Resources mentioned:

- Deep Learning: This Disruptive Innovation Could Rewrite (or Erase) Us All: https://www.youtube.com/watch?v=J583J5Ts5uE

- ARKG: ARK Invest's BEST ETF | Everything You Need to Know About ARK's Genomic Revolution Fund: https://www.youtube.com/watch?v=2dIHDOA8rRA

- RIP Moore's Law – ARK Invest Finds Winning Stocks by Using Wright's Law: https://www.youtube.com/watch?v=FKt_yeRa7TI

- ARKQ: More Tesla Than Tesla | ARK Invest's BILLION Dollar Bet on the Autonomous Revolution: https://www.youtube.com/watch?v=tqMaH8U9c7g

- ARKF: Breaking the Banks | ARK Invest's Fintech ETF Rages Against the Machine and YOU Can Too: https://www.youtube.com/watch?v=FlXCvnLtLHA

- How ARK Invest Finds Winners Like Tesla Before Wall Street – The Law of Diffusion of Innovation: https://www.youtube.com/watch?v=E86akB3DfBE

- Support the channel and get extra member-only benefits by joining us on Patreon: https://www.patreon.com/tickersymbolyou

#CathieWood recently wrote an article, warning investors to be on the right side of change. #ARKInvest has clearly identified a set of investments they think are bad ideas, in industries that will collapse to new and disruptive innovations. We use #Tesla (#TSLA) as an example of a single company that is disrupting TRILLIONS of dollars of industries across all market sectors.

#ARK Invest's Bad Ideas Report: https://ark-invest.com/badideas/

Investors Beware: Stay On The Right Side Of Change by Catherine Wood, Chief Executive Officer & Chief Investment Officer of ARK Invest: https://ark-invest.com/articles/marke…

🎧 Investing in Disruptive Innovation (Discord Community): https://discord.gg/9UHrHex4JX

I am not a financial advisor or affiliated with ARK Invest in any way (other than being a shareholder). Thanks for investing your precious time with me.

Video Transcript:

[00:00:00.210]

The global economy has entered a period of convulsive changes, some exceptionally good and others devastating, that will shape financial markets for years to come. Thanks to seeds planted during the tech and telecom bubble more than 20 years ago, record-breaking technological changes are creating not only exponential growth opportunities, but also black holes in global economies and financial markets. Staying on the right side of change will determine success and failure not only in investment portfolios but also in careers, companies and countries.

[00:00:31.410]

This video includes two parts. One, where the black holes associated with technologically enabled innovation are. And two, what does the right side of change look like and how can you ensure that you're on it?

[00:00:43.200]

Are you an investor looking for long term capital appreciation but worried about the short term volatility associated with innovative companies? Well, you're not alone. Many investors appear to be afraid of companies that offer newer, faster, cheaper and creative products and services. Now you can avoid these innovative companies. How? Ark your adviser today, if investing in a traditional broad-based index is right for you. A broad-based index provides investors with a feeling of safety and comfort, knowing that they hold past success often based on tangible assets like a bank, branch, railroad, or real estate. Indices should generate predictable cash flows because, hey, that's historically been the case and things never change. In harm's way,

[00:01:22.500]

are the companies that have spent the last 10 to 20 years engineering their financial results to satisfy the short-term demands of short-sighted investors. While their disruptors have spent that same time engineering the future, your future and mine. Among these short-term siloed and highly specialized sectors at risk of decapitation, I mean disintermediation, our energy, industrials, consumer discretionary, traditional communication services, health care, and financial services. For centuries, financial organizations have relied on physical distribution to attract and serve customers. In ancient Greece, money changers gathered in the ports of Athens and 14th century Italy saw the beginnings of organized physical branch networks.

[00:02:06.670]

Today, we have modern branch banking. Now, however, the Internet and smartphones are transforming the distribution of financial services. Digital wallets, which are bank branches in your pocket, render expensive physical infrastructure useless, putting at risk hundreds of billions of dollars of traditional financial institutional assets. While customers set foot in banks less and less each year, the costs of operating a bank branch are near all time highs due to costs like having and maintaining the biggest buildings in the best part of town.

