Introduction to Palantir Stock

Palantir is one of the most powerful AI companies on the planet, as they create some of the most powerful AI platforms on the planet, and they have just crossed a billion dollars in quarterly revenue. However, with Palantir stock more than doubling so far this year, there is really only one question left to ask: are we seeing the top for Palantir stock, or are its best days still to come? Your time is valuable, so let's dive right in.

Table of Contents

1. Palantir's Quarterly Earnings Results

2. Palantir's Crazy Growth and Valuation

3. Is Palantir a Good Investment?

First things first, if you consider yourself a value investor then this video is not for you. Palantir's price to earnings ratio is around 600 and if that's all it takes for you to ignore a generational winner I want to respect your time. This is a once in a generation uh truly anomalous quarter uh and we're very proud and we're sorry that you know our haters disappointed but there are many more quarters to be disappointed and we're working on that too. For everyone else here's what I'll cover in this post: Palantir's quarterly earnings results, their central role in the enterprise AI revolution, the right numbers to understand Palantir's crazy growth and valuation, and of course where Palantir goes on my list of stocks to get rich without getting lucky in 2025.

So here's the list I created back in December with each stock's performance year to date, and its performance versus the S&P 500 since the whole idea is to get rich without getting lucky. As you can see, we're already crushing the index, and now it's time to start adjusting the order as new numbers come out. So, let's dive right into Palantir's insane quarterly earnings.

Palantir's Quarterly Earnings Results

Palantir reported record revenues of billion for the quarter, which is up by 14% quarter over quarter and a whopping 48% year over year. But their growth gets even more interesting when we break their revenue down by business unit. Palantir has four major business units, U.S. Commercial, U.S. Government, Non-U.S. Commercial, and Non-U.S. Government. As Palantir continues to grow, investors want to watch Palantir's U.S. commercial growth the most, since that's the largest and most lucrative market for all of their platforms.

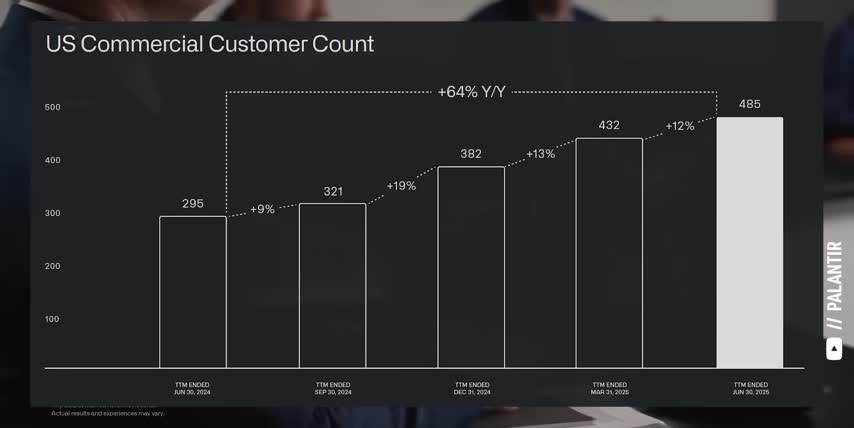

Palantir's U.S. commercial revenue came in at $306 million for the quarter, which is up by 20% quarter over quarter and a massive 93% year over year. In my previous video covering the Figma stock IPO last week, I talked about two key metrics that investors should obsess over when it comes to AI software businesses, customer retention, and net dollar retention rate. Palantir's U.S. commercial customer account grew to 485, which is up 12% quarter over quarter and 64% year over year.

Not just for the enterprise markets that Palantir already plays in, like supply chain management and logistics, life sciences and healthcare, and energy and automotive, but for new markets altogether, which should only accelerate their growth over time. On the other hand, Palantir's net dollar retention rate grew to 128% for the quarter, which is the highest it's been in over three years. Net dollar retention measures how much recurring revenue a company makes from its existing customers year over year.

Palantir's net dollar retention rate of 128 means their existing customers spent 28 more with them this year versus last. The reason that investors should obsess about these two retention numbers is because they multiply together. Palantir is acquiring 64 more customers and growing their revenue per customer by 28, which is why they're seeing such explosive U.S. commercial revenue growth.

In fact, half of all companies are already using AI and the tech sector has shrunk by over 100,000 jobs this year alone. That sounds scary, but what the media isn't reporting is that these same companies are hiring anyone who understands AI. The same is true if you're freelancing or if you run your own business like I do. AI is not optional. It's a competitive advantage that you either have or you don't.

OutSkill is running a two-day AI training to take you from beginner to advanced AI professional in just 16 hours, this Saturday and Sunday. And they're giving the first 1,000 people who sign up with my link a free seat. Whether you work in tech or sales, marketing or HR, you'll learn to use 10 of the most powerful AI tools like Make.com and Claude, best practices for prompt engineering, learn how to analyze data and automate workflows without coding, and even build AI agents.

Is Palantir a Good Investment?

Over 4 million people from 40 different countries have already participated, and slots for this one are filling up faster than ever. This is a great way to level up your AI knowledge, get a serious competitive advantage, and understand the science behind the stocks. So make sure to register for your free seat with my link below today.

Palantir's platforms are in a unique position to enable that because they have 20 years of experience solving the hardest data science problems for the Department of Defense. A bug in consumer software might mean a refund or an apology. A bug in Palantir's government deployments could mean an airstrike at the wrong coordinates. That's why manufacturing companies trust Palantir Warp Speed, which is their operating system to optimize production schedules, supply chains, and quality control.

That's why healthcare organizations trust AIP to accelerate their clinical trials, enhance patient care, and streamline regulatory compliance. That's why financial services trust Foundry to assess their risks in real-time, detect fraudulent transactions, and trust Palantir with their most sensitive data. While software companies that like to move fast and break things can't even get in the door.

That's why Palantir's customer account and net dollar retention rate keep climbing. That's why Palantir has a Rule of 40 score of 94 with high growth revenues and operating margins. That's why it's so important to understand the science behind this stock.

Key Takeaways:

- Palantir reported record revenues of $1 billion for the quarter, up by 14% quarter over quarter and 48% year over year.

- Palantir's U.S. commercial revenue came in at $306 million for the quarter, up by 20% quarter over quarter and 93% year over year.

- Palantir's net dollar retention rate grew to 128% for the quarter, which is the highest it's been in over three years.

- Palantir's Rule of 40 score is 94, which is one of the highest among all enterprise software companies.

- Palantir is a great bet on AI infrastructure, but it's much more focused than Amazon Web Services.

Alright, this was easily one of Palantir's best earnings calls yet, but the stock price is up by an insane 600% since this time last year, and it's now over $170 per share. Which means there's really only one question left to ask. Is it too late to buy Palantir stock, or are there best days still to come?

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.