The Investment Opportunity of a Lifetime (Don't Miss Out)

Introduction to the AI Revolution

I'm convinced that Wall Street still doesn't understand AI, and I think I figured out why. I just got back from two huge AI conferences in Paris, where I saw some serious innovations that investors need to know about. Things are moving fast, so in this video, I'll break down everything you need to know about the AI revolution, the reason Wall Street is still getting it wrong, and which stocks could win big as a result. Your time is valuable, so let's get right into it.

Checkout our YouTube Channel

Get the latest videos and industry deep dives as we check out the science behind the stocks.

Table of Contents

1. Introduction to AI Opportunity

2. Understanding AI Market Growth

3. Key Takeaways from AI Conferences

Understanding AI Market Growth

Just look at Apple, the third biggest company in the world and still Warren Buffett's biggest holding today. They tried to rebrand AI as Apple Intelligence in 2024, only to basically abandon it altogether in 2025. Now, I'm not here to naysay Apple or Warren Buffett, but my point is that if the world's biggest company and the world's best investor still don't have a solid AI strategy, then the average Wall Street analyst doesn't stand a chance. So, I've been trying something different.

I've been going to AI conferences and trade shows where I've been interviewing high-level executives and AI program leaders, talking to AI developers and end users, and touching real AI services, products, and prototypes, not just in the US, but in Asia and Europe too. I even talked to the godfather of AI, Jensen Huang himself, about the infrastructure powering the future.

And the more I learn about how different companies, industries, and even countries are actually using AI, the more I see why Wall Street keeps missing the mark. Alright, so I just got back from two more conferences in France, NVIDIA GTC Paris and Viva Technology 2025, where a couple things finally clicked for me as an investor. The special thing about the Viva Tech conference was its deep focus on AI for consumer industries, not just business to business.

This conference had companies from all over the world working on everything from personal AI assistance all the way to self-driving cars. Even Tesla had a big booth there where they showed off the new Model Y, the Optimus Robot, and the Cyber Cab. Everyone working at the booth was super knowledgeable and I'm wishing Tesla a successful Cyber Cab launch in Austin later this week. But the booth that blew my mind wasn't Tesla's, it was actually Louis Vuitton.

Key Takeaways

The AI market is expected to grow by more than 8x in size over the next 8 years, with a compound annual growth rate of over 30% through 2033. Generative AI is making its way into every industry, from robots and self-driving cars to movies, materials, and luxury goods, faster than most people realize. Companies like NVIDIA, Google, and Meta Platforms are building foundational hardware and software for generative AI, kicking off the generative AI era.

Not because of what they were showing off, because of what it means for the overall pace of AI in their industry. Louis Vuitton was showing off a robot with cameras designed to make hyper-realistic digital twins of their products. The special thing about these digital twins was that they also captured how different materials, like cloth, leather, and metal, change under motion and in different lighting conditions.

That way, the company can do things like film a commercial and add in different products after the fact instead of filming multiple versions of the scene. Or they could show a consumer exactly what a personalized product would look like before making any physical changes to it. Now, using AI for these things is nothing new. I've been covering technologies like these for years. Back in 2021, Tesla showed off how they made simulations to train and test their full self-driving systems.

The challenge with Tesla's approach was that it wasn't very scalable, since it required software engineers with specific knowledge of Unreal Engine to make realistic camera responses, weather and traffic patterns, and pedestrian motion.

Remember, if the data isn't physically accurate and photorealistic, it can be used to train robots for the physical world Well earlier this year NVIDIA announced Cosmos a platform which uses generative AI to create many photorealistic variations of physically accurate simulations built in Omniverse. Again, for testing and training robots and self-driving cars to operate in the real world.

And now, just a few months later, we're seeing Louis Vuitton do the same thing at the Viva Technology Conference.

They're using specialized cameras and robots to build physically accurate digital twins of their products and then using generative ai to make many different variations from a single model not to train robots but to create all kinds of content for their customers and employees this isn't just about handbags and commercials or even self-driving cars the entertainment industry can use the same technology to make a movie or a tv show or a video game once and release it in every market on the planet stuck on this stupid freaking tower in the middle of freaking nowhere and it's all my fault.

Today these AI tools are being used by the biggest companies in the world but the trend I'm seeing at these conferences is crystal clear. More companies are using generative AI for more use cases more often. We have physical robots and we have information robots, we call them agents. So the next wave of AI has started. It's going to require inference workloads to explode. It's basically going to go exponential.