[00:02:36.010]

Big banks spend almost one thousand dollars per customer in acquisition costs, while digital wallets spend just 20. Finance and insurance account for roughly eight percent of GDP in the United States and 10 percent of the S&P 500 equity market cap. In other words, approximately three trillion dollars of market capitalization is facing the threat of disintermediation.

[00:02:58.870]

I mean, let's let's just state the obvious. As you mentioned, some of these names banks are so… So… I mean, people go, oh, I'm going to short you short the banks. I love it. I mean, those dummies have lost so much money. How many times do you have to get your face ripped off to realize you're just an idiot? Go short the bank.

[00:03:17.600]

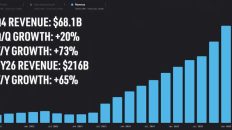

Speaking of brick and mortar, traditional retail is starting to crack under the shift to e-commerce and innovations in last mile delivery, such as postal service trucks going electric and maybe one day fully autonomous, and drones that will be delivering your pizza for as little as twenty-five cents per trip. The U.S. has many times the retail square footage per capita of that in other countries, five times as much as the UK and ten times that of Germany. Companies with a large retail real estate footprints will suffer in the same types of declines in foot traffic as traditional banks. ARK Invest expects that global e-commerce will quadruple over the next decade from 16 percent of retail today to 60 percent with the help of drones and automation.

[00:03:59.530]

That's a growth from eight hundred and twenty billion dollars in 2019 to two point seven trillion dollars in 2025. One interesting way to show this decline is to see how much money retail stores make per square foot of brick and mortar they own. And that's what you're seeing here. Remember, physical real estate shows up as a cost spread out across all customers or sales because you have to cover rent before you can turn a profit. If 2020 has taught us anything, it's that having physical stores can go from being an asset to being a liability really quick.

[00:04:31.600]

ARK Invest is predicting a steep decline in dollars generated per square foot of real estate owned by retail brands, making buildings worth less and less over time until one day worthless may be the only word to describe them. Here's how today's two trillion dollar physical retail space is broken down by ARK Invest. I couldn't write it any better, so let me just emphasize what they're saying. We believe the brick and mortar retail apocalypse will continue to impact both equity and fixed income holders.

[00:05:00.490]

ARK estimates that roughly two trillion dollars in enterprise value is at risk in the public equity markets across the retail categories with heavy real estate footprints. While some companies will transition successfully to an e-commerce model, ARK expects more bankruptcies during the next five to ten years as not every business will survive or cut retail assets quick enough. In the fixed income markets, the performance of real estate investment trusts, or REITs with high exposure to retail real estate will continue to be at risk as their underlying assets become less valuable and will have to be repurposed.

[00:05:34.060]

In ARK's view, the decline in retail real estate values during the pandemic is a preview of what's to come. Linear TV is real-time programing accessed over the air or by cable or satellite at scheduled times. It's making sure you're home by 8:00 p.m. on Thursday nights to catch Buffy the Vampire Slayer and getting mad when you miss the start because of traffic. Don't judge me. 83 million households in America still use linear TV as their primary method of visual entertainment. That's two thirds of American households.

[00:06:04.670]

Buffy doesn't wait for these 83 million households. Not only that, but these households pay for hundreds of channels, almost 90 percent of which go completely unwatched. I'm talking channels like Boomerang and the original Fusion. Fusion at one point had more employees working the channel than viewers watching it in 2016, even though 40 million homes paid for it. When you combine the cable subscription and advertising revenue, when your TV's total market cap is something like four hundred and forty billion dollars, that's a big lunch

[00:06:35.630]

getting eaten by a small number of outsized players like Netflix, Amazon Prime, Hulu and Disney Plus. Not only do these services cost way less than traditional cable, they do a much better job matching you to content and advertisements through smart content matching algorithms powered by artificial intelligence. Cord-cutting has been happening at a rate of about two percent per year, but ARK Invest thinks it'll accelerate to about 15 percent per year in the coming decade. The big reason things are changing now is because of the sports drought.

