Millionaires are made when the stock market crashes, and the bigger the decline, the bigger the opportunity. Especially if you know which stocks to buy and how to be greedy when others are fearful. That's the best way to get rich without getting lucky. So in this post, I'll show you the best way to take advantage of this latest market downturn before it's too late. Your time is valuable, so let's get right into it.

Table of Contents

1. Introduction

2. Understanding Market Fear

3. Market Manipulation

4. Consumer Sentiment

5. Being Greedy When Others Are Fearful

6. Stock Picks

I'm making this video now because some of the top ai stocks on the market are starting to crash semiconductor stocks like nvidia and amd are down by 10 percent while high performance computing companies like core weave are down by over 20.

but being greedy when others are fearful doesn't mean blindly buying the dip that's not a good investment strategy the first step is understanding what's causing the fear in the first place investing is never about gut feelings we want to look at data to understand what's really happening in the market and i'll show you how to do that throughout this video step two is finding the market's biggest mistakes specifically the biggest mismatches between a stock's price and the company's real value and i'll show you how i do that too step three is making a plan if everything is going on sale which stocks should we actually be buying so of course i'll show you the top three stocks i'm watching right now and step four is updating our plan as things continue to change because the market is always changing which brings us right back to step one that means long term investing shouldn't be something that we rush into only when prices start to fall it's an ongoing process that helps you adapt to whatever the stock market throws at you so let's start by looking at some data to understand what's really going on right now there are two big stories causing stocks to drop first michael burry is famous for predicting the global financial crisis and shorting the u.s housing market before it collapsed in 2008 and now he's betting over a billion dollars that ai will be the next bubble to pop a few days ago burry's fund scion asset management disclosed a 900 million dollar short position against palantir and another 200 million dollar short position against nvidia these are massive bets for michael burry together accounting for 80 percent of his overall portfolio it's important for investors to remember that short positions are bets on short-term price action, not long-term value.

So Michael Burry isn't really betting against AI as much as he's betting that AI stocks are overbought and they'll go down before they make their next move up. The thing is, Michael Burry is famous enough to move the market, so his short positions become something of a self-fulfilling prophecy, since all the media attention and headlines covering them become the reason that those stocks fall in the first place.

Being short is a very difficult place to be because you can lose everything, right? You can drive these people into the ground. Thank God. Michael Burry put a really big bet on it. It's almost a billion dollars. It's $912 million. What do you do? What do you go back in? Well, first of all, it's like he's actually putting a short on AI. So the way I read it, it was us and NVIDIA. Honestly, I think what is going on here is market manipulation.

We delivered the best results anyone ever seen It not even clear he not doing this to get out of his position You know currently as far as I can tell the two companies he shorting are the ones making all the money which is super weird Like, the idea that chips and ontology is what you want to short is batshit crazy. Whether or not this is really market manipulation, it's definitely market noise and has nothing to do with the underlying value of these businesses.

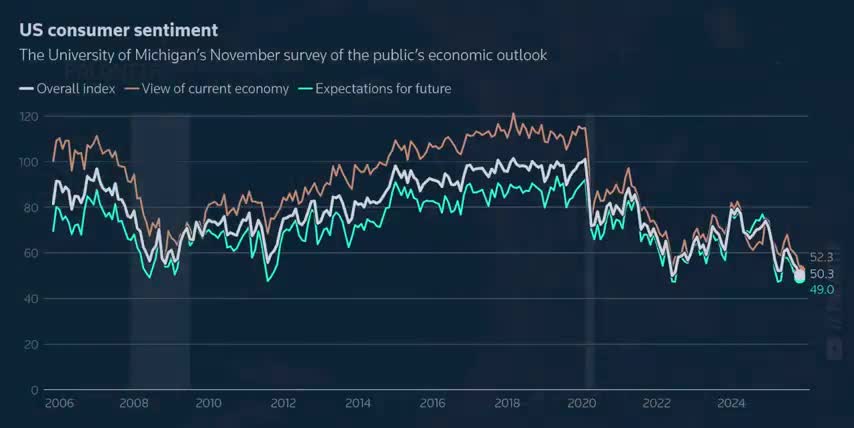

The second story causing stocks to drop is a little more meaningful, and that's the U.S. government shutdown and its impacts on the economy. The latest Consumer Sentiment Survey hit its lowest reading since 2022, and its second lowest reading in history. The University of Michigan Consumer Sentiment Survey is a monthly report that measures consumer confidence in their personal finances, the current state of the economy, and their outlook on the future.