The number of people that are using inference has gone from 8 million to 800 million, a hundred times in just a couple of years. And it's not just about digital twins. That's just one example. This is a slide from an NVIDIA GTC panel that I attended by Jonathan Godwin, the CEO of Orbital Materials, and the former lead for AI and Materials at Google DeepMind.

Each x-axis is time in months, and the y-axis is basically the impact of generative AI on the discovery of new materials in Chart 1, the resulting increase in patent filings in Chart 2, and the rise of new product prototypes in Chart 3. The first 12 months show us the average amount of progress in each area, and the next 20 months show us the impacts of generative AI.

and the impact has been massive six months after adopting ai scientists started discovering a record number of advanced materials for transistor-based chips and quantum computers solar cells for energy generation and solid-state batteries for energy storage and lightweight composites and high temperature ceramics for huge industries like aerospace and robotics the same exact industries we invest in just eight months after adopting generative ai material scientists were filing a record number of new patents.

And by month 17, they were testing a record number of new product prototypes. And all of this will only keep accelerating as reasoning models become more advanced, cheaper, and more accessible. Even I find myself using AI more and more, especially when I'm on the go. Speaking of which, one thing I always do when I travel is declutter my digital life, especially when I'm interviewing industry leaders, editing videos at conferences, and taking notes on the go.

For example, it can easily declutter your downloads by removing duplicates and clean up your system cache, development junk, and temporary files that can take up a ton of space.

It also has a whole section dedicated to increasing performance by managing background apps, running maintenance scripts, and freeing up RAM.

And the SmartCare feature not only cleans up and optimizes your Mac, but it also checks for malware, ransomware, and viruses to ensure your machine stays safe, all with just one button So if you care about your Mac and you like saving money you can get 20 off CleanMyMac with my code SYMBOL And since they offer a 7 free trial there's no risk in trying it with my link in the description below today.

Alright, so what I learned at Viva Technology and NVIDIA GTC Paris is that Generative AI is making its way into every industry from robots and self-driving cars, to movies, materials, and luxury goods faster than most people realize. Now let's zoom out and talk about which stocks will win big as a result. But to do that, we need to look at the last general purpose technology that really took the world by storm.

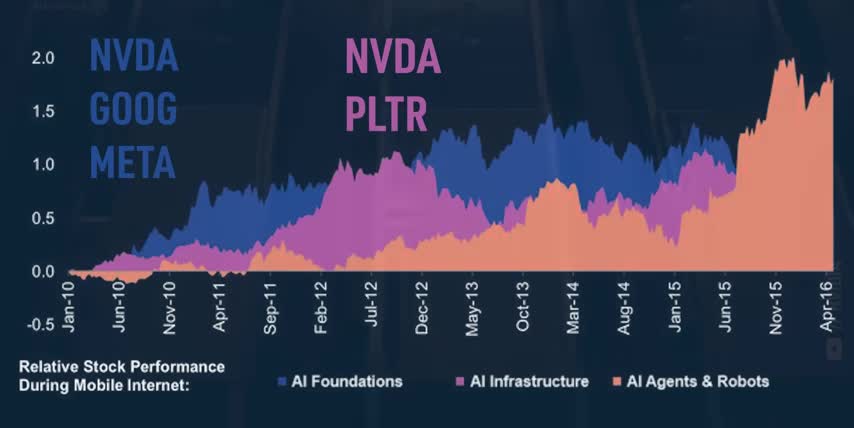

This is a chart from Morgan Stanley Research that looks at how different kinds of stocks performed during the rise of the mobile internet. I've gained over 100,000 subscribers and learned a ton since the last time I walked through this so it'll be great to get everyone back on the same page first the mobile internet evolved over a very long time this chart starts in 2010 but apple released the first iphone in 2007.

they launched their app store in 2008 and they still didn't dethrone blackberry until 2011 four years after the original iphone came out and on the flip side this chart ends in 2016 but 5g didn't even start rolling out until 2018, and all kinds of mobile apps and businesses launched during the lockdowns in 2020 and 2021. That means the mobile internet really evolved over at least 14 years end-to-end, and it's arguably still getting better today.

So, when it comes to generative AI, I think we're still in the BlackBerry era of what could be another 10-plus-year technology cycle, and stocks like Nvidia and Palantir taking off mark the beginning of this cycle, not the end.

The second big takeaway is that while companies with high-margin software and services perform the best over the long run, they're still the last group of stocks to rise, since everything they make runs in data centers and on edge devices like smartphones, laptops, workstations, and eventually robots, self-driving cars, and AI agents. And before these infrastructure companies can make big moves of their own, semiconductor companies need to build the chips that power them.