[00:07:05.120]

Sports are a major factor in successfully selling cable packages. Disney owns ESPN and I can't help but wonder what would happen to traditional TV services if Disney decided to cut ties with cable completely. Even if ARK Invest's estimates are half off, the collapse of linear TV would be reminiscent of the collapse of print media during the financial crisis of 2008. Print media tried to stabilize in the beginning and now faces double-digit readership declines annually. Freight rail companies are worth over three-quarters of a trillion dollars in combined enterprise value, and they make up an eighth of the S&P 500's industrial sector. In the next decade,

[00:07:47.680]

ARK expects the combination of electrification and autonomous mobility to reduce the cost of trucking by 75 percent from 12 cents per ton-mile to just three. Remember, the relationship between cost and demand is not linear. A four times reduction in cost might bring in something like a 10 times jump in demand, like what we've seen in past videos involving industrial robotics. Trucks already offer faster and more convenient service, since you know you can't pull a train up to your front door to deliver your sweet Batmobile bed.

[00:08:19.420]

Do you see this thing? Autonomous trucks will also kick off some serious consolidation in the trucking industry. There are over 500000 trucking companies in the United States, most of which are owned and operated with fewer than six trucks. Autonomous fleets equipped with optimized path planning software will collapse traditional trucking. Due to the staggering amount of data necessary to train up these autonomous trucks, unmanned freight transport is a winner take most market, at least per geographic region. The commercialization of autonomous electric trucks will lead to serious displacement, if not the outright collapse of rail, because physical legacy, infrastructure, and equipment like railways, rail cars, and rail stations account for a very large majority of their assets.

[00:09:06.610]

And the obvious pattern here is that the new world order is turning most of these things into liabilities. ARK wonders which, if any, freight rail operators will survive. I'm pretty sure a regular point-to-point transport is going to be just fine, though. Gas cars will be around for a long time, am I right? I'm just kidding. ARK Invest expects U.S. auto sales to drop by 40 percent or more over the coming decade. Unlike the slow erosion of these other industries, robo taxis may disrupt traditional auto much faster as fleets of ready for autonomy

[00:09:37.690]

cars get turned into fully autonomous cars via over-the-air software updates. The current legacy vehicle fleet today is worth two point six trillion dollars and will immediately face serious devaluation when they can't check the box of autonomous navigation. That's not even including the collapse of traditional auto insurance, as premiums will get cut in half since autonomous vehicles become hundreds of percent safer than manually driven ones. Tesla's autopilot is already nearing ten times more miles, driven between accidents than the average American driver.

[00:10:11.380]

That's today, right now in 2020. And that doesn't include the reduction in demand for oil as the vehicles of this new world order become increasingly electrified. Today, we use our cars less than five percent of the time. The other 95 percent, they stay parked. In the future, autonomous electric vehicles providing mobility as a service could be utilized as much as 50 percent of the time, meaning they're eating up ten times as many miles that could have been powered by oil.

[00:10:39.130]

The New World Order may see oil supply exceed demand. And let's talk about the decimation in demand for one to three-hour flights, particularly when you account for the drive to and from the airport and airport security lines. And don't even get me started on traditional ride hailing services like taxis, Uber and Lyft. Robo taxis are going to disrupt more and more industries and will start generating revenue in excess of one hundred and fifty billion dollars annually. Each one of these massive disruptions warrants their own video and we'll get there in time.

[00:11:11.980]

But for now, ARK Invest sums up this disruption beautifully. ARK believes the market has not discounted adequately the robot taxi disruption likely to upend the traditional world order in transportation, tallying up the risk to airlines, public transit, ride hailing insurers, automakers, auto dealers, rental companies and oil. ARK estimates that roughly eight trillion dollars of enterprise value in the public markets is at risk long before dealers sell their last gasoline-powered car. We believe robo taxis will disrupt a dozen industries, destroying a meaningful percentage of portfolios

[00:11:48.880]

tracking these broad-based benchmarks. We believe traditional automakers and their dealer networks are in grave danger. The transition to autonomous electric platforms could create a “winner takes most” industry thanks to the massive amounts of data necessary to create autonomous driving platforms. As a result, the industry is likely to consolidate, with the survivors being those with successful autonomous technology and or electric vehicle platforms. Auto dealerships could become casualties as service, financing, and insurance account for roughly 70 percent of their gross profits, with much lower maintenance expenses relative to gas-powered autos, EVs are likely to eat into dealer servicing businesses at the same time that default rates hit their financing