That makes this survey a leading indicator of overall economic activity and good data for investors to be tracking. The way to read this data is that a score of 100 means consumer sentiment is neutral. Scores above 100 mean more people are positive about the economy, while scores below 100 mean more people are negative. So, a score of 115 in February of 2020 would mean that consumers had a slightly positive overall outlook on the economy.

The public's view of the current economy just hit a 20-year low of 52, which means most consumers have a negative view of the economy today. That's even lower than in the summer of 2022 when the S&P 500 crashed by around 20%, and their expectations for the future are even lower. So, as of Friday, November 7th, when this data was released, the Sentiment Index shows that consumers have a very pessimistic outlook on the economy, which means they'll spend less money over time.

and the companies we invest in will report lower revenues and profit margins as a result. That's the big connection between consumer sentiment, spending, and the stock market. The biggest takeaway here is that stocks like NVIDIA, AMD, Palantir, and CoreWeave aren't dropping because of problems with their businesses. They're dropping from events that are completely out of their control.

We have record-low consumer sentiment, causing fears of lower earnings for great companies in general, and downward pressure on AI and semiconductor stocks specifically from Michael Burry Shorting, Palantir, and Nvidia. And now that we know investors are afraid, but not because of any fundamental issues with these companies, the next step is to figure out just how greedy we can be. And we do that by looking at even more data.

And speaking of data, you probably know that VPNs protect you and your data by encrypting it and making it look like you're somewhere else.

But did you know that VPNs can also save you a ton of money? That's where surfshark comes in the sponsor of this video surfshark is a super fast and easy to use vpn that you can install on unlimited devices with just one account to protect you and your entire family but some online stores raise their prices based on your location so you can also use surf shark to always get the best price on expensive purchases like plane tickets hotel rooms and rental cars and since vpns change your digital location surf shark lets you access content websites and services that are blocked in your region altogether I do this all the time when I travel So if you care about your family privacy and you like saving money you can go to surfshark slash ticker to get up to 4 extra months for free And since Surfshark offers a 30-day money-back guarantee, there's no risk in trying it with my link in the description below today.

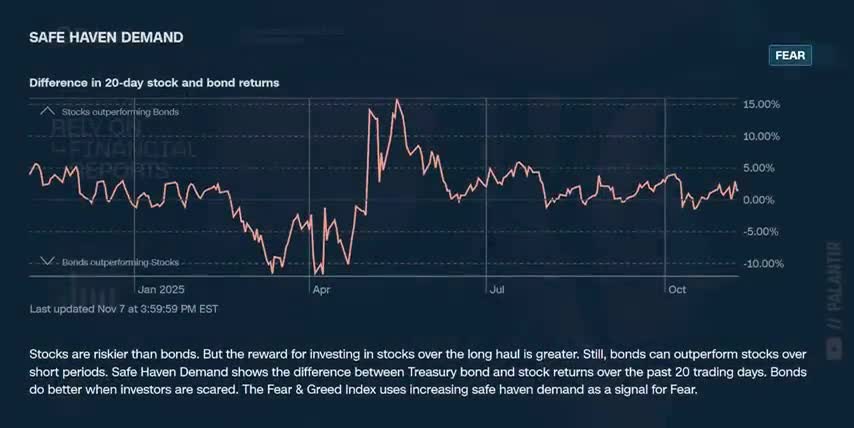

Alright, let's look at some data to figure out how greedy we should be and when. One of my favorite indicators is CNN's Fear and Greed Index, which I'll leave a link to below for you as well. The index goes from 0 to 100 and it's currently showing extreme fear in the market. You can also see a 1-year timeline, which is a good way to see how fast the index fell since the US government shutdown began in October, followed by the news of Michael Burry's short positions last week.

This is very useful information for anyone looking to be greedy when others are fearful. The reason it's one of my favorite data sources is it's calculated from 7 useful market indicators, Like stock price momentum, strength and breadth, the ratio of puts to call options, market volatility, demand for stocks vs bonds, all of which are different ways of measuring risk in the stock market. Out of these 7, I pay attention to market momentum and volatility the most.

I like to dollar cost average into my favorite stocks more aggressively when market momentum falls below its 125 day moving average, which is 6 months of trading days. As you can see, we're not there yet, but look what happened back in April. The market's momentum was well below the 6-month average from mid-March to mid-May, which ended up being the perfect time to buy stocks. And market momentum hit its low point on April 8th, the exact same day the S&P 500 bottomed.

I also like to buy stocks when the VIX, which is the S&P 500's volatility index, rises to 30 or higher. That hasn't happened yet either. But if we look back at April, we can see the VIX also peaked on April 8th, the exact bottom for the S&P 500, making it another powerful indicator for knowing when we should be greedy. So, in my opinion and based on all this data, now isn't the right time to buy the dip just yet.