That's how it worked for the mobile internet. But what I've learned from all these conferences is that it's not necessarily the same for generative AI. And the big thing that most Wall Street analysts are still missing is that AI infrastructure isn't just hardware. There's a lot of software that supports it too. Digital AI infrastructure. Let me show you what I mean by mapping all the stocks I've been talking about onto this case study but for generative AI instead of the mobile internet.

NVIDIA, Google, and Meta Platforms are great examples of what I'm calling AI Foundation Companies, because they build foundational hardware and software for generative AI. NVIDIA has their massive ecosystem of Blackwell GPUs and the rest of their AI data center hardware, but they also have CUDA and their Nemotron family of foundation models. Google has their custom TPU chips and Google Cloud, but they also have the Gemini family of foundation models.

Meta Platforms has their meta training and inference accelerators on the hardware side, and the Lama family of foundation models on the software side. So, while semiconductor companies were the first group of stocks to rise during the mobile internet, these AI foundation companies are the ones kicking off the generative AI era.

And what makes a company an AI foundation company? They build the chips, the foundation models, and even the data centers that all the AI infrastructure will be built on top of. But if data centers are made by AI foundation companies, then what do AI infrastructure companies actually make? Well, they make the software and hardware platforms around AI, for businesses and consumers. Palantir's platforms are a great example of AI infrastructure.

Palantir doesn't build AI chips, data centers, or foundation models They build things like data pipelines ontologies and custom automations on top of them so that their customers can leverage AI without needing to be experts in it If you remember the Humane AI pin, that device would be an example of AI infrastructure too. The reason they flopped is because they were trying to sell the next iPhone without building the foundational hardware and software first.

Speaking of iPhones, companies can be in more one group. Apple has their own chips, they have their own devices and operating systems, but they also have their own apps, putting them in all three groups for the mobile era.

That's how Apple became one of the world's biggest companies in the first place, and Nvidia is trying to do the same thing in the AI era, with hardware platforms like the DGX Spark and DGX Station, and software platforms like Omniverse and Cosmos, their avatar cloud engine, and tons of inference microservices called NIMS for other applications. In the mobile era, the line between infrastructure and software and services was pretty clear.

Developers build on top of infrastructure, and consumers pay to use software and services without really needing to know how they work. I think the same will be true in the AI era, but we still don't know what that could look like. Just last month, OpenAI acquired Johnny Ive's AI device startup called I.O. for about $6.4 billion.

If you didn't know, Johnny Ive was Apple's chief design officer, and he was the lead designer on the iPhone, the iPad, the iPod, and the MacBook Air before leaving Apple in 2019. And now he's working with OpenAI to create a screenless, minimalistic device for the AI era. So the obvious challenge for investors is figuring out what AI software and services could look like if AI devices won't have screens at all. My current guess is that they'll actually be digital AI agents and physical robots.

This is where I'd put companies like Tesla and Waymo.

Both companies have their own foundational AI models and AI infrastructure, but the actual revenue comes from consumer products and services, in this case, self-driving cars and a more affordable ride-hailing network built on top them on the flip side nvidia sells self-driving infrastructure in the form of their drive agx hyperion platform which is a fully integrated sensor suite an ai compute chip and a software stack for autonomous vehicles it's infrastructure because another company still has to build the final solution on top of it while tesla and waymo are going directly to the end consumer hopefully you can see the value in categorizing ai companies this way ai foundations ai infrastructure and ai agents both digital and physical the ai foundation companies i'm investing in today are the same ones i've been covering since openai released chat gpt nvidia google meta platforms as well as supporting companies like amazon microsoft and broadcom qualcomm and arm could also belong in this category but mostly for edge devices on the ai infrastructure front we have companies like Palantir and Nvidia again, as well as maybe OpenAI if they do come out with a physical AI device.

I also think that cybersecurity companies belong to this category, because there will be a lot of digital infrastructure built around data rights, permissions, safety, and security in a world where AI models can read and write anything and robots are everywhere.

Companies like CrowdStrike, Palo Alto Networks, and Fortinet are already well positioned here, which is why I also cover them on this channel but ai applications are much harder to predict because the infrastructure and devices are still anybody's game in almost every market so right now i'm looking at ai agents physical robots and any other form of ai at the edge and if you want to see what other ai companies i'm investing in check out this video next either way thanks for watching and until next time this This is ticker symbol U.

My name is Alex, reminding you that the best investment you can make is in TickerSymbol: YOU..