[00:12:33.610]

businesses. Traditional auto manufacturers have significant balance sheet exposure to this disruption, given the inexpensive financing they have provided to encourage sales. If auto loan delinquencies and defaults continue to rise, not only could dealerships go bankrupt, but automakers could lose both their distribution networks and their ability to stimulate sales with bargain basement financing. Here's the funny part about Wright's law. If that kind of change is happening due to the cost of lithium ion batteries declining by 28 percent per cumulative doubling,

[00:13:07.030]

Imagine what will happen to health care as the costs of sequencing a human genome continue to fall by 40 percent per cumulative doubling. The health care industry will cross the 10 trillion dollar mark in 2022. How much of that is at risk? What about if you include the disruptive technologies that result in more disintermediation, automation, and electrification? This convergence between and among innovation platforms and technologies seems to be throwing economic and company forecasts for a loop, particularly in the developed world, which is saddled with major infrastructure.

[00:13:42.670]

The sectors at risk of disintermediation account for more than half of the S&P 500. Here's what Cathie Wood has to say about the future of these broad-based indices. The first time I heard it, it stopped me in my tracks.

[00:13:54.980]

We think the most massive misallocation of capital in the history of the world took place in these later days of indexation. Now that more than half of stocks are indexed-based strategies, we believe the pendulum has pretty much swung as far as it is going to. I say that famous last words, who knows? But it seems as though that is true and that this search for how is the world going to look instead of, you know, how is this index positioned and shall we take 50 basis points, more of that stock or 50 basis points less. We're getting some real research now moving into the innovation space.

[00:14:41.200]

The most massive misallocation in the history of the world took place in these later days of indexation. Now that more than half of stocks are in indexed-based strategies, we believe the pendulum has pretty much swung as far as it's going to. One in eight dollars in the market today is passively managed. That's about four point three trillion dollars. More than half of all stocks are represented in some sort of index or fund. And many of those companies rely on passive investors blindly allocating money to that index to survive.

[00:15:14.500]

Though at small bases today, most of these disruptive platforms are entering exponential growth trajectories, thanks to the falling costs and increasing productivity associated with technologically enabled innovation, consumers will continue to benefit as one innovation is built to top another and another and another. Autonomous vehicle networks will scale and continue to drop transportation costs by more than 50 percent from 70 cents per mile that it is today for personal cars to just 25 cents per autonomous mile driven by an electric vehicle.

[00:15:48.520]

Then add in cost reductions due to safer driving, then more efficient path planning. What other combinations of these disruptive technologies are yet to be created or even discovered, and who will they disrupt? Let me give you a clear example of stacking innovations. Tesla today is investing heavily in industrial robotics to automate manufacturing. The giga factories or the machines that build the machine are becoming much more efficient at building cars and batteries. The battery itself is becoming better and better through the advancements in battery chemistry and structure that Elon Musk highlighted during the most recent battery day.

[00:16:30.740]

Through things like Project Dojo and the full self-driving chip, Tesla is advancing the state of the art in autonomous mobility until they hit Level five autonomy. Once these three things are successfully combined, we'll see a major disruption to every market sector any of these innovations touch. Let's add a fourth. Tesla now owns your time spent traveling from point A to point B, they know how long that is and a lot about you as a person, since Tesla can connect to the Internet and you can imagine logging into your Tesla through a Facebook or a Google account or any login you already use today.

[00:17:06.110]

So, Tesla recommends you the perfect playlist from your Spotify or your Netflix or your Tesla infotainment dashboard or whatever. It's tailored not only to you, but to the duration of your trip this time. And it can be not just music and movies, but maybe it's games that Tesla knows can get completed before you have to leave the car. If you can pay less for an experience like that than the current cost of an Uber, why would you use anything else?

[00:17:31.580]

Now, imagine if the games you play could earn you reward points for stores that you pass on your trip while helping Tesla fill out its own mapping database. Oh yeah, and those reward points can be redeemed for things like supercharging uses or bitcoin. I'm stretching a bit on that last one, but only a bit. This is what I mean when I say that Tesla's infotainment and connectivity is fundamentally undervalued. It's the next disruption on top of an already massive stack.

[00:17:58.010]

Many people think ARK Invest is too big on Tesla. I think they are fundamentally limited by the maximum amount of a single stock they can hold, and if they could hold even more Tesla, they would. I bet ARK Invest thinks their position size in Tesla is not big enough. More broadly, if ARK Invest's forecasts for these five innovation platforms are near the mark, nominal GDP growth is likely to slow from four point one percent annually, down to two or three percent, regaining momentum only after new technologies hit their tipping points across the chasm and are adopted at scale.