I'm waiting for the VIX to get closer to 30 and for market momentum to drop below its 6-month average, at which point both of these indicators will be in extreme fear territory. Until that happens, my plan is to keep building cash and dollar cost averaging into all my holdings like normal. That's how I use data to drive my investment decisions instead of gut feelings. And now you can too. Which brings us right to step 3.

Deciding which stocks to watch ahead of time so we're ready to buy them when the time is right. And if you feel I've earned it, consider hitting the like button and subscribing to the channel. That really helps me out and it lets me know to make more content like this.

Thanks and with that out of the way, let's find some undervalued stocks remember how we got here consumer sentiment is near an all-time low and ai stocks are feeling extra pressure from michael burry's short positions on nvidia and palantir so i'm looking for at least one of two things when it comes to picking stocks first i want them to be affected by consumer spending since i don't expect consumer sentiment to stay near all-time lows forever that way when consumer sentiment rises the stocks i pick will rise as well and second i want want them to be core holdings for the AI era That way when headlines around Michael burry big short on ai stocks fade away the stocks i pick will see even more upside so let start with amazon everybody knows that amazon is the world's biggest e-commerce company and amazon web services is the world's biggest cloud service provider so it already checks both of these boxes according to discounted cash flow models like simply wall street's amazon is currently 17 undervalued said Said another way, Amazon stock would have to go up by 20% to hit its fair value today.

That's a 20% upside on one of the biggest and most diversified businesses on the planet. And I think that's actually conservative, since most industry analysts and investors tend to underestimate Amazon's overall growth. For example, most of them still don't realize that advertising is one of Amazon's fastest growing segments. In fact, Amazon is already the third largest advertising company on earth. only behind Google and Meta platforms.

Speaking of which, while most analysts are worried that Meta is burning too much cash on the AI revolution, my audience understands that AI takes a lot of research, development, and infrastructure investment. Meta Platforms serves 3.5 billion monthly active users, so they're actually investing to stay ahead of the curve and serve their massive user base. According to DCF models, Meta Platforms is currently 45% undervalued, giving it an 81% upside from today's prices.

That's an 81% upside on one of the biggest companies sitting at the center of the AI revolution. Like I said at the start of this video, millionaires are made when the stock market crashes, and now you can see why. And that brings me to CoreWeave. CoreWeave is a cloud computing company that provides infrastructure for AI workloads, which means cutting-edge GPU clusters, high-bandwidth networking, and high-performance data storage.

What I really like about CoreWeave is they get priority access to NVIDIA's latest data center infrastructure. Not just the latest GPUs, but the CPUs, the data processing units or DPUs, the latest generation of NVLink switch chips, and all the networking equipment to connect them all for AI at massive scales.

On top of that, CoreWeave is NVIDIA's biggest public investment by far, representing around 90% of their public portfolio which is why i'm so comfortable holding the stock for years even though they just went public six months ago and thanks to their insane year-over-year revenue growth of 207 discounted cash flow models calculate core weave's fair value to be over 400 dollars per share which would be around a 300 upside from today's prices talk about an obvious investment for the ai era so hopefully this video helped you understand why stocks dropped over the last week what data to look at to be greedy when others are fearful and of course three great stocks to watch for when it's the right time to buy because relying on data instead of gut feelings is the best way to get rich without getting lucky and if you want to see what other stocks i'm buying to get rich without getting lucky check out this video next either way thanks for watching and until next time this is ticker symbol you my name is alex reminding you that the best investment you can make is in you.

Key Takeaways

- The stock market crash presents an opportunity to make money if you know which stocks to buy and how to be greedy when others are fearful.

- Understanding what's causing market fear is crucial to making informed investment decisions.

- Market manipulation and consumer sentiment are two key factors affecting the market right now.

- Being greedy when others are fearful requires looking at data and making informed decisions, rather than relying on gut feelings.

- Amazon, Meta Platforms, and CoreWeave are three stocks that could be good investments for the AI era.

- The stock market crash presents an opportunity to make money if you know which stocks to buy and how to be greedy when others are fearful.

- Understanding what's causing market fear is crucial to making informed investment decisions.

- Market manipulation and consumer sentiment are two key factors affecting the market right now.

- Being greedy when others are fearful requires looking at data and making informed decisions, rather than relying on gut feelings.

- Amazon, Meta Platforms, and CoreWeave are three stocks that could be good investments for the AI era.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.