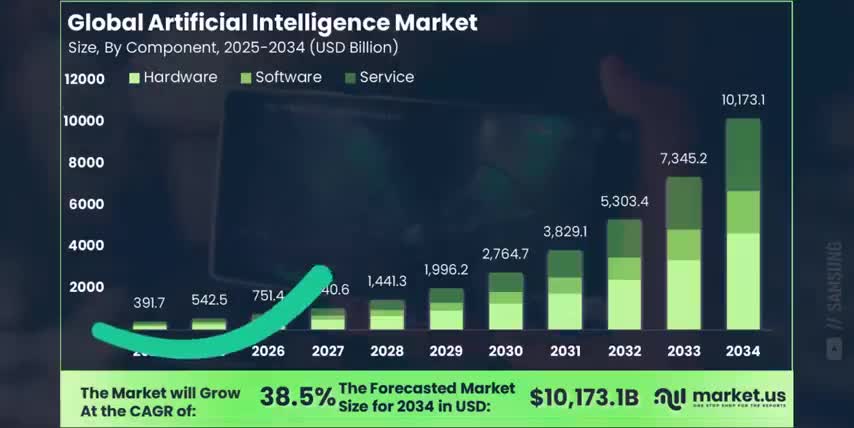

TSMC reported record revenues of 33 billion dollars for the quarter, which is up 10 percent quarter over quarter and a whopping 41 percent year over year. Their operating margins also expanded from 47 and a half percent last year to 50.6 percent today. Having over 50 operating margins doesn't just make them one of the most profitable hardware semiconductor or manufacturing companies, but also more profitable than the average software company, and that means TSMC is one of the most profitable AI companies on earth. Like I said earlier, 57 of their revenue comes from high performance computing, and another 30 comes from smartphones, which means 87 of TSMC's revenue is exposed to the two markets that benefit the most from the AI boom: data centers, where AI model training and inference happens today, and smartphones, which are constantly seeing new AI applications and agents at the edge. And if you think the AI chip market is growing fast, according to Market US, the global artificial intelligence market is expected to almost 19x in size over the next nine years, which is a compound annual growth rate of 38.5% through 2034.

But many of the companies building next-generation AI applications are not publicly traded. Think about the 90s and early 2000s. Companies like Amazon and Google went public very early in their growth cycle, but today they're waiting an average of 10 years or longer to go public.

That means investors like us can miss out on most of the returns from the next amazon the next google the next nvidia that's where fundrise comes in the sponsor of this video their venture capital product lets you invest in some of the best tech companies before they go public venture capital is usually only for the ultra wealthy but venture capital with fundrise gives everyday investors access to some of the top private pre-ipo companies on earth with an access point starting at ten dollars they have an impressive track record already investing more more than 250 million dollars in some of the largest most in-demand AI and data infrastructure companies so if you want access to some of the best late stage companies before the IPO check out venture capital with fundrise using my link below today all right so tsmc quarterly revenue came in at 33 billion dollars which is up 41 year over year while their operating margins expanded to over 50 but let's look at their revenue in a different way almost 80 percent of tsmc's revenue comes from advanced processing nodes which means any node 7 nanometers or below and the smaller the node the more in demand it's going to be from tsmc's most advanced customers Let's walk through what this means without all the industry jargon.

TSMC's Future Growth

A process node's size actually refers to the size of the features that chip fabrication processing line can put on a silicon wafer. Smaller feature sizes mean those chip-making machines can pack more transistors in the same area, which makes chips more powerful, more energy-efficient, or smaller depending on what the customer is looking for.

A chip made on a 3-nanometer node can have tens of billions more transistors than a chip made on a 5 nanometer node which means it can run better smartphone features bigger ai models or heavier cloud workloads than chips made on bigger nodes but the big trade-off is that smaller features are much harder to make which is why yields are another important metric that investors should be following tsmc's two nanometer nodes are entering mass production right now with yields around 65 and they're aiming for 75 yields as volume production continues to ramp that means one out of every three two nanometer chips that tsmc makes still doesn't work today and they're hoping to improve that to one out of every four tsmc's two nanometer yields are even lower coming in at around 30 to 50 percent depending on the chip and intel's yields are just 10 to 35 percent when it comes to the most advanced high performance cpus or ai accelerators meaning intel lose over two thirds of the two nanometer chips they make today.