[00:18:31.820]

Growth in terms of volume and inflation will likely be the low side of expectations as market share shifts to the digital world, which is fundamentally mismeasured and new technologies that are fundamentally misvalued today, take hold. Like the example I just mentioned, the winners will win big and the losers, specifically those who have built balance sheets to satisfy stakeholders instead of technologies to enrich humanity will collapse. This is what the term creative destruction really means. Cutting GDP in half is what disruption could really look like.

[00:19:04.880]

Those that have leveraged their balance sheets to pay dividends and buy back shares instead of leveraging new technologies to pay it forward and pave the way for a better tomorrow are in particular peril because deflation can ravage debt holders and technology enabled innovation is deflationary. Stretching for yield, fixed income investors have enabled this behavior and at some point will have to pay for it. In ARK Invest's view, any company not investing aggressively in one or more of five major innovation platforms and 14 technologies evolving today run the risk of collapse.

[00:19:41.000]

The New World Order is coming and we may not be ready for it.

[00:19:48.540]

We believe that there are five innovation platforms evolving at the same time. This has never happened in history. You have to go back to the late eighteen hundreds to see three innovation platforms evolving at the same time. Back then, electricity, telephone and the internal combustion engine. For the 50 years through 1929, because of those innovation platforms, we experienced a booming economy and very low inflation. We see that happening with these five platforms which are already, we believe for prime time. The five innovation platforms upon which we base all of our research, are bDNA sequencing, robotics, energy storage, artificial intelligence and block chain technology.

[00:20:47.790]

These platforms cut across sectors, they cut across geographies, they cut across markets. And importantly, they are converging with each other to spawn new innovation. Now, just think about traditional research departments. Who's going to follow those stocks? These are platforms which cut across sectors and geographies. Only with a new kind of research effort do we believe the capital markets will fully be able to exploit these transformational opportunities.

[00:21:25.170]

This poses huge problems for research efforts that are short term, siloed, and highly specialized. Most research departments in the financial world are structured in a way that have created inefficiencies to exploit as these interdisciplinary convergences create the new world order. Side note, this is also true in most academic and industry research departments as well, where most time and money is focused on a single end result, instead of seeing and contributing to the bigger picture. We need to change the way we discuss progress everywhere.

[00:21:56.430]

These platforms involve 14 technologies, including gene therapies, 3D printing, cloud computing, big data analytics and crypto currencies. They mean mobility as a service, reusable rockets, new levels of connectivity and banks in your pocket. So investors beware. According to ARK Invest's research, innovation is evolving at such a rapid pace that traditional equity and fixed income benchmarks are being filled more and more with value traps. These stocks and bonds are cheap for a reason. Critical to investment

[00:22:28.470]

success will be moving to the right side of change, avoiding industries and companies in the crosshairs of creative destruction and embracing those creating disruptive innovation and perhaps a shot at another roaring 20s.

[00:22:42.330]

This niche strategy, what once people consider a niche strategy, is the way the world is going to work. These are the next big benchmark stocks, and we think that we are in the early days of scaling each of our five platforms. Retail is only now in the United States begun to enter that sweet spot of the S curve. So I think that the next five years is going to be scaling these exponential growth trajectories and learning that this wasn't a niche strategy,

[00:23:16.950]

this was a strategy that understood that five major innovation platforms evolving at the same time, again, involving 14 technologies. We're going to transform the world completely. And, you know, you have to be on the right side of change.

[00:23:34.230]

And if you'd like to help me change the way we discuss progress and investing in disruptive innovation, my Discord community is now up and running. It has channels for every aspect of ARK Invest's strategy that I could think of, including channels for each major fund, each disruptive technology, and even sections dedicated to other disruptors like Elon Musk and Chamath. Come join the already 200 member strong community as we try to work together to clarify our vision of the future and our investment thesis in it.

[00:24:03.270]

Your voice matters. Thanks for investing your precious time with me. This is Ticker Symbol: You. My name is Alex, reminding you that the best investment you can make is in you.

If you want to comment on this, please do so on the YouTube Video Here