Introduction to Figma Stock

Figma just went public and it could be one of the most exciting stocks of the AI era. They want to be the operating system for digital design and the foundation for building every online product. Could Figma be the next big AI platform stock like Nvidia or Palantir? Or will Generative AI make them crash like so many companies before? Your time is valuable, so let's get right into it.

Table of Contents

1. What is Figma

2. Figma's AI Strategy

3. Investing in Figma

What is Figma

First things first, I'm not here to hold you hostage, so here's what I'll be covering up front: what Figma does and how they make their money, the markets that Figma dominates and how fast they're growing, Figma's AI strategy to fend off their competition, and of course, what all that means for Figma stock right after its IPO. There are timestamps so you can jump to different sections of the post, but let me point out a few things before you do. First, investing in IPOs always has some extra risks, like the stock being overhyped, the price making big swings as investors rush in, and limited financial history since private companies don't report their earnings like public ones do. So, I spent the last week reading through Figma's S1 filing, which has all the information on the company, its operations, finances, and risks. Most of what I'll cover comes straight from the source, and I'm sharing my research for educational purposes only.

Figma's big value add is letting multiple teams of people across multiple operating systems work together on any phase of a visual project all at the same time, all while seeing everybody's changes in real time, and all without ever needing to install an app, kind of like Google Docs, but for user interfaces.

Figma's software also enforces all design requirements across the entire process, which is huge for enterprises and big-name brands that go for specific looks and audiences, that's why Figma is used by designers, developers, product managers, and marketing teams at companies of all sizes, including 95 of the Fortune 500.

Figma's AI Strategy

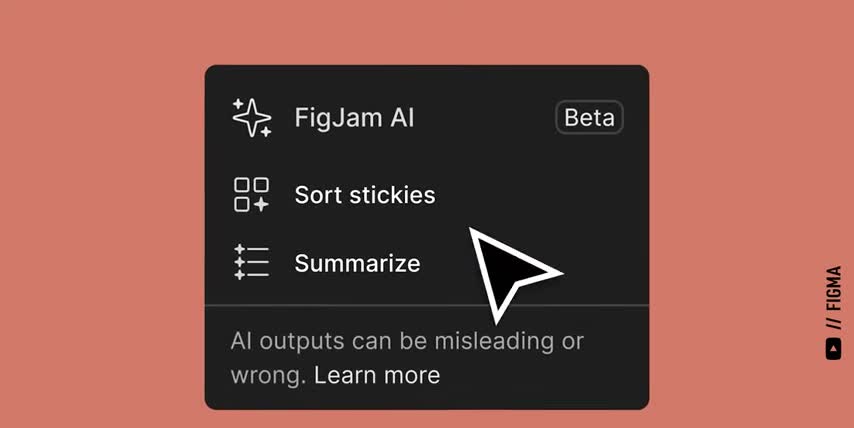

FigJam is Figma's digital whiteboarding tool, used for collaborative brainstorming, product planning, and mapping user interfaces. Figma is adding AI features like automated layout suggestions, intelligent spacing recommendations, intelligent handling of asset variants, and content-aware resizing, all of which positions Figma to handle more sophisticated design and interaction requirements. Dev mode launched in 2023 as a way for Figma to add developer workflows to their growing list of revenue streams. Dev mode addresses the challenges between somebody non-technical approving a design and the developers that have to actually implement it by providing code generation, asset measurement, and export tools, and integrations with different development environments, that makes it the perfect part of Figma's platform to integrate AI tools like code generation, responsive design creation, and custom asset automations.

Figma Make is their most aggressive expansion into AI content creation and it just entered general availability this past month. Unlike competing AI tools that generate static designs, Figma Make takes in prompts and generates functional prototypes and interactive web apps that are ready for deployment. That means that even non-designers can create prototypes, validate concepts, and use existing design systems that stay consistent with the rest of the brand. This also gives Figma a huge advantage in terms of data from millions of users making billions of design decisions all across their platform, which can then be used to train the next generation of Figma AI design tools.

Investing in Figma

Alright, now that we understand what Figma actually does, the markets that they operate in, and their overall AI strategy, we can ask the big question, is Figma stock a good investment right after its IPO? Figma definitely has a lot going for it. Their customer count with businesses that make over $100,000 a year has been growing by 50% per year for the last two years. Figma's existing tools are much more popular with users than competing products from much bigger companies like Adobe. And they're constantly coming out with new tools to address design challenges at every step of the process, from whiteboarding with FigJam to transitioning designs to developers via dev mode and then pushing them to production.

That combination of customer growth, customer satisfaction, and expanding into new markets like developers is what's driving Figma's revenue to grow 46% year over year. But there are real risks to buying this stock, especially right after its IPO. Figma's S1 filing makes special mention of competitive risks from AI-native design tools like Midjourney, Dolly, and other generative AI platforms focused on automated design creation. If those tools start handling more complex interface design and prototyping tasks, then they could reduce demand for Figma's platform.

Key Takeaways

Figma's AI strategy and the success of Figma Make will decide if the company captures the design market or gets disrupted by more advanced AI workflows from their competitors. Ultimately, if you believe collaborative design will form the foundation of how all digital products will be built in the AI era, then Figma is a solid stock. On the flip side, if you believe more specialized AI-powered design tools will become commodities, then Figma can be more easily replaced, which would make it a pretty expensive bet against the generative AI revolution.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.