This is why I always invest in TSMC over every other chip maker. This is why it's so important to understand the science behind the stocks. But why are the world's best chip makers losing so many chips along the way? Well, two nanometers is 50 times thinner than a single particle of the flu virus and 50,000 times thinner than a human hair.

That means absolutely everything can affect the yields of these chips, from tiny defects in the silicon wafers and tiny misalignments and distortions in the lithography lenses to a single atom of dust on a mirror so early in a node's life cycle chip manufacturers are still learning how to optimize every step and eliminate these failures which is why yields start low and naturally rise over time and since they have much higher yields than their competitors 74 percent of tsmc's revenue can come from advanced chips today with 23 coming from 3 nanometer nodes 37% coming from 5nm and the other 14% coming from 7.

By the way, all of this advanced chip capacity is fully booked through 2027, making this very reliable revenue for TSMC. And since most of TSMC's customers are at least indirect competitors like Apple and Qualcomm, Nvidia and AMD, and all three hyperscalers, once one company transitions their chips to their 2nm nodes, the other companies will have to follow suit if they want their chips to keep up.

Importance of TSMC in AI Revolution

That's why I think TSMC ramping up their 2nm chip production now and through 2026 will be a huge deal for TSM stock. Alright, so far we covered what Taiwan Semiconductor does, how they make their money, their quarter three earnings call, and their future growth. Now let me tell you something that will put you ahead of almost every Wall Street analyst that's covering this stock. And if you feel I've earned it, consider hitting the like button and subscribing to the channel.

That really helps me out and it lets me know to make more content like this. Thanks and with that out of the way, here's why they're the most important company to the entire AI revolution, even over companies like Nvidia, Tesla, and Palantir. While TSMC has the highest yields for every advanced chip fabrication node from 7 nanometers all the way down to 2, that's not the main reason I'm betting on them over companies like Intel and Samsung.

It's the advanced packaging that happens after a wafer leaves the fab.

Advanced Packaging Technologies

Advanced packaging is just a fancy way of saying the manufacturing methods that integrate multiple chips into a single package, like GPU and CPU cores, high bandwidth memory, custom chiplets, input and output controllers, and so on. The real bottleneck for AI is bandwidth, the speed of moving data to and through hundreds of thousands of GPUs. Better advanced packaging methods mean faster connections between GPUs and memory and IO controllers, which ultimately improves overall AI performance.

And there are two packaging technologies that TSMC basically has a chokehold on. The first is called COWOS, C-O-W-O-S, which stands for Chip on Wafer on Substrate. COWOS creates an ultra-high bandwidth, ultra-low latency connection directly between two chips. For example, the two dies that make up an NVIDIA Blackwell GPU are connected via COWOS, so they act like a single chip that's bigger than any modern machine can make today.

demand for co-op packaging more than doubled in 2024 and tsmc's co-op capacity is fully booked through 2027 even after their huge increases to production capacity that resulted in them controlling around 90 of the global co-op market the second advanced packaging technology is called soic which stands for systems on integrated chips at a high level this is a way to stack chips face to face and then create short but ultra high bandwidth connections between them chips like AMD's MI300X GPUs and their Epic line of data center CPUs stack their caches and compute dies with SOIC, and companies like Samsung and Intel are still roughly a generation behind on their version of chip stacking and packaging technology.

The thing investors really need to understand is that packaging is deeply tied to a chip's layout, its power, and its thermal requirements. So if a company like Nvidia or Apple wants to switch to one of TSMC's competitors, they have to redesign the entire chip so that it can be made with entirely new process nodes and packaging techniques, making TSMC almost impossible to switch away from.

And since they already make the most important chips for every AI company from Nvidia to AMD and from Google to Tesla, TSMC is actually the most important company of the entire AI era, making it a great stock to get rich without getting lucky.

Key Takeaways

And if you want to see what other stocks I'm buying to get rich without getting lucky, check out this post next. Either way, thanks for reading, and until next time, this is TickerSymbol: YOU. My name is Alex, reminding you that the best investment you can make is in you.